Macro: Americas

- US Economy is moving forward at a modest pace, with the Q4 2017 estimate reduced slightly from +2.6% to +2.5% (annualized) at the first usual update. While the Atlanta Federal Reserve is now projecting +2.8% annualized for Q1 2018 (lower than its first projections of +4.0%), South Bay Research notes that semiconductor billings have been strong for the US (+50% year-on-year) which implies potential upside. With chips and related electronic equipment in all durable goods these days (dolls, bombs, cars and so forth), economic activity is still moving forward despite some negative numbers in recent months. Various industrial indices registered declines for January including: durable goods orders (-3.7% versus -2.0% expected), industrial production fell -0.1% versus +0.2% expected and factory orders were down -1.4%

as forecasted. Retail sales in January also were lower (-0.3% versus +0.2%) and December’s were revised lower (though colder than expected temperatures (snow in Florida!) may have had an impact). Inflation, however, was a bit higher at +0.3% month-on-month in January versus +0.2 forecasted. Finally, January existing and pending homes sales were lower (-3.2% and -4.7%, respectively, month-on-month) though median prices rose +5.8% versus last year to $240,500. Until institutional investors begin to put their portfolio of homes up for sale and more hesitant homeowners decide to sell, the housing market will remain tight, the National Association of Realtors said. It will be interesting to see when hedge fund

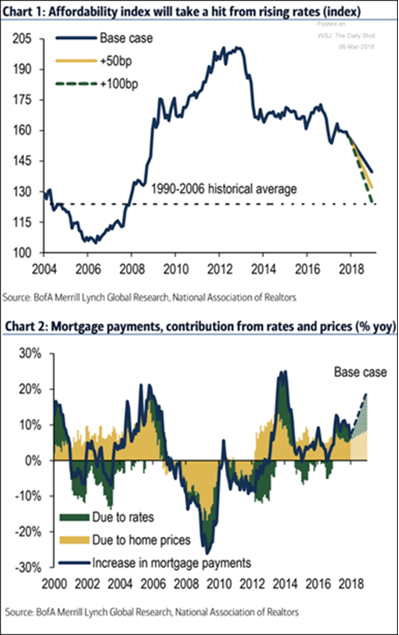

as forecasted. Retail sales in January also were lower (-0.3% versus +0.2%) and December’s were revised lower (though colder than expected temperatures (snow in Florida!) may have had an impact). Inflation, however, was a bit higher at +0.3% month-on-month in January versus +0.2 forecasted. Finally, January existing and pending homes sales were lower (-3.2% and -4.7%, respectively, month-on-month) though median prices rose +5.8% versus last year to $240,500. Until institutional investors begin to put their portfolio of homes up for sale and more hesitant homeowners decide to sell, the housing market will remain tight, the National Association of Realtors said. It will be interesting to see when hedge fund s and private equity buyers from the 2009 downturn start selling – after all they have locked in low interest rate costs so they will not be immediately affected by any rate increases. Looking at the graphs to the right from Merrill Lynch, we should expect to see higher mortgage payments (perhaps as much as +20%) in 2018 which would certainly put a crimp on future home sales.

s and private equity buyers from the 2009 downturn start selling – after all they have locked in low interest rate costs so they will not be immediately affected by any rate increases. Looking at the graphs to the right from Merrill Lynch, we should expect to see higher mortgage payments (perhaps as much as +20%) in 2018 which would certainly put a crimp on future home sales.

- Three Rate Increases are still expected by the Federal Reserve per the latest Congressional statements by Chairman Powell, based on the current growth projections. Inflation mayturn higher, but hard to see right now unless wages and/or velocity of money turn higher – which we are not seeing right now. Higher deficits are projected in 2018 and 2019 which should be inflationary or at least “crowd out” corporate debt. More budget negotiations are required to finalize the budget and there is

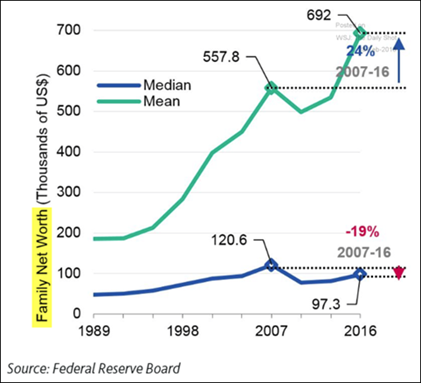

a deadline of March 23rd to do so (or pass more extensions!). The fiscal fun will not stop. Furthermore, the growth in the gap between the wealthy and less so continues to be dramatic (see left as represented by the difference between the average and center-ranked household) – those top-end tax breaks will likely have to be rescinded at some point to deal with our rising debts. Note that the difference primarily has to do with the sharply lower ownership of stocks and houses for the less-wealthy. Finally, we note that the “tariff tantrum” over steel looks overhyped and may be simply a NAFTA negotiation tactic. However, the US does use some imported steel for its oil and natural gas pipelines and higher costs there may interfere with energy independence goals. There are no easy trade-offs.

a deadline of March 23rd to do so (or pass more extensions!). The fiscal fun will not stop. Furthermore, the growth in the gap between the wealthy and less so continues to be dramatic (see left as represented by the difference between the average and center-ranked household) – those top-end tax breaks will likely have to be rescinded at some point to deal with our rising debts. Note that the difference primarily has to do with the sharply lower ownership of stocks and houses for the less-wealthy. Finally, we note that the “tariff tantrum” over steel looks overhyped and may be simply a NAFTA negotiation tactic. However, the US does use some imported steel for its oil and natural gas pipelines and higher costs there may interfere with energy independence goals. There are no easy trade-offs.

Macro: Europe

- Eurozone GDP also performed well in Q4 2017 at +0.6% for the quarter and +2.5% for the year. German export growth of +2.7% for Q4 was a highlight. Inflation is lower than the US at +1.3% will spur the ECB to keep up with its bond-buying program. The Italian elections in early March have led to a populist, right-wing set of winners across multiple parties. The Five Star Movement has the largest percentage of any one party with the three center-right parties in the driver’s seat for building coalitions but there are many combinations. Will we see a staunchly anti-immigrant set of ministers or a more left-wing government? Or new elections? Brexit negotiations are fumbling along but more interesting is the beginning of negotiations within the EU on how to fill the €15 billion-per-year UK contribution. Raiding taxes on corporations or carbon emissions currently going to national governments is one option. Agricultural subsidy cuts are another. Neither are popular!

- Like China, Russia has an aging demographic which is perhaps more dramatic. While China’s working age population is projected to peak this year and slowly decline (as documented in previous commentaries), Russia’s economy minister forecasts a 10% fall in working age population over the next six years! That is faster than Japan! It will be hard to expand the economy or support Russia’s geopolitical ambitions with these demographics.

Macro: Asia

- In a Mao Move, China’s Xi is to expand his lifetime positions with the expected elimination of term limits for the Presidency. It is least powerful of his positions given Xi’s other posts as head of the Communist Party and chair of China’s military commission (neither of which have term limits), but the term-limit elimination is a significant demonstration of his power. On the other hand, he may need the formal power in order to direct China through demographic changes (as alluded to before and above), military expansion and economic change. The official GDP growth rate for 2018 of +6.5% was announced at the National People’s Congress – and money will be spent to achieve it (again officially). Challenges

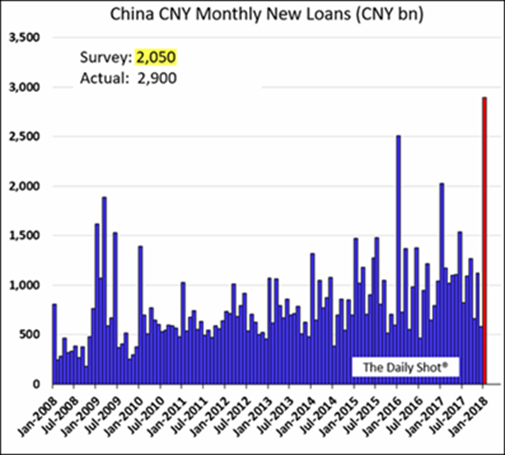

include the dependence on debt for growth as seen in the graph to the right. Quality standards were lowered in early March as Chinese authorities cut the amount of cash that banks are required to set aside to cover bad loans. With the sector struggling to boost profits, the country’s banking regulator will lower the provision coverage ratio for commercial banks—a requirement to safeguard their ability to weather losses—to a range of 120%-150%, from the current minimum of 150% of their bad loans.

include the dependence on debt for growth as seen in the graph to the right. Quality standards were lowered in early March as Chinese authorities cut the amount of cash that banks are required to set aside to cover bad loans. With the sector struggling to boost profits, the country’s banking regulator will lower the provision coverage ratio for commercial banks—a requirement to safeguard their ability to weather losses—to a range of 120%-150%, from the current minimum of 150% of their bad loans.

- Lowering credit standards was an odd decision as the Chinese government took over some high-profile companies, particularly Anbang Insurance Group and CEFC China Energy. Anbang expanded rapidly on promises of high-paying insurance policies and debt to eventually buy over $123 billion of assets but after its founder and chairman was convicted on “economic crimes” (typically bribery) last year, high leverage and lack of cash flow doomed the company. To avoid its bankruptcy and jeopardizing the savings of 35 million people, the central government announced that they were taking over its operations for at least a year as assets are sold and debts paid. CEFC was China’s largest independent oil-and-gas until again over-expansion caught up with it. The latest major acquisition was a 14.2% stake into Russia’s oil company Rosneft for $9.1 billion in September 2017. A criminal investigation into its founder and chairman is underway. Speculated as next on the bailout list is HNA Group, a conglomerate with $173 billion in assets that too is struggling to make debt payments to government lenders. With over 220,000 employees, bankruptcy there would further tarnish China’s image and reputation for economic success.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BBC, Bloomberg, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.