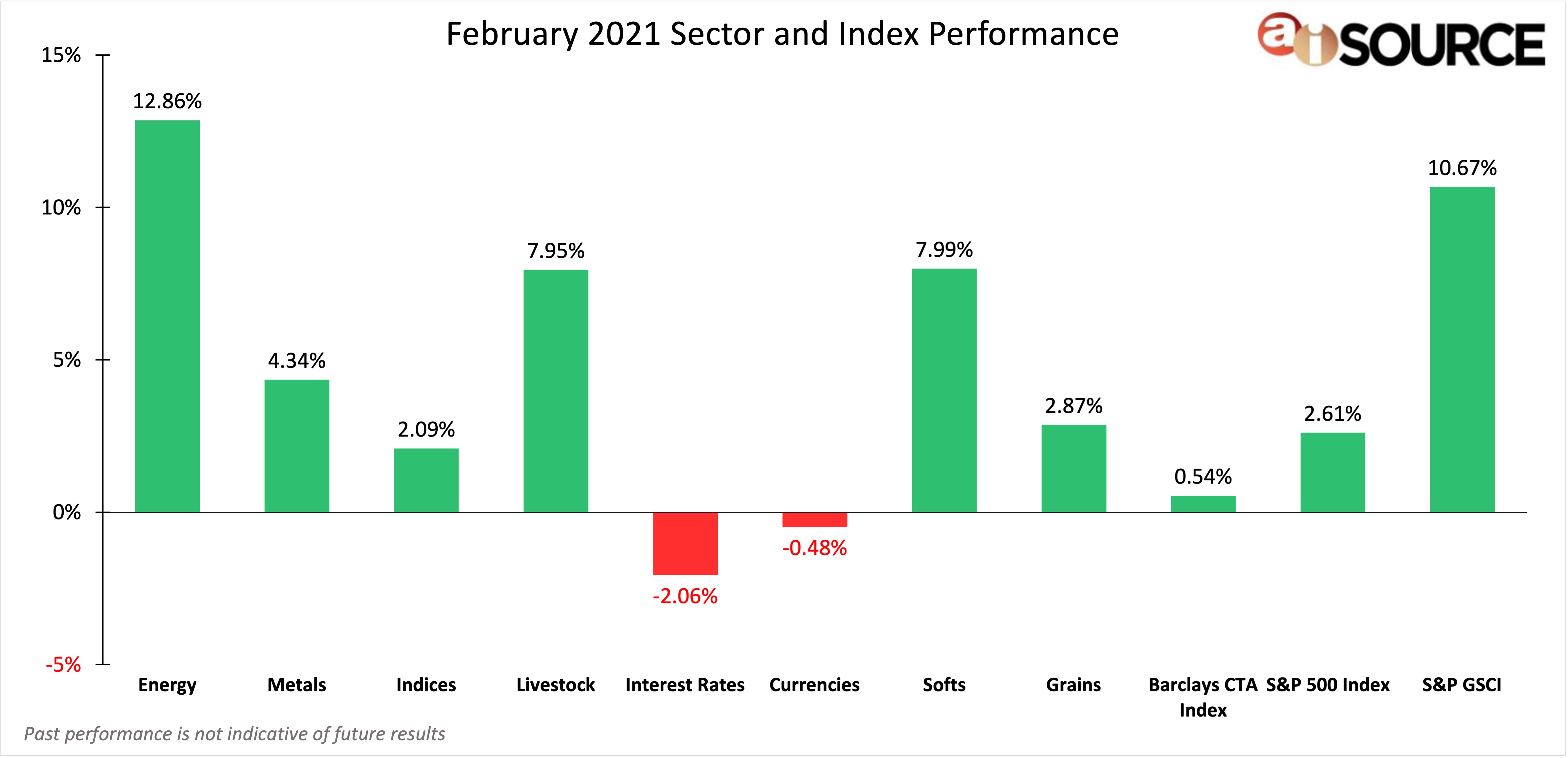

During the month of February, the top 3 performing sectors were: energies (12.86%), softs (7.99%), and livestock (7.95%). The bottom 3 sectors were: interest rates (-2.06%), currencies (-0.48%) and the financial indices (2.09%). The S&P GSCI broke its January 2020 levels and has posted four consecutive months of positive returns. It’s been a good representation of the global commodity market as a whole.

February brought a majority of the United States extremely cold temperatures, which in turn, increased in the price of energy. Crude oil was up more than 15%, heating oil roughly the same, and natural gas was up 8%. As we enter the home stretch of the pandemic with positive covid-19 news and vaccination relief, we are seeing a building frenzy in the housing market. Commodities like copper and lumber are topping all time highs as builders compete for materials, some even postponing projects indefinitely because it’s just too expensive to continue the operation. As for livestock, US pork is back in high demand as the African Swine Fever resurfaced in Hong Kong early February. Such news has lean hog futures up more than 20% this year.

For month to date and year to date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. S&P 500 Index – data collected from investing.com. Barclay CTA Index – data collected from barclayhedge.com, the calculation of the total return may only a percentage of the reporting CTA’s. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.