- OPEC+ Reached An Agreement at their meeting on December 3rd to ease its output cuts next year by 500,000 barrels per day (bpd), 25% of the original 2 mbpd scheduled. Ministers will then hold monthly consultations to determine how to adjust production in subsequent months. OPEC oil output rose to 25.31 mbpd for a fifth month in November, as

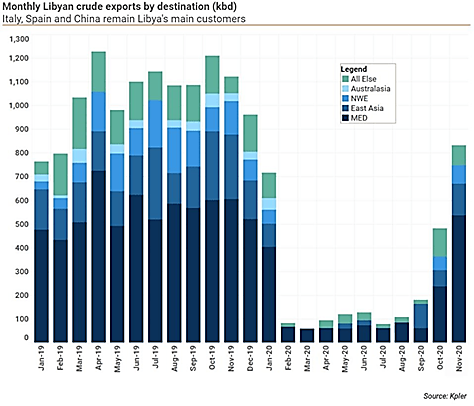

increased Libyan production offset full adherence by other producers to cuts agreed in an OPEC-led supply deal. Russian oil and gas condensate output last month exceeded 10 mbpd and is set for another increase of 125,000 bpd in January. Libya was set to reach at least 1.1 mbpd in December (higher than the graph on the right) as the ceasefire was threatened but still held. Libya and France’s Total discussed efforts to further raise production capacity. Saudi Arabia was hit by Houthi attacks in November but interruptions were minimal. The UAE announced a find of 22 billion barrels close to Abu Dhabi, adding to its reserves (the sixth-largest in the world). Iran claimed that its oil exports were 700,000 bpd despite US sanctions and RBC predicted that Iran would “officially” return 1 mbpd to the oil market as Biden would renew the 2015 nuclear deal… though this week Europeans expressed “dismay” that Iran started up new centrifuges to isolate fissionable material. Higher oil prices are not going to stem from OPEC.

increased Libyan production offset full adherence by other producers to cuts agreed in an OPEC-led supply deal. Russian oil and gas condensate output last month exceeded 10 mbpd and is set for another increase of 125,000 bpd in January. Libya was set to reach at least 1.1 mbpd in December (higher than the graph on the right) as the ceasefire was threatened but still held. Libya and France’s Total discussed efforts to further raise production capacity. Saudi Arabia was hit by Houthi attacks in November but interruptions were minimal. The UAE announced a find of 22 billion barrels close to Abu Dhabi, adding to its reserves (the sixth-largest in the world). Iran claimed that its oil exports were 700,000 bpd despite US sanctions and RBC predicted that Iran would “officially” return 1 mbpd to the oil market as Biden would renew the 2015 nuclear deal… though this week Europeans expressed “dismay” that Iran started up new centrifuges to isolate fissionable material. Higher oil prices are not going to stem from OPEC.

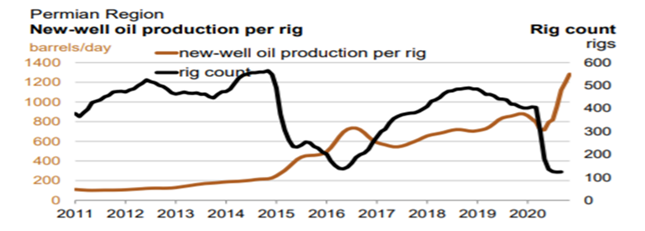

- US Crude Oil Production came in at 11.1 mbpd at the end of November, up 0.5 mbpd from the end of October, but still below the 13.0 mbpd production at the beginning of the year. Shale oil output declined slightly to 8.0 mbpd in November with a small decrease in December. US operating drilling rigs jumped higher, moving to 241 on November 27th from 221 on October 30th. Notably, frackers are bringing back equipment even as oil prices languish in the mid-$40 a barrel in a bid to boost production and tap into a backlog of drilled wells left uncompleted (DUCs). The

number of active hydraulic fracturing fleets has climbed by nearly 50% since mid-September to 127, according to data from consultancy Primary Vision, outpacing a roughly 17% jump in the number of active drilling rigs over that same period of time. Per the Reuters graph to the left, it was clear that productivity remains high! Looking ahead, the challenge for US oil production would be on the transportation side, with Michigan’s governor filing a lawsuit that would close the Enbridge pipeline transporting fuel and oil from Canada to the Midwest. Environmental groups appealed a decision made last month by Illinois regulators to allow the expansion of the Dakota Access oil pipeline, which ships about 40% of the crude oil produced from the Bakken shale region in North Dakota to refiners in the Midwest and exporters in the US Gulf. On the other hand, GM recalled thousands of electrical cars due to battery fire risk. With Biden’s views 180 degrees against the industry but with higher oil prices an effective way to damage the economy, new challenges lay ahead.

number of active hydraulic fracturing fleets has climbed by nearly 50% since mid-September to 127, according to data from consultancy Primary Vision, outpacing a roughly 17% jump in the number of active drilling rigs over that same period of time. Per the Reuters graph to the left, it was clear that productivity remains high! Looking ahead, the challenge for US oil production would be on the transportation side, with Michigan’s governor filing a lawsuit that would close the Enbridge pipeline transporting fuel and oil from Canada to the Midwest. Environmental groups appealed a decision made last month by Illinois regulators to allow the expansion of the Dakota Access oil pipeline, which ships about 40% of the crude oil produced from the Bakken shale region in North Dakota to refiners in the Midwest and exporters in the US Gulf. On the other hand, GM recalled thousands of electrical cars due to battery fire risk. With Biden’s views 180 degrees against the industry but with higher oil prices an effective way to damage the economy, new challenges lay ahead.

- China Still Hungary for Commodities though their oil imports took a step back from setting new highs with November imports at 11.6 mbpd, just below the September record of 11.8 mbpd. Weaker prices as well as logistical capacity to take on floating storage offshore contributed to the numbers. China inked its first longer term deal to buy liquefied natural gas from an American exporter since the trade war disrupted deliveries in March. Sinopec agreed to purchase 26 cargos from 2021 and 2025. China’s 2020 purchases of US energy products totaled $6.61 billion, about 26% of the $25.3 billion target in the Phase One trade deal. Chinese imports of US soybeans surged almost three-fold in October on a year-on-year basis, as cargoes arrived in the country. The world’s top buyer of soybeans brought in 3.4 million tonnes of the oilseed from the United States in October, up 196.4% from 1.147 million tonnes a year ago. November imports also increased from last year from 8.3 million tonnes to 9.6 million tonnes. Already China is looking to purchase beans for next season’s delivery, per reports in Bloomberg. Finally, US hog exports to China reached 70% higher y/y, but with their climbing swine herd, these numbers look unsustainable.

- Global Grain Production is looking decent, with Brazil’s soybean production expected reach a record of 131.8 million tonnes as high prices drove farmers to increase plantings, or a +5.6% rise from last season, which was an estimated 124.8 million tonnes. Meanwhile, rainfall over the past week and the week ahead improved conditions for corn and soybean across Brazil, though Argentina is still looking at relatively dry conditions. Australian farmers were on track to harvest their second-biggest-ever wheat crop after years of drought and France rated its winter wheat crop as 96% good to excellent. Even India, with back to back record crops, emerged as a potential exporter.

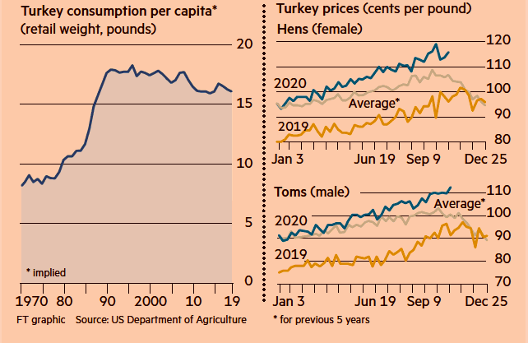

Looking at the latest Thanksgiving stats, it seemed that consumption has peaked with higher prices not helping the big  bird’s popularity. Actually, grocery food prices did experience decent inflation this year as COVID-related disruptions and the shift to eating at home from dining out pushed food prices up +3.9% in October versus a year ago. Meat, dairy and egg prices were up +6.1% y/y, which is down from the peak in June when the difference was +12.8% y/y. Ham, another seasonal choice, was in relatively tight supply versus previous years on the China demand mentioned above. I suppose that Tiny Tim will be lucky to get a Christmas goose from Scrooge this year too.

bird’s popularity. Actually, grocery food prices did experience decent inflation this year as COVID-related disruptions and the shift to eating at home from dining out pushed food prices up +3.9% in October versus a year ago. Meat, dairy and egg prices were up +6.1% y/y, which is down from the peak in June when the difference was +12.8% y/y. Ham, another seasonal choice, was in relatively tight supply versus previous years on the China demand mentioned above. I suppose that Tiny Tim will be lucky to get a Christmas goose from Scrooge this year too.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource