Macro: Americas

- The US Forges Ahead as Q2 GDP growth was revised up from +2.6% to +3.0% on better consumer spending and non-residential (i.e., business software and factory) investment. Q3 GDP growth is currently projected at +2.6% by the Atlanta Fed lower than a month ago but still decent. The debt limit discussion is off the table for a few months as the Republicans passed a limited spending bill along with initial hurricane relief spending. The can has been kicked. The raw economic news was on the balance positive but not great. Core durable goods orders (ex-military, ex-transportation) was up a strong +1.0% for July after climbing +0.1% in June. Industrial

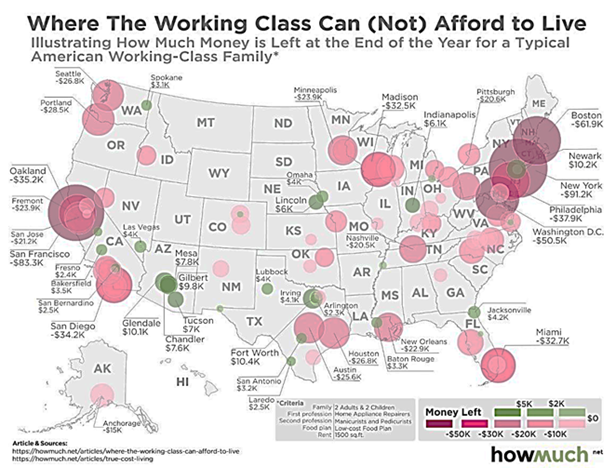

production also rose +0.2%. Automobile production fell strongly but with the hurricane destruction there may be a pickup into the end of the year (depending on the displacement of other spending and availability of credit). Payrolls grew +156,000, below estimates but unemployment is still a low 4.4% and manufacturing payrolls grew the most in five years (+36,000). Finally on the good news front, July retail sales jumped +0.6% with gains in ten of the thirteen categories. Home sales fell with previously owned home closings down -1.3% in July, partially as home prices continued their run higher, exceeding the levels seen at the 2006-7 peak. The stronger prices levels have shown up in the mortgage delinquency rates, which are at the lowest since 2000 at 4.2%, and foreclosure rates, the lowest since 2006. Of course, the packaging and selling of mortgage pools has picked up as investors seek yield and put the financial crisis behind them. Housing wealth has not helped the “typical working-class families” as per the map on the right (apologies for the fine print!) unlike the last boom.

production also rose +0.2%. Automobile production fell strongly but with the hurricane destruction there may be a pickup into the end of the year (depending on the displacement of other spending and availability of credit). Payrolls grew +156,000, below estimates but unemployment is still a low 4.4% and manufacturing payrolls grew the most in five years (+36,000). Finally on the good news front, July retail sales jumped +0.6% with gains in ten of the thirteen categories. Home sales fell with previously owned home closings down -1.3% in July, partially as home prices continued their run higher, exceeding the levels seen at the 2006-7 peak. The stronger prices levels have shown up in the mortgage delinquency rates, which are at the lowest since 2000 at 4.2%, and foreclosure rates, the lowest since 2006. Of course, the packaging and selling of mortgage pools has picked up as investors seek yield and put the financial crisis behind them. Housing wealth has not helped the “typical working-class families” as per the map on the right (apologies for the fine print!) unlike the last boom.

- Will the Fed Act at their upcoming September meeting on the 19th and 20th? While the markets expect no increase in rates, there may be an announcement on Quantitative Tightening (QT). The schedule mentioned earlier this year would have a very modest decline in the rate of the reinvestment so while there may a shock from the Fed actually doing something, the markets *should* recover quickly enough. Of course margin debt used to buy stocks is well above the 2008 level so that leverage may feed upon itself in the case of weakness. Nothing of import came out of the Fed’s Jackson Hole symposium this year. In terms of pension debts, the average pubic pension became worse off as of the end of 2016 versus 2015 and 2014. At 71.1% funded overall, five states are below 50% funded (New Jersey (31%), Kentucky (31%), Illinois (36%), Connecticut (44%) and Colorado (46%)) and only one state is overfunded (insignificant Washington DC. 101%). No one is going to stop making payments tomorrow but if you want to avoid the major tax increases that will be needed to fund those retirees, then avoid living in those states. Puerto Rico should get some hurricane money which will put off its debt crisis – something for 2018.

Macro: Europe

- Europe was Truly on Vacation as Draghi hung out at Jackson Hole with Yellen and friends. The Eurozone grew by +0.6% for the quarter ending June, assisted particularly by Germany and Spain, though heavyweights Italy and the Netherlands also performed well. The UK is still surviving Brexit as unemployment fell to a 42-year low of 4.4% (the lowest since 1975) and wages increase by +2.1% (though real wages went negative). Italian employment recovered to the same level as pre-financial crisis, causing Moody’s to increase the country’s GDP estimate for 2017 and 2018 to +1.3% for each year. However, a general election in the first half of 2018 could derail a recovery. The German election on September 24th looks good for Merkel as of the current polling.

Macro: Asia

- China Not Slowing as factory orders rose +6.4% year-on-year in July while the orders for fixed assets rose +8.3% and as retail sales came in at +10.4% (note that all these numbers missed expectations to various degrees. Steel in particular expanded +10% from a year earlier to 74 million metric tons. That’s the biggest ever monthly output figure, though the extra day helped. China’s August trade report showed a notable rebound in imports (+7.1% month-on-month versus July’s -5.9%) though exports remained pretty soft (+0.4% month-on-month but better than July’s -4.2%). Import of major commodities (iron ore, copper, oil and

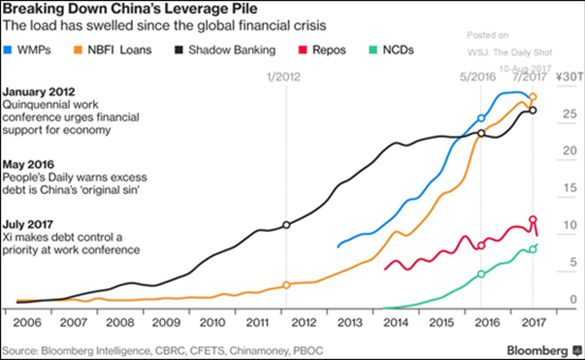

steel) all were impressive. Admittedly, all this growth is debt fueled as demonstrated by the graph to the right. The IMF even said that the level of Chinese debt is “dangerous” ($28 trillion at the end of 2016 and counting) and set to worsen as the government repeatedly shies away from reining in spending and lending. In fact, reportedly Chinese banks have “spent” 80% of their lending quota for the year by the end of June. “Shadow lending” should take care of the rest but that is already at high levels (see above). The clampdown on investment outflows has been successful per the FT, which also would direct funds to domestic GDP activity. Of interest, further limitations have been put in place on Bitcoin trading as well. These monetary flow restrictions have been complemented by the government forcing large firms to write in the supremacy of the Communist Party over other constituents (shareholders, management, employees, etc.). Not the central government, but the Communist Party. Never forget who is in charge and for whom the second-largest economy of the world is run.

steel) all were impressive. Admittedly, all this growth is debt fueled as demonstrated by the graph to the right. The IMF even said that the level of Chinese debt is “dangerous” ($28 trillion at the end of 2016 and counting) and set to worsen as the government repeatedly shies away from reining in spending and lending. In fact, reportedly Chinese banks have “spent” 80% of their lending quota for the year by the end of June. “Shadow lending” should take care of the rest but that is already at high levels (see above). The clampdown on investment outflows has been successful per the FT, which also would direct funds to domestic GDP activity. Of interest, further limitations have been put in place on Bitcoin trading as well. These monetary flow restrictions have been complemented by the government forcing large firms to write in the supremacy of the Communist Party over other constituents (shareholders, management, employees, etc.). Not the central government, but the Communist Party. Never forget who is in charge and for whom the second-largest economy of the world is run.

- Censorship also was raised at the prestigious Cambridge University Press (CUP) as the publisher dropped 300 articles critical of China on the 18th only to restore them on the 21st after protest. Why were the articles dropped? The government threated to curtail or ban its publications in China, a source of double-digit revenue growth for the CUP. Other foreign companies face similar threats when beneficial for Chinese firms – Volkswagen had to drop its brand name from electric cars made under its Chinese joint venture. South Korean firms saw their car sales cut in half since March and the Chinese government banned group tours from going to Korea in retaliation over Seoul’s decision to put in U.S.-designed missile defense systems. When / If will these forms of oppression and reprisal affect economic growth? Who knows but innovation and a supportive business environment is needed to move the economy forward in the long run and suppression runs counter to that.

- Japan performed well on Q2 GDP growth, turning in +2.5% annualized. July also put in some positive numbers for retail trade (+1.0% year-on-year) and industrial production (+4.7% year-on-year). Machine tool orders for August continued to move higher at +36.3% year-on-year, supporting the chances for another good number for Q3.

The state of Jalisco, Mexico broke the world’s record of 3-tonne (6,600 pounds) guacamole made from 25,000 avocados and 1,000 people to mash them. Wish we were there!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.