- Weather Risk Reintroduced as hurricane Harvey swept through the key refining zones of Texas and western Louisiana during the last week of August. The market concerns were not centered on oil production (though 98 oil and gas extraction rigs were evacuated of the 737 manned platforms in the Gulf), but on oil refining and the related distribution. While Harvey was not the strongest hurricane in terms of wind force, it did absorb and release record amounts of rain which overwhelmingly caused the damage along the entire coast of Texas. In Houston for example, a year’s worth of rain fell in a week (30 inches). In oil refining, from about 850,000 barrels per day (bpd) in Corpus Christi in the west to 2,600,000 bpd in the Houston area to 1,600,000 bpd in Port Arthur in the east, roughly 25% of US refining capacity went off-line. A few refineries had to request supply from the US Strategic Petroleum Reserve in order to resume operations. In distribution, key logistical hubs were shut including the Colonial Pipeline (which services the Southern states up to New York City with products (e.g., gasoline, etc.) over its 5,500 mile network) and the key import/export ports of Corpus Christi, Sabine and nine others. 25 oil tankers holding about 16.8 million barrels were stacked up to deliver foreign crude while in the other direction product tankers could not make deliveries to South America and beyond. In reaction, at least 20 tankers were booked to import European fuels to the Americas. Moving into September, the restarts of refineries, ports and pipelines have begun though the flooding has not fully subsided in eastern Texas/western Louisiana. While this catastrophe has left the emergency stage, the tens of billions of dollars in damages has yet to be tallied. Storm season continued in September with Irma causing damage and injury in Florida/US south (though less than expected), Jose staying out in the Atlantic and Katia moving into Mexico.

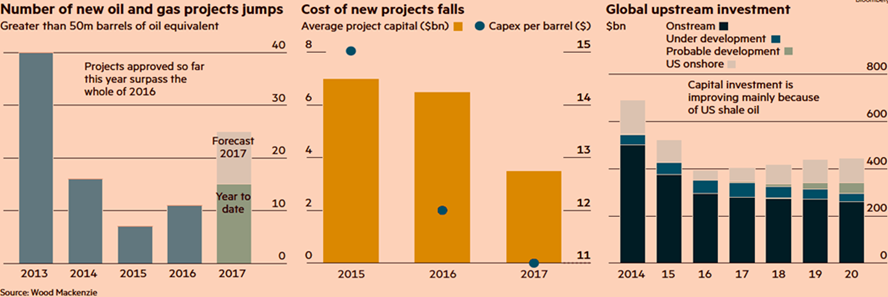

- Pre-Harvey, US Oil Markets were focused on strong supply. The EIA projected US shale output to grow by 117,000 bpd in September for the ninth consecutive monthly increase. US shale production was forecast to set a record at 6.2 million bpd while total production reach over 9.5 million bpd. Meanwhile, gasoline production by US refiners was running near record levels over the first seven months of 2017, with four-week rolling average production close to the top of its five-year range. Despite growing domestic and foreign demand leading to draws from gasoline stocks, gasoline inventories also were above their five-year average levels. However, with the reverberating storm effects on both supply and demand, the US petroleum inventory numbers will be uncertain at best in September. The US oil-drilling rig count slipped from 766 on July 28th to 759 on September 1st but the inventory of “drilled-but-incomplete” wells (AKA DUCs), had increased to 2,330 by the end of July, implying sufficient pending oil supply. Investment in the space remains strong as the graphs below from the Financial Times indicates.

- Separately, the breakeven costs for many US shale formations was estimated at or below $40 per barrel, though that analysis may be biased from outdated lease assumptions. Canadian firms are also aggressively working to drive costs lower to be profitable at or below $50, which will further limit US price increases. As a reminder, output up north is expected to increase around 250,000 bpd in 2017 to about 2.75 million bpd from oil sand projects alone.

- OPEC Oil Production Higher Then Lower as OPEC oil output in July increased by about 210,000 bpd per Bloomberg, moving total production to 32.9 million bpd. However, August saw production problems in Libya as militant action blocked exports its largest field, causing total oil output to fall. OPEC oil exports also fell though Saudi Arabia, Iran and Kuwait made up for much of the Libyan and Nigerian shortfalls. Looking ahead, the UAE, a persistent non-complier, and Saudi Arabia separately announced supply reductions to customers starting in October. It is a little early but we must keep in mind that the Aramco IPO is next year and Saudi Arabia is prone to make more of these types of announcements. OPEC product exports however increased to the second-highest bi-monthly volume, demonstrating the growing refining capabilities of the Middle East. China is importing oil now at a rate of 8 mbpd (comparable to the US) though part of that is earmarked for its strategic reserve. These imports are expected to slow to 7.3 mbpd the second half of 2017 and increase only 7.4 mbpd year on year for 2018 as existing strategic reserve capacity is estimated to be full by July 2018, requiring more infrastructure and storage building.

- Global Food Production is looking good as Brazil raised its upcoming soybean crop to 114.0 million tonnes from 113.9 million tonnes and its corn projection to 97.2 million tonnes from 96 million tonnes in July, citing increases in planted acreage. The current Brazilian soybean production hit records, with exports up 3.5% from last year, even though it is only August. Brazilian corn exports too are well ahead of last year. Likewise, Argentina’s corn planted area for the 2017-18 crop cycle is seen at a record-high 13.3 million acres), up about 0.4 million from last season. In Europe, Ukraine’s 2017/18 grain export forecast increased by 3.4% to 42.1 million tonnes and overall harvest increase to 63.2 million tonnes from 61.7 million a month ago from higher grain yields and larger harvested area. US crops are set for a fifth bumper year, though not a record. In cotton, Egypt’s growth is expected to hit 38,000 tonnes, up 19% from last year. In industrial metals, global economic growth generally and Chinese demand particularly sent prices rallying sharply. Keep an eye on “Dr. Copper” to see if this trend continues or if speculators went too far.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource