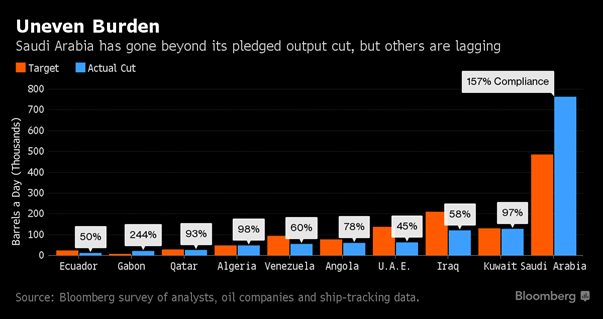

- Month two of the grand OPEC (and friends) experiment of how long compliance can stay in place while Saudi Arabia attempts to get the oil market higher before its IPO late this year. As the graphic to the right indicates, those countries that pledged to reduce production have met that standard overall thanks to the Saudis pumping only

9.78 million barrels per day (bpd) instead of their commitment of 10.06. This success also has been undermined by the increases seen in the OPEC members not subject to any caps (Iran, Nigeria and Libya), meaning that OPEC’s total output is 415,000 bpd above the target production set on November 30th. Unlike the verbiage proclaimed in the media, therefore, the compliance is not 100% but about 75%. The non-OPEC parties to the agreement have also fallen short with the largest producer Russia cutting 100,000 bpd of its 300,000 bpd pledge. In short, a good start but more has to be done to bring 2017 supply into deficit versus demand.

9.78 million barrels per day (bpd) instead of their commitment of 10.06. This success also has been undermined by the increases seen in the OPEC members not subject to any caps (Iran, Nigeria and Libya), meaning that OPEC’s total output is 415,000 bpd above the target production set on November 30th. Unlike the verbiage proclaimed in the media, therefore, the compliance is not 100% but about 75%. The non-OPEC parties to the agreement have also fallen short with the largest producer Russia cutting 100,000 bpd of its 300,000 bpd pledge. In short, a good start but more has to be done to bring 2017 supply into deficit versus demand.

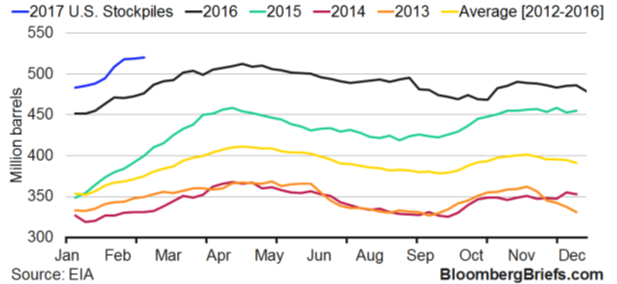

- In comparison, non-signatories have continued to expand. The US oil-drilling rig count continued to move higher from 566 on January 27th to 602 on February 24th. US oil production likewise moved higher, crossing back over nine million bpd. Some estimates of Canada’s 2017 production were edged higher and Brazil’s oil

exports increased to a record 1.6 million bpd. There is plenty of oil in storage as well – the stockpiles in the United States, the world’s top oil consumer, rose 1.5 million barrels last week, touching a record at 520.2 million barrels after eight straight weekly builds. The Keystone XL pipeline construction is looking to be back on track with the protesters cleared, weather relatively warm and the US Army Corps of Engineers signing off. A federal judge has to consider a final request by Native Americans to block the construction on religious grounds, but given there is a pipeline already in place on the same route since 2010, it seems hard to think that they will be

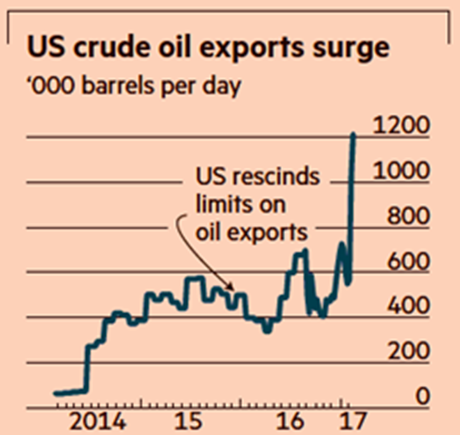

exports increased to a record 1.6 million bpd. There is plenty of oil in storage as well – the stockpiles in the United States, the world’s top oil consumer, rose 1.5 million barrels last week, touching a record at 520.2 million barrels after eight straight weekly builds. The Keystone XL pipeline construction is looking to be back on track with the protesters cleared, weather relatively warm and the US Army Corps of Engineers signing off. A federal judge has to consider a final request by Native Americans to block the construction on religious grounds, but given there is a pipeline already in place on the same route since 2010, it seems hard to think that they will be  successful. If rejected and construction commences, it will be finished this year. If nothing else, that means more Canadian and North Dakotan (Bakken) crude oil will be available to the US or for export (US exports reached a record high in the last week of February of 1.2 million bpd with cargos to China replacing shipments from the Middle East).

successful. If rejected and construction commences, it will be finished this year. If nothing else, that means more Canadian and North Dakotan (Bakken) crude oil will be available to the US or for export (US exports reached a record high in the last week of February of 1.2 million bpd with cargos to China replacing shipments from the Middle East).

- Overall, the supply picture is looking ample – Saudi Arabia just cut its standard prices to Asia in early March, perhaps indicating that it will not cut production further. The main concern we have for supply is a socio-political collapse in Venezuela, Libya and/or Nigeria. Venezuela only has $10.5 billion in foreign reserves left and owes roughly $7.2 billion in outstanding debt payments in 2017. Chaos seems highly likely which would have at least a temporary impact on oil prices (though OPEC/Saudi Arabia/Russia could easily ramp up production to cover the shortfall). Libya and Nigeria will face running battles and sabotage though the year – any production gains should be seen as precarious. In good news, Iraq continues to make progress against ISIL in Mosel and beyond.

- Grain harvest continue to move forward in South America – rains have slowed some soy exports in Brazil but there is plenty coming out of that country. Traders are trying to talk up US grain prices on drought fears / warm weather but it is too soon to start with that forecasting. Of noteworthy consideration, any trade spat between the US and Mexico imperils the $17.7 billion grain and meat exports from the US – a loss of that market will crush the heartland farmer which voted overall for Trump. In the end, the US President will cut a deal.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.