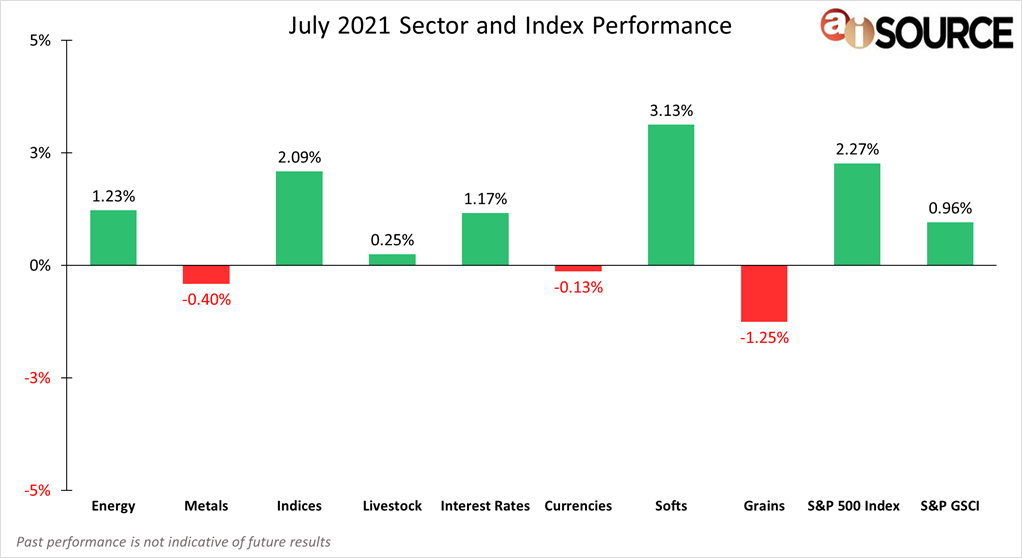

During the month of July, the top 3 performing sectors were: softs (+3.13%), financials (+2.09%), and energies (+1.23%). The bottom 3 sectors were: grains (-1.25%), metals (-0.40%) and currencies (-0.13%). Vaccination numbers look like they are beginning to plateau and the Delta variant spreads like wildfire breaking February 2021 highs of 100,000 daily cases, per the CDC. That being said, near-term economic outlook remains strong as financial indices lock in their sixth consecutive month of positive gains. The Federal Reserve remains focused on issues such as maximum employment and price stability naming the overall financial conditions “accommodative”. Thus, implying that the path of the economy continues to depend on the course of COVID. Looking into the commodity markets, grains posted an overall negative return as corn (-24%) consolidated back to about $5.50 as forecasts suggested ideal growing conditions in the heart of the US growing belt. Livestock up 0.25% as cattle faced a tightening supply and continued in trend showing strong support on its lows. Coffee (12.7%) and frozen OJ (12.2%) led the way in softs. And, WTI crude closed the month just above $70 but saw some increased volatility as OPEC oil output hit a 15-month high.

For month to date and year to date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. S&P 500 Index – data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.