Commodities: Global

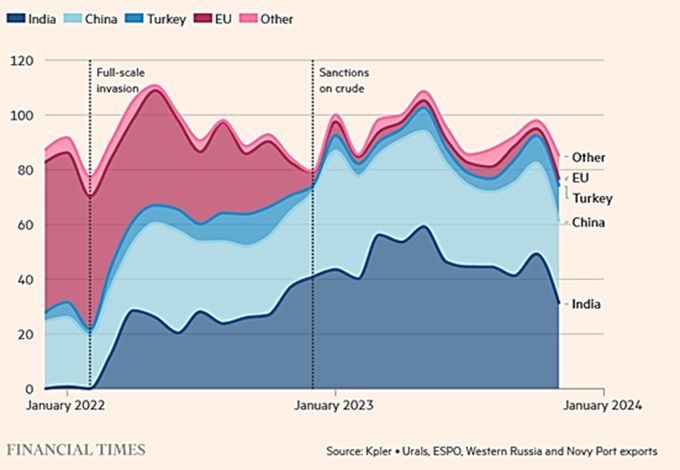

OPEC Oil Output Fell Slightly increased slightly to 28.1 million barrels per day (mbpd) in December, as the fighting in Gaza and Red Sea terror attacks were far away from areas of production. Indian crude imports from Russia in December were the lowest since January of 2023 due to payment issues amid tightening sanctions, according to data intelligence company Kpler. Six tankers carrying Sokol grade oil could not be delivered. India and China still dominate Russian oil exports as indicated to the right.

imports from Russia in December were the lowest since January of 2023 due to payment issues amid tightening sanctions, according to data intelligence company Kpler. Six tankers carrying Sokol grade oil could not be delivered. India and China still dominate Russian oil exports as indicated to the right.

US Oil Production held the record set last month at 13.2 mbpd despite a decline in operating oil rigs from 505 as of December 1st to 500 as of December 29th. Per AAA, US average regular gasoline prices fell further to $3.11 (14¢ lower) as of the end of the month. California prices fell 25¢ to $4.47 per gallon for regular unleaded – nice to see lower but still a wide differential. The United States agreed to purchase 3 million barrels of oil to help replenish the SPR after the largest sale in history last year, for an average of $77.31 a barrel, below the average of $95 a barrel that oil was sold for in 2022. The U.S has purchased 14 million barrels for replenishment after last year’s sales with another 4 million barrels to come back to the SPR by February as oil companies return oil that had been loaned to them through a swap (about 7.5% of what was depleted). Fossil fuels may be getting a new lease on life as electric vehicle inventories on US dealer lots reached a new high in December. With a 114-day supply, the bloated inventory of EVs is up from a 53-day supply a year ago and compares to 71-days’ worth of inventory for the overall auto industry. Per media, US consumers are apparently growing wary of EVs, balking at high prices and still-spotty charging infrastructure. Finally, US dry natural gas production in the lower 48 states reached an all-time monthly high of 104.9 billion cubic feet per day (bcfd) in November of 2023, according to S&P. With a world desperate for natural gas, this is a key export as well.

China’s Crude Oil imports in November fell -9.2% y/y in the first annual decline since April as high inventory levels, weak economic indicators and slowing orders from independent refiners weakened demand. The drop in imports is also attributable to the high prices that existed in September, when November’s arrivals would have been purchased. While China is the world’s biggest crude importer, it was also the world’s sixth-largest crude oil producer last year, with production at just under 4.2 mbpd.

Brazilian Soybean Exports, the world’s largest, for the first time reached over 100 million metric tons of the oilseed within a year, boosted by a record harvest and lower international prices. However, consultancy StoneX cut its estimate for Brazil’s soybean crop in 2023/24 due to lack of rain in key farmlands, and forecasted a 152.8 million metric ton harvest, lower than this season’s 157.7 million metric tons. Meanwhile, recent rains across Argentina’s farming heartland are boosting prospects for the country’s key soy crop, reports from the government and the leading grains exchange showed. The European Commission on Thursday increased its forecast for usable production of maize in the European Union in 2023/24, to 61.4 million metric tons from 59.9 million forecast a month ago. The revised estimate was 15.6% above last year’s drought-hit crop though 10.8% below the average of the past five years.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource