COVID-19

- US Economic Activity looks challenged in the month ahead due to COVID and the holidays, at least until the

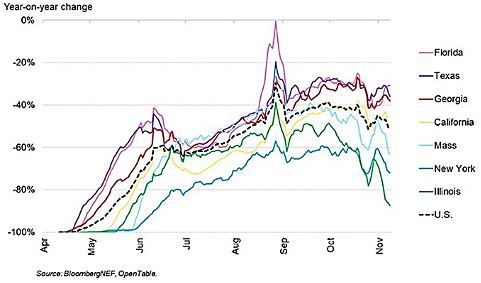

vaccines start rolling out. This month we feature US restaurant dine-in activity which began to fall again per OpenTable (see right). Note that graph does not yet include the expansion of dining restrictions in California (the yellow line close to the total US line) and other states in late November / early December. Over the past thirty days to mid-November, the US fell -12% with Illinois the hardest hit, as dining activity there was just one-tenth of last year’s levels after falling -30%. Although the case/hospitalization/death numbers moved higher, three vaccines reached the final stages of approval. The UK on December 2nd became the first western country to

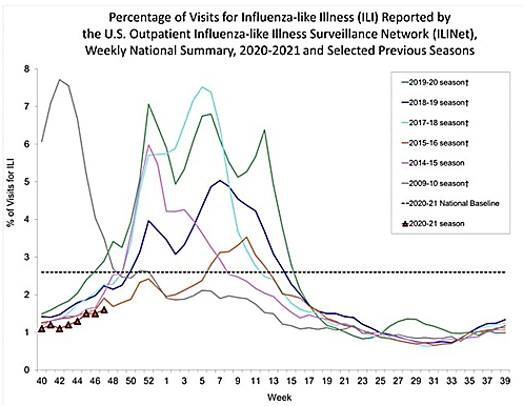

vaccines start rolling out. This month we feature US restaurant dine-in activity which began to fall again per OpenTable (see right). Note that graph does not yet include the expansion of dining restrictions in California (the yellow line close to the total US line) and other states in late November / early December. Over the past thirty days to mid-November, the US fell -12% with Illinois the hardest hit, as dining activity there was just one-tenth of last year’s levels after falling -30%. Although the case/hospitalization/death numbers moved higher, three vaccines reached the final stages of approval. The UK on December 2nd became the first western country to  approve a COVID-19 vaccine, choosing the one developed by Pfizer. The vaccine will be rolled out the following week – if it all works out, Prime Minister Johnson may salvage his public opinion ratings. In other good news, at least the hospitalization rate for influenza is running lower this year versus most of the recent years, freeing up medical resources (see graph right with 2020 as the triangles). While the real turning point will not be until Q2 or so next year, it cannot happen soon enough for downtown retailers as Bloomberg reported that foot traffic at downtown merchants was down by around -70% in U.S. cities including Chicago and San Francisco, according to smartphone data compiled by SafeGraph Inc. Suburban and rural main streets are off much less but at -30 to -45%, still devastating.

approve a COVID-19 vaccine, choosing the one developed by Pfizer. The vaccine will be rolled out the following week – if it all works out, Prime Minister Johnson may salvage his public opinion ratings. In other good news, at least the hospitalization rate for influenza is running lower this year versus most of the recent years, freeing up medical resources (see graph right with 2020 as the triangles). While the real turning point will not be until Q2 or so next year, it cannot happen soon enough for downtown retailers as Bloomberg reported that foot traffic at downtown merchants was down by around -70% in U.S. cities including Chicago and San Francisco, according to smartphone data compiled by SafeGraph Inc. Suburban and rural main streets are off much less but at -30 to -45%, still devastating.

- While Q4 GDP growth looks good for the US and Europe, the increased lockdowns on the populous coasts will likely carry through Q1 2021, damaging prospects in early 2021. However, a successful medical response will keep markets buoyant as investors look past the next six months. Managing through this is everyone’s responsibility. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

US

- Q3 GDP Growth of annualized +33.1% (+7.4%ish just for the quarter) stayed unrevised while Q4 is estimated at +11.1% per the Atlanta Fed. While unemployment for the US made further gains in November (dropping from 6.9% to 6.7%), there was a small decline in the labor force participation rate from 57.4% to 57.3%. On the other hand, the improvement in unemployment overcame the negative effect of 93,000 temporary census workers finishing their positions. Nonfarm payrolls increased by 245,000 from the prior month, missing expectations of a gain of 460,000 positions. A review of the news implied that the increase in COVID cases as well as stricter lockdowns in reaction limited employment gains and put December and Q1 2021 into question. Other economic indicators were supportive of a good Q4 with October’s durable goods increasing +1.3% m/m versus +0.8% in the survey with September’s number revised higher to +2.1%. While highly volatile but material to the durable goods reports, the aircraft industry received some good news as Boeing’s 737 MAX received approval to fly and RyanAir placed an

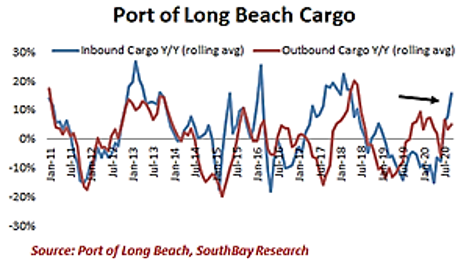

order for 75 of the jets – a needed win for US industry. Overall US industrial production rose +1.1% m/m. Retail sales grew +0.3% m/m in October, the slowest pace in six months but still positive at least. Personal spending rose +0.5% but income fell -0.7%, lower than the -0.1% expected. Housing benefited from record-low mortgage rates of 2.71 for 30-year loans with existing home sales rising +4.3% m/m to the highest level in fifteen years. Pending and new home sales were off a little from very high levels. Finally the US showed strong foreign trade activity with South Bay Research noting that container imports surged +10% y/y at most ports in September (see graph right). Hope yet for a Merry Christmas!

order for 75 of the jets – a needed win for US industry. Overall US industrial production rose +1.1% m/m. Retail sales grew +0.3% m/m in October, the slowest pace in six months but still positive at least. Personal spending rose +0.5% but income fell -0.7%, lower than the -0.1% expected. Housing benefited from record-low mortgage rates of 2.71 for 30-year loans with existing home sales rising +4.3% m/m to the highest level in fifteen years. Pending and new home sales were off a little from very high levels. Finally the US showed strong foreign trade activity with South Bay Research noting that container imports surged +10% y/y at most ports in September (see graph right). Hope yet for a Merry Christmas!

- More Government Spending was put on the table with a tentative deal for just over $900 billion in Congress. The breakdown was as follows: $288 billion for small business support, $180 bill for additional unemployment benefits, $160 billion for state/local/tribal governments and the remaining $280 to various industries, schools and vaccine-related logistics. An indication of the difference in party sentiment was seen with the Republicans generally accepting this level of emergency spending with Democrats viewing it as a good start with much more to come in 2021. However, a lot will unfold between now and next year so not going to speculate on the final outcome. The US has spent about three times the amount it spent ten years ago in % of GDP to counter the effects of the 2008-9 financial crisis – a lot but less than other countries such as Germany which has spent almost ten times it spent ten years ago.

- Tame Inflation (+1.2% y/y with +1.6% y/y for the core rate) has kept the US Federal Reserve on the dovish side. With room on the employment side for further gains (at 6.7% which is about double the low of 3.5% in February 2020!) and energy prices likely to stay low for the next few months given the excess of production capacity of OPEC, the only changes to Fed policy that we expect are to continue the slow rotation out of mortgage-backed securities and to extend the weighted duration of its US Treasury assets. We shall see at the December 15th-16th

Asia

- China’ Recovery Held as industrial production grew by +6.9% in October from a year earlier while retail sales

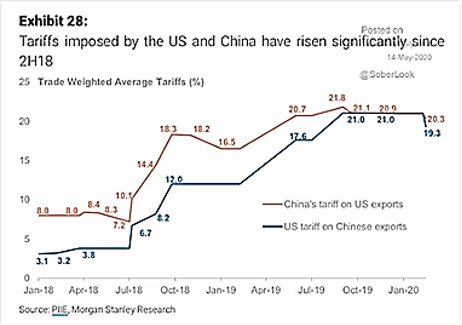

accelerated to +4.3%, both of which missed market expectations. Unemployment fell to 5.3% officially and inflation fell to +0.5% y/y as pork prices fell by 2.8% with better supply (both domestic and imported). China’s total trade value in October was, up 4.6% y/y, primarily on exports to ASEAN nations and the US, while those to the EU dropped -5.8% y/y. It was interesting to note that both American and Chinese tariffs are about the same per the graph to the right, with the Chinese tariffs on US goods at 1% higher than the corresponding American. The only real storm cloud on the horizon is an increase in Chinese AAA debt defaults as even some state-sponsored firms halted payments. Payment failures included Yongcheng Coal & Electricity, Tunghsu Optoelectronic Technology and Brilliance Auto Group Holdings Co., the parent of BMW’s joint venture partner in China. The total amount of debt affected is relatively small (about $1.5 billion equivalent) but given the official government ties and high domestic profile, these occurrences are unsettling. Foreigners own 9.2% of central government debt and 4.6% of debt by the main banks – given that China has the world’s second-largest bond market at more than $15 trillion in value, these incidents undermine confidence in their economic management.

accelerated to +4.3%, both of which missed market expectations. Unemployment fell to 5.3% officially and inflation fell to +0.5% y/y as pork prices fell by 2.8% with better supply (both domestic and imported). China’s total trade value in October was, up 4.6% y/y, primarily on exports to ASEAN nations and the US, while those to the EU dropped -5.8% y/y. It was interesting to note that both American and Chinese tariffs are about the same per the graph to the right, with the Chinese tariffs on US goods at 1% higher than the corresponding American. The only real storm cloud on the horizon is an increase in Chinese AAA debt defaults as even some state-sponsored firms halted payments. Payment failures included Yongcheng Coal & Electricity, Tunghsu Optoelectronic Technology and Brilliance Auto Group Holdings Co., the parent of BMW’s joint venture partner in China. The total amount of debt affected is relatively small (about $1.5 billion equivalent) but given the official government ties and high domestic profile, these occurrences are unsettling. Foreigners own 9.2% of central government debt and 4.6% of debt by the main banks – given that China has the world’s second-largest bond market at more than $15 trillion in value, these incidents undermine confidence in their economic management.

- Japanese Machinery Orders and industrial output again made gains in October though are still negative on a y/y basis. Q3 GDP growth. (+21.4% annualized) was spectacular like other countries but below the rates of Europe and the US. Japanese exports in October essentially recovered year-on-year, improving more than expected as shipments to the US and China held up, even as rising waves of infections weighed on demand from Europe. Imports were down -13.3% y/y and worse than expected, confirming a lingering shortfall in domestic demand.

Europe

- Europe Re-entered Lockdown as cases surged, dashing hopes for an economic recovery but setting expectations for an expanded money-printing stimulus by the ECB at their December 10th However, with case counts falling since late November and vaccines being rolled out, the worst may be over (barring a Christmas outbreak). The Eurozone’s unemployment rate fell in October for the first month in seven to 8.5%, although cuts by Thyssenkrupp (11,000 positions or 10% of the workforce) and IBM (10,000 jobs or 20% of the staff) and other businesses in the New Year offer a grim prognosis. On the other hand, October retail sales were up +1.5% m/m or +4.3% y/y, handily beating estimates. German October factory orders were up as well by +2.9% m/m, continuing the recovery in September. However, the Eurozone industrial production was mixed in September, with the steepest declines in Italy, Ireland and Portugal while France and Germany continued to expand. The UK and EU still struggled through Brexit negotiations which seem pretty farcical at this late stage and not likely good for the UK.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource