Alpha! It’s a term frequently used within the managed futures space, but what do people mean when they reference it and how does it benefit an investor? Prior to understanding the concept of Alpha, one must understand the basis of the modern portfolio theory (MPT). Initially developed in the 1950’s, modern portfolio theory emphasized diversification into various non-correlated assets in order to maximize portfolio expected return for a given amount of portfolio risk. In short, modern portfolio theory describes how to find the best possible diversification strategy, in hopes of achieving a greater expected return with a lower amount of risk.

How does Modern Portfolio Theory (MPT) relate to Alpha?

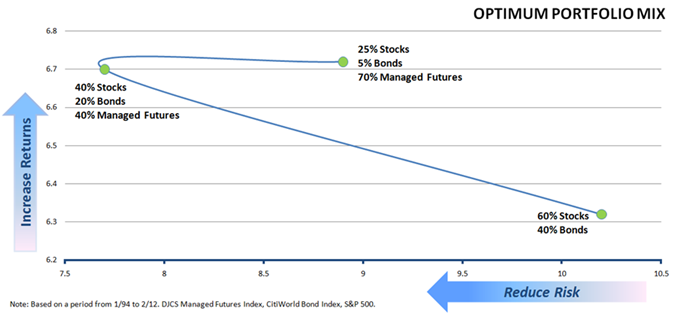

With the help of MPT, an investor will be able to find a combination of investments that has the best possible expected level of return for an appropriate level of risk. This is also referred to as the efficient frontier, or finding the most “efficient” level of expected return for the lowest possible risk. See below chart for details:

Now that we are clear on what MPT is, we can shift our focus to Alpha (αi). Within MPT, there are five specific risk ratios that help investors determine the risk-reward profile of an investment: alpha, beta, standard deviation, R-squared, and Sharpe ratio. Simply stated, alpha is used to measure performance on a risk adjusted basis. As an investor we want to know if we are being compensated for the risk taken in our investment, and alpha helps assess whether or not an investment is worth investing in. Alpha is presented as a numerical value. For example, a positive alpha of 1.0 means the investment has outperformed its benchmark index by 1%. In comparison, a similar negative alpha would indicate an underperformance of 1%. An alpha of zero means the investment has earned the same risk-adjusted return as its benchmark.

In summary, the alpha coefficient indicates how an investment has performed after accounting for the risk involved. The following are true:

αi<0: the investment has earned too little for the risk taken (or, was too risky for the return)

αi=0: the investment has earned a return adequate for the risk taken

αi>0: the investment has a return in excess of the risk taken

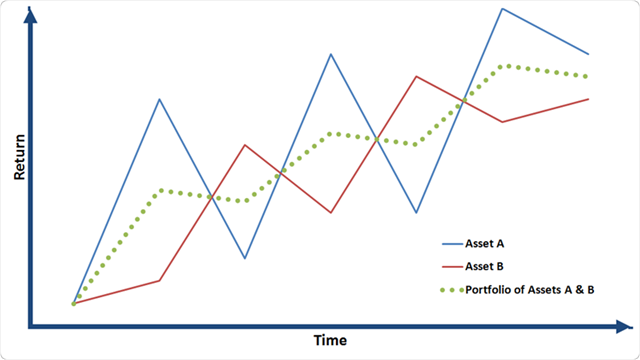

With the help of modern portfolio theory (MPT) and the risk statistics within MPT, such as alpha, investors have the ability to assess whether the potential return for specific investments are worth the assumed amount of risk. It should be noted that Modern Portfolio Theory has come under significant scrutiny over the past decade as many of its assumptions have been proven to be only partially true. Despite these assumptions MPT can still provide a useful structure for all investors. The one thing that all investors should walk away with, in regards to MPT, is that investors have the greatest opportunity for success if they build portfolios of diversified assets.

In conclusion, when investment managers say “our goal is to generate alpha,” they are basically saying that their goal is to generate a higher return while assuming a similar amount of risk as compared to the benchmark against which they measure their performance. Alpha can be interpreted as the value that an asset/portfolio manager adds, above and beyond a related index’s risk/reward profile. A higher alpha is a good thing!