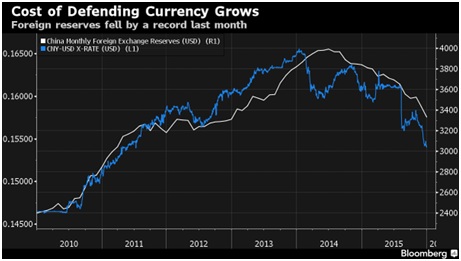

The ECB kicked off the central bank holiday festivities with a less-than-expected expansion of its Q€ program, disappointing the markets. Draghi did announce a reduction in the deposit rate and increase to the term of the monthly bond purchases, but did not increase the monthly €60 billion purchase amount as expected. urthermore, the expectations for the end of 2016 were lowered slightly to a median of 1.4% with one increase per quarter. This seems a bit lofty but the committee historically has been dovish in lowering their numbers as time passes. The theme of a “gradual pace” of higher rates is still in place. Europe is still wrestling with its self-created (or at least self-accelerated) refugee crisis while Greece’s economic festering was joined by Portugal’s $2.2 billion bailout of a local lender. Russia is still suffering economically due to low oil prices. Perhaps that is why it decided to shore up its finances by forcing a default on the $3 billion Ukrainian bond that it holds. China is still struggling to control its finances – its declining currency is placing negative pressure on its stock and bond markets, which in turn is causing the country to spend its reserves. In mid-2014, foreign exchange reserves peaked at $4 trillion, but by the end of 2015 they stood at $3.3 trillion. This asset decline will likely weigh on global markets as will the declines in other sovereign wealth funds. And do not forget about the bad debt at the municipal and corporate level. Oil continued its fall in December with the US WTI futures down -14.7%. Mine closures headlined the industrial metals sector and Argentina elected a non-Kirchner to the presidency after twelve years. Agricultural quotas and taxes were reduced or eliminated, bringing additional competition to the American farmer and grain prices. Wrapping 2015 up, the World Bank joined other super-national institutions (OECD, World Bank) in lowering 2016 GDP growth estimates from +3.3 to +2.9% on poorer results by emerging markets (Russia, China, Brazil) by -0.8%. And yes, the risks are seen skewed to the downside.

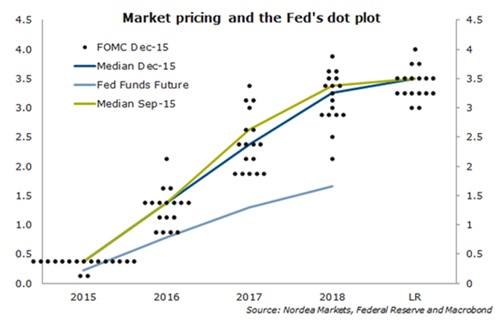

Get Higher, Baby: The US Federal Reserve followed its guidance and moved short-term rates up +0.25% at its last meeting of 2015, as well as set the expectations for three to four more hikes in 2016 (see dot plot to the right which outlines each governor’s interest rate expectation per year). However, the federal funds futures market as represented by the blue line is collectively predicting only two increases. With the global markets in turmoil to start the New Year, I think that it is very unlikely that the next rate increase will occur at the January meeting. This implies that mid-March meeting will be the next important one. Short-term rates at 1.0 – 1.5% would not have a strong economic impact I believe and long-term rates will likely stay low as well given the relative attractiveness of the US economy and markets. The stock and bond markets will fret but fundamentals are good enough it seems to keep the US growing slowly into the election late this year.

three to four more hikes in 2016 (see dot plot to the right which outlines each governor’s interest rate expectation per year). However, the federal funds futures market as represented by the blue line is collectively predicting only two increases. With the global markets in turmoil to start the New Year, I think that it is very unlikely that the next rate increase will occur at the January meeting. This implies that mid-March meeting will be the next important one. Short-term rates at 1.0 – 1.5% would not have a strong economic impact I believe and long-term rates will likely stay low as well given the relative attractiveness of the US economy and markets. The stock and bond markets will fret but fundamentals are good enough it seems to keep the US growing slowly into the election late this year.

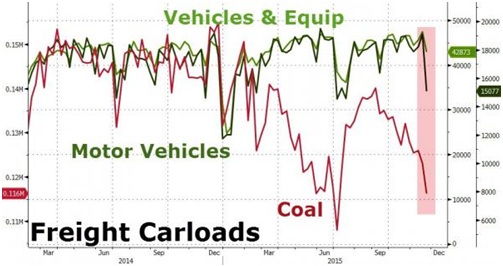

Economic data for the US still has a wide range. Unemployment held at 5.0% with a strong +292,000 jobs gain in December (though we should watch the revisions next month). Given the importance that Dr. Yellen places on this gauge for guiding economic policy, this possible trend is more likely to lead to a rate increase in March. Q3 GDP growth was finalized at +2.0%, down slightly from the previous estimate of +2.1%. Q4 growth is projected at below +1.0% by the Atlanta branch of the Federal  Reserve, as a host of indicators have decelerated over the last few months. US housing starts rose nicely but the more important pending home sales unexpectedly fell in November, dropping -0.9%, widely missing economist estimates of +0.7%. Industrial Production fell -0.6% in November on lower utility output from the warmer weather. Defense spending saved durable goods spending (+0.0% though -1.5% ex-defense). US rail freight tumbled -5.1% in October on lower energy (coal and oil) transportation and intermodal traffic (see chart on the right). Finally, manufacturing indications (PMI) fell to the lowest level in three years in December with new order growth the weakest since September 2009. The US government did manage to pass a budget. Some of the headlines included an extension of tax credits for solar and wind energy, the permitting of oil exports from the US, a delay in the Obamacare taxes on medical device companies and generous high-cost healthcare plans and solidifying a few tax credits for low-income families. In other words, something for everyone at an estimated cost of $2 trillion in additional government debt over the next ten years. At least we can now sit back and enjoy the upcoming Presidential election! Finally, it looks like Alaska will have to re-impose an income tax to help make up for a $3.5 billion deficit. Last levied in 1980, the income tax will help make up the shortfall caused by declining oil royalty revenue. Other taxes on drinks, cigarettes, mining and fishing are to be increased with oil tax credits cut, assuming Governor Walker’s budget goes through.

Reserve, as a host of indicators have decelerated over the last few months. US housing starts rose nicely but the more important pending home sales unexpectedly fell in November, dropping -0.9%, widely missing economist estimates of +0.7%. Industrial Production fell -0.6% in November on lower utility output from the warmer weather. Defense spending saved durable goods spending (+0.0% though -1.5% ex-defense). US rail freight tumbled -5.1% in October on lower energy (coal and oil) transportation and intermodal traffic (see chart on the right). Finally, manufacturing indications (PMI) fell to the lowest level in three years in December with new order growth the weakest since September 2009. The US government did manage to pass a budget. Some of the headlines included an extension of tax credits for solar and wind energy, the permitting of oil exports from the US, a delay in the Obamacare taxes on medical device companies and generous high-cost healthcare plans and solidifying a few tax credits for low-income families. In other words, something for everyone at an estimated cost of $2 trillion in additional government debt over the next ten years. At least we can now sit back and enjoy the upcoming Presidential election! Finally, it looks like Alaska will have to re-impose an income tax to help make up for a $3.5 billion deficit. Last levied in 1980, the income tax will help make up the shortfall caused by declining oil royalty revenue. Other taxes on drinks, cigarettes, mining and fishing are to be increased with oil tax credits cut, assuming Governor Walker’s budget goes through.

Elsewhere in the Americas, Puerto Rico continued its slide into insolvency as it failed to make $37 million in bond payments due January 1st for its infrastructure funds – though it did make the required $357 million payment on its more important general obligation bonds. Per the governor, fiscal collapse will be avoided until May when the next large general obligation payment is due. The electric utility avoided bankruptcy on $8.2 billion of debt from its January 1st payment only by agreeing to restructure its debt with bondholders. Bondholders should note that the government held back enough money to pay out $120 million in Christmas bonuses to officials and employees, demonstrating who has monetary priority in its eyes. Meanwhile, the downgrades continued in South America, as Fitch (who?) cut Brazil’s rating to BB+ and maintained a negative outlook. Moody’s cut Brazilian energy firm Petrobras’ debt deeper into junk territory from Ba2 to Ba3 and prominent mining company Vale too was cut. Venezuela continued its death spiral as President Maduro undercut legislative election results that would have put opposition into power with a supermajority. With the economy falling by -10% in 2015 and another 6-7% decline in 2016, the country faces a tough situation even without this power grab. Looking ahead, Venezuela has $5.2 billion of bonds and interest to pay in the next 12 months and the currency reserves are now below $15 billion. Will the Chinese step in with more money for oil? Not likely. Finally Argentina cast out Kirchner and elected a center-right president who immediately let the currency float freely (well, quickly plunge -29% versus the US Dollar) and cut taxes on a number of key export commodities such as on beef, corn, wheat and soybeans. A lack of foreign currency reserves and a pending court battle over unpaid debt means that there is more financial negotiation to come. Hopefully, the economy can right itself quickly and begin the growth that is so needed.

2015: A Year to Forget: Draghi finally flubbed his monetary messaging with November filled with hints of more negative rates and greater Q€ being met with disappointment on December 3rd when he did lower the benchmark deposit rate by -10 basis points to -30 bps but did not increase the amount of Q€ bought per month from the €60 billion target as expected. He did extend the official buy-back period by six months which is an extra $360 billion worth as well as extend the buy-back universe into certain municipal securities but the market had been led to think that bigger things were to come. We shall see if he over-compensates at the next ECB meeting. Greece reminded everyone that it is still a source of trouble with the passing of an austerity budget which perhaps paradoxically assumes better economic growth. However it drew the line at cutting pensions to meet the demands of the Troika that may jeopardize the recent €86 billion bailout. Additional employer / employee labor taxes or bank transaction fees are proposed to raise €600 million for the pension system but political resistance is strong. Meanwhile in Portugal, the new socialist government was castigated by its far left wing for approving a €2.2 billion bailout of Banif, a local bank, though a total of €3 billion may be needed per the European Commission. More money also may be needed to cover losses from the loans of bankrupted Banco Espirito Santo, taken over by the government in 2014. Not a popular place to be for an anti-banking party. On the good news front, Eurozone unemployment figures fell to 10.5% from 10.6%, the lowest level in four years. This despite the announcement of 100,000 layoffs from the banking sector in 2015 with more to come in 2016 as two of the largest banks (Barclays and BNP Paribas) have plans for a few thousand more. Retail sales fell for the month ending November by -0.3% (though were up +1.7% in the UK) and German industrial output unexpectedly fell -0.3% in November, badly undershooting expectations of a +0.5% increase. With an expectation of only +1.6% 2016 GDP growth, Europe has a long way to go to bridge the gap between it and the US (see FT graphic on the previous page).

Russia and Ukraine failed to agree on how to restructure a $3 billion bond owed to Russia from natural gas imports in 2013 before the fall of Putin’s puppet Yanukovich. Now it is to the courts to decide, though the IMF has ruled in favor of Russia over the status of the debt being sovereign as opposed to commercial. Russia though has other problems – the war in Syria, a plunging ruble and GDP (-3.7% expected for 2015), a -9.2% fall in wages year-to-date November, -13.1% decline in retail sales year-on-year ending in November and an increase to 39% from 22% a year ago in the number of households that cannot afford to buy sufficient food or clothing (a poverty proxy). In looking for new sources of funding, Russia plans to issue $1 billion in renminbi-denominated bonds in early 2016. China benefits from receiving a relatively high rate of interest as well as expanding the role of the renminbi in international finance.

Endangered Pandas: China sentiment continued to get hit during December and into early January as economic and monetary data continued to raise concerns. Foreign exchange reserves continued their slump (the white line in the Bloomberg graphic to the right), having fallen about $670 billion from the peak set in mid-2014. China is bringing its reserves back home to cover the mounting costs of supporting local governments, stumbling corporations and its stock market. Chinese foreign corporate debt totaled $1.53 trillion at the end of September 2015 and more than 2/3rds of that comes due within a year (per Dealogic). Declining commodity prices and trade (exports fell a fifth straight month in November) are pressuring companies. A coal company, Heilongjiang

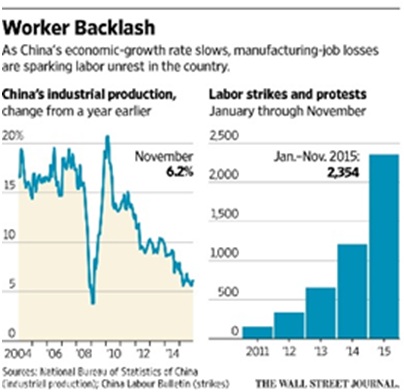

exchange reserves continued their slump (the white line in the Bloomberg graphic to the right), having fallen about $670 billion from the peak set in mid-2014. China is bringing its reserves back home to cover the mounting costs of supporting local governments, stumbling corporations and its stock market. Chinese foreign corporate debt totaled $1.53 trillion at the end of September 2015 and more than 2/3rds of that comes due within a year (per Dealogic). Declining commodity prices and trade (exports fell a fifth straight month in November) are pressuring companies. A coal company, Heilongjiang  Longmay Mining Holding Group, announced 100,000 cuts from its 240,000 person workforce in order to raise funds to cover its health insurance and retirement costs for its workers and 180,000 pensioners. Another coal company and two chemical firms also failed to repay debt by the end of December. Sinosteel, mentioned last month, postponed required payments for a third time. The central government will be hard-pressed to avoid unemployment unrest even as worker dissatisfaction increases (see WSJ graphic to the left). Yes, November Industrial Output grew more than expected at +6.2% versus +5.7%, but the steady decline needs to be arrested. Electricity consumption also edged upward by +0.6 but industrial production contracted for the fifth straight month in December as measured by the PMI index with a reading of 49.7. The service PMI issued in early January contracted strongly for the tenth month in a row, sending the stock market down its maximum -7.0% and instigating a cascade of stock market declines around the world the first week in January. The heavy smog that plagues Beijing (and other cities) has become so bad that a “red alert” was issued, closing schools and cutting permitted automobile use – a convenient reminder to the government to support the Paris climate change talks that were occurring at the same time. As the largest carbon emitter (though not on a per capita basis – thank you, United States), China generally has to literally clean up its act across a host of toxic pollution problems.

Longmay Mining Holding Group, announced 100,000 cuts from its 240,000 person workforce in order to raise funds to cover its health insurance and retirement costs for its workers and 180,000 pensioners. Another coal company and two chemical firms also failed to repay debt by the end of December. Sinosteel, mentioned last month, postponed required payments for a third time. The central government will be hard-pressed to avoid unemployment unrest even as worker dissatisfaction increases (see WSJ graphic to the left). Yes, November Industrial Output grew more than expected at +6.2% versus +5.7%, but the steady decline needs to be arrested. Electricity consumption also edged upward by +0.6 but industrial production contracted for the fifth straight month in December as measured by the PMI index with a reading of 49.7. The service PMI issued in early January contracted strongly for the tenth month in a row, sending the stock market down its maximum -7.0% and instigating a cascade of stock market declines around the world the first week in January. The heavy smog that plagues Beijing (and other cities) has become so bad that a “red alert” was issued, closing schools and cutting permitted automobile use – a convenient reminder to the government to support the Paris climate change talks that were occurring at the same time. As the largest carbon emitter (though not on a per capita basis – thank you, United States), China generally has to literally clean up its act across a host of toxic pollution problems.

Japan too is still working through its economic malaise, though it has not triggered an additional expansion of its QE. Recent numbers include a -2.9% year-on-year fall in November Household Spending, with a corresponding increase in the jobless rate of 3.3% from 3.1% and a -1.0% decline in Industrial Production for the month. Retail Sales fell -2.5% in November for the month, which is the worst drop since the Touhoku earthquake and tsunami in 2011 (excluding the effect of the consumption tax hike in April 2014). The Chinese market problems have caused the Yen to strengthen to start the New Year so we shall see if there is a correspondingly negative effect on exports. Lots of work ahead.

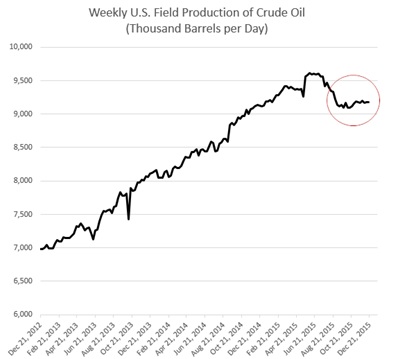

Oil Flow or News Flow: Saudi Arabia and Iran seem to be vying over who is in the headlines more – Iran with the end of sanctions in sight or Saudi Arabia with its budget remedies and potential IPO of its national oil company. The quick summary is that there is and there will be plenty of oil – too much oil – to meet demand in 2016. Iran can up supply to try to increase net revenue but that is only a short term gain. Increases beyond one million barrels per day will take a lot of (foreign) investment and time and may not be possible anyway. Saudi Arabia has a very generous subsidy budget and can cut some of it if it wants to return order to its financial condition. Iran has subsidies too but has been cutting them over the last few years. In this game of chicken, Iran appears weaker. Saudi production has stayed at high levels, over 10.2 million barrels per day and exports were boosted in October – the most recent data. Russia’s crude and gas condensate hit a monthly record with production hitting 10.825 million barrels per day in December, beating the previous record set in November by 0.4%. Looking at the US, consulting firm PVM stated “According to the storage capacity numbers provided by the EIA, crude oil stocks in PADDs 2 and 3 covering the mid-West and Gulf Coast already exceed working capacity levels and are very close to filling contingency space as well.” The number of US oil rigs may be falling precipitously (moving from 555 on November 27th to 536 on January 1) but US production has leveled off at a high level in the US (see graph to the right). OPEC’s figures show a demand of 30.4 million barrels per day in 2016 but production of 31.7 – and this is before any Iranian barrels hit the market. The difference of 1.3 is not a lot historically but with world stockpiles growing and effectively no quota enforcement at the December OPEC meeting, the pressure is building. Libya is lurching towards stability with a UN agreement signed in December by the various tribes to create a unity government backed by troops from the UK, France, Italy and Germany. The ISIL attacks in that country stand in the way but perhaps we will see some progress there. Of course the greatest improvement has been the retaking of Ramadi by Iraqi forces – an important step but bigger challenges remain in the form of holding the city and the retaking of Mosel and Fallujah. This will continue on through 2016. Finally, the last day of 2015 saw the first export of US crude in forty years (aside from the volumes allowed under several exemptions). The shipment of Eagle Ford crude by NuStar and ConocoPhillips was sold to trading house Vitol, but the volume and destination have not been made publicly available (JBC Energy). Hopefully Vitol does not go the way of Noble Group (recently downgraded to junk by both S&P and Moody’s) or Glencore (their US alumina producer just went bankrupt).

appears weaker. Saudi production has stayed at high levels, over 10.2 million barrels per day and exports were boosted in October – the most recent data. Russia’s crude and gas condensate hit a monthly record with production hitting 10.825 million barrels per day in December, beating the previous record set in November by 0.4%. Looking at the US, consulting firm PVM stated “According to the storage capacity numbers provided by the EIA, crude oil stocks in PADDs 2 and 3 covering the mid-West and Gulf Coast already exceed working capacity levels and are very close to filling contingency space as well.” The number of US oil rigs may be falling precipitously (moving from 555 on November 27th to 536 on January 1) but US production has leveled off at a high level in the US (see graph to the right). OPEC’s figures show a demand of 30.4 million barrels per day in 2016 but production of 31.7 – and this is before any Iranian barrels hit the market. The difference of 1.3 is not a lot historically but with world stockpiles growing and effectively no quota enforcement at the December OPEC meeting, the pressure is building. Libya is lurching towards stability with a UN agreement signed in December by the various tribes to create a unity government backed by troops from the UK, France, Italy and Germany. The ISIL attacks in that country stand in the way but perhaps we will see some progress there. Of course the greatest improvement has been the retaking of Ramadi by Iraqi forces – an important step but bigger challenges remain in the form of holding the city and the retaking of Mosel and Fallujah. This will continue on through 2016. Finally, the last day of 2015 saw the first export of US crude in forty years (aside from the volumes allowed under several exemptions). The shipment of Eagle Ford crude by NuStar and ConocoPhillips was sold to trading house Vitol, but the volume and destination have not been made publicly available (JBC Energy). Hopefully Vitol does not go the way of Noble Group (recently downgraded to junk by both S&P and Moody’s) or Glencore (their US alumina producer just went bankrupt).

In metals news, Anglo American announced a suspension of its dividend, sell off assets and lay off workers, shrinking from 135,000 workers at the end of 2015 to 50,000 by 2018. By asset sales or closures, the firm looks to go from 55 mines to just over twenty in the next eighteen or more months. Low iron and copper prices have also caused Freeport McMoRan (the world’s largest supplier of copper) to suspend its dividend in mid-December. Rio Tinto, on the other hand, is looking to expand its Mongolian copper and gold mining operations in 2016 with $4.4 billion in bank financing, so there are some that are betting on a future recovery. Morgan Stanley will not be one of them, however, as they are closing their base metals trading operations as part of a plan to cut up to 25% of positions in fixed income and commodities. Meanwhile, Chinese steel exports hit a record of more than 100 million tonnes in 2015, about 50% larger than the entire US production. The metals glut continues.

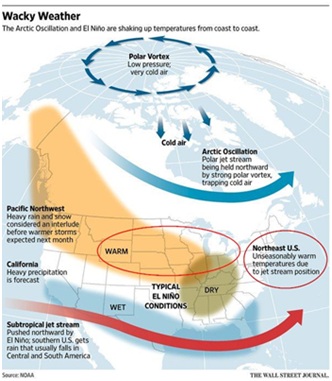

In grains, the new Argentine President Macri eliminated export taxes on grains apart from soybeans and beef, while lowering the soybean tax from 35% to 30%. With as much as $11 billion in corn, wheat and soybean horded by farmers, the government needs foreign exchange reserves to recover as foreign liquidity approaches zero. The quota system was also scrapped, with licenses issued to monitor sales commitments. With the need to negotiate the repayment of a $10 billion bond that went overdue by the Kirchners and a weakened currency, Macri has a lot of financial work to do over his term to try to get the country out of its morass. Brazil is not going to be helpful as its corn exports hit a record high in November with December exports expected to be 10% higher. In December, the USDA revised its domestic corn stockpiles upward by 25 million bushels due to weakening demand. Looking at 2016 planting, the initial expectations are for corn acres to be higher. China also has large stockpiles of domestic corn bought to prop up prices and it is trying to sell those into the market as well. It seems that the only thing that can save grain prices is a dry Midwest over the next six to nine months from El Nino with the graph to the right outlining the expected weather effects. Just when we finally got enough rain in California for our avocados.

corn exports hit a record high in November with December exports expected to be 10% higher. In December, the USDA revised its domestic corn stockpiles upward by 25 million bushels due to weakening demand. Looking at 2016 planting, the initial expectations are for corn acres to be higher. China also has large stockpiles of domestic corn bought to prop up prices and it is trying to sell those into the market as well. It seems that the only thing that can save grain prices is a dry Midwest over the next six to nine months from El Nino with the graph to the right outlining the expected weather effects. Just when we finally got enough rain in California for our avocados.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.