COVID-19

- Omicron: Foe or Friend? As the new variant crowds out Delta (Omicron 95% of cases reported in early January), the playing fiel

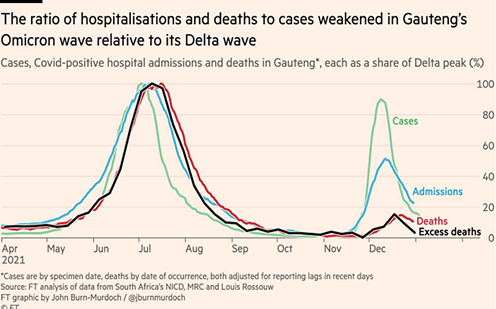

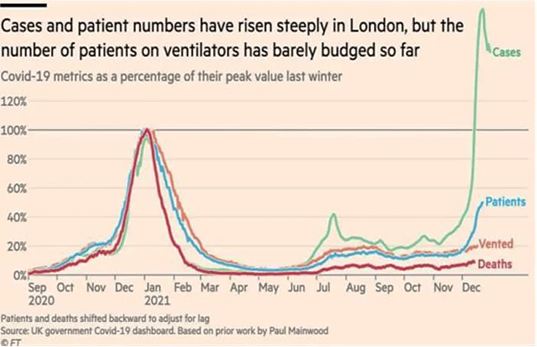

d shifted to data that suggested so far that indeed it is dramatically milder than previous iterations. First, looking at the origin country (South Africa), one can see the infection wave appeared to be in terminal decline in early January. The Financial Times graphic to the right gave the numbers as % of Delta – in absolute numbers, the 7-day average of cases peaked at 23,437, average hospitalizations peaked at almost 10,000 and average deaths was still trending higher to 67. With the lag in deaths, one would expect that number to increase slightly. Since some would complain that testing has not been sufficiently widespread in that country (though no reason to think that testing quality nowadays would be worse than a year ago so the relative testing rate would be consistent), one can look at the London data also from the FT seen to the right – a rise in cases (but recently falling), with relatively smaller rises in serious cases and deaths (too soon to see a fall with the time lag).

d shifted to data that suggested so far that indeed it is dramatically milder than previous iterations. First, looking at the origin country (South Africa), one can see the infection wave appeared to be in terminal decline in early January. The Financial Times graphic to the right gave the numbers as % of Delta – in absolute numbers, the 7-day average of cases peaked at 23,437, average hospitalizations peaked at almost 10,000 and average deaths was still trending higher to 67. With the lag in deaths, one would expect that number to increase slightly. Since some would complain that testing has not been sufficiently widespread in that country (though no reason to think that testing quality nowadays would be worse than a year ago so the relative testing rate would be consistent), one can look at the London data also from the FT seen to the right – a rise in cases (but recently falling), with relatively smaller rises in serious cases and deaths (too soon to see a fall with the time lag).

- What Does This Mean For The US? Columbia University researchers suggested that the US could peak by January 9th at around 2.5 million cases per week, though that number may go as high as 5.4 million. Remember also that starting in 2022, testing must separate COVID from flu infections which will also affect these numbers going forward. Still, 90% of hospitalized cases have co-morbidities (obesity, high blood pressure, etc.), so the best way to avoid the worst outcomes is to have strong overall health or consider stringent medical precautions if have an underlying co-morbidity. Finally, following the CDC advice of not taking a cruise seemed wise given their

rampant cases despite passengers and crew being 100% vaccinated/boosted.

rampant cases despite passengers and crew being 100% vaccinated/boosted.

- As always, our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- US Q4 GDP Projection still was a strong +6.7% from the Atlanta Fed, despite the Omicron lockdowns. However, US consumer prices year-on-year spiked to +6.8% in November, with more price increases expected in shipping, housing and consumer products in early 2022. Core inflation also accelerated to +4.9% year-on-year. While the rate of inflation was expected to moderate around mid-year, a combination of low previous-year levels, supply-side disruptions, delivery bottlenecks (freight costs are still double versus a year ago), labor shortages (3 million older workers have not returned to the workforce versus trend expectations), elevated energy and food costs and rising residential rents could keep the CPI rate above 6% in Q1 2022, with a corresponding core rate of 5%. November factory goods and durable goods orders posted strong increases (+1.6% and +2.5%, respectively), confirming the trend. The December employment report continued the theme of tight labor supply, with headline job growth of just 199k due to extreme seasonal adjustment but a very low unemployment rate of 3.9%. Manufacturing payrolls grew by the second-largest number in over a decade. Wage growth was well above expectations at +0.6% on the month and +4.7% year-on-year with prior headline job growth and wages revised higher. The participation rate was steady at 61.9%, and the under-employment rate also dropped sharply, from 7.8% to 7.3%. In short, strong like bull.

- Fed Tapering (buying fewer bonds) plans solidified at its December 14-15th meeting though when the minutes came out in early January, it became apparent that the Fed considered more serious shifts to a restrictive policy: “It may become warranted to increase the federal funds rate sooner or at a faster pace than participants had earlier anticipated. Some participants also noted that it could be appropriate to begin to reduce the … balance sheet relatively soon after beginning to raise the federal funds rate” (my emphasis). While interest rates have already moved higher in reaction, the balance of risk looked to keep shifting against rate-sensitive assets. Larger government deficit spending should be expected, with the 2021 budget deficit projected to be $1.8 trillion, falling to “only” $1.4 trillion the following fiscal year – and that was without the delayed $1.8 trillion “Build Back Better” supplemental spending bill.

Macro: Asia

The Chinese Economy still signaled growth in November with retail sales improving (though at a slowing pace +3.9% year-on-year), as did industrial production at +3.9% year-on-year. The Chinese Central Bank cut one-year loan rates for the first time in 20 months as well as injected liquidity to banks during December in order to ease lending conditions as it battles a property crisis. More downgrades hit the sector, with Moody’s, Fitch and S&P downgraded Chinese developers’

ratings 43, 54 and 30 times, respectively, in 2021, compared with six, 12 and 11 in 2020. Besides Evergrande and Kaisa, Shimao Group, one of the highest quality names in the sector, suffered from unconfirmed speculation of payment difficulties, which sent the company’s bonds tumbling from nearly 90 cents on the dollar to 59 cents. In another sign of growing stress, Guangzhou R&F Properties Co. sought to delay payment of a $725 million dollar note maturing in January by six months. China still has time to continue repressing its population, arresting independent journalists and tearing down the Tiananmen Square commemorative statue in Hong Kong. Some large cities (Xi’an – 13 million population and Tianjin – 14 million) were locked down after COVID cases were discovered as well.

ratings 43, 54 and 30 times, respectively, in 2021, compared with six, 12 and 11 in 2020. Besides Evergrande and Kaisa, Shimao Group, one of the highest quality names in the sector, suffered from unconfirmed speculation of payment difficulties, which sent the company’s bonds tumbling from nearly 90 cents on the dollar to 59 cents. In another sign of growing stress, Guangzhou R&F Properties Co. sought to delay payment of a $725 million dollar note maturing in January by six months. China still has time to continue repressing its population, arresting independent journalists and tearing down the Tiananmen Square commemorative statue in Hong Kong. Some large cities (Xi’an – 13 million population and Tianjin – 14 million) were locked down after COVID cases were discovered as well.

Japan’s Industrial Production data jumped by a record +7.2% month-on-month in November mainly due to the auto industry (see graph right). Higher exports of these automobiles, as well as steel and semiconductor equipment lifted the overall value of Japanese shipments +20.5% from last year’s level, the finance ministry reported, boding well for Q4 GDP. Likewise, South Korea’s exports grow +25.8% year-on-year in 2021, the sharpest in 11 years. These countries seem to be holding their own against China.

Macro: Europe

German Industrial Production Fell slightly in November (-0.2% month-on-month, -2.4% year-on-year) as COVID lockdowns and radically high electricity rates took their toll. Exports rose month-on-month by +1.7%, supported by automobiles (+4.1% month-on-month). Eurozone annual inflation hit a record +5.0%, higher than expectations of +4.7%, with core inflation at +2.6%. To offset the resulting increases in bond yields, the ECB pledged to briefly double asset purchases to cushion the end of its 1.85 trillion-euro ($2.1 trillion) Asset Purchase Program by doubling purchases to 40 billion euros a month, starting in the second quarter, tapering to 30 billion euros before returning to the existing pace of 20 billion euros in October. ECB officials also changed reinvestment rules around another program, further loosening policy and give more emergency support to Greece, which is excluded from regular bond purchases because of its low credit rating. How much longer will their nerve hold, especially the US tapering its bond purchases and raising rates in 2022? In early January German Bunds made a move close to zero – are positive interest rates around the corner? With natural gas from Russia well under its usual levels, one wonders how “transitory” European GDP growth will be too.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource