Ukraine & Israel: Attack / Counter-Attack

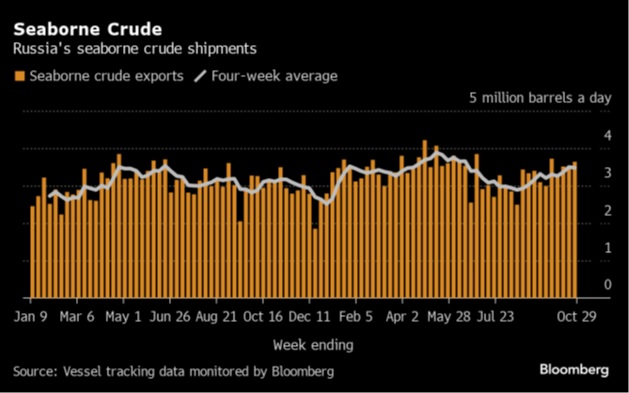

The Ukraine-Russia Conflict saw little progress by both sides as Ukraine inched forward in the south-east around Bakhmut and Russia inched forward in the north-east close to Kupyansk and Stelmakhinka. There was some evidence that the Ukrainians are more aggressively using the longer-range missile systems provided by NATO as deep strikes were made against Russia’s “Dnepr” army group headquarters. The grain war continued with the new grain shipping corridor along the west Black Sea coast seeing Ukraine export 3 million metric tons of food in October from its Black Sea and Romanian Danube River ports, versus 2.3 million tons of agricultural goods in September. Other estimates were higher. However, overall, Ukraine’s grain exports have fallen to 8.6 million metric tons so far in the 2023/24 July-June marketing season. Last year at this time, Ukraine had exported 12.3 million tons of grain. While still sending missiles and drones against grain warehouses and silos, Russia has not attacked any ships, perhaps to avoid causing an international incident with a non-combatant country. Meanwhile Russian seaborne crude oil exports rose to a five-month high in October, averaging 3.5 million barrels per day (mbpd), a +7.4% rise on the month. On the other hand, Russia’s natural gas monopoly, Gazprom, reported its lowest output levels since 1978. Sanctions targeting piped natural gas have effectively cut off supply to Europe, and the existing infrastructure cannot be easily redirected. Putin has been petitioning Xi for more pipelines to China but even if he is successful, it will be five or more years before construction is completed.

continued with the new grain shipping corridor along the west Black Sea coast seeing Ukraine export 3 million metric tons of food in October from its Black Sea and Romanian Danube River ports, versus 2.3 million tons of agricultural goods in September. Other estimates were higher. However, overall, Ukraine’s grain exports have fallen to 8.6 million metric tons so far in the 2023/24 July-June marketing season. Last year at this time, Ukraine had exported 12.3 million tons of grain. While still sending missiles and drones against grain warehouses and silos, Russia has not attacked any ships, perhaps to avoid causing an international incident with a non-combatant country. Meanwhile Russian seaborne crude oil exports rose to a five-month high in October, averaging 3.5 million barrels per day (mbpd), a +7.4% rise on the month. On the other hand, Russia’s natural gas monopoly, Gazprom, reported its lowest output levels since 1978. Sanctions targeting piped natural gas have effectively cut off supply to Europe, and the existing infrastructure cannot be easily redirected. Putin has been petitioning Xi for more pipelines to China but even if he is successful, it will be five or more years before construction is completed.

Middle East Clashes Erupted as Hamas invaded southern Israel, killing approximately 1,000 civilians and 350 soldiers and policemen, and kidnapping about 200 Israelis. The estimate was 2,900 Hamas fighters were involved in the attacks, with about 1,000 of them killed in Israel. The Israeli retaliation, an invasion of northern Gaza, has led to over 9,000 Arab deaths at this time of writing. As horrible as this is, there has been limited expansion of the conflict, apart from Iran’s proxies of Hezbollah in Syria and Houthi rebels in Yemen, both of which limited their actions to firing rockets into Israel. No rockets from Iran directly or aggressive actions in the strategic oil conduit of the Strait of Hormuz. The offshore natural gas fields managed by Israel and shared with Egypt are effectively guarded by US navy carrier forces in the eastern Mediterranean Sea. OPEC+ rebuffed Iran’s attempts to sanction Israel, though treaty negotiations between Israel and Saudi Arabia have been suspended. Finally, Russia’s Wagner Group may be sending anti-aircraft Pantsir S-1 missiles to Hezbollah which may deter Israel and/or provide cover for a step-up in attacks. We shall see but the markets are trading this situation as completely contained.

Macro: Asia

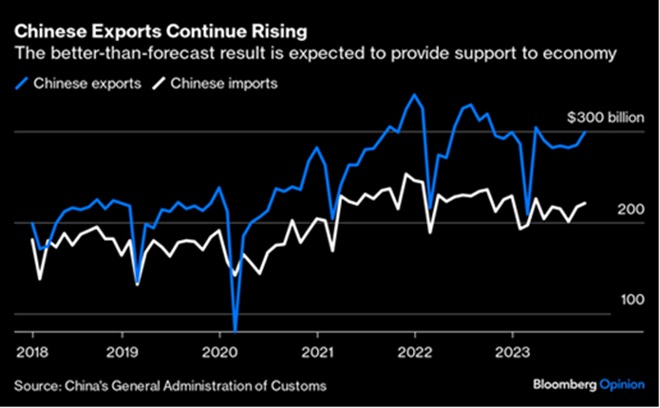

China’s Exports improved again year-on-year in September falling a better-than-expected -6.2% year-on-year with imports also better, down -6.2% versus -7.3% for the last twelve months. China’s crude oil imports were strong ahead of Golden Week travel and improved manufacturing. Shipments last month to the world’s biggest oil importer were 11.1 mbpd. China’s headline economic activity data for September was neutral to positive. Fixed asset investment growth grew at +3.1% over the last nine months but retail sales were better at +5.5% and industrial production rose +4.5% (both beating expectations). GDP grew at +4.9% annualized in Q3, better than expected but worse than in Q2. The central government approved more stimulus, authorizing about 1% of GDP ($137 billion) worth of construction bonds (more unneeded housing and ghost cities?) to be spent in Q4 2023 and 1H 2024. This may be just in time kick the can further down the road as the closely-watched purchasing managers’ activity index indicated contraction – fewer orders. Too late to help the troubled real estate developer Country Garden, which failed to pay interest due within the grace period. Apparently the bond’s terms allow for immediate repayment of principal and interest if 25% of holders demand it… no indication that this has happened – yet.

were strong ahead of Golden Week travel and improved manufacturing. Shipments last month to the world’s biggest oil importer were 11.1 mbpd. China’s headline economic activity data for September was neutral to positive. Fixed asset investment growth grew at +3.1% over the last nine months but retail sales were better at +5.5% and industrial production rose +4.5% (both beating expectations). GDP grew at +4.9% annualized in Q3, better than expected but worse than in Q2. The central government approved more stimulus, authorizing about 1% of GDP ($137 billion) worth of construction bonds (more unneeded housing and ghost cities?) to be spent in Q4 2023 and 1H 2024. This may be just in time kick the can further down the road as the closely-watched purchasing managers’ activity index indicated contraction – fewer orders. Too late to help the troubled real estate developer Country Garden, which failed to pay interest due within the grace period. Apparently the bond’s terms allow for immediate repayment of principal and interest if 25% of holders demand it… no indication that this has happened – yet.

Macro: US

The Federal Reserve left its benchmark interest rate unchanged at its October 31st-November 1st meeting while signaling borrowing costs will likely stay higher for longer… but Powell backed off from confirming another hike this year and said that financial conditions are doing the Fed’s work for them. In other words, 5% long-dated Treasury bond yields and higher mortgage (at 8% or more), automobile (13% for those with fair credit ratings) and credit card (now charging 23% on average) interest rates are successfully dampening employment and slowing the economy. Yes, Q3 GDP indicated a massive +4.9% annualized growth per the Atlanta Fed but they projected a much more sedate +1.1% growth for Q4. Unemployment figures for October showed an increase of 150,000 jobs, about half the downwardly revised 297,000 positions taken for September. Stock and bond markets were ecstatic, with the S&P 500 up over 5% and long-term yields falling about 0.5% the last full week bridging October and November. Inflation still had some heat in September, growing a little faster than forecast at +3.7% versus +3.6%. US retail sales increased in September by more than forecast (+0.7% month-on-month) as well as factory output (+0.4% month-on-month), supporting the strong Q3 GDP showing.

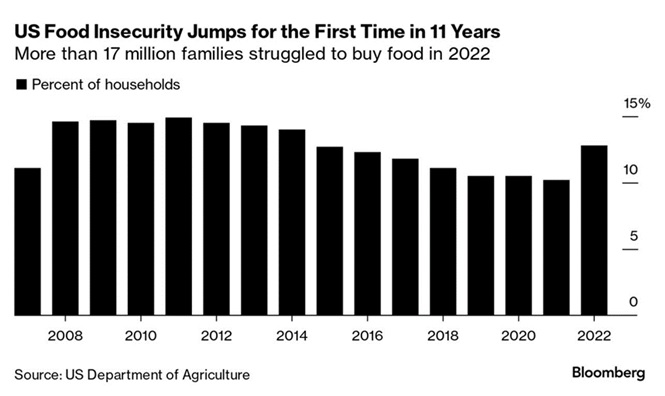

However, Consumers Are Bifurcating into the better off who are enjoying stock and bond gains and the lower classes as evidenced by the dramatic reversal seen in the graph to the right. Food needs compete with shelter but with such high mortgage rates, the median American household would need to spend ~45% of their income to afford the median priced home, a record high. More precisely, a US homebuyer now needs to earn a record $115,000 to afford the median priced home for sale, a +53% increase in the last three years. This is $40,000 more than the median US household income of $75,000. Automobile delinquencies hit 6.1% of borrowers, up from the low of 2.1% in May, 2021. Credit card debt topped $1 trillion for the first time and the national average card debt among cardholders with unpaid balances in December 2022 (most recent data) was $7,279 – one can imagine that it would be higher now, with those 23% or higher interest rates compounding them.

shelter but with such high mortgage rates, the median American household would need to spend ~45% of their income to afford the median priced home, a record high. More precisely, a US homebuyer now needs to earn a record $115,000 to afford the median priced home for sale, a +53% increase in the last three years. This is $40,000 more than the median US household income of $75,000. Automobile delinquencies hit 6.1% of borrowers, up from the low of 2.1% in May, 2021. Credit card debt topped $1 trillion for the first time and the national average card debt among cardholders with unpaid balances in December 2022 (most recent data) was $7,279 – one can imagine that it would be higher now, with those 23% or higher interest rates compounding them.

The US Federal Government was still part of the problem with a deficit of $2 trillion for the year ending September 2023 (reminder: they do not use a calendar year). US’ national debt crossed above $33 trillion for the first time on September 15th, just three months after hitting the $32 trillion mark. While October may be better due to one-time factors (e.g., Californians were allowed to pay their income taxes in October, delayed due to severe weather in early 2022-23), the pace of spending is expected to continue. A simple way to think about this is that US debt grew at a +8.5% annualized rate since 2008 (the previous pre-COVID recession) while nominal GDP (which includes inflation) grew at +4.0%, only half as fast. Washington DC still acts as if the checkbook was still open; remember that the current administration wanted to forgive $379 billion in student loans and send $106 billion to Ukraine/Israel/Taiwan/migrants in recent weeks. At least Congress is being told about this problem as policymakers were advised on November 1st to pay attention to the deteriorating federal budget, with investors demanding steeper premiums to buy the government’s longer-term securities. “Effectively, while there is still reasonable demand for US Treasuries from many domestic and international market participants, it has not kept pace with the increase in supply,” according to the recent Treasury Borrowing Advisory Committee analysis. Setting aside the merits of any particular program or policy, it appears that the US will have to make some tough decisions in the near future.

Macro: Europe

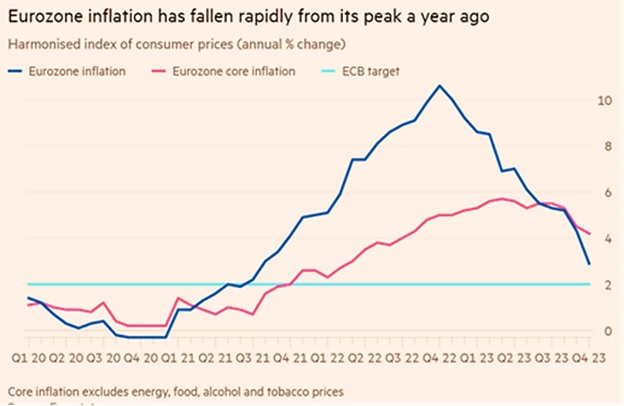

European Central Bank Held their main interest rate at 4%, and the markets expect the ECB to start cutting rates before the US Federal Reserve due to a faster decline in the rate of inflation and poor economic metrics. As the graph on the right shows, headline inflation fell rapidly, more than expected, though core inflation less so. Energy costs are hurting manufacturing with October’s purchasing managers’ new orders index contracting to a lower level than in September and unemployment showing weakness – Germany for example had an uptick to 5.8% in September, partially made higher by +0.4% by including Ukrainian refugees. Bloomberg Economics forecasted German GDP to decline by -0.4% in 2023, much lower than the +1.0% EU average for this year. Falling inflation and expected falling interest rates are not a positive in a recession, for Europe or anyone else.

metrics. As the graph on the right shows, headline inflation fell rapidly, more than expected, though core inflation less so. Energy costs are hurting manufacturing with October’s purchasing managers’ new orders index contracting to a lower level than in September and unemployment showing weakness – Germany for example had an uptick to 5.8% in September, partially made higher by +0.4% by including Ukrainian refugees. Bloomberg Economics forecasted German GDP to decline by -0.4% in 2023, much lower than the +1.0% EU average for this year. Falling inflation and expected falling interest rates are not a positive in a recession, for Europe or anyone else.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource