Macro: Americas

- US Q1 GDP growth was revised up to +1.2% from +0.7%

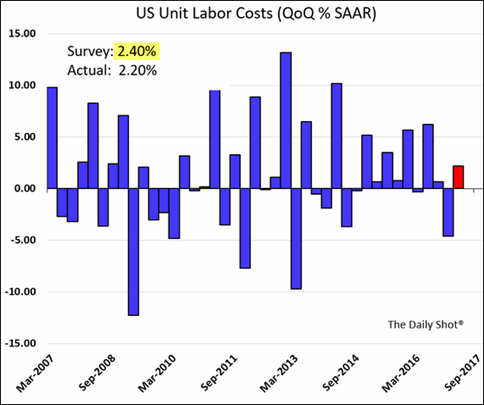

annualized (due to higher business investment and consumer spending) and the Q2 forecast has held in the high 3% range for most of the quarter by the Atlanta Federal Reserve, setting the expectation for a decent 2017. Inflation has been subdued with the core rate up +1.7% year-on-year in April, a lower and declining annual increase than seen in March and February. US unit labor costs are positive but not high (see graph to the right), which also indicates low inflationary pressure. The change in payrolls is also positive but not very dynamic, with May missing expectations to grow at 138k but April and Marchs’ numbers revised downward a net of 66k. The unemployment rate dropped to 4.3%, largely on the decline of the overall size estimate of the labor force, and the broader underemployment rate fell to 8.6%. Other economic news was mixed but generally positive: industrial production beat expectation to grow 1% month-on-month, pending home sales missed as prices continued to increase on tight inventory and consumer spending ticked up in April. Auto manufacturer Ford announced 1,400 layoffs between now and September (about 10% of the non-union workforce) as total US auto sales are expected to fall (General Motors has already shed 3,000 jobs in the past year). Finally, the share of mortgage refinances used to take cash out of the property (AKA cash-out-refi’s) is moving up. While not close to the go-go days of 2008 when the percentage hit 90%, it moved to 50% in 2017, well above the 2012 low of 10%. Also, the portion of auto debt more than 90 days overdue rose to 3.8% in the first quarter, the highest in four years. Some concerns to monitor.

annualized (due to higher business investment and consumer spending) and the Q2 forecast has held in the high 3% range for most of the quarter by the Atlanta Federal Reserve, setting the expectation for a decent 2017. Inflation has been subdued with the core rate up +1.7% year-on-year in April, a lower and declining annual increase than seen in March and February. US unit labor costs are positive but not high (see graph to the right), which also indicates low inflationary pressure. The change in payrolls is also positive but not very dynamic, with May missing expectations to grow at 138k but April and Marchs’ numbers revised downward a net of 66k. The unemployment rate dropped to 4.3%, largely on the decline of the overall size estimate of the labor force, and the broader underemployment rate fell to 8.6%. Other economic news was mixed but generally positive: industrial production beat expectation to grow 1% month-on-month, pending home sales missed as prices continued to increase on tight inventory and consumer spending ticked up in April. Auto manufacturer Ford announced 1,400 layoffs between now and September (about 10% of the non-union workforce) as total US auto sales are expected to fall (General Motors has already shed 3,000 jobs in the past year). Finally, the share of mortgage refinances used to take cash out of the property (AKA cash-out-refi’s) is moving up. While not close to the go-go days of 2008 when the percentage hit 90%, it moved to 50% in 2017, well above the 2012 low of 10%. Also, the portion of auto debt more than 90 days overdue rose to 3.8% in the first quarter, the highest in four years. Some concerns to monitor.

- The Federal Reserve looks set to increase rates a quarter point at its June 13th / 14th meeting and may give guidance on reducing their balance sheet. There is much speculation on the guidance that Janet Yellen will give to the market but we believe that a slow bleed-off of maturing securities (perhaps $10 to $15 billion per month) is reasonably the most that the market should expect. Drama is not the style of this chair or committee.

- On the other hand, the Trump spectacle continued with a proposed budget that had deep cuts in discretionary social spending (41% over ten years) and expansions in military and border security spending. Tax revenue would be under pressure due to unspecified cuts and GDP growth would uptick to a notably higher level. Congress has to square these concepts with reality so expect a lot of political noise over the next four months (apart from the summer recess of course). And yes, no movement on Puerto Rico’s pseudo-bankruptcy. In state news, S&P cut Illinois’ credit rating by one notch to just over junk with the threat of further reductions if lawmakers again fail to agree on a budget. California is looking to contribute $6 billion to the state/municipal pension plan (CalPERS) in order to reduce future obligations. Technically it is a loan but will it ever be repaid? I think not.

Macro: Europe

- Greece and the EU/ECB said they agreed to “extend and pretend” its debts with money up front to pay the €6 billion due in July and €1 billion in August in exchange for pension and personal income tax

changes, but the announcement was put into question by late May. We believe that there will be a bailout – hate to ruin the summer – but will take more grandstanding. The European Central Bank met on June 8th with no real change in policy. Economic activity is going pretty well – German Q1 GDP outperformed other large developed nations as overall Eurozone exports and imports rose to their highest ever in March after climbing by 10.8% and 14.7% respectively from a year earlier. Eurozone unemployment also continued to improve as seen in the chart as well as indications for industrial activity increased, promising better Q2 GDP.

changes, but the announcement was put into question by late May. We believe that there will be a bailout – hate to ruin the summer – but will take more grandstanding. The European Central Bank met on June 8th with no real change in policy. Economic activity is going pretty well – German Q1 GDP outperformed other large developed nations as overall Eurozone exports and imports rose to their highest ever in March after climbing by 10.8% and 14.7% respectively from a year earlier. Eurozone unemployment also continued to improve as seen in the chart as well as indications for industrial activity increased, promising better Q2 GDP.

- In politics, the UK’s snap election will be held on the 8th of June. Prime Minister May called the vote to expand her majority as well as extend her leadership tenure but the polling suggests that while she should win handily, it may not be the size of the majority that she was hoping for. The new French president Macron also is facing a slightly deteriorating budget situation that will require cost-cutting or greater revenues to meet EU guidelines. Or it could just disregard them. The EU has bigger issues in Italy and Greece, for example.

Macro: Asia

- To combat speculation in property (see graph on right), commodities and the markets, the Chinese government continued its slow tightening of credit availability and interest rates, with 5- and 10-year bonds well over 3.5%, the highest level in three years. The results are filtering through to the economy, with many statistics showing a downshift. Export and import growth cooled by more-than-expected in April with the former rising by 8% from a year earlier and the latter by 11.9%. Fixed Asset Investment and

Industrial Production both rose less than expected (+8.9% versus +9.1% and +6.5% versus +7.1%, respectively), though Retail Sales did slightly beat expectations (+10.7% versus +10.6%). Given the credit risks, Moody’s downgraded China from Aa3 to A1 as well as the outlook from stable to negative. Hong Kong was also marked down the same. China manufacturing expectations measured by PMI fell below 50 for first time since Jun 2016. This comes alongside below consensus (and sub-50) PMI prints from Taiwan, South Korea and Malaysia, thus displaying a possible Asia-led softening in economic momentum.

Industrial Production both rose less than expected (+8.9% versus +9.1% and +6.5% versus +7.1%, respectively), though Retail Sales did slightly beat expectations (+10.7% versus +10.6%). Given the credit risks, Moody’s downgraded China from Aa3 to A1 as well as the outlook from stable to negative. Hong Kong was also marked down the same. China manufacturing expectations measured by PMI fell below 50 for first time since Jun 2016. This comes alongside below consensus (and sub-50) PMI prints from Taiwan, South Korea and Malaysia, thus displaying a possible Asia-led softening in economic momentum.

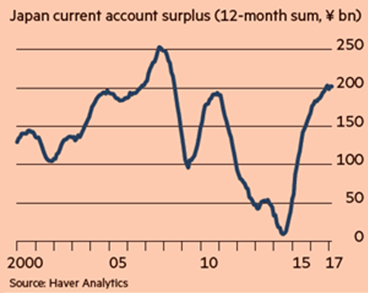

- On the other hand, Japan had a strong Q1 GDP print at +2.2% annualized – beating Europe and the US! Consumption and

exports were the main drivers which has been a concern with the aging population and overall deflation in the economy. Investment was positive but small. The current account (which measures trade) hit its highest level measured in Yen since 2007 as low energy prices and strong tourism (and the strong exports mentioned above) all made material contributions. Q2 is expected to see a similar growth trend as April’s industrial production grew strongly though not quite as much as expected (+4.0% versus +4.2% expected). Inflation and unemployment stayed constant at low levels. All of this is quite welcome news to Prime Minister Abe given his administration’s repeated attempts to support the economy.

exports were the main drivers which has been a concern with the aging population and overall deflation in the economy. Investment was positive but small. The current account (which measures trade) hit its highest level measured in Yen since 2007 as low energy prices and strong tourism (and the strong exports mentioned above) all made material contributions. Q2 is expected to see a similar growth trend as April’s industrial production grew strongly though not quite as much as expected (+4.0% versus +4.2% expected). Inflation and unemployment stayed constant at low levels. All of this is quite welcome news to Prime Minister Abe given his administration’s repeated attempts to support the economy.

Finally, the quote of the month which reminds us that even in dark times, there is the potential for a positive perspective:

“Adventure is just a romantic name for trouble. It sounds swell when you write about it, but it’s hell when you meet it face to face in a dark and lonely place.”

– Louis L’Amour – American novelist and cowboy

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.