COVID-19

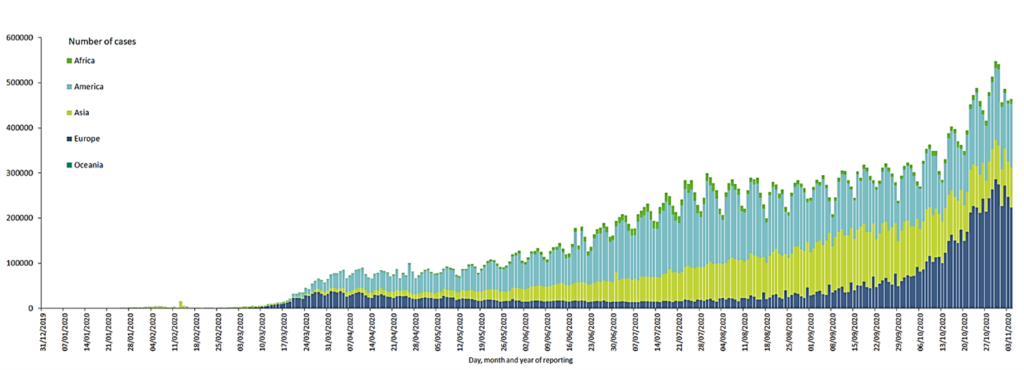

- Europe’s Case Count Worsened dramatically through October, well surpassing the US (at least in the near term) with outbreaks particularly in the UK, France, Spain and Italy. The graph below from the EU’s CDC website was not the easiest to read but the colors tell the story (Americas in light blue, Asia in yellow-green and Europe in dark blue). Note that Asia’s cases are concentrated in India which saw a rapid decline in recent days. Will the winter period naturally keep people away from each other in their homes or when they meet indoors accelerate the spread?

- Q3 GDP gains were very strong as expected for the US and Europe on the eased lockdown restrictions and Q4 has been a small positive for the US (+0.8% for the quarter per the Atlanta Federal Reserve) but a decline (-2.3% per Goldman Sachs) for the EU. Both economies are forecasted to decline for all of 2020, -3% roughly for the US and -6% or so for the EU. The lockdowns and the headlines are not over yet. Our thoughts and prayers go out to those taken ill and we hope that they have access to proper care and recover fully.

Macro: US

- Q3 GDP Growth of annualized +33.1% (+7.4% just for the quarter) demonstrated the power of the US consumer since the personal spending component also had a record increase. Other economic measures posted improvements too with September factory orders growing +1.1% month-on-month (m/m), existing home sales grew by +9.4% m/m (and median selling prices also increased by +14.8% to $311,000), personal income grew +0.9% m/m and inflation increased

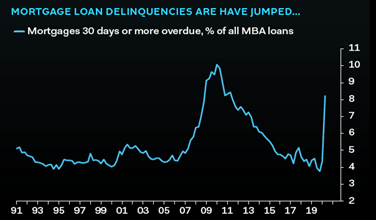

at the slowest pace in four months (+0.2% m/m). US unemployment for October fell to 6.9%, a further improvement in the jobless rate, with corresponding progress in the under-employment rate to 12.1%. Nonfarm payrolls (+638,000) beat expectations and September’s gain was revised upward slightly. On the negative side, new home sales (a relatively small percentage of the housing market) fell -3.5% m/m (although prices moved up in line with existing home sales), industrial production fell -0.6% m/m and malls suffered with two regional landlords declaring bankruptcy and reports of foreclosures increasing over non-payment of rent. Mortgage loan delinquencies have jumped per the graph on the left, though are still below the mortgage-crisis peak. This meant that 3.5 million homeowners were in a workout plan. Employment at Boeing will fall by an additional 7,000 positions by the end of 2021, bringing their total to 30,000 layoffs from 160,000 employees at the end of 2019. Looking ahead, just 45% of U.S. consumers plan to go to a shopping mall this season, down from 64% who visited last November and December, according to International Council of Shopping Centers.

at the slowest pace in four months (+0.2% m/m). US unemployment for October fell to 6.9%, a further improvement in the jobless rate, with corresponding progress in the under-employment rate to 12.1%. Nonfarm payrolls (+638,000) beat expectations and September’s gain was revised upward slightly. On the negative side, new home sales (a relatively small percentage of the housing market) fell -3.5% m/m (although prices moved up in line with existing home sales), industrial production fell -0.6% m/m and malls suffered with two regional landlords declaring bankruptcy and reports of foreclosures increasing over non-payment of rent. Mortgage loan delinquencies have jumped per the graph on the left, though are still below the mortgage-crisis peak. This meant that 3.5 million homeowners were in a workout plan. Employment at Boeing will fall by an additional 7,000 positions by the end of 2021, bringing their total to 30,000 layoffs from 160,000 employees at the end of 2019. Looking ahead, just 45% of U.S. consumers plan to go to a shopping mall this season, down from 64% who visited last November and December, according to International Council of Shopping Centers.

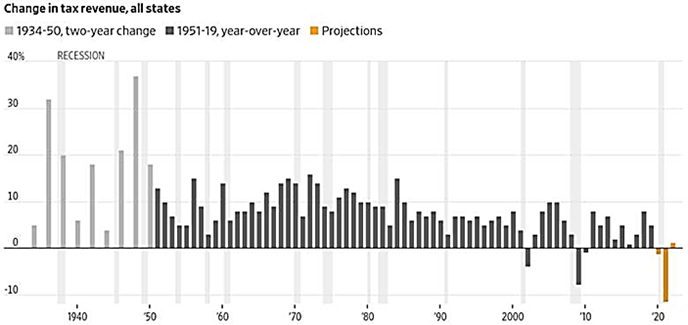

- States Looking for Money as the drop in tax revenue led to a total shortfall expected in the hundreds of billions of dollars—greater than 2019’s pre-college education budget for every state combined, or more than twice the amount spent that year on state roads and other transportation infrastructure.

Nationwide, the US state budget shortfall from 2020 through 2022 could amount to about $434 billion, according to Moody’s Analytics. The estimates assumed no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel (especially in the more populous states of California, Illinois and New York), and extra job-related costs for Medicaid and unemployment insurance. In what could be presaging a broader trend, voters in Illinois rejected a proposal by 55-45 that would tax wealthier taxpayers more (those making more than $250,000 could have paid up to 7.99% versus the current flat 4.95%). With $8.3 billion in past-due bills, the state is looking to the Federal Reserve buying their debt and/or shifting to junk-bond status. Given that many other states are facing similar deficit / debt problems, this slow-moving train wreck seems unstoppable without major repairs.

Nationwide, the US state budget shortfall from 2020 through 2022 could amount to about $434 billion, according to Moody’s Analytics. The estimates assumed no additional fiscal stimulus from Washington, further coronavirus-fueled restrictions on business and travel (especially in the more populous states of California, Illinois and New York), and extra job-related costs for Medicaid and unemployment insurance. In what could be presaging a broader trend, voters in Illinois rejected a proposal by 55-45 that would tax wealthier taxpayers more (those making more than $250,000 could have paid up to 7.99% versus the current flat 4.95%). With $8.3 billion in past-due bills, the state is looking to the Federal Reserve buying their debt and/or shifting to junk-bond status. Given that many other states are facing similar deficit / debt problems, this slow-moving train wreck seems unstoppable without major repairs.

- No Fed Change in policy at the November 4th-5th meeting so the likely dovish move will be at the mid-December in coordination with the European Central Bank. Even with a mass-available vaccine, rates seem lower for longer – though the Fed will likely step up their bond buying pace with expected additional stimulus spending.

Macro: Asia

- China’ Recovery Continued with its economy growing by +4.9% in Q3, taking the country to official positive GDP year-to-date at +0.7%. Industrial production

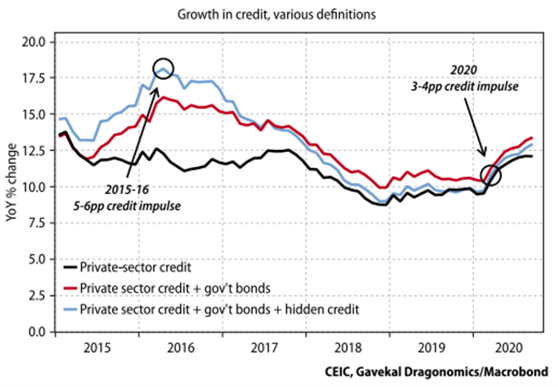

grew by +6.9% in September from a year earlier, while retail sales grew +3.3%, both exceeding market expectations. Auto sales fueled the growth, increasing +11% y/y. China’s exports also helped, rising for the fourth straight month in September while imports surged, pointing to further recovery in the month for global trade and a robust domestic rebound. Exports grew +9.9% in dollar terms in September from a year earlier, while imports rose +13.2%. That generated a trade surplus of $37 billion for the month. Just like its economic rivals, China depended on debt to fuel its performance: the leverage ratio of China’s real economy — the percentage of debt in households, non-financial enterprises and governments to total GDP — increased to 269.2% in the third quarter. China’s credit increase may not be at the same rate as their last push in 2015, but the economy is now much larger (see graphic above). Also of interest is beginning of construction of a $20 billion petrochemical complex in Shandong – in a time when other countries are closing or repurposing refineries and chemical plants, what is China thinking with such a large expansion in that sector?

grew by +6.9% in September from a year earlier, while retail sales grew +3.3%, both exceeding market expectations. Auto sales fueled the growth, increasing +11% y/y. China’s exports also helped, rising for the fourth straight month in September while imports surged, pointing to further recovery in the month for global trade and a robust domestic rebound. Exports grew +9.9% in dollar terms in September from a year earlier, while imports rose +13.2%. That generated a trade surplus of $37 billion for the month. Just like its economic rivals, China depended on debt to fuel its performance: the leverage ratio of China’s real economy — the percentage of debt in households, non-financial enterprises and governments to total GDP — increased to 269.2% in the third quarter. China’s credit increase may not be at the same rate as their last push in 2015, but the economy is now much larger (see graphic above). Also of interest is beginning of construction of a $20 billion petrochemical complex in Shandong – in a time when other countries are closing or repurposing refineries and chemical plants, what is China thinking with such a large expansion in that sector?

- Japanese Machinery Orders eked out a gain for a second straight month while separate tool data showed a further improvement. Japanese exports posted another recovery, pushing the year-on-year decline even lower to -4.9% for the period ending September. Exports to China rose +14%, with chip-making equipment surging +47%, with higher exports to the US but falling shipments to the EU.

Macro: Europe

- Europe Re-entered Lockdown as cases surged, dashing hopes for an economic recovery but setting expectations for an expanded money-printing stimulus by the ECB at their December meeting. While the ECB kept its benchmark deposit rate unchanged at minus 50 basis points and maintained its pandemic asset purchases program at €1.35 trillion ($1.58 trillion), all eyes looked forward as the ECB promised it will “recalibrate its instruments, as appropriate, to respond to the unfolding situation. . .” ECB President Christine Lagarde added after the meeting that an ECB staff review of “all our instruments” was already underway. Speculators pushed ideas of as much as €500 billion in additional QE, with the program deadline extended an additional six months from the current June 30, 2021 deadline, per the Financial Times. Debt issuers did not wait: Italy sold three-year bonds at 0%, issuing debt at no interest for the first time in its history and the EU began selling €100 billion in new bonds to support employment. Next year at the end of Q2, the EU will start issuing €750 billion in “pandemic” bonds for even more spending. Meanwhile in the real economy, French consumer spending fell unexpectedly in September, dropping -5.1% from the previous month — taking it back below pre-pandemic levels. German retail sales dropped -2.2%, more than expected. The UK and EU still struggled through Brexit negotiations which seem pretty farcical at this late stage and not likely good for the UK.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource