Ukraine-Russia War & Red Sea Shipping: Positioning

The Ukraine-Russia Conflict saw little movement with some territorial losses by Ukraine in the east. Russia pressed with its weight in numbers though evidence of equipment shortages was seen by the utilization of antiquated tanks (i.e., T-62s which were first introduced in 1961 and even T-55s which first came out in 1946) to press assaults. The relative ease that all tanks and armored vehicles are destroyed by cheap drones kept the attack tempo cautious. The UK’s military estimated that the Russian average monthly causalities (killed and wounded) have reached a new high of over 980 soldiers a day in February, roughly double what they were a year ago, particularly with the human-wave attacks on Avdiivka. At that rate, Russian total causalities would double by the end of 2024 (to roughly over 700,000). Before the war, Russia had around 1.1 million active personnel and 1.5 million in reserve. Ukraine was estimated with half those numbers, though with one-third the population. In the skies, Ukraine said it had shot down 15 warplanes over the last two weeks in February, including an expensive A-50 electronic spy plane – reportedly Russia has only five or fewer of these in flyable condition. Holding back the Russian air force removes a Ukrainian vulnerability to glide-bomb attacks. In short, Ukraine is being pushed back but giving better than what it takes. Still, it seems that only an influx of NATO weaponry and ammunition can turn the initiative around to Ukraine.

Ukraine Grain Exports hit almost 4.7 million metric tons in February, basically unchanged versus over the same period a year earlier. Overall, Ukraine’s grain exports in the 2023/24 July-June marketing season have so far fallen to about 28.6 million tons from 31.8 million a year earlier. Only 1-2% of the Ukrainian winter wheat crop was predicted to not survive the current winter. Usually, up to 7% of the winter sowing area dies, mainly due to heavy frosts and ice crust on fields, but the winter has been milder this year. This is an important crop as winter wheat accounts for more than 95% of Ukraine’s overall wheat output.

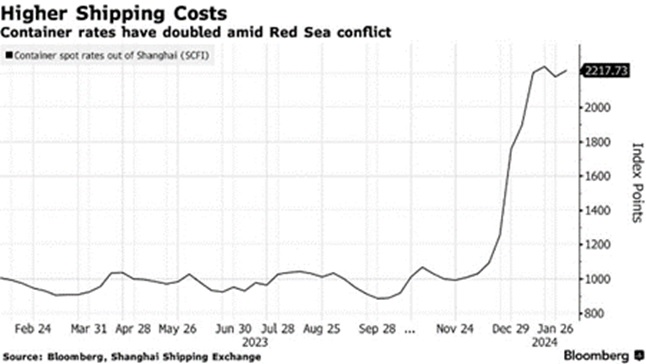

Shipping Basically Ceased In the Red Sea as only grain ships originating from the Black Sea or bound for Iran are about the only ones still sailing through the area as Houthi militants continue to attack vessels, with the first one sunk in February and another in early March. The impact on shipping is quite evident, looking at the graph to the right.

the only ones still sailing through the area as Houthi militants continue to attack vessels, with the first one sunk in February and another in early March. The impact on shipping is quite evident, looking at the graph to the right.

Macro: Asia

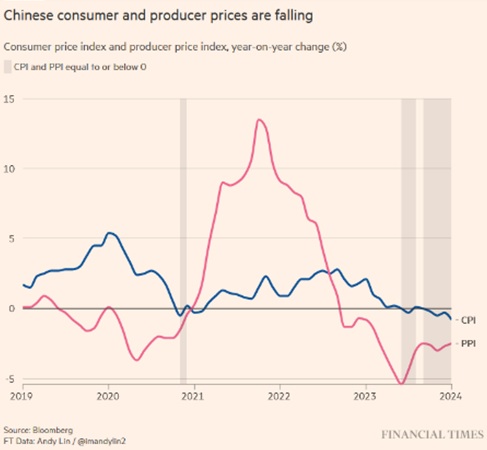

China Consumer Price Index (Inflation) fell -0.8% in January (versus -0.3% in December), worse than expected and the steepest decline since September 2009. The economy has been in deflation (not disinflation) since July as per the graph right (blue line). Meanwhile, the producer price index fell -2.5%, marking 16 straight months of deflation for factory-gate costs (red line). To try to jump-start the economy, Xi has announced several small reforms and interest rates cuts, such lowering the benchmark five-year prime rate that directly affects many mortgages to 3.95%. However, while this assists new homebuyers, existing loans were generally repriced in January, one month prior. China continues to face headwinds as foreign direct investment (e.g., new factories) collapsed (see left) in 2023.

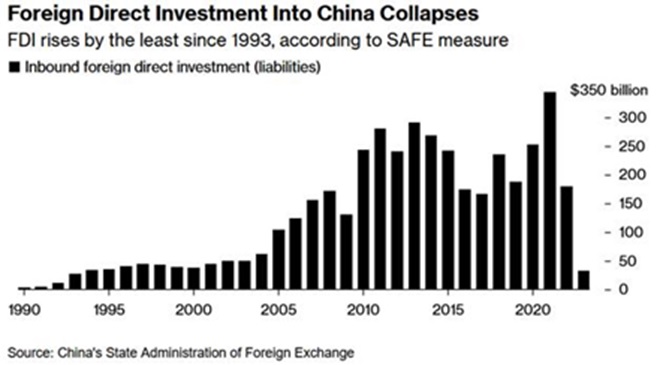

and the steepest decline since September 2009. The economy has been in deflation (not disinflation) since July as per the graph right (blue line). Meanwhile, the producer price index fell -2.5%, marking 16 straight months of deflation for factory-gate costs (red line). To try to jump-start the economy, Xi has announced several small reforms and interest rates cuts, such lowering the benchmark five-year prime rate that directly affects many mortgages to 3.95%. However, while this assists new homebuyers, existing loans were generally repriced in January, one month prior. China continues to face headwinds as foreign direct investment (e.g., new factories) collapsed (see left) in 2023.  COVID, heightened media censorship and propaganda, espionage accusations against foreign companies (particularly in the financial space), and the resulting trend towards “near-shoring” and “friend-shoring” all saw investment dry up. Just think what will happen to sentiment if China invades Taiwan! Meanwhile, the National People’s Congress that was just held in early March offered little new stimulus, though the military spending target increased +7.2%, higher than the +5% GDP target. Exports out of China in the first two months of 2024 were +7.1% higher than a year before, customs data showed, beating a Reuters poll that expected an increase of +1.9%. Imports into China were up +3.5% year on year, compared with a poll forecast for growth of +1.5%. The better than expected readings were in part due to a low base versus last year as COVID restrictions lingered. Semiconductor demand helped exports too.

COVID, heightened media censorship and propaganda, espionage accusations against foreign companies (particularly in the financial space), and the resulting trend towards “near-shoring” and “friend-shoring” all saw investment dry up. Just think what will happen to sentiment if China invades Taiwan! Meanwhile, the National People’s Congress that was just held in early March offered little new stimulus, though the military spending target increased +7.2%, higher than the +5% GDP target. Exports out of China in the first two months of 2024 were +7.1% higher than a year before, customs data showed, beating a Reuters poll that expected an increase of +1.9%. Imports into China were up +3.5% year on year, compared with a poll forecast for growth of +1.5%. The better than expected readings were in part due to a low base versus last year as COVID restrictions lingered. Semiconductor demand helped exports too.

Japan’s Core Consumer Inflation slowed for a third straight month in January but beat forecasts and held at the central bank’s 2% target, keeping alive expectations that its central bank will end negative interest rates by April. This will tend to keep Japanese investors repatriating dollars into yen, further reducing their participation in the US Treasury markets. Unemployment at 2.4%, pushing up wages, supported these movements. Q4 GDP growth fell -0.1%, slipping the country into a shallow recession. However, net exports contributed +0.2 percentage point to growth, led by automobiles to the US and chip manufacturing gear to China. Inbound tourism, classified as service exports, also saw continued growth. Down under, Australian Unemployment climbed to a two-year high at the opening of 2024, advancing to 4.1% from 3.9%, while the participation rate was steady. With Q4 GDP growth at +0.2% for the quarter, the lucky country delivered a modest +1.5% GDP number for 2023, positive but slowing.

Macro: US

The Federal Reserve Fed messaging in February made it clear that strong economic data will defer rate cut possibilities until the May or June meetings and the market came around to only three interest rate cuts (-0.75%) over 2024. A very different tune than the six or seven cuts priced in late last year. Long-term bond rates flirted with 4.5% before coming off. While there is possibility of a tapering of QT, record equity and bitcoin returns highlight speculative market fervor. January inflation was above expectations at +0.3% for the month (+0.2% expected) and +0.4% without food and energy (versus +0.3% forecasted), supporting

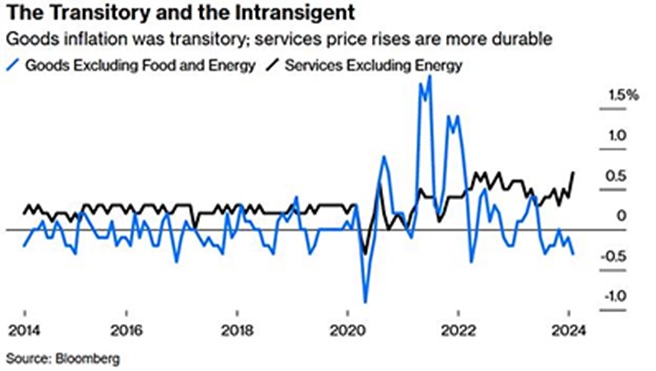

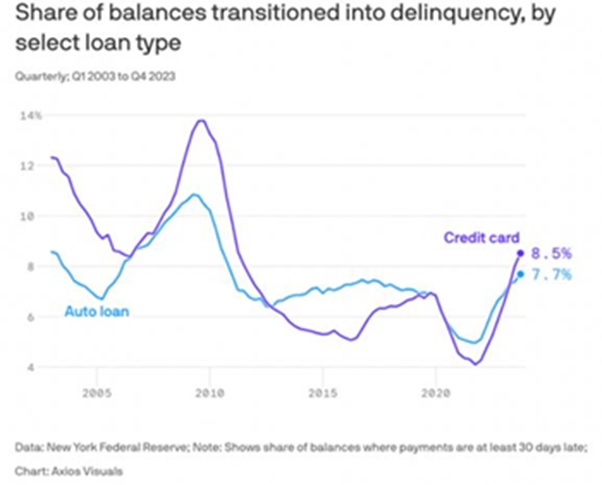

the market came around to only three interest rate cuts (-0.75%) over 2024. A very different tune than the six or seven cuts priced in late last year. Long-term bond rates flirted with 4.5% before coming off. While there is possibility of a tapering of QT, record equity and bitcoin returns highlight speculative market fervor. January inflation was above expectations at +0.3% for the month (+0.2% expected) and +0.4% without food and energy (versus +0.3% forecasted), supporting the Fed’s reticence to aggressively cut rates. To summarize, services continued to rise with physical goods deflating slightly (graph right). The unemployment rate ticked up to 3.9% but really due to the revised lowering of January payrolls, which undercut the stronger than expected February gain of +275,000. Average hourly earnings increased only slightly. The jobs report also showed the participation rate — the share of the population that is working or looking for work — held at 62.5%. The more important rate for workers age 25-54, however, climbed to a five-month high of 83.5%. Consumers are still in a tight spot, with credit card debt hitting a record $1.13 trillion in the 4th quarter (+14.5% over 2023 and well above the rate of inflation). Meanwhile, the average interest rate on credit card balances has moved up to 21.5%. Delinquencies continued to move higher, though still below stress levels of 2008-9 (see left). FICO scores fell for the first time in a decade. Meanwhile, food spending as a percentage of disposable income climbed to a three-decade high as both groceries and dining out consumed more of the average person’s budget. Home affordability also is at the lows last seen at the 2008-9 crash and going back in the late 1980’s as mortgage rates hovered around 7% – double that of three years ago. No wonder people are unhappy.

the Fed’s reticence to aggressively cut rates. To summarize, services continued to rise with physical goods deflating slightly (graph right). The unemployment rate ticked up to 3.9% but really due to the revised lowering of January payrolls, which undercut the stronger than expected February gain of +275,000. Average hourly earnings increased only slightly. The jobs report also showed the participation rate — the share of the population that is working or looking for work — held at 62.5%. The more important rate for workers age 25-54, however, climbed to a five-month high of 83.5%. Consumers are still in a tight spot, with credit card debt hitting a record $1.13 trillion in the 4th quarter (+14.5% over 2023 and well above the rate of inflation). Meanwhile, the average interest rate on credit card balances has moved up to 21.5%. Delinquencies continued to move higher, though still below stress levels of 2008-9 (see left). FICO scores fell for the first time in a decade. Meanwhile, food spending as a percentage of disposable income climbed to a three-decade high as both groceries and dining out consumed more of the average person’s budget. Home affordability also is at the lows last seen at the 2008-9 crash and going back in the late 1980’s as mortgage rates hovered around 7% – double that of three years ago. No wonder people are unhappy.

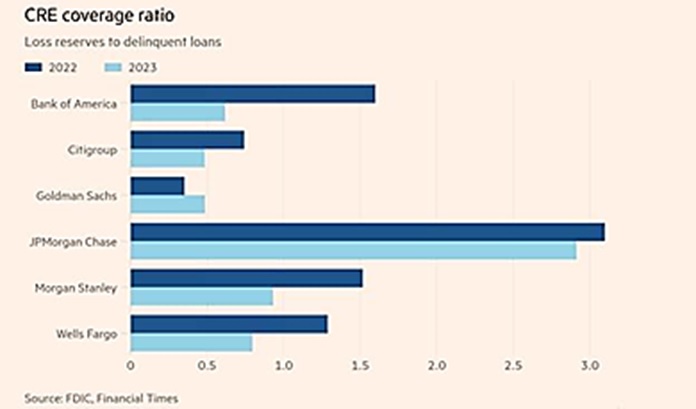

Bank Exposure To Business Property Also Ugly as nearly 20% of outstanding debt on US commercial and multifamily real estate ($929 billion) will mature this year, requiring refinancing or property sales. About one-third ($270 billion) of that amount had already had their maturities extended, hoping for lower rates. Banks in particular hold about one-half ($441 billion) of that debt. Bad commercial real estate loans have overtaken loss reserves at the biggest US banks after a sharp increase in late payments linked to offices, shopping centers and other properties over the last year. The average reserves at JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley fell from $1.60 to $0.90 for every dollar of commercial real estate debt on which a borrower is at least 30 days late, according to filings to the Federal Deposit Insurance Corporation (graph at right, by bank). Only JPMorgan Chase appeared to be adequately reserved. Relatedly, New York Community Bank almost failed in February, but was able to raise equity financing in early March. Overall, delinquent commercial property debt for the six big banks nearly tripled to $9.3 billion in 2023. An estimated $85.8 billion of debt on commercial property was considered distressed at the end of 2023, MSCI Real Assets reported, citing an additional $234.6 billion of potential distress.

this year, requiring refinancing or property sales. About one-third ($270 billion) of that amount had already had their maturities extended, hoping for lower rates. Banks in particular hold about one-half ($441 billion) of that debt. Bad commercial real estate loans have overtaken loss reserves at the biggest US banks after a sharp increase in late payments linked to offices, shopping centers and other properties over the last year. The average reserves at JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley fell from $1.60 to $0.90 for every dollar of commercial real estate debt on which a borrower is at least 30 days late, according to filings to the Federal Deposit Insurance Corporation (graph at right, by bank). Only JPMorgan Chase appeared to be adequately reserved. Relatedly, New York Community Bank almost failed in February, but was able to raise equity financing in early March. Overall, delinquent commercial property debt for the six big banks nearly tripled to $9.3 billion in 2023. An estimated $85.8 billion of debt on commercial property was considered distressed at the end of 2023, MSCI Real Assets reported, citing an additional $234.6 billion of potential distress.

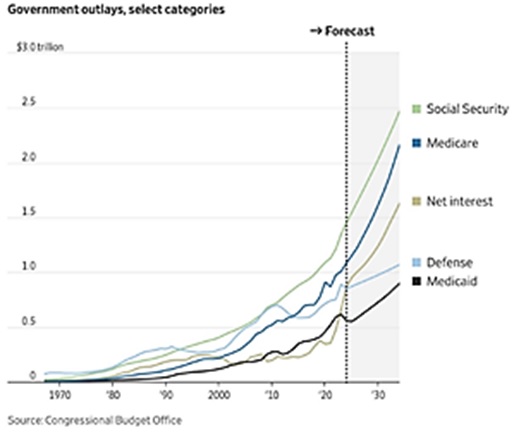

Meanwhile, the US Government is confronting a series of shutdown deadlines: on March 1st (which was pushed to March 22nd) and March 8th. At the end of February, congressional leaders announced an agreement on six appropriations bills and said the package of full-year bills will be enacted before March 8, while the remaining appropriations bills to fund the rest of the government will be finalized and passed before March 22. Given the additional $10s of billions that the Biden administration wants for military spending Ukraine, Taiwan and Gaza, it is uncertain what will actually happen. And of course no one is dealing with the forecasted spending (see graph left). In simple terms, the US national debt is rising $1 trillion every 100 days per Bank of America strategists. They estimated it will take just 95 days for the burden to climb to $35 trillion from $34 trillion, compared to the 92 days it took to grow to $33 trillion from $32 trillion.

February, congressional leaders announced an agreement on six appropriations bills and said the package of full-year bills will be enacted before March 8, while the remaining appropriations bills to fund the rest of the government will be finalized and passed before March 22. Given the additional $10s of billions that the Biden administration wants for military spending Ukraine, Taiwan and Gaza, it is uncertain what will actually happen. And of course no one is dealing with the forecasted spending (see graph left). In simple terms, the US national debt is rising $1 trillion every 100 days per Bank of America strategists. They estimated it will take just 95 days for the burden to climb to $35 trillion from $34 trillion, compared to the 92 days it took to grow to $33 trillion from $32 trillion.

Macro: Europe

European Inflation Ticked Lower from +2.8% to +2.6% over the last twelve months and core inflation followed (from +3.3% to +3.1%). Wages were seen growing by more than +4.5% this year and per the Financial Times the ECB has held that anything above +3% is inconsistent with its own inflation target. Markets now see around 0.9% of rate cuts this year with the first move coming in June, basically in line with the US. ECB President Christine Lagarde said, “The current disinflationary process is expected to continue, but the Governing Council needs to be confident that it will lead us sustainably to our 2% target.” Similar to the US, property prices are a concern, but from a price declining (see right) not increasing. For years under negative interest rates, property in Europe and particularly Germany boomed. But the move higher in rates to combat inflation and higher building costs tipped some developers into insolvency as bank financing dried up and deals froze. Britain’s economy fell into a recession in the second half of 2023, threatening PM Rishi Sunak who has promised to boost growth ahead of an expected 2024 election. The UK’s Office for National Statistics said GDP contracted by a worse-than-expected -0.3% in Q4, compounding the decline, following a decline of -0.1% in Q3.

in June, basically in line with the US. ECB President Christine Lagarde said, “The current disinflationary process is expected to continue, but the Governing Council needs to be confident that it will lead us sustainably to our 2% target.” Similar to the US, property prices are a concern, but from a price declining (see right) not increasing. For years under negative interest rates, property in Europe and particularly Germany boomed. But the move higher in rates to combat inflation and higher building costs tipped some developers into insolvency as bank financing dried up and deals froze. Britain’s economy fell into a recession in the second half of 2023, threatening PM Rishi Sunak who has promised to boost growth ahead of an expected 2024 election. The UK’s Office for National Statistics said GDP contracted by a worse-than-expected -0.3% in Q4, compounding the decline, following a decline of -0.1% in Q3.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource