Global Trade

- Tariff News confirmed that a “Phase One” deal will be signed January 15th in the US. In short, the deal agreed for the US to halve 15% duties on $120 billion of imports while still maintaining a 25% levy on $250 billion of Chinese goods. Trump also delayed new import taxes set to take effect in December on $160 billion of products such as smartphones and toys. In return, in 2020 China would likely buy $30 billion or so in agricultural products, short of the $40-50 billion touted. A surprise fall in Chinese exports overall in November (-1.1% year-on-year) and particularly to the US (-23% year-on-year) that ran counter to the usual trade before the Christmas season perhaps spurred the Chinese. US exports to China picked up (+2.7% year-on-year) as China began to issue tariff waivers on agricultural, technology, chemical and energy products. Volumes are still much lower than in recent years. Chinese interest in US goods will also be helped by the increase in taxes on Argentinian beans, agricultural products and wheat by the country’s incoming leftist government. Tyson Foods received approval to export American poultry to China from all 36 of its U.S. processing plants and expects the first orders in 2020. The US trade deficit unexpectedly narrowed in November to its smallest since 2016 as it showed a third consecutive monthly decline. In order to counter China’s production of rare earth metals (needed for many electronic devices such as phones), the US and Australia signed a cooperation agreement to reduce their mutual dependence on these important inputs.

North America

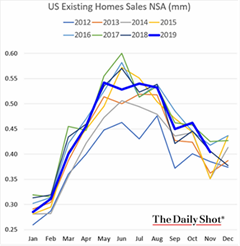

- Q3 US Growth Held at +2.1% while the latest estimate of Q4 from the Atlanta Fed is +2.3%. Existing home sales fell year-on-year (see graph right), generally on tighter inventory. US retail sales increased by +0.2% month-on-month in November and the Christmas shopping season turned in a strong +3.4% estimate based on credit card transactions. However, a record 9,300 stores closed in 2019 demonstrating the ongoing retailpocalypse. US November industrial output rose the strongest in two years by +1.1% month-on-month with the conclusion of the GM auto strike. The US trade deficit narrowed to the lowest level in three years as both imports fell and exports increased. The figures suggest the gap may shrink on an annual basis for the first time since 2013, largely reflecting a steep drop in imports from China due to US tariffs. Finally, Celadon, one of the biggest truckload carriers in North

America, filed for bankruptcy, leaving nearly 4,000 employees out of work. This large bankruptcy was due to executives engaged in securities fraud; the US shipping industry has demand for about 51,000 truckers with online sales increasing so unsurprisingly rival firms aggressively sought out Celadon employees.

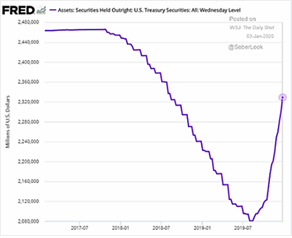

- The Federal Reserve’s next meeting on January 28th and 29th and we expect a hold on rates changes, but not for long. At his last Fed press conference, Chair Powell noted that he wanted to wait before raising rates until he saw “a significant move up in inflation that’s also persistent.” Besides, Fed’s focus seemed to be providing bank liquidity via lending in the repo markets. While there may be some decline as we move further into January, the size of the Fed’s balance sheet stood at $4.17 trillion, up $410 billion since the end of August, retracing over half of the reduction started January 2018 (see right). A rapid turnaround indeed that arguably supported the higher stock market (at least via sentiment if not also leverage capacity).

Asia

- China’s Borrowing Reacts in November to lower rates and additional government support (see graph below left). The central bank also kicked off the year with another cut to the

required reserve rate, releasing a potential 800 billion yuan ($115 billion) to the banking sector. There was also a report on the 2019 plan to lend to small businesses, with big banks even giving loans to businesses already in default in order to meet targets. Chinese banks lent a record 2 trillion yuan ($286 billion) in the first ten months of 2019 and by May already the non-performing rate was 5.9% (for large firms the same rate is only 1.4%). Since when is throwing good money after bad a long-run strategy? On the other hand, China is angling for a $1 billion loan from the World Bank to support its green development. The US opposed the loan, questioning why a preeminent power needed loans subsidized by the rest of the world. Of course, defaults are steadily increasing in China, the latest being Tewoo Group Corp, a major Chinese commodities trader. They became the biggest dollar bond defaulter among the nation’s state-owned companies in two decades with its dollar bond investors representing 57% of the total US$1.25 billion (S$1.7 billion) accepting repayment at 63 cents on the dollar. Also, Greenland Group, one of the largest property developers, had to halt construction on a 475 meter building because it could not afford to pay its contractors.

required reserve rate, releasing a potential 800 billion yuan ($115 billion) to the banking sector. There was also a report on the 2019 plan to lend to small businesses, with big banks even giving loans to businesses already in default in order to meet targets. Chinese banks lent a record 2 trillion yuan ($286 billion) in the first ten months of 2019 and by May already the non-performing rate was 5.9% (for large firms the same rate is only 1.4%). Since when is throwing good money after bad a long-run strategy? On the other hand, China is angling for a $1 billion loan from the World Bank to support its green development. The US opposed the loan, questioning why a preeminent power needed loans subsidized by the rest of the world. Of course, defaults are steadily increasing in China, the latest being Tewoo Group Corp, a major Chinese commodities trader. They became the biggest dollar bond defaulter among the nation’s state-owned companies in two decades with its dollar bond investors representing 57% of the total US$1.25 billion (S$1.7 billion) accepting repayment at 63 cents on the dollar. Also, Greenland Group, one of the largest property developers, had to halt construction on a 475 meter building because it could not afford to pay its contractors.

- Japan Struggled despite Q3 GDP outperforming expectations, increasing +1.8% annualized versus +0.2% annualized per survey, but only because of consumer frontloading purchases before the sales tax increase from 8% to 10% on October 1st. Economists are expecting an offsetting Q4 GDP hit of -0.7%. In reaction, the government authorized an increase in infrastructure spending by $122 billion for 2020, though many were skeptical that the money can be spent due to a lack of projects and labor. Note that Japanese unemployment was at 2.2%. Japan’s industrial output slipped for the second straight month in November, also supporting the expectation that the economy will contract in the fourth quarter.

Europe

- Brexit Expected as the UK election on December 12th handed Johnson and the Conservatives a decisive win in December. After Parliament opens in January, debate will begin on the divorce deal. They should vote to leave the EU on January 31st. Then there is an eleven month period to negotiate a new economic deal with the EU. The EU will undoubtedly try to extend and delay this process like it did against PM May so Johnson’s job is not done until the end of 2020, at least. Meanwhile, the Bank of England will have a new governor on March 16th. Monetary policy is still expected to be accommodative. At least the UK’s third-quarter growth was revised higher, rising +0.4% instead of +0.3% estimated.

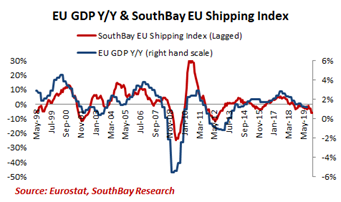

- The EU announced plans for a new “plastics tax” to replace the UK’s former contribution; the surcharge is expected to raise €42 billion over the next seven years, still insufficient to fill the €15 billion hole left behind by the Brexit. The ECB forecasted 2020 Eurozone GDP growth to decline to +1.1% despite the resumption of Q€ last year. While Germany had a decent improvement in its November exports of +1.2% month-on-month, Eurozone industrial production still faltered as seen in the graph on the right. SouthBay Research also noted that container shipping volumes for Europe hit a seven-year low which is correlated with EU GDP (see below). In country news, Sweden announced that it was ending negative interest rates by raising its main repo rate to 0% from -0.5% as it feared that negative rates were hurting savers and

causing bad investment decision. Greece agreed to allow its banks to place €30 billion of non-performing loans into a government supported fund, cutting capital requirements and potentially cleaning up the banking system after the Great Financial Crisis. Finally, Fiat Chrysler agreed to merge with Peugeot to form the fourth-largest car company by sales. While the pledge is to cut €3.7 billion in costs, no plants are to close. Estimates were for 10,000 employees to lose their jobs in the months to come.

causing bad investment decision. Greece agreed to allow its banks to place €30 billion of non-performing loans into a government supported fund, cutting capital requirements and potentially cleaning up the banking system after the Great Financial Crisis. Finally, Fiat Chrysler agreed to merge with Peugeot to form the fourth-largest car company by sales. While the pledge is to cut €3.7 billion in costs, no plants are to close. Estimates were for 10,000 employees to lose their jobs in the months to come.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource