Ukraine-Russia War & Red Sea Shipping: Positioning

The Ukraine-Russia Conflict saw little progress by both sides as Ukraine strove to shore up military funding from Europe and the US. On the funding side, Ukraine shipped a record amount of grain through Romania’s Black Sea port of Constanta, with further growth expected as infrastructure projects advance. The port shipped 32.6 million metric tons of grain in January-November, while its previous annual record was a little over 25 million tons. The shipping corridor along the west Black Sea coast saw Ukraine rebuild many of its exports but disagreements with the Polish government limited replacement land routes. Total Ukrainian grain production remained about 8 million metric tons lower than before the war, primarily in wheat (6.4 million metric tons) but also sunflower seeds (1.5 million metric tons). Conversely, Putin this month said Russia’s total harvest would include 5 million to 6 million metric tons of grain from Kremlin-controlled regions of Ukraine. Finally, the EU agreed to discuss Ukrainian membership though the last country, Croatia, spent ten years in negotiations. Not for 2024!

Iran’s Houthi Proxies Remain Undeterred though finally the US put some teeth in standing up against their attacks. Four Houthi boats tried to board a Maersk container ship in the Red Sea and while the U.S. helicopters were “in the process of issuing verbal calls to the small boats, the small boats fired upon the US helicopters with crew served weapons and small arms.” The Navy helicopters returned fire and sank three of the four small boats, killing ten militants, allowing the fourth boat to flee. Remember, you have to let one go so that they will spread fear in others.

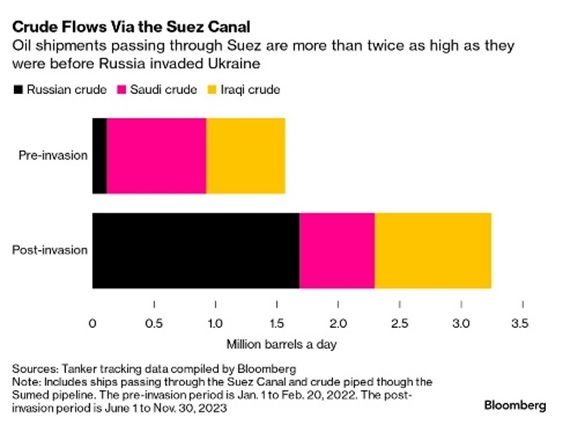

At least 22 commercial vessels have been targeted in the Red Sea and Gulf of Aden since November, causing container shipping capacity through the area at times to drop to just 12.7 percent of normal. Iran stepped up its support of Houthi attacks with a spy ship coordinating attacks (per WSJ) and sending a destroyer into the conflict area. Iran’s navy has about twenty large ships, but only seven of the size sent out (their largest class). Interestingly, Russia and Iraq are heavy users of the transit for their oil shipments. Perhaps a small “thank-you” to the USN!

times to drop to just 12.7 percent of normal. Iran stepped up its support of Houthi attacks with a spy ship coordinating attacks (per WSJ) and sending a destroyer into the conflict area. Iran’s navy has about twenty large ships, but only seven of the size sent out (their largest class). Interestingly, Russia and Iraq are heavy users of the transit for their oil shipments. Perhaps a small “thank-you” to the USN!

Macro: Asia

China’s Economic Data picked up with exports positive for the first time since April, by +0.5% year-on-year (y/y) in USD terms (vs. -6.4% in October), amid signs of improvement in global trade flows.  Within this, exports to the U.S. increased +7.3% y/y, while those to the EU dropped further to -14.5% y/y. Imports declined by -0.6% y/y (vs. +3.0% in October), missing market forecasts of a +3.3% rise. China’s crude oil imports in November fell -9.2% y/y, offsetting gains in other areas. Chinese inflation fell further, dropping -0.5% y/y as pork prices dipped to the lowest level in twenty months. Ample hogs and weak demand hurt farmers. However, core consumer prices, which exclude food and energy, inched up +0.6% y/y, the same as seen in the previous month. Other economic data held strong as fixed asset investment growth remained at +2.9% y/y, the same as through October – however retail sales were up +10.1% y/y in November (vs. +7.6% in October), and industrial production gained +6.6% y/y (vs. +4.6%), while the unemployment rate hovered at 5% for the third month in a row. Finally, property data was slightly better, with floor space new starts and completions both positive but home sales by value remained deeply negative.

Within this, exports to the U.S. increased +7.3% y/y, while those to the EU dropped further to -14.5% y/y. Imports declined by -0.6% y/y (vs. +3.0% in October), missing market forecasts of a +3.3% rise. China’s crude oil imports in November fell -9.2% y/y, offsetting gains in other areas. Chinese inflation fell further, dropping -0.5% y/y as pork prices dipped to the lowest level in twenty months. Ample hogs and weak demand hurt farmers. However, core consumer prices, which exclude food and energy, inched up +0.6% y/y, the same as seen in the previous month. Other economic data held strong as fixed asset investment growth remained at +2.9% y/y, the same as through October – however retail sales were up +10.1% y/y in November (vs. +7.6% in October), and industrial production gained +6.6% y/y (vs. +4.6%), while the unemployment rate hovered at 5% for the third month in a row. Finally, property data was slightly better, with floor space new starts and completions both positive but home sales by value remained deeply negative.

