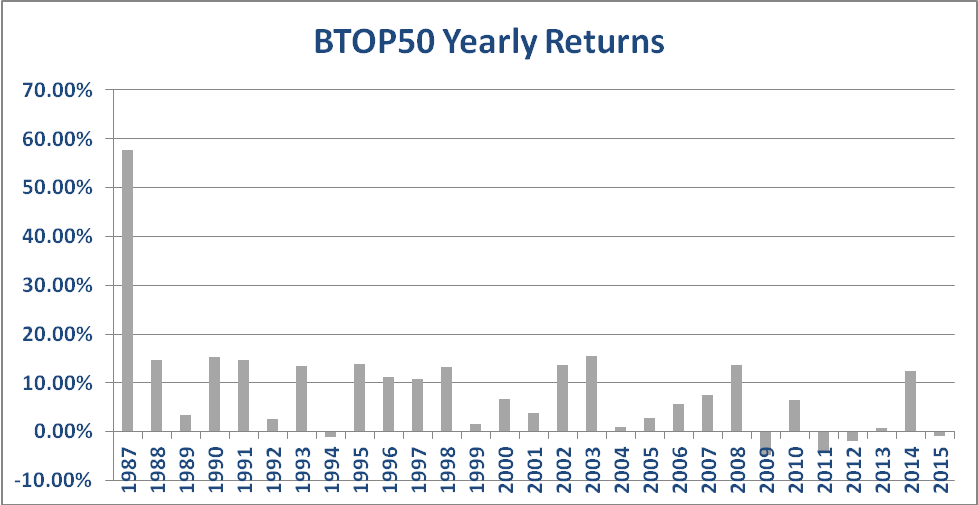

When we tweeted the following article: http://money.cnn.com/2015/10/28/investing/stock-market-democrats-republicans/index.html , we immediately thought it would be interesting to see what impact the President’s political party had on managed futures performance. In order to conduct this exercise, we decided to use the Barclay’s BTOP50 index since it goes all the way back to 1987. While the stock market results in the above article go back to 1945, we still felt it would be interesting to see the results for managed futures going back to 1987.

First, here is a chart of the BTOP50 Index performance going back to 1987:

*Past performance is not indicative of future results.

Index info: http://www.barclayhedge.com/research/indices/btop/

While 1987 was an outlier at 57.64%, all other yearly returns for the BTOP50 fall within the -5.00% to 20.00% range.

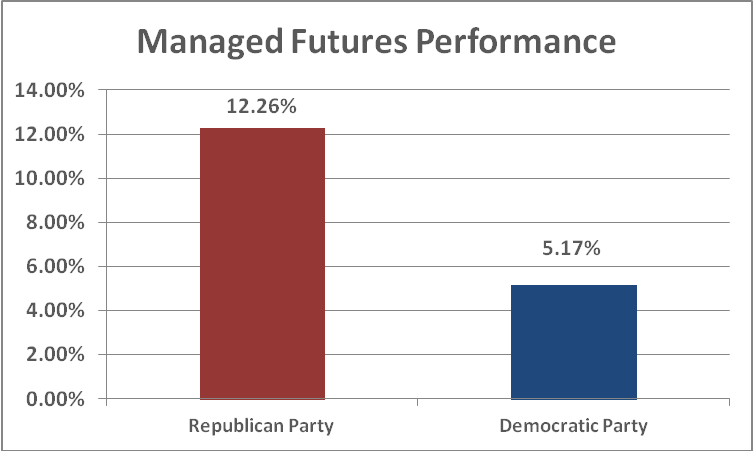

Republicans have been better for Managed Futures

While the sample size is not as large as it is for the stock market, unlike the stock market, Republicans have been better for managed futures performance. Here are the average annual returns under each party:

*Past performance is not indicative of future results.

Index info: http://www.barclayhedge.com/research/indices/btop/

The above results are slightly skewed due to 1987. Since 1987 was a Republican president year, and the return that year was 57.64%, it is inflating the Republican Party average return. If you make 1987’s return 0.00%, the Republican Party average drops down to 8.14%.

While the Republican Party has been “better” for Managed Futures, there is no direct correlation to Republican Party policies and Managed Futures performance. In fact, the last 5 years have been particularly challenging for managed futures, producing a total return ~10% since 2009. All those years have been Democratic President years, which is weighing down the Democratic average. Now, it can be argued that the monetary policy since the 2008 crash has impacted the “tradability” of futures and equity markets, but monetary policy cannot be tied to any one political party. From a purely quantitative stand point, it can be concluded that Republican president years have been better for Managed Futures.