OPEC+ Held to Increasing Production by 400,000 barrels per day for February, though is continually missing their total quota due to underproduction in many countries. OPEC pumped 27.8 mbpd in December, a Reuters survey found, up 0.07 mbpd from the previous month but short of the 0.3 mbpd increase allowed under their supply deal. Libya, for example, was at 0.9 million barrels per day (mbpd), up from a recent low of 0.7 mbpd, as pipeline maintenance has finished. But, 0.3 mbpd remained offline in several fields due to blockades and other internal strife. Iraq, which was OPEC’s second largest producer, raised their crude oil output in December to 4.2 mbpd, just shy of quota. Despite the street battles in Kazakhstan (1.7 mbpd production in November), oil production in Kazakhstan is gradually returning to normal according to Chevron, the largest foreign producer there. Russian paratroopers and “shoot-on-sight” orders from the leader look to be either successfully cracking down on a coup plot or cementing control over his rivals. Hard to say who is doing what to whom with the internet shutdown.

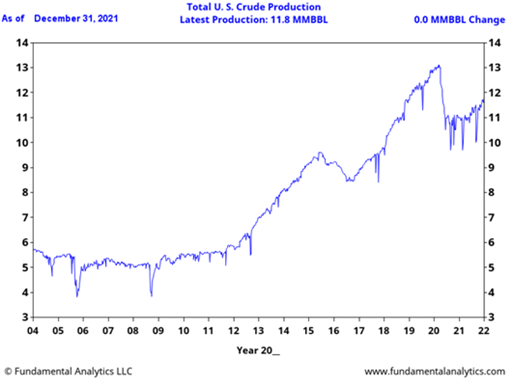

US Oil Production increased versus last month to 11.8 mbpd during December while operating rigs continued higher from 467 as of December 3rd to 480 as of December 31st. Biden’s acceleration of the already-Congressionally approved SPR sale of 18 million barrels and to allow another 32 million barrels to be swapped out with the commitment to replace them in the future failed to stem the +14% ramp in oil prices in December. Per AAA, US average regular gasoline prices were at $3.29 per gallon last month versus the high of $3.42 in early November, only slightly lower. A deep-freeze in Canada and Northern US disrupted oil flows, just as American stockpiles are declining – with temperatures from North Dakota to Northern Alberta below zero Fahrenheit (-18 Celsius), TC Energy Corp.’s Keystone pipeline was shut briefly and North Dakota’s Bakken shale region lost production due to the freeze. Biden did get South Korea to release some oil from their reserves – 3.2 million barrels over three months – but like with the US release, oil sent out would have to be returned within a year, limiting the effect. India also pledged to release 5 million barrels, although questions remain on timing.

China Bought Cheap Iranian Crude after independent refiners were granted additional import quotas before the end of 2021. The nation imported almost 18 million barrels in November from Iran, equivalent to about 0.6 mbpd, according to market intelligence firm Kpler. That’s up almost 40% from October and the biggest volume since August. Note that official Chinese data indicated the nation hasn’t taken Iranian oil since December 2020. Supplies have often been re-branded as originating from Oman and Malaysia in the past.

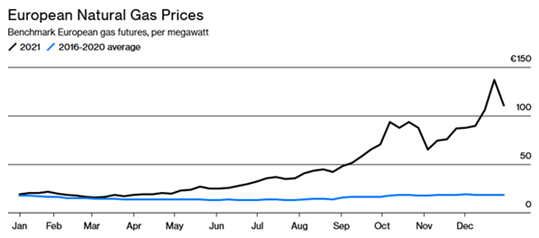

Looking At Europe, natural gas futures extended gains as Russia failed to deliver promised extra volumes as seen in the graph to the right. Europe responded by increasing its dependence on Russian energy as Germany shut down three of its remaining six nuclear power plants on December 31st with the other three due to be shut down by the end of 2022. Germany has been investing heavily in renewable power generation capacity, which currently supplies 41% percent of the country’s needs. However, coal and natural gas that currently meet 28% and 15%, respectively, will now have to make up for the 25% share that  nuclear power plants once supplied. Substituting stable-baseline, zero-carbon-emissions power with dirty coal and unreliable wind/solar while granting power to an external autocratic government that carries deep historical animosity seems like a complete set of bad German decisions. Still baffling. Meanwhile, France outlined plans for new nuclear reactors with a target date of 2035-37 for the reactors to go online.

nuclear power plants once supplied. Substituting stable-baseline, zero-carbon-emissions power with dirty coal and unreliable wind/solar while granting power to an external autocratic government that carries deep historical animosity seems like a complete set of bad German decisions. Still baffling. Meanwhile, France outlined plans for new nuclear reactors with a target date of 2035-37 for the reactors to go online.

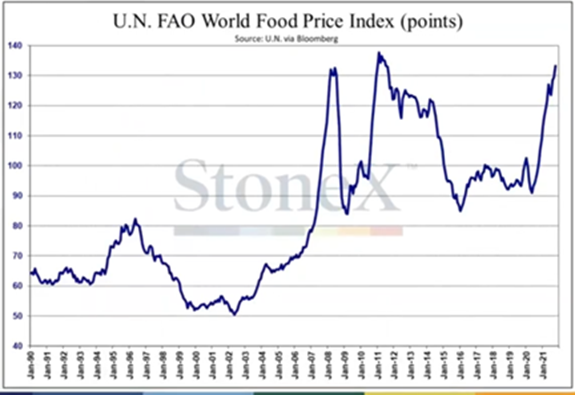

US Farmers Will Increase combined planted acreage of corn, soybeans, wheat and cotton by +2.7% in 2022 in an expansion that could bring down food inflation per Citigroup, though the market currently was obsessed by relatively dry weather in South America, particularly Argentina. However, recent improvements to mid-range forecasts in South America could bring some much-needed rains to Brazil and Argentina. US soybean export inspections totaled 33.3 million bushels for the week ending January 6, sliding substantially lower than the prior week. It was also below the entire range of trade estimates. Ukraine’s 2021 corn harvest is now seen at 40.4m tons, up 0.5m tons from a prior estimate, consultant SovEcon wrote, based on good yields in the  west and would be an all-time high. China was reportedly aggressively booking Ukrainian supply and was estimated to purchase 8m-10m tons so far to make Ukraine its leading corn supplier this season. In total, Ukraine reportedly shipped over 5 MMT of corn in December with the season total reaching 12 MMT. Of this amount, 4.0 MMT was shipped to China. The big picture question comes from the graph to the right which reminded us that the last time food prices were this high, there were a series of revolutions and civic strife (the “color revolutions”) and with fuel costs also high / rising, will there be a repeat?

west and would be an all-time high. China was reportedly aggressively booking Ukrainian supply and was estimated to purchase 8m-10m tons so far to make Ukraine its leading corn supplier this season. In total, Ukraine reportedly shipped over 5 MMT of corn in December with the season total reaching 12 MMT. Of this amount, 4.0 MMT was shipped to China. The big picture question comes from the graph to the right which reminded us that the last time food prices were this high, there were a series of revolutions and civic strife (the “color revolutions”) and with fuel costs also high / rising, will there be a repeat?

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource