Ukraine & Israel: Attack / Counter-Attack

The Ukraine-Russia Conflict saw little progress by both sides as Ukraine strove to shore up military funding from Europe and the US. Ukraine’s grain exports have fallen to around 13.4 million metric tons so far in the 2023/24 July-June marketing season, per their agriculture ministry, versus by Dec. 5 last year when Ukraine had exported 18.3 million tons of grain. Ukraine’s sugar industry, one of the country’s few profitable farm sectors, may expand planted area in 2024 and with good weather the 2024/25 exportable surplus could jump by around 50%, the producers’ union Ukrsugar said. Current production is just over one million tons. A Russian rocket hit a ship under the Liberian flag that was entering the Ukrainian port of Pivdennyi to pick up a shipment of iron ore destined for China. While many discuss the oil profits that keep the Russian war machine lubricated, few mention the role of Chinese banks, which have stepped in after Western banks retreated. Total lending moved up from $2.2 billion to $9.7 billion through March (the latest data) and Russia has shifted from the dollar and euro to the yuan as a reserve currency. Russia remained China’s top oil supplier in October, totaling 2.0 million barrels per day (mbpd).

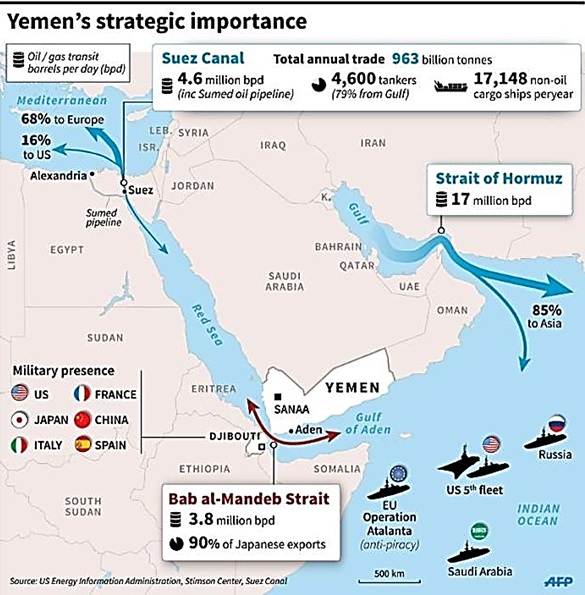

Middle East Fighting Resumed between Hamas and Israel after a ceasefire allowed the exchange of Israeli hostages / Arab prisoners and substantive evidence of Hamas using hospitals and schools as cover for underground operations, against the Geneva Convention. The substantive shelter destruction by Israeli bombing added to the misery of those caught in the middle. Meanwhile, another of Iran’s proxy forces in the area, the Yemini Houthis engaged in multiple shipping attacks in the Red Sea area, including on US Navy vessels (see map to the right). The waterways are critical to shipping between Europe and Asia as the Suez Canal to the north would be effectively nullified as a transit route. Sailing around the Cape of Good Hope would add ten days to voyages while going through the Panama Canal in the other direction would add at least eleven days – assuming the water levels are high enough. So far, markets have treated the situation as contained. The main wild card left is Hezbollah in Lebanon and Syria, which has been content to send missiles into Israel but not further aggression.

evidence of Hamas using hospitals and schools as cover for underground operations, against the Geneva Convention. The substantive shelter destruction by Israeli bombing added to the misery of those caught in the middle. Meanwhile, another of Iran’s proxy forces in the area, the Yemini Houthis engaged in multiple shipping attacks in the Red Sea area, including on US Navy vessels (see map to the right). The waterways are critical to shipping between Europe and Asia as the Suez Canal to the north would be effectively nullified as a transit route. Sailing around the Cape of Good Hope would add ten days to voyages while going through the Panama Canal in the other direction would add at least eleven days – assuming the water levels are high enough. So far, markets have treated the situation as contained. The main wild card left is Hezbollah in Lebanon and Syria, which has been content to send missiles into Israel but not further aggression.

Macro: Asia

China’s Exports slipped year-on-year in October, falling -6.4% year-on-year (versus a consensus forecast of -3.3%) with imports higher, up +3.0% for the last twelve months, as opposed to falling by an expected -4.8%. Within this, exports to the U.S. dropped -15.4% YTD 2023 versus YTD 2022 and those to the EU -10.6% y/y (see right). Meanwhile, imports posted strong gains from Australia, Brazil, Russia, and India. China imported +13.5% more crude oil in October from a year earlier, as refiners stepped up purchases using fresh import quotas and as domestic fuel demand expanded during the Golden Week holiday. Crude oil arrivals totaled 11.5 mbpd, up marginally compared with 11.1 mbpd in September. China’s economy showed modest signs of improvement in October as consumer spending picked up – retail sales rose +7.6% compared with the same period last year, an acceleration from September’s +5.5% year-over-year growth and topping the +7% expected by economists. Industrial production was up fractionally (+4.6% y/y versus +4.5% in September) and fixed asset investment growth declined (+2.9 y/y versus +3.1% in September).

refiners stepped up purchases using fresh import quotas and as domestic fuel demand expanded during the Golden Week holiday. Crude oil arrivals totaled 11.5 mbpd, up marginally compared with 11.1 mbpd in September. China’s economy showed modest signs of improvement in October as consumer spending picked up – retail sales rose +7.6% compared with the same period last year, an acceleration from September’s +5.5% year-over-year growth and topping the +7% expected by economists. Industrial production was up fractionally (+4.6% y/y versus +4.5% in September) and fixed asset investment growth declined (+2.9 y/y versus +3.1% in September).

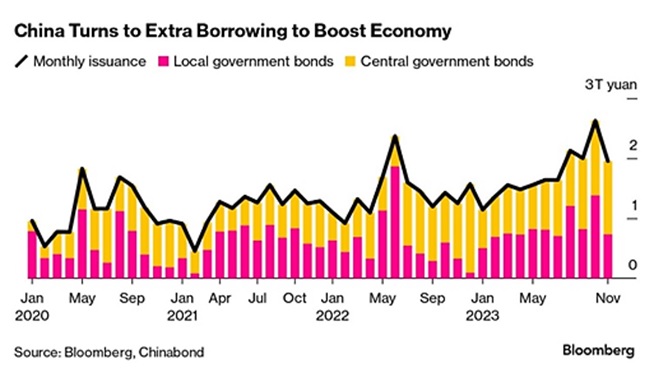

China Continued to Lever Up with the People’s Bank of China offering 1.45 trillion yuan ($200 billion) of cash through its medium-term lending facility — 600 billion yuan more than the amount coming due in November. Meanwhile, consultancy PRC Macro estimated that the cost of a systemic bailout for property developers would be at least RMB 7 trillion (about $1 trillion), or 6% of China’s GDP. Home prices in 70 major Chinese cities fell for the fourth straight month in October, recording the steepest drop in nearly nine years, falling -0.4% m/m in October, the most since a -0.5% decline in February 2015. Problems spread to the shadow banking sector with the Zhongshi financial conglomerate disclosing a $36.4 billion shortfall after missing interest payments and confessing it has about $28 billion of assets versus over $55 billion of liabilities. No wonder Moody’s downgraded China’s government bond outlook to negative from stable. The firm said China’s fiscal stimulus to support local governments and its spiraling property downturn was posing risks to the nation’s economy, underscoring deepening global concerns about the level of debt in the world’s second-largest economy (which at 340% total is about the same as the US’ at 360%).

drop in nearly nine years, falling -0.4% m/m in October, the most since a -0.5% decline in February 2015. Problems spread to the shadow banking sector with the Zhongshi financial conglomerate disclosing a $36.4 billion shortfall after missing interest payments and confessing it has about $28 billion of assets versus over $55 billion of liabilities. No wonder Moody’s downgraded China’s government bond outlook to negative from stable. The firm said China’s fiscal stimulus to support local governments and its spiraling property downturn was posing risks to the nation’s economy, underscoring deepening global concerns about the level of debt in the world’s second-largest economy (which at 340% total is about the same as the US’ at 360%).

Meanwhile, in Japan, the most recent auction of 30-year Japanese sovereign securities had the lowest bid-to-cover ratio since 2015. The so-called tail, or the difference between the average and lowest-accepted prices, was the longest on record. Yields on the 30-year debt jumped 9.5 basis points to 1.69%, raising speculation that higher interest rates may be allowed at the Bank of Japan’s next meeting on December 19th. This would further decrease Japanese holding of US Treasury bonds as local assets become more attractive.

Macro: US

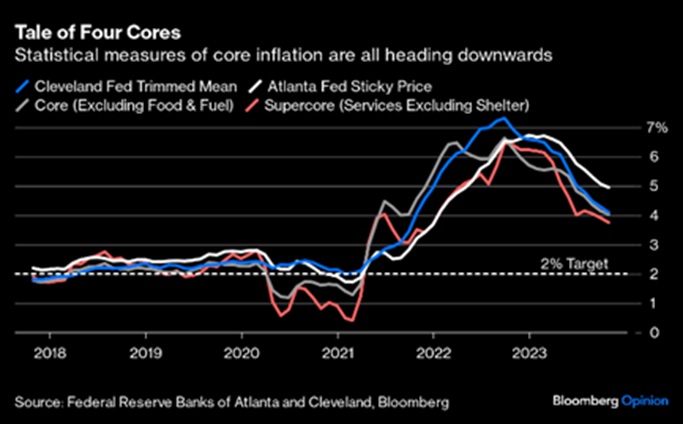

The Federal Reserve left its benchmark interest rate unchanged at its October 31st-November 1st meeting while signaling borrowing costs will likely stay higher for longer… but Powell backed off from confirming another hike this year. Stock and bond markets were ecstatic, with the S&P 500 up over 9% and long-term yields falling over 0.6% in November. The December 12 – 13th meeting will either confirm these confident moves or send the markets reeling. US Q3 GDP was revised upward from +4.9% to +5.2% annualized growth, though Q4 is expected to be up a more sedate +1.2% annualized (lower than the previous +1.8%). US inflation declined in October to +3.2% y/y overall (helped by lower gasoline prices) – much better than the +3.7% y/y for September and core inflation +4.0% y/y. All the common measures showed the same trend and lower is expected for November CPI announcement as well. The Global Supply Chain Pressure Index recently hit a record low of -1.74 standard deviations below the mean, indicating that supply chains are normal which would put less pressure on businesses to raise prices, and could cool inflation further. US employment for October was strong at +199,000 jobs added, lowering the rate from 3.9% to 3.7%.

long-term yields falling over 0.6% in November. The December 12 – 13th meeting will either confirm these confident moves or send the markets reeling. US Q3 GDP was revised upward from +4.9% to +5.2% annualized growth, though Q4 is expected to be up a more sedate +1.2% annualized (lower than the previous +1.8%). US inflation declined in October to +3.2% y/y overall (helped by lower gasoline prices) – much better than the +3.7% y/y for September and core inflation +4.0% y/y. All the common measures showed the same trend and lower is expected for November CPI announcement as well. The Global Supply Chain Pressure Index recently hit a record low of -1.74 standard deviations below the mean, indicating that supply chains are normal which would put less pressure on businesses to raise prices, and could cool inflation further. US employment for October was strong at +199,000 jobs added, lowering the rate from 3.9% to 3.7%.

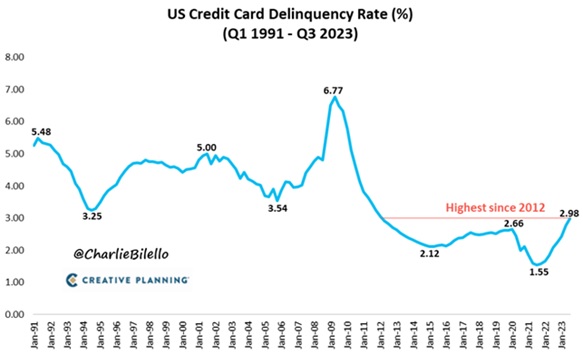

On the other hand, US Wages have outpaced inflation for the last six months but workers are still deeply behind as there were 25 consecutive months of negative real wage growth before that. A Bloomberg analysis of the cost of living had groceries increasing by almost 35% since January 2020… do you know anyone whose wages increased that much over the last four years? https://www.bloomberg.com/graphics/2023-inflation-economy-cost-of-living/ for the full article (registration required). Credit card delinquencies were the highest in over a decade (see graph below) and mortgage rates have risen more than twofold from around 3% to 7.5% over the same period. Existing home sales were 15% lower than last year’s total, the 26th consecutive month showing a year-on-year decline – the longest down streak since 2007-09. 54,000 US home purchases were canceled in October, which equates to 17.2% of all homes under contract. That’s the highest cancellation percentage on record. Finally, US factory orders fell -3.6% m/m in October, worse than the estimate at -3.0%.

the highest in over a decade (see graph below) and mortgage rates have risen more than twofold from around 3% to 7.5% over the same period. Existing home sales were 15% lower than last year’s total, the 26th consecutive month showing a year-on-year decline – the longest down streak since 2007-09. 54,000 US home purchases were canceled in October, which equates to 17.2% of all homes under contract. That’s the highest cancellation percentage on record. Finally, US factory orders fell -3.6% m/m in October, worse than the estimate at -3.0%.

The US Government avoided a partial government shutdown as the Senate passed a stopgap spending bill and sent it to President Joe Biden to sign into law before a weekend deadline. The 87-11 vote marked the end of this year’s third fiscal standoff in Congress that saw lawmakers bring Washington to the brink of defaulting on its more than $33 trillion in debt this spring and twice within days of a partial shutdown that would have interrupted pay for about 4 million federal workers. However, the next deadline is Jan. 19, just days after the Iowa caucuses signal the start of the 2024 presidential campaign season – campaign topic?

Macro: Europe

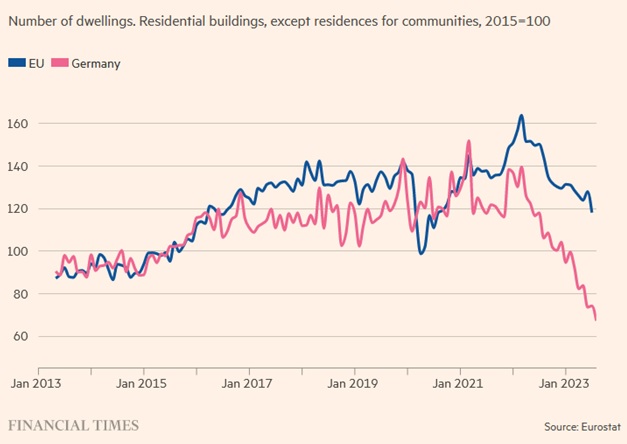

European Central Bank Expected To Hold their main interest rate at 4%, but begin cutting in April, before the US Federal Reserve, due to a faster decline in the rate of inflation (most recently at 2.4% y/y, falling from 2.9% previously). Germany in particular is holding Europe back as its GDP fell by -0.1% in the third quarter (not annualized) as households pulled back spending. Analysts predicted a contraction of the same magnitude in the final quarter of the year, producing a shallow recession. German industrial production fell more than expected in September by -1.4% compared with the previous month, more than the prediction of a -0.1% decline. German homebuilding is in a crisis, with many builders insolvent – the graph on building permits tells the story to the right. Overall Eurozone employment remained at record lows, ticking up from 6.4% to 6.5%, which like the US, if it holds could delay interest rate decreases.

quarter (not annualized) as households pulled back spending. Analysts predicted a contraction of the same magnitude in the final quarter of the year, producing a shallow recession. German industrial production fell more than expected in September by -1.4% compared with the previous month, more than the prediction of a -0.1% decline. German homebuilding is in a crisis, with many builders insolvent – the graph on building permits tells the story to the right. Overall Eurozone employment remained at record lows, ticking up from 6.4% to 6.5%, which like the US, if it holds could delay interest rate decreases.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource