The Federal Reserve came out in October with both guns blazing, talking up the likelihood of an increase of US interest rates. US payrolls for October were much higher than expected and the disappointing previous months were also revised upward, giving Yellen the ammunition for talking up the possibility. While I would welcome modestly higher rates, a decline in the excess reserves (i.e., a reversal of QE) seems more relevant in providing room for an activist monetary policy. Since that has not been raised by the Fed Chair or the other governors despite their incessant communications, I suspect that December will again prove reassuring with no change in monetary policy. To me, 2016 will not see an interest rate increase either, given that the Fed wishes to appear neutral during a US Presidential election. With low growth out of Europe and Asia, extended QE promises by Draghi, continued monetary dovishness by the UK and Japan, emerging market growth faltering (e.g., by most of the BRICs), low global inflation and other political/military concerns (migration policy in Europe, global warming and Syria), it seems that Yellen is still likely to keep rates unchanged and let the relatively higher US rates versus Europe and Japan attract capital naturally. In addition, the trending stronger US dollar would slow US exports and add emerging market uncertainty – this is unwelcome by her and the Obama administration. In summary, I see too many downside risks for this academic Federal Reserve and comparatively little benefit. Europe was (and still is) working through a partially self-created crisis over an up-swell of migrants that is pitting less wealthy Euro-zone countries (that just happen to be largely on the migrant path) against more wealthy ones (AKA Germany). While proper assimilation of these younger, spirited populations will benefit the EU in the long run, there are large up-front costs in terms of education and social services. The IMF and OECD both lowered global GDP growth forecasts on a slowing Chinese economy where the ruling Communist party shifted tone slightly to put into place a number of social spending and growth edicts, including an official end to the “one-child” policy. The Chinese central bank also lowered interest rates and, with the complete intimidation of short-sellers, sparked a stock market turnaround to new highs. In commodities, we have an oil glut. The world is swimming in crude oil and products – even despite US drilling rigs being idled every week for the last many months, the amount in storage is still at seasonal highs and with global production greater than demand, some believe that we will run out of space by Q2 2016. Countries need oil revenues to fight their wars and pay for their social programs. This situation will get worse for oil producers before it gets better. Industrial metal producers are in the same boat. Foodstuffs are also relatively plentiful though we are watching for dryness/drought in the US Midwest in 2016 due to El Niño. Too soon for energy inflation, again keeping monetary policy benign.

Never Underestimate the Fed: While the Federal Reserve left rates alone in October, unsurprisingly, Yellen and the rest of governors went on the offensive in terms of talking up the likelihood of a rate increase in December. In late October, the meeting minutes revealed the removal of previous warnings about the risks of higher rates, sparking newfound certainty that the December meeting will see the long-awaited “lift-off.” In early November, Yellen testified to the US Congress that due to falling risks, raising rates was a “live possibility” in the December meeting with any further increases occurring at a “gradual and measured pace.” These events have been the strongest signals that the Fed will finally move. This tone was reinforced for the markets with a much stronger-than-expected payrolls report, showing 271,000 new jobs for October with an annual wage growth of 2.5% (the fastest rate since the collapse in 2009). The employment report also had minor upward revisions for the disappointing September and August reports. Unemployment rate declined by 0.1% to 5.0% and the participation rate of all workers in the economy stayed at 62.4% (note that higher is better in the sense of a greater percentage of the population is employed). However, the participation rate is still much lower than recent decades, staying at the lowest level since 1977. This low participation rate and the fact of low US inflation (0.0% for the last twelve months ending in September, 1.9% for the core (ex-food and energy) rate), leaves the Federal Reserve on safe ground to not raise rates if it does not want to (considering solely their duel mandate to manage both inflation and employment). There is a lot of time before the next meeting (December 15th and 16th) and another employment report early next month so it is too soon to be certain about rate lift off, I believe. Eliminating some of the excess reserves created by QE would be a more effective tool to signal a hiatus of dovish monetary policy, which would also ease liquidity issues in the repo and credit markets as well. This could be done gradually by not fully reinvesting interest and maturing principal and thus be a highly controlled process. However, this topic has not been on the speaking agenda so we are still left speculating as to the Fed’s direction. Meanwhile the US Treasury sold $21 billion of 3-month treasury bills at 0.00% for the first time.

Meanwhile the political turmoil over the Republican leadership of the House and the need for a new budget and debt ceiling was averted in a “grand bargain” moment with the elevation of Paul Ryan to the Speakership and a budget that allows for spending increases in both 2016 and 2017 in both military and social spending. It also allows for limited sales of the US Strategic Petroleum Reserve (SPR) but these are too small, too far in the future and with new supply of shale oil, a non-issue. This is a remarkable change in mindset, having lived for decades under a meme that oil is ultra-scarce to one of an uber-glut. Meanwhile, the US economy slowed as expected with Q3 QDP growth at an annualized +1.5% rate. Household spending stayed at the strong Q2 rate but a fall in inventory accumulation was the headwind. Overall, this leads to expectations that Q4 GDP will be higher – in the low-to-mid 2% range – assuming household spending stays on track and inventories catch up. The August US trade deficit increased sharply as exports fell and imports rose, again dragging on Q3 GDP. September retail sales also were barely positive for the month and was negative if one excludes automobile sales, underscoring the Q3 results.

Puerto Rico is still flailing with large payments on its general obligation G.O. debt coming due in December – payments for which there is no money. Negotiations have continued to stall on their defaulted Public Finance Corporation debt, which is only $1 billion of the commonwealth’s $72 billion amount outstanding. The $55 billion in G.O. debt is the real trigger for litigation and cross-default risk for the public utility debt which is most of the remaining amount outstanding. Even after spending cuts, Puerto Rico will have only $5 billion to pay $18 billion of interest and principal coming due in the next five years. With the third-highest amount of municipal debt (after California and New York, states with dramatically stronger financial resources and economies), a write off of 40-45% seems in the offing. Will the US Congress do anything? One thing I know is that there is no provision in the new budget! Look for this to come up in the election chatter next year. On the continent, Illinois continues its downward spiral with the state “delaying” payments from the state to the employee pension system. To quote the state comptroller, “This decision is choosing the least of a number of bad options… For all intents and purposes, we are out of money now.”

Turning to Brazil, Fitch (who?) downgraded the country from BBB to BBB- with a negative outlook as its economy is forecasted to contract by -3% and -1%, respectively in 2015 and 2016. Meanwhile the number of individuals and companies delinquent on their loans increased to a record $24.7 billion of bad loans. Petrobras continues to suffer with most of its revenues in weakening reals but costs in foreign currency, forcing the firm to cancel a bond sale in October as interest rates were higher than desired. With $60 billion coming due over the next four years, interest costs could get very ugly, very quickly. Another default in the reasonably near future?

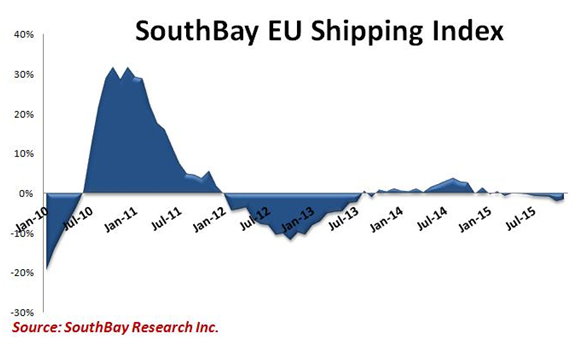

Who is Most Dovish? In late October Draghi signaled that the ECB is ready to boost its €1.1 trillion QE program at its December 3rd meeting, ready to weaken the euro further against the dollar. Despite more countries with negative rates (Italy sold 2-year debt at -0.023% just after the Draghi announcement), the impact is questionable. Certainly there is no inflation (the year-on-year change in prices is literally 0.0% with a 1% core inflation rate), which the ECB ostensibly desires.  At least overall EU unemployment is lower at 10.8%, the lowest since January 2012. Spain is the relative star with the number of employed falling below 5 million for the first time in four years (though is still 21.2%). However, its GDP growth is slowing from a 3.4% year-on-year rate to an annualized 0.8% rate in Q3. Germany too saw a worrying decline in August exports at -5.2%, the greatest fall since the financial crisis, largely due to declining sales to emerging markets (see net EU impact on the right). Eurozone industrial production slipped in September, falling by -0.3% versus a -0.1% expected decline (core economy Germany fell -1.1%) and compounding a -0.5% decline in August (Germany at -1.2%). The UK is relatively better off, with unemployment at 5.4% (the lowest since June 2008) but decided to not raise rates at their most recent meeting – keeping the pressure on the US and EU. Ironically Cyrus is looking to return to the bond markets with a €1.5 billion 10-year bond offering. At 3.7% yields (down 2% from February), why not?

At least overall EU unemployment is lower at 10.8%, the lowest since January 2012. Spain is the relative star with the number of employed falling below 5 million for the first time in four years (though is still 21.2%). However, its GDP growth is slowing from a 3.4% year-on-year rate to an annualized 0.8% rate in Q3. Germany too saw a worrying decline in August exports at -5.2%, the greatest fall since the financial crisis, largely due to declining sales to emerging markets (see net EU impact on the right). Eurozone industrial production slipped in September, falling by -0.3% versus a -0.1% expected decline (core economy Germany fell -1.1%) and compounding a -0.5% decline in August (Germany at -1.2%). The UK is relatively better off, with unemployment at 5.4% (the lowest since June 2008) but decided to not raise rates at their most recent meeting – keeping the pressure on the US and EU. Ironically Cyrus is looking to return to the bond markets with a €1.5 billion 10-year bond offering. At 3.7% yields (down 2% from February), why not?

The Ukrainian situation continues to stabilize (though the beleaguered country is not out of the woods yet), with Russia redirecting its military power and attention to Syria. The eastern rebels gave up their plans for independent elections this year. However, the December payment of €3 billion to Russia for natural gas shipments is still being negotiated, with non-payment possibly scuttling the IMF deal made last month. Always the spoiler. And winter is coming.

China Spending to Try to Regain Momentum: The IMF cut global growth in October from +3.5% to +3.1% largely on their China slowdown forecasts to +6.3% for 2016 and beyond (note that the Communist party has pledged +6.5%). Commodity exporters that have fed the China growth engine and Germany who has also benefited saw their numbers reduced. India is the sole bright spot at +7.0%. China did announce a +6.9% GDP growth figure for Q3 but industrial production in September was below expectations at +5.7%. Retail sales growth was in line. Exports were down -1.1% in Yuan terms, better than expected, but a plunge in imports of -17.7% (versus -16.5% in expectations) underscores the slowing pace. October’s numbers were even worse (-6.9% for exports and -18.8% for imports). The WSJ reporting that Apple cut component orders by up to 10% cannot be helpful either. In local company news, Shenzhen Fu Chang Electronic Technology Co, an electronic parts supplier to domestic telecommunication giants such as Huawei Technologies, said that it would stop all operations immediately because it was having liquidity problems after facing legal and debt issues. Fu Chang owes banks and suppliers 480 million yuan, and it is two months behind on pay for its employees, the National Business Daily reported on Friday. The shutdown would affect more than 3,800 employees and more than 300 suppliers. The dollar figures may not seem like a lot ($78 million) but apparently that’s enough to close the doors. Meanwhile, the government-owned SinoSteel did not have the cash ($315 million) to repay interest and principal so the government mandated that bondholders had to wait until November 20th to demand payment. No news of a bailout in the meantime and that date is fast approaching. $16 billion in total liabilities could be effected and their debt-to-asset ratio is estimated at 98% per Reuters so a direct bailout seems the only remedy.

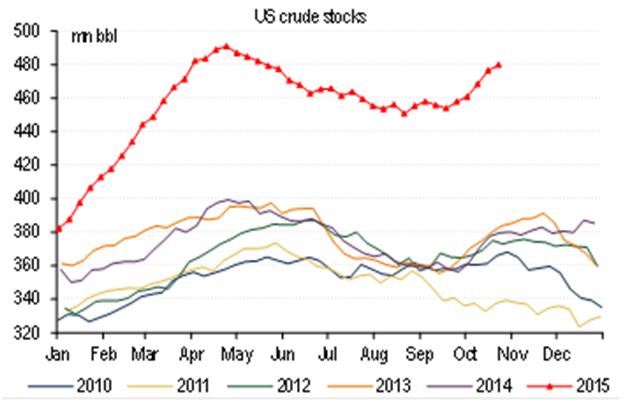

Lower US Production Fails to Dent Global Glut: Despite US rigs still being taken off-line and declining production for seven months, storage continue at high levels (e.g., US monthly shale output is estimated to fall the most in November but US crude stocks are 25% above last year’s levels and are at the highest seasonal level ever recorded). Exhibit one is that Russia’s output hit a post-Soviet high of 10.78 million barrels per day (bpd).  Exhibit two is the Saudi vow to continue their high production despite Saudi inventories hitting a record high as exports fell slightly in August. For reference, their production was 10.23 million in September, against the high of 10.56 million from June). Exhibit three is lifting of Iranian sanctions moved forward as its parliament ratified the nuclear deal after a shorter-than-expected debate period (it lasted an hour instead of several days). At the upcoming December OPEC meeting, Iran said that it will formally announce an increase to its output of 500,000 barrels per day and is “ready” to supply even more to the global markets. OPEC may be correct that US shale output will continue to decline, but it doesn’t seem to do much good. The US’ EIA revised down its US 2016 production numbers by 520,000 bpd – but that output will still average 8.77 million bpd or double 2008’s production. The US has returned to Africa for supplies, quickly reviving trade to post-slump levels. Demand still looks at best stable – the US oil demand is no higher now than seven years ago per research firm PVM – all the incremental demand is from emerging markets. China, however, may not be the same boon it was with tankers waiting offshore to unload and its economic growth slowdown.

Exhibit two is the Saudi vow to continue their high production despite Saudi inventories hitting a record high as exports fell slightly in August. For reference, their production was 10.23 million in September, against the high of 10.56 million from June). Exhibit three is lifting of Iranian sanctions moved forward as its parliament ratified the nuclear deal after a shorter-than-expected debate period (it lasted an hour instead of several days). At the upcoming December OPEC meeting, Iran said that it will formally announce an increase to its output of 500,000 barrels per day and is “ready” to supply even more to the global markets. OPEC may be correct that US shale output will continue to decline, but it doesn’t seem to do much good. The US’ EIA revised down its US 2016 production numbers by 520,000 bpd – but that output will still average 8.77 million bpd or double 2008’s production. The US has returned to Africa for supplies, quickly reviving trade to post-slump levels. Demand still looks at best stable – the US oil demand is no higher now than seven years ago per research firm PVM – all the incremental demand is from emerging markets. China, however, may not be the same boon it was with tankers waiting offshore to unload and its economic growth slowdown.

Oil jobs are still under pressure, with Shell cutting 1,000 positions and $8.2 billion in write-downs. Weatherford plc is cutting 3,000, Baker Hughes an additional 3,700 after 2,500 in Q2 and Schlumberger said that an unspecified number were being considered (July saw 20,000 laid off globally). Norway has to tap into its oil savings fund for the first time to shore up its budget (only a little – but not a positive trend when considering just last year it contributed about $18 billion). Meanwhile, Saudi Arabia has spent about 11% of its reserves ($745 billion from August 2014 to $662 billion in August 2015). In Iraq, where the southern oil fields were never seriously under threat, the government has made significant progress against ISIL, particularly taking the city of Baiji with its vast refinery complex and contesting the Sunni city of Anbar. In fact, their southern oil fields had a record month of exports in October. Against this backdrop, the Obama decision (finally) to block the Keystone XL pipeline from Canada through the United States to the Gulf of Mexico seems anti-climactic (pun intended). A more strategically important gas pipeline is being built between Poland and the Baltic countries which will reduce their dependency on Russia for natural gas supplies. Finally, the oil industry may be losing sight of a longer term strategic change where China is expanding its refinery capacity to challenge South Korea’s gasoline / fuel oil export business (its number four export after electronics, automobiles and machinery). Will China gasoline compete against US exports? And Saudi Arabia is aggressively moving into the refining business, reaching five million bpd in capacity this year. As long as oil is cheap (and in Saudi Arabia it is), it can improve its finances by moving up the value chain.

