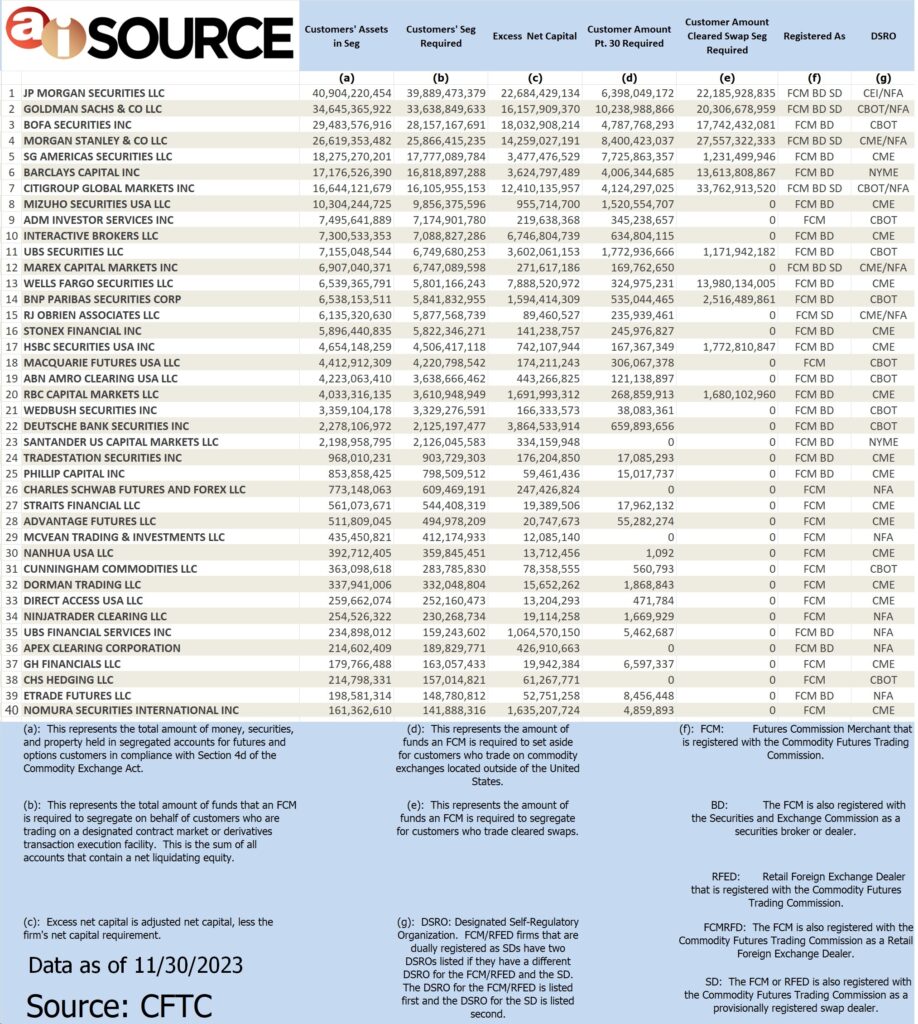

One of our most popular blog posts: a list of the top FCMs (based on customer funds held in segregation) has been updated with end of 2023 numbers. When doing research in selecting a futures commission merchant, or FCM, (i.e. custodian) to house your managed futures portfolio, it can be difficult to find a resource to assist in your decision-making process. The best tool the aiSource team has found is the data put together by CFTC that lists the all the FCMs each year based on total customer equity. Our 2024 ranking contains the top 40 FCMs based on customer funds as of November 30th, 2023. Please keep in mind that there is a total of 62 FCMs on the CFTC list. Here our Top 40 Rankings:

Total assets in segregation of the Top 40 FCMs declined from 2022 to 2023. In 2022 the top 40 had ~$297 Billion; this year’s total is ~$280 Billion. FCM consolidation has taken a pause over the last year with many mergers occurring in years prior. Furthermore, clients likely withdrew excess funds to park them in risk-free interest rate bearing accounts. Investor demand for managed futures continued in 2023 as investors demanded more “alpha” given the risk-free rate. aiSource also has seen a major spike in investor demand through our website and CTA database registrations.

The top eight FCMs on the list are institutional specific FCMs that do not house accounts smaller than $10M in size. FCMs that aiSource uses to house its clients’ accounts all fall between spots eleven through thirty-two: Marex North American (#12), R.J. O’Brien, (#15), StoneX (#16), Phillip Capital (#25), Cunningham Commodities, LLC (#31) and Dorman Trading (#32). Marex Capital Markets is the largest FCM that is available to all types of clients; as of November 30th, 2023, they had $6.9 billion in client funds. The FCM selection process is different based on the specific needs of each client, and our clients are divided amongst the FCMs that we use.

Some FCMs that managed futures investors and CTAs should stay away from are the ones that are not equipped to handle managed futures accounts. Time and time again, aiSource has seen novice investors get attracted by “low commissions,” and open an account with Interactive Brokers (#11) and face hardship when facilitating the needs of a managed account. Interactive Brokers is a great FCM but is better suited for self-directed traders.

As an independent brokerage/investment advisory firm, aiSource has the ability to house its client accounts at any FCM. We are always looking to develop new FCM relationships and offer those to our clients, but based on our experience, R.J. O’Brien, StoneX, and Marex North America are some of the best to house multi-CTA portfolios.