Commodities: Global

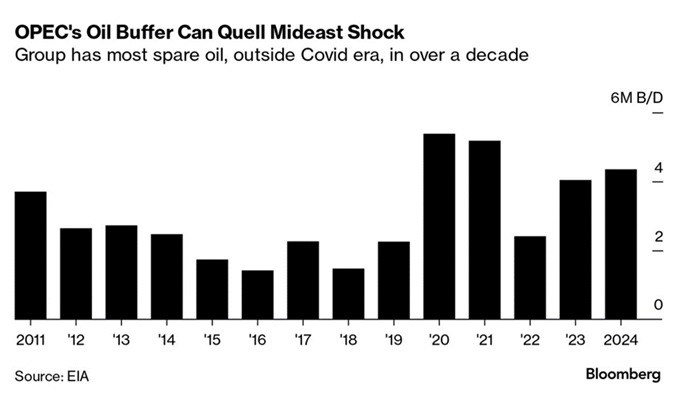

OPEC Oil Output Rose again in October, reaching 27.9 million barrels per day (mbpd), as Angola and Nigeria increased production while Saudi Arabia and Russia reiterated their voluntary reductions though it became more apparent that Russia has not reached 100% of what they promised. They have a war to fund, after all. Saudi Arabia has been busy in China, buying a stake in independent Chinese refiner Rongsheng Petrochemical Co. in exchange for supplying it with 480,000 barrels a day of crude for 20 years. Aramco also signed agreements with a pair of smaller processors to embark on similar deals (equity stake coupled with an agreement to provide crude for the plants to process). One item from the Israel-Hamas war is that OPEC+ had the biggest buffers in more than a decade, outside of the COVID pandemic when lockdowns caused demand to slump. Biden administration broadly eased sanctions on Venezuela’s oil sector in response to a deal reached between the government and opposition parties for the 2024 election – which Venezuela has already abrogated. Potentially the country can pump 200,000 more barrels of crude a day — a roughly 25% jump in production. However, after four years, the US will finally allow an auction to sell the oil refiner Citgo Petroleum owned by Venezuela due toits owing creditors billions of dollars. Which came first – the action or the reaction – is unclear between the US and Venezuela.

Petrochemical Co. in exchange for supplying it with 480,000 barrels a day of crude for 20 years. Aramco also signed agreements with a pair of smaller processors to embark on similar deals (equity stake coupled with an agreement to provide crude for the plants to process). One item from the Israel-Hamas war is that OPEC+ had the biggest buffers in more than a decade, outside of the COVID pandemic when lockdowns caused demand to slump. Biden administration broadly eased sanctions on Venezuela’s oil sector in response to a deal reached between the government and opposition parties for the 2024 election – which Venezuela has already abrogated. Potentially the country can pump 200,000 more barrels of crude a day — a roughly 25% jump in production. However, after four years, the US will finally allow an auction to sell the oil refiner Citgo Petroleum owned by Venezuela due toits owing creditors billions of dollars. Which came first – the action or the reaction – is unclear between the US and Venezuela.

US Oil Production Hit a New Record at 13.05 mbpd despite only a small increase in operating oil rigs from 502 as of September 29th to 504 as of October 27th. Oil companies cited productivity enhancements in their shale regions. Per AAA, US average regular gasoline prices fell sharply to $3.46 per gallon as of October 31th. Likewise, California prices fell about $1 to $5.06 per gallon for regular unleaded. In mid-October, Saudi Arabia sent just 67,000 bpd to the US, the second-lowest volume on record in data going back to 2010 – the lowest was this past June. Oil and gas giant Chevron agreed to buy peer Hess in a deal worth $60 billion including debt, marking the second large deal in the US oil industry in two weeks. The real prize is Guyana — one of the world’s biggest hydrocarbon growth stories — where Chevron gains a slice of the 11 billion barrels-equivalent of recoverable resources. Exxon Mobil struck an agreement the week prior to buy Pioneer Natural Resources for around $58 billion. Both underpin a bet by US majors that oil and gas are not dead by any stretch. Finally, President Biden’s administration hoped to buy 6 million barrels of crude oil for delivery to the Strategic Petroleum Reserve in December and January to slowly replenish the emergency stockpile. The Department of Energy hopes to sign purchase contracts for the oil at $79 a barrel or less (basically current prices).

US Crop Harvests Were Wrapping Up with over 80% completed for corn and over 90% for soybeans. China’s soybean imports from Brazil rose in September by +23% from a year earlier, after a huge crop. China imported 6.88 million metric tons of the oilseed from Brazil last month, the highest for September in three years. Meanwhile, US soy exports to China lagged last year by about -15% at the current pace while US corn exports were ahead of last year. Rains are finally relieving Argentina’s drought, just in time to feed their corn and soy crops. Meanwhile planting is relatively slow in Brazil on weather although the key Moto Grosso region had almost caught up with the historical pace.

Central Banks Bought 800 Tonnes of Gold in 2023 so far with china leading the way at 181 tonnes. Poland at 57 tonnes and Turkey at 37 tonnes. At this rate, the total should match last year’s total of almost 1,100 tonnes. With fiat currencies under pressure due to fiscal largesse and the prospect of easier central bank rates, countries are looking for alternatives.

Finally, for Christmas and winter holidays, one can buy the Coloma gold-prospecting board game – sold at only the finest toy and bookstores worldwide:

https://gamefound.com/en/projects/finalfrontiergames/coloma-new-prospects-expansion-and-reprint

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource