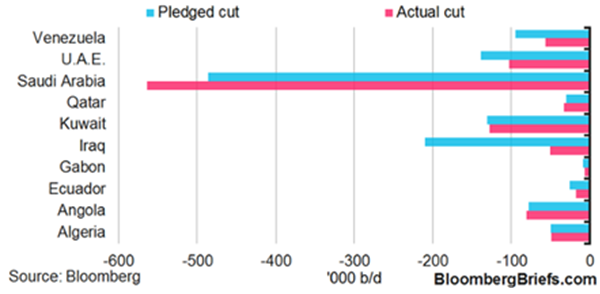

- A new year and a month worth of lower oil output by OPEC and friends. Did they really cut? And by how much? Per the early February chart to the right by Bloomberg, one can see that OPEC itself did a decent job of reaching the pledged cuts, with Saudi Arabia making up for some of the non-compliance of Venezuela

(which is dying on its feet economically), UAE (no excuse) and Iraq (the Kurdish production is basically impossible for the central government to control and besides, there is an active war going on against ISIL). Exempt Iran, Libya and Nigeria added 90,000 barrels of production with more expected in the months to come. Overall, OPEC fell short of its 31.75 million barrels per day (mbpd) target and supply remains well above the estimated 1H demand of 31.28 mbpd. Non-OPEC production also missed cut targets, with Russia in particular curtailing production by only 100,000 bpd instead of the pledged 300,000. Let us call the overall compliance at 70% of the total – pretty good, but not enough to bring supply into deficit in 2017.

(which is dying on its feet economically), UAE (no excuse) and Iraq (the Kurdish production is basically impossible for the central government to control and besides, there is an active war going on against ISIL). Exempt Iran, Libya and Nigeria added 90,000 barrels of production with more expected in the months to come. Overall, OPEC fell short of its 31.75 million barrels per day (mbpd) target and supply remains well above the estimated 1H demand of 31.28 mbpd. Non-OPEC production also missed cut targets, with Russia in particular curtailing production by only 100,000 bpd instead of the pledged 300,000. Let us call the overall compliance at 70% of the total – pretty good, but not enough to bring supply into deficit in 2017.

- The American and Canadian producers are still expanding, with the US oil-drilling rig count charging higher from 525 on December 30th to 566 on January 27th. Production is reacting as well, with January’s average production at 8.9 mbpd versus the low in 2016 at 8.5 mbpd. Canada’s production is also moving higher with a forecasted increase of 300,000 bpd in 2017. With Trump backing the Keystone XL pipeline connecting to Canada, the US will lay the infrastructure to keep the crude oil coming to the US. Brazil has a 2017 forecast for an increase of similar magnitude (+240,000 bpd). Oil in storage is still at high levels, and there are high if not record levels of gasoline and other oil products in inventory, which backs up the pressure to oil production. Overall, the oil consultancy Wood Mackenzie expects new oil projects to double in 2017 and capital expenditure to increase for the first time in three years to $450 billion (up 3% versus 2016). Chevron, Total, BP ExxonMobil and Eni were also cited as continuing projects or green-lighting them in the near future. Finally, Venezuela is reported as having more than 4 million barrels of oil and fuels sitting in tankers that cannot be delivered as the state oil company cannot pay for hull cleaning and inspections (required by ports to keep invasive species from spreading). The oil is bought and paid for, but cannot be delivered.

- In looking at geopolitical catalysts, Chinese oil production is seen to fall 7% in 2017, a similar amount as 2016. However, with the central government still stimulating the economy, their industrial production and GDP growth should maintain demand. Their strategic petroleum reserve buys should also keep demand up. The cold war between Russia and Ukraine turned a little hotter in late January with heavy shelling by the Russian-controlled forces in western Ukraine. Russia further consolidated its position in Syria as well as more publically backing General Khalifa Haftar’s army in eastern Libya (who is also supported by Egypt and the UAE). If Trump stands off from involvement, in theory Tripoli’s forces (backed by the US and Europe) in the west and General Haftar’s troops could clash more seriously. For now though, the focus looks to be eliminating ISIL and increasing oil production (wars are expensive!).

- The soy harvest is underway in Brazil and Argentina, earlier than

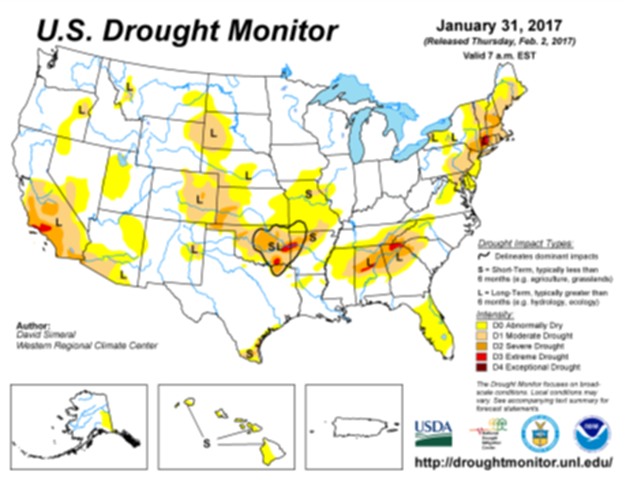

last year. Brazil’s Mato Gross region is cited as being well ahead of schedule and drier weather is projected in early February, which will help speed it up. Brazil, Paraguay and Uruguay are all forecasted to produce record output this season, with Argentina falling behind (though still respectable) due to heavy rains in the first half of January. In particular, Brazil is projected to be at 103.8 million tonnes versus 95.4 million tonnes last year. U.S. weather looks good for the upcoming summer as drought conditions in the west and south look very diminished.

last year. Brazil’s Mato Gross region is cited as being well ahead of schedule and drier weather is projected in early February, which will help speed it up. Brazil, Paraguay and Uruguay are all forecasted to produce record output this season, with Argentina falling behind (though still respectable) due to heavy rains in the first half of January. In particular, Brazil is projected to be at 103.8 million tonnes versus 95.4 million tonnes last year. U.S. weather looks good for the upcoming summer as drought conditions in the west and south look very diminished.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource