Commodities: Global

OPEC Oil Output Fell Slightly in November, posting at 27.8 million barrels per day (mbpd), as a result of lower shipments by Nigeria and Iraq as well as Saudi Arabia and Russia reiterated their voluntary reductions. The bigger news was that the OPEC meeting was delayed four days as Saudi Arabia wanted more members to reduce output and other countries resisted. When the meeting did happen, an extra 1 mbpd cut was announced for a total of 2.2 mbpd but oil prices declined on the day in part because the reductions were voluntary and because of investor expectation ahead of the meeting that additional supply cuts might be deeper. Angola, for example, has already rejected its new reduced target, saying it will continue pumping at 1.18mbpd versus 1.11mbpd. Brazil announced that it plans to join OPEC+ in January, but would not take part in the group’s coordinated output caps, which basically nullified that news. Brazil is the largest oil producer in South America at 4.6 mbpd of oil and gas, of which 3.7 mbpd is crude oil. Venezuela stirred up trouble as it reneged on an agreement with the US to release a detained American and threatened to invade its neighbor Guyana in a grab for its offshore oil and gas fields. Venezuela produced some 786,000 bpd in October, while Guyana produced around 380,000 bpd but expected to reach 1.2 mbpd by 2027. It is one of the fastest growing oil producing countries and Exxon and other international oil companies are investing heavily. Seems like another US foreign policy failure in the making.

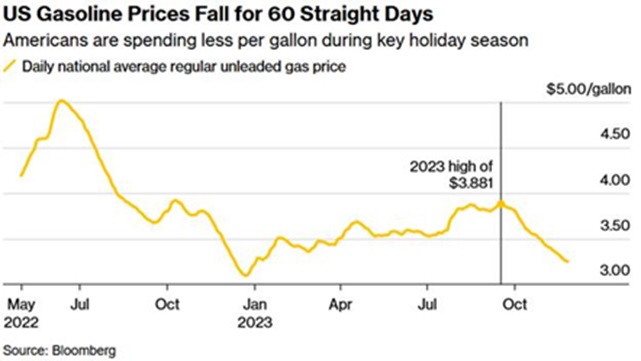

US Oil Production Hit a New Record at 13.2 mbpd despite only a small increase in operating oil rigs from 504 as of October 27th to 505 as of December 1st. Oil companies cited productivity enhancements in their shale regions, where average well production reached 1,319 bpd, a long way from a year ago when it was 183 bpd. For the year, the US was estimated to produce an additional 850,000 bpd, 80% of the global expansion in oil supply. Further increases are projected for 2024, putting the possibility of 15 mbpd total production by 2028. Per AAA, US average regular gasoline prices fell further to $3.25 (21¢ lower) as of November 30th. California prices fell 34¢ to $4.72 per gallon for regular unleaded – nice to see lower but still a wide differential. Meanwhile, sales of hybrids, plug-in hybrids, and battery electric vehicles have accounted for 15.8% of all new light-duty vehicle sales in the United States so far this year, compared with 12.3% in 2022 and 8.5% in 2021. Doesn’t sound bullish for oil.

was 183 bpd. For the year, the US was estimated to produce an additional 850,000 bpd, 80% of the global expansion in oil supply. Further increases are projected for 2024, putting the possibility of 15 mbpd total production by 2028. Per AAA, US average regular gasoline prices fell further to $3.25 (21¢ lower) as of November 30th. California prices fell 34¢ to $4.72 per gallon for regular unleaded – nice to see lower but still a wide differential. Meanwhile, sales of hybrids, plug-in hybrids, and battery electric vehicles have accounted for 15.8% of all new light-duty vehicle sales in the United States so far this year, compared with 12.3% in 2022 and 8.5% in 2021. Doesn’t sound bullish for oil.

US Corn Harvest Was A Record with corn totaling 15.2 billion bushels, the USDA said, surpassing the previous peak of 15.1 billion set in 2016. Brazil’s soybean crop will reach 150 to 155 million metric tons in the 2023/24 cycle, likely below last season’s 154.10 million tons, per estimates – however, the country will export a record 99.5 million metric tons. Brazilian corn exports are expected to reach 56 million metric tons in 2023, a 25% increase from last year’s level, which was already a record. Finally, Argentina is expected to produce more than twice last year’s soy output as the season has started well with late rains.

Finally, for Christmas and winter holidays, in addition to buying the Coloma gold-prospecting board game – sold at only the finest toy and bookstores worldwide: https://gamefound.com/en/projects/finalfrontiergames/coloma-new-prospects-expansion-and-reprint one may consider diamonds… De Beers sold the least diamonds since halting sales during the pandemic as the industry struggles with weak demand and too much stock. The company sold $80 million of rough diamonds at the end of October, compared with $454 million a year earlier. Watch out cubic zirconia!!!

All the best in your investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource