The Federal Reserve saw something it did not like and left rates alone for the 82nd month in a row at its September meeting. Certainly there was the usual verbiage about doing something this year – but only if there are no unpleasant surprises. On October 2nd we got that unpleasant surprise in the form of a total miss on the September payroll report. Given Dr. Yellen’s training as a labor economist, one may suspect that she will pay close attention to that number and the other related labor data. In fact, she may have had an inkling despite saying a week later on the 24th that labor market conditions were improving. Note also that as the year closes and 2016 looms, the opportunity to raise rates without seeming to try to influence the US Presidential election will be over. Therefore, to my mind, it is very possible that nothing will happen rate-wise until 2017. Given foreign economic weakness cited as the reason to keep rates low (for the first time, some say), we should expect easier monetary and fiscal policies for the near future. In fact, low economic growth is not expected to change for the next six to twelve months (the IMF, WTO and OECD lowered their 2015 GDP forecasts in September though differed on 2016). With the latest deflation worries out of Europe, Standard & Poor’s went on record that it thinks that the ECB will extend its Q€ another eighteen months to 2018 with a doubling of its monetary injection to €2.4 trillion. With the floundering of their economies simply heightened by the Volkswagen scandal, one wonders when and where relief will come. At least the hot war in Ukraine is calming down as Russia decides that it needs its military focused on propping up Assad in Syria. This may not dispel potential conflict with western European countries given the NATO treaty includes Turkey, right there on the front lines. The refugee issue will also keep Europe involved in a costly way. China’s slowdown is finally causing some fiscal stimulus reaction as its slowing GDP growth spurred the government to cut automobile taxes and down payment requirements for first-time home buyers. Japan too shows signs of slippage as manufacturing missed estimates badly. In energy news, oil production and inventories are still very high with the only bullish sign seen in the drop in the number of operating US oil rigs. Without over-generalizing, commodities are well-supplied now and into the near future. There are plenty of raw materials and food above ground, either in storage or waiting to be harvested. Demand looks anemic in a world of slow GDP growth. Those with strong balance sheets and/or access to cheap money will be the ones who make it through to the other side.

Hawks, Doves and Chickens: When talking about the US Federal Reserve, “hawks” tend to worry about inflation and are prone to keep interest rates high while “doves” are more concerned about employment growth and generally desire to keep interest rates low (inflation and employment are the matters that the Fed is officially charged with managing AKA the “duel mandate”). It seems, however, that there is a third bird in the Fed flock, the chicken. This bird does not want to make a decision, thinking that the world is too fragile to handle one. Therefore, the reason for no rate change is new every Fed meeting, from economic weakness, to deflation, to supporting the wealth effect (AKA keeping stock and bond prices high) and now to foreign concerns (specifically China’s slowing growth). To quote the minutes from the September meeting, “Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term.” So “everything in the world” is keeping the Fed on edge. It seems that while the story changes, the result stays the same – don’t do anything, as if 25 or 50 basis points would change any real human decision (though it may change some purely financial decisions, but those are not technically part of the duel mandate). Later in October and then December are the two final meetings for 2015 and while a majority of Fed presidents say they are expecting a rate rise this year, the most recent economic numbers are generally guiding otherwise. And then the political year of 2016 will come into play, postponing the need for a decision for another year. Nice rudderless stewardship, Fed!

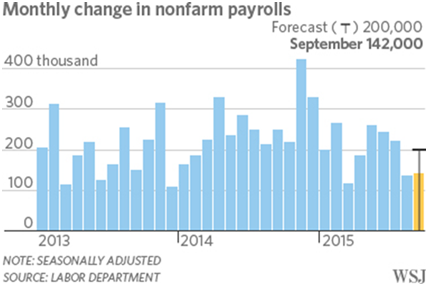

The good starting news for the US is that Q2 GDP was revised upwards from +3.7%  annualized to +3.9% annualized on slightly higher stronger consumer spending from lower gasoline prices. However the Q3 projection from the Atlanta branch of the Federal Reserve was revised down from +1.8% to +0.9%, so the good news may be short-lived. The jobs data also started the month well, with companies wanting to hire a record number of workers (5.75 million), much more than expected (5.3 million). The interest in hiring broadly ranged by industry as well as geography. Weekly initial jobless claims have been both better and worse than expected. However, the most closely watched employment news for September indicted a big miss to market expectations with only 142,000 jobs created versus the 201,000 expected, and August’s decent 173,000 figure was revised downward to 136,000 (see right for the WSJ graph). The unemployment rate stayed at 5.1% as the number of people looking fell as well from 62.6% to 62.4%. Wages were flat for the month-on month and at an annual increase of +2.2%. Looking at other GDP components, US factory orders fell -1.7% in August versus a fall of -1.2% expected and July’s number was revised lower from +0.4% to +0.2%. Durable goods orders dropped -2.0%, which was better than expected, however. Pending home sales fell -1.4% versus a +0.4% increase. So all-in-all, the recent surprising slide in the employment data needs to be turned around soon if we are to see any ghost of a chance of a Fed rate hike this year (let alone 2016).

annualized to +3.9% annualized on slightly higher stronger consumer spending from lower gasoline prices. However the Q3 projection from the Atlanta branch of the Federal Reserve was revised down from +1.8% to +0.9%, so the good news may be short-lived. The jobs data also started the month well, with companies wanting to hire a record number of workers (5.75 million), much more than expected (5.3 million). The interest in hiring broadly ranged by industry as well as geography. Weekly initial jobless claims have been both better and worse than expected. However, the most closely watched employment news for September indicted a big miss to market expectations with only 142,000 jobs created versus the 201,000 expected, and August’s decent 173,000 figure was revised downward to 136,000 (see right for the WSJ graph). The unemployment rate stayed at 5.1% as the number of people looking fell as well from 62.6% to 62.4%. Wages were flat for the month-on month and at an annual increase of +2.2%. Looking at other GDP components, US factory orders fell -1.7% in August versus a fall of -1.2% expected and July’s number was revised lower from +0.4% to +0.2%. Durable goods orders dropped -2.0%, which was better than expected, however. Pending home sales fell -1.4% versus a +0.4% increase. So all-in-all, the recent surprising slide in the employment data needs to be turned around soon if we are to see any ghost of a chance of a Fed rate hike this year (let alone 2016).

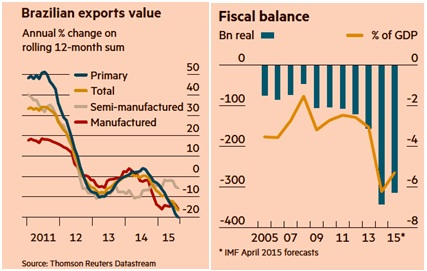

Brazil had a bad September with a cut in its debt rate by S&P from BBB- to BB+, solidly  in junk territory. As the FT graphs show, inflation, the fiscal balance and the export situation all look nerve-wracking. A lower currency (the real moved from 1.5 back in 2012 to about 4.3 real per US dollar today), is not helping economic activity (a warning to those QE central bankers) – though it is spurring more commodities exports! Meanwhile, Venezuela’s president-for-life Maduro is flailing about Frankenstein-style, accusing neighbors Columbia and Guyana of waging “economic war” against him as well threatening military action, perhaps to take the oil-holding Essequibo region from tiny Guyana, a country of about 735,000 people (versus Venezuela’s 33 million people). With Venezuelan marine and ground forces deployed on the border per Guyana’s president, one wonders if there will be another international headache for the US.

in junk territory. As the FT graphs show, inflation, the fiscal balance and the export situation all look nerve-wracking. A lower currency (the real moved from 1.5 back in 2012 to about 4.3 real per US dollar today), is not helping economic activity (a warning to those QE central bankers) – though it is spurring more commodities exports! Meanwhile, Venezuela’s president-for-life Maduro is flailing about Frankenstein-style, accusing neighbors Columbia and Guyana of waging “economic war” against him as well threatening military action, perhaps to take the oil-holding Essequibo region from tiny Guyana, a country of about 735,000 people (versus Venezuela’s 33 million people). With Venezuelan marine and ground forces deployed on the border per Guyana’s president, one wonders if there will be another international headache for the US.

No Joy There: Europe still is in a quagmire – to quote the FT, “Europe is juggling five simultaneous [unforeseen] crises… refugees from Syria, Eurozone periphery debt [AKA PIIGS], a global economic downturn, Russia’s annexation of Crimea and its aftermath and Volkswagen’s crimes and misdemeanors.” Like the US, Q2 GDP was revised upward from +1.2% annualized to +1.5%. However, July industrial production fell -0.6% versus +0.3% expected and the September Purchasing Manager Index came in a little softer than expected but still indicating industrial expansion. French joblessness increased by 20,000 people for the 36th month out of the last 39, reaching a new high. German inflation turned to German deflation in the year-on-year September numbers, catching the markets by surprise, and German and French retail sales fell short of expectations by -0.6%. SouthBay Research is forecasting further declines in German![]() GDP as German factory production is showing less semiconductor demand, falling trade of intermediate and finished goods, and lower capital demand. And this was before the impact from the Volkswagen scandal will affect the numbers. Greece should be back in the headlines soon as Tsipras was re-elected and negotiations can restart on the upcoming privatizations and other austerity measures that are required as part of the new €86 billion debt package with the Troika. We will see how that “extend and pretend” agenda progresses. In other PIIGS news, Portugal decided to cancel its auction of its pool of bad loans and real estate holdings due to “unsatisfactory” offers. This means that losses from the €4.9 billion of taxpayer money that was injected as capital will show up as additional deficit. There will be a second attempt, perhaps by the end of 2015, as the junk debt needs to be sold by August 2016 per their agreement with the EU. Perhaps the ECB will buy it! After all, with the bad economic news, there is an opportunity for dovish Draghi to expand Q€…

GDP as German factory production is showing less semiconductor demand, falling trade of intermediate and finished goods, and lower capital demand. And this was before the impact from the Volkswagen scandal will affect the numbers. Greece should be back in the headlines soon as Tsipras was re-elected and negotiations can restart on the upcoming privatizations and other austerity measures that are required as part of the new €86 billion debt package with the Troika. We will see how that “extend and pretend” agenda progresses. In other PIIGS news, Portugal decided to cancel its auction of its pool of bad loans and real estate holdings due to “unsatisfactory” offers. This means that losses from the €4.9 billion of taxpayer money that was injected as capital will show up as additional deficit. There will be a second attempt, perhaps by the end of 2015, as the junk debt needs to be sold by August 2016 per their agreement with the EU. Perhaps the ECB will buy it! After all, with the bad economic news, there is an opportunity for dovish Draghi to expand Q€…

Meanwhile in the Ukraine, the government avoided a default with their parliament approving an $18 billion debt restructuring deal that cuts principal by 20% for creditors in exchange for an extra payout if economic growth increases above a certain threshold. This paves the way for a $40 billion bailout led by the IMF. There is still the question of $3 billion due to Russia by the end of the year, just in time for winter cold and the threat of natural gas supplies cut off. In another piece of halfway-good news, the Russian-supported rebels in eastern Ukraine have decided to agree to pull back all weapons and hold to a cease-fire. On the one hand, this reflects Russia’s higher priority to redirect its military power and budget elsewhere (i.e., Syria). On the other, it could be an attempt by Russia to try to push off the rebuilding costs to Kiev while still retaining the option to become re-involved. We do not have a real peace, just a phantom peace. And winter is coming.

Asia Downshifting: In case anyone was seriously believing in the official Chinese annualized GDP growth number of +7.0 % for Q2 2015, the year-on-year September trade figures from China should have put a stop to that nonsense. The export numbers did fall less than expected (-5.5% in US dollar terms versus -6.6% expected) but the import figures were way off estimates with a decline of -13.8% in US dollar terms versus -7.9% expected. Commodities imports were flat to down in August versus July, with declines in oil and iron ore and neutral for copper. The underlying statistics hold little promise. For year-over-year ending in August, industrial production grew +6.1%, below 6.5% expected, fixed asset investment +10.9% versus +11.2% expected and the purchasing manager’s index was in slight contraction territory. Retail sales was a spot of stability at +10.8%, over +10.6%. In significant company news, Chinese coal producer Heilongjiang Longmay Mining Group will cut 100,000 jobs in the next three months, China Daily reported. This move marks a 40% reduction in workforce, demonstrating the continuing problems faced by China’s heavy industry. Coal production has fallen in China by 4.8% during the first eight months of 2015 on weakening industrial demand, though its share of energy production has stayed relatively steady at 66%. Despite its size, Heilongjiang Longmay is only the 16th largest by output in China. Also in shutdowns, China’s largest maize refiner, Global Bio-Chem Technology, closed and left thousands of corn farmers unpaid. Global Bio-Chem was the third-largest corn refiner in the world, making lysine, sweeteners and other corn additives. The company is reported to be offering new shares to raise funds to pay off farmers but we shall see if they are successful or become another zombie company. In reaction to all these concerns, the Chinese government is tacitly acknowledging their economic issues by expanding consumer stimulus – firstly they are halving the 10% sales tax on new cars until the end of 2016 (sales have been flat for the first eight months of 2015) and the second is cutting the down payment for first-time home buyers to step up support for the real estate market. Prices have stabilized the last few months though are at lower levels than last year. With $3.56 trillion in estimated foreign reserves, China has plenty of firepower to buy its way through the next few years. However it has spent already $286 billion this year so far, about 8% of their total. Not an issue for now, but something to watch.

Japan is not doing much better, with Standard & Poor’s reducing its government debt rating from AA- to A+, though it is the last of the rating agencies to cut to that level. What set it apart is that while Moody’s and Fitch (who?) cited the large fiscal deficit and debt, S&P called out the failure of Abenomics, “[it] will not be able to reverse this [economic] deterioration in the next two to three years.” August industrial production fell -0.5% after a -0.6% fall in July, leading to predictions for a negative GDP growth rate for Q3 after a -1.2% annualized decline for Q2 2015. Machinery orders fell -3.6% in July, slightly worse than expected. Retail sales grew +0.8% in August but that is half the +1.5% expected rate. In response, the Japanese stock market entered negative territory for the year at the end of September as investors, particularly foreign investors, chose to take profits. As recently as August 10th, the Nikkei was up +20%, but as of September 30th, it was down -3.1%. Elsewhere, India cut its interest rates by a larger-than-expected -0.5% to 6.75%, marking the fourth cut from the beginning of 2015 when the rate was 8.0%. Inflation is running at 3.7%, below the long-run average. Weaker global market conditions (AKA competitive devaluation) were cited as the reason.

Excess Oil Supply, Though Tightening Expected: There is still plenty of oil about with Iran, Kuwait and Saudi Arabia cutting the prices of shipments to Asia during September to multi-year lows, per Reuters. Still, Saudi crude oil stockpiles increased to a record 320 million barrels as exports slumped. Their production is slightly down but still over 10.36 million barrels per day (from a high in June of 10.56 million barrels per day). Overall OPEC output increased in September, led by Iraq. Russia too is increasing output, which reached a new high of 10.74 million barrels per day in September. The US domestic production is at 9.4 million barrels, only 0.2 million barrels below April’s all-time high, as new offshore production offset shale production declines. This despite a 10% reduction of producing oil rigs to 614 for the week ending October 2nd. With the current surplus at 1.3 million barrels per day and Iran expected to come on line with additional barrels next year, there needs to be a major reduction in production for oil prices to recover significantly next year. However, with Saudi Arabia, Iran, Iraq and Russia all directly engaged in wars in Syria, Iraq and Yemen, I do not see them cutting supply. All these countries need the oil revenue to fund their military/geopolitical efforts.

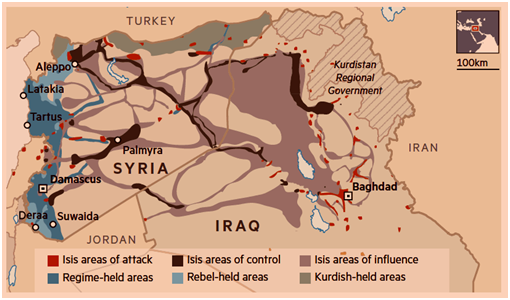

The US should see continued slow production declines but with many independent US shale oil and gas companies having renewed their credit lines and plenty of private equity cash waiting on the sidelines, that deterioration will be modest. There are some non-US reductions – Iraq is cutting its exploration budget for 2016, and Shell has terminated its US Arctic exploration after spending $7 billion over the last number of years. While ISIS does not threaten many oil fields now, it is good to monitor their progress, especially with Russia actively involved. As the map from the FT demonstrates, the blob that ISIS controls / influences is the interior of Syria and the northern part of Iraq down to Baghdad. The Iranians, Russians and Assad may be focused now on pushing back the rebels aligned with the US and Saudi Arabia (the light blue), but they will have to go after ISIS in short order. In Yemen, the Saudis intercepted an Iranian ship carrying smuggled weapons for the Shi’a rebels there that are fighting the Sunni and Saudi forces. No shooting war yet between these two regional superpowers but there are many flashpoints.

equity cash waiting on the sidelines, that deterioration will be modest. There are some non-US reductions – Iraq is cutting its exploration budget for 2016, and Shell has terminated its US Arctic exploration after spending $7 billion over the last number of years. While ISIS does not threaten many oil fields now, it is good to monitor their progress, especially with Russia actively involved. As the map from the FT demonstrates, the blob that ISIS controls / influences is the interior of Syria and the northern part of Iraq down to Baghdad. The Iranians, Russians and Assad may be focused now on pushing back the rebels aligned with the US and Saudi Arabia (the light blue), but they will have to go after ISIS in short order. In Yemen, the Saudis intercepted an Iranian ship carrying smuggled weapons for the Shi’a rebels there that are fighting the Sunni and Saudi forces. No shooting war yet between these two regional superpowers but there are many flashpoints.

We are further seeing the financial impact of the lower oil and commodities prices on countries and companies. Per the FT, 60% of the $7.3 trillion in sovereign wealth fund assets are from oil and natural gas profits and 25% of the assets are held by China, another major commodities player (leaving 15% as “other”). With oil and natural gas no longer covering budgets, these players have to dip into these savings, a potentially large headwind from an investor class that markets used to count on providing cash instead. Saudi Arabia alone has withdrawn $50 to 70 billion over the last six months with large managers such as Blackrock (my former employer in an earlier iteration as Barclays Global Investors), Legal & General and Franklin Templeton. In particular, Blackrock had $24 billion in redemptions from its Europe, Middle East and Africa customers for Q2 versus an $18 billion inflow in Q1. As these petrodollars evaporate, the desire for liquidity does as well, perhaps supporting developed fixed income markets over emerging market equity or other illiquid investments. Will we see “de-financialization” of the commodities markets as trades lose risk capital or will there be an allocation to macro managers and CTAs given their relative liquidity and ability to go long and short? Too soon to tell but nimbleness should be a consideration these days.

In company news, Glencore and the similar commodities trading firms (e.g., Noble Group, Mercuria, Mitsui, Trifigura and Vitol) have come under pressure as losses on held inventories and mines have undercut their credit ratings. Fears over commodities trading results and credit exposure at banks have also spooked investors, forcing these firms to reaffirm their financial situation and raise capital (Glencore raised $2.5 billion in mid-September, and Trifigura and Vitol raised a combined $10 billion during the first week of October). The whispers of a “Lehman moment” are circling but I suspect that the fears are overdone – there has been no shady accounting (so far) and these firms are reportedly being used to hedge against Chinese stocks given their commodities exposure and the restrictions against shorting Chinese equities. Not the best proxy but the logic is there. At some point, this crisis will pass – they may even better survive a market meltdown than their banks given that they have raised additional capital already! In other commodities company news, Caterpillar, the manufacturer of industrial equipment particularly for the mining and energy sectors (and Gary’s former employer), faces a fourth year of declining sales in 2016 and expects to cut 4,000 to 5,000 positions and $2 billion in expenses next year with a potential goal of 10,000 jobs by 2018. Note that they have already eliminated 31,000 positions since 2012. The job woes are not just in the oil patch.

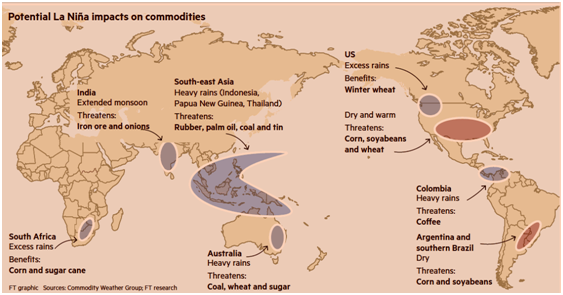

With record or near record crops being harvested, some forecasters are already turning to 2016 and the possibility of a “La Niña” event, which would put more rain over Southeast Asia and Australia but dryness over the US Midwest. The Financial Times published this excellent map of the potential impacts of this type of weather system. 2012 and its drought in the US Midwest was the third-warmest La Niña year on record and we saw record-high row crop prices. In the meantime, watch for a strong El Niño event this winter as the three strongest El Niños have been followed by La Niñas. A strong El Niño would exacerbate the global cocoa shortage due to stress in West Africa where 75% of production takes place.

With record or near record crops being harvested, some forecasters are already turning to 2016 and the possibility of a “La Niña” event, which would put more rain over Southeast Asia and Australia but dryness over the US Midwest. The Financial Times published this excellent map of the potential impacts of this type of weather system. 2012 and its drought in the US Midwest was the third-warmest La Niña year on record and we saw record-high row crop prices. In the meantime, watch for a strong El Niño event this winter as the three strongest El Niños have been followed by La Niñas. A strong El Niño would exacerbate the global cocoa shortage due to stress in West Africa where 75% of production takes place.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.