- The OPEC cuts are holding (thanks primarily to Saudi Arabia) as early indications for March exports have been assessed at 25.27 million bpd in March, almost flat compared to February levels. For those not subject to cuts, Iran is seen as having to struggle to expand much further as its stored oil inventories have been largely depleted, Nigerian production is questionable due to its civil war but Libya has lifted the force majeure on supplies from its largest field (Sharara), sending output back up to 660,000 bpd (with a goal of 800,000 bpd by the end of April). Russia moved towards its commitment in March by reaching 200,000 bpd in cuts (2/3rds of promised with the last portion cut by the end of April). The real question lies ahead – will the cuts be extended at the next OPEC meeting on May 25th?

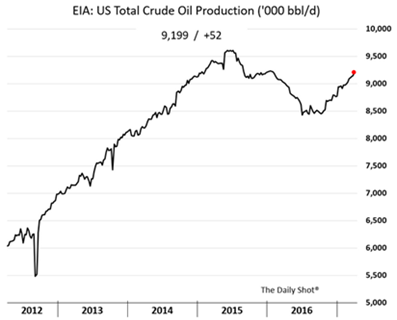

- Meanwhile, the rest of the world continues to produce as best they can and without restraint. The United States is leading the way with expanding production (see graph to the right). The US oil-drilling rig

count continued inexorably to move higher from 602 on February 24th to 662 on March 31st. In the Drilled but Un-Completed (DUC) well category, the February list has grown 8% from October last year. These partially completed shale wells (needed to preserve lease rights) represent an estimated supply boost of 300,000 bpd. Shale production is expected to expand by 109,000 bpd in April per the US government as breakeven costs continue to decline so expect the adjacent graph to continue its trend.

count continued inexorably to move higher from 602 on February 24th to 662 on March 31st. In the Drilled but Un-Completed (DUC) well category, the February list has grown 8% from October last year. These partially completed shale wells (needed to preserve lease rights) represent an estimated supply boost of 300,000 bpd. Shale production is expected to expand by 109,000 bpd in April per the US government as breakeven costs continue to decline so expect the adjacent graph to continue its trend.

- Looking ahead, the Trump administration lifted its objections to the Keystone XL pipeline and opposition lost their case in Federal court. There are a number of state-level hurdles still to go but if constructed, Canadian oil will have more options to flow through the US. The Dakota Access pipeline is already filling and is expected to be fully operational by June 1st. The US government is also selling small amounts from its strategic oil reserve. Brazilian crude oil output is set to rise by 210,000 bpd in 2017, with Wood Mackenzie seeing exports rising to 1 million bpd from 798,000 bpd in 2016. Mexico’s recent auction of offshore oil and gas parcels saw renewed interest by foreign producers with Royal Dutch Shell, Chevron and Exxon winning bids.

- Stepping back to the bigger picture, Saudi Arabia’s Aramco is looking to IPO in 2H 2018 so they are clearly banking on stronger demand starting in 2H 2017. India’s growth looks to be critical to meet that conclusion – doable with the latest IMF GDP projection showing +7.2% in 2017 versus +6.6% in 2016. This result by itself would increase oil demand by an estimated 265,000 bpd. The other major bullish event (should it occur) would be the collapse of Venezuela’s government and related oil exports. President Maduro expanded his powers as his Supreme Court granted him direct control over the oil company even as $3 billion in debt payments come due in mid-April. On the bearish side, US gasoline consumption is slowing as the average fuel economy of vehicles on U.S. roads is improving, which is offsetting the continued growth in driving demand. Will exports make up the difference? Finally, US wind generating capacity surpassed hydro capacity at the end of 2016. Trump’s policies may affect further growth.

- Brazil made agriculture-related headlines again, with the announcement of a widespread bribery investigation code-named “Weak Flesh” (I am sure it sounds better in Portuguese) to cover up tainted beef production, including for export. After quick suspension/restriction of Brazilian beef imports by China, the EU, Japan and Chile (and other countries), the bans were subsequently lifted or softened by the end of March, minimizing the impact. In grain news, size of the Brazilian soybean crop continues to grow with Agro Consult now forecasting the crop there to be 113.3 million metric tonnes (mmt), compared to the USDA’s current forecast of 108 mmt and last year’s production of 96.5 mmt. Likewise, Argentina’s 2016/17 soy crop was estimated at 56.5 mmt, the Buenos Aires Grains Exchange said on Thursday, citing better-than-expected yields as it raised its forecast from the previous outlook of 54.8 mmt. In corn, Brazil looks to be 91.5 mmt (versus last year’s 67 mmt) and Argentina is projecting 37.5 mmt versus last year’s 29 mmt. In a word, enormous! And no help from the US, which in the latest USDA report, surprised the trade with larger-than-expected corn, soybean and wheat supplies in its quarterly stocks estimates. In terms of this upcoming growing season, the annual USDA prospective plantings showed an estimated 89.5 million acres for soy (versus 83.4 last year) and 90.0 million acres for corn (down from 94 million acres last year). Corn planting has started in southern states, with Texas 56% done versus 41% a year ago. The Midwest states have to get through some nearby wet weather but planting is expected to start in earnest the week of April 10th. The next USDA report on April 11th may address the plentiful supply situation – or hammer home the excess in local and worldwide grain supply.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.