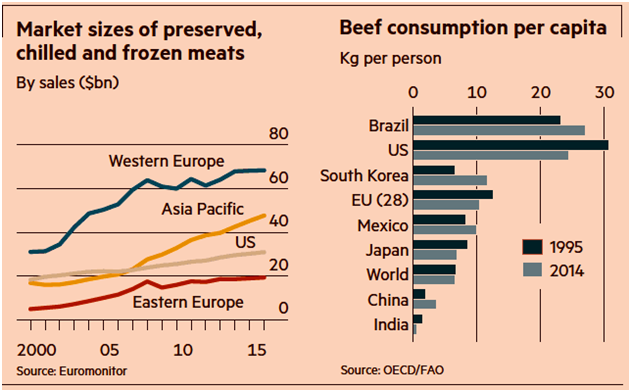

In other commodities news, the World Health Organization told us something that we all know – processed meat products are not healthy for us.  The United States actually has seen declining per capita beef consumption (from over 30 kilos per year to under 25) but it has been increasing in many parts of the world. A classic luxury good – people eat more as they become wealthier and then temper their consumption after a point. Looking elsewhere, grain production was lifted in the United States for 2015 and corn inventories also saw a noted increase on lower China feed use. Soybeans was less dramatically increased but also saw an improvement in yields and exports. Looking ahead Brazilian soybean planting progress remains ahead of last year but behind the average. Likewise, their corn planting is ahead of schedule. While we forecast dryness to possible drought in the US Midwest next year thanks to El Niño, the world should still be amply supplied. The same is true in metals with Rio Tinto pledging to maintain copper output and rival BHP Billiton ruling out any production cuts. The burst dam in Brazil that will cut iron ore production of BHP Billiton and Vale is a hit to their profits by about 3% or less – notable but not critical. Meanwhile aluminum prices in China hit a seven-year low – but 3.5 to 4 million tonnes per year of capacity is expected to come on line in the next eighteen months as electricity costs are falling. Apparently profits are not the first concern of Chinese firms! In comparison, Glencore has been aggressively shoring up its balance sheet, cutting net debt from $30 billion at the end of June to $25 billion in early November. It has announced cuts at its copper and zinc mines, finished a $2.5 billion secondary share offering and has foregone two dividend payments. Its goal of net debt to the $20 billion level by the end of 2016 seems doable. In the world of gold, prices have not done that well, but central banks are still buying – adding 175 tonnes in Q3 2015, concentrated in Russia (77 tonnes) and China (50 tonnes). Kazakhstan, Jordan, Ukraine and UAE were the other significant buyers with only Venezuela as the significant seller (6.9 tonnes).

The United States actually has seen declining per capita beef consumption (from over 30 kilos per year to under 25) but it has been increasing in many parts of the world. A classic luxury good – people eat more as they become wealthier and then temper their consumption after a point. Looking elsewhere, grain production was lifted in the United States for 2015 and corn inventories also saw a noted increase on lower China feed use. Soybeans was less dramatically increased but also saw an improvement in yields and exports. Looking ahead Brazilian soybean planting progress remains ahead of last year but behind the average. Likewise, their corn planting is ahead of schedule. While we forecast dryness to possible drought in the US Midwest next year thanks to El Niño, the world should still be amply supplied. The same is true in metals with Rio Tinto pledging to maintain copper output and rival BHP Billiton ruling out any production cuts. The burst dam in Brazil that will cut iron ore production of BHP Billiton and Vale is a hit to their profits by about 3% or less – notable but not critical. Meanwhile aluminum prices in China hit a seven-year low – but 3.5 to 4 million tonnes per year of capacity is expected to come on line in the next eighteen months as electricity costs are falling. Apparently profits are not the first concern of Chinese firms! In comparison, Glencore has been aggressively shoring up its balance sheet, cutting net debt from $30 billion at the end of June to $25 billion in early November. It has announced cuts at its copper and zinc mines, finished a $2.5 billion secondary share offering and has foregone two dividend payments. Its goal of net debt to the $20 billion level by the end of 2016 seems doable. In the world of gold, prices have not done that well, but central banks are still buying – adding 175 tonnes in Q3 2015, concentrated in Russia (77 tonnes) and China (50 tonnes). Kazakhstan, Jordan, Ukraine and UAE were the other significant buyers with only Venezuela as the significant seller (6.9 tonnes).

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

November 17, 2015

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.