Trends to Watch in China are first the drying up of foreign direct investment in China (see graph right) as the Xi expanded his authoritarian powers. The technology bans may get more press but this trend implies that that technology transfer from West to East is ending. Can China continue to so rapidly expand its technology foundation to challenge the US/Europe/Japan? It is harder to do on your own instead of copying/stealing. Second, China’s state health insurance system lost 19 million people in 2022 as higher costs caused people to drop coverage. 2023 has likewise drops for the partial year. Admittedly, this is a small percentage of their 1.3 billion people. However, with the main policy premiums up over 100% versus migrant wages up only 24% since 2018 and co-payments of up to 70%, affordability and value are questionable. Sounds like the US system, actually.

technology bans may get more press but this trend implies that that technology transfer from West to East is ending. Can China continue to so rapidly expand its technology foundation to challenge the US/Europe/Japan? It is harder to do on your own instead of copying/stealing. Second, China’s state health insurance system lost 19 million people in 2022 as higher costs caused people to drop coverage. 2023 has likewise drops for the partial year. Admittedly, this is a small percentage of their 1.3 billion people. However, with the main policy premiums up over 100% versus migrant wages up only 24% since 2018 and co-payments of up to 70%, affordability and value are questionable. Sounds like the US system, actually.

The Bank of Japan Maintained Ultra-loose monetary policy in a widely expected move, underscoring policymakers’ preference to await more clues on whether wages will rise enough to keep inflation durably around its 2% target. The central bank also made no change to its dovish policy guidance.

Macro: US

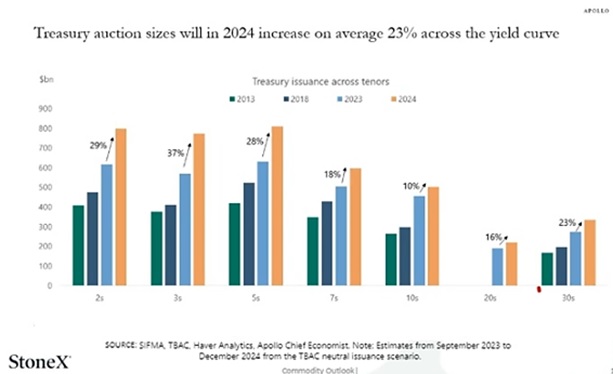

The Federal Reserve left its benchmark interest rate unchanged at its December meeting but shifted the messaging to signaling an easing of inflation and  that, plus dovish comments from Chair Powell, cemented the bullish sentiment seen over the last six weeks. While the committee’s members were willing to project only three interest rate cuts (0.75%) over 2024, the market quickly priced in six, with the first at the March 19-20th meeting. Long-term bonds fell below 4% before reverting above that in the New Year. This was also despite a clear increase in US Treasury issuance to cover the expanding debt (see graphic to the right). US inflation may be heading in the right direction as November’s headline CPI rose +0.1% (vs. 0% prior), above consensus expectations, while the year-over-year change ticked down to +3.1% (vs. +3.2% prior). Core inflation edged up +0.3% month on month (vs. +0.2% prior), with the year-over-year pace staying at +4.0%. US employment for December was strong at +216,000 jobs added, holding the rate at 3.7% and hourly earning increasing +0.4% from the month prior. This was despite the participation rate falling by 0.3% to 62.5%, decent but low versus the pre-COVID era.

that, plus dovish comments from Chair Powell, cemented the bullish sentiment seen over the last six weeks. While the committee’s members were willing to project only three interest rate cuts (0.75%) over 2024, the market quickly priced in six, with the first at the March 19-20th meeting. Long-term bonds fell below 4% before reverting above that in the New Year. This was also despite a clear increase in US Treasury issuance to cover the expanding debt (see graphic to the right). US inflation may be heading in the right direction as November’s headline CPI rose +0.1% (vs. 0% prior), above consensus expectations, while the year-over-year change ticked down to +3.1% (vs. +3.2% prior). Core inflation edged up +0.3% month on month (vs. +0.2% prior), with the year-over-year pace staying at +4.0%. US employment for December was strong at +216,000 jobs added, holding the rate at 3.7% and hourly earning increasing +0.4% from the month prior. This was despite the participation rate falling by 0.3% to 62.5%, decent but low versus the pre-COVID era.

The US Government faces a budget deadline on January 19th, just days after the Iowa caucuses signal the start of the 2024 presidential campaign season – will political posturing get in the way of a better budget? Even doing nothing, the Congressional Budget Office projects an increase of $1.5 trillion in US federal debt with the same in each of the next few years. In their estimate, even adding every large tax increase they model (payroll taxes, income taxes, a new consumption tax) which would raise about $13.7 trillion over the next ten years, will not be enough to cover the $20 trillion in their expected deficit over that time. Expect this mess to be in place for the next five years at least. Meanwhile, the US homeless count reached a new record in 2023, increasing 12% per the US Department of Housing and Urban Development, and reached 653,000 people. Per WSJ, the increase reflected rising housing costs, limited affordable housing units, the opioid epidemic, and the expired pandemic-era aid that had helped keep people in their homes. A surge of migrants into shelters in places such as New York City, Massachusetts and Chicago also contributed. Given that over five million illegal immigrants have come into the US over the last three years (that have been counted per US Customs and Border Patrol), the problem is more serious than the announcement indicated.

Macro: Europe

The European Central Bank Stayed “Higher for Longer” as their inflation showed a surprise uptick for December, moving to +2.9% from +2.4% for November (both y/y). The reduction of government subsidies on gas, electricity and food that were in place last year has triggered a re-acceleration of annual inflation in much of Europe. German inflation increased to +3.8% from +2.3% a month earlier. French inflation ticked higher as well. German manufacturing factory orders in October dropped -3.7% m/m, reversing two months of sequential gains and affirming the weakening trend in Europe heading into Q4. However, businesses may simply be reacting to higher energy and electricity costs.

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource