Any time a specific sector experiences a large rally or sell-off within a matter of weeks, it’s interesting to see how commodity trading advisor’s respond to the moves. In June 2015, there was a big rally in grain markets (corn, soybeans, and wheat) caused by large amounts of rainfall throughout the Midwestern United States. In most areas the heavy rainfall led to flooding, which led to poor farming conditions. The poor conditions led to concern about the upcoming new crop supply, which led to a spike in prices.

Here is a daily corn chart:

The circled area shows the spike in June. Corn made a low on June 15th of 362.5, but ended up closing the month at a price of 431.5; almost a 20% increase in price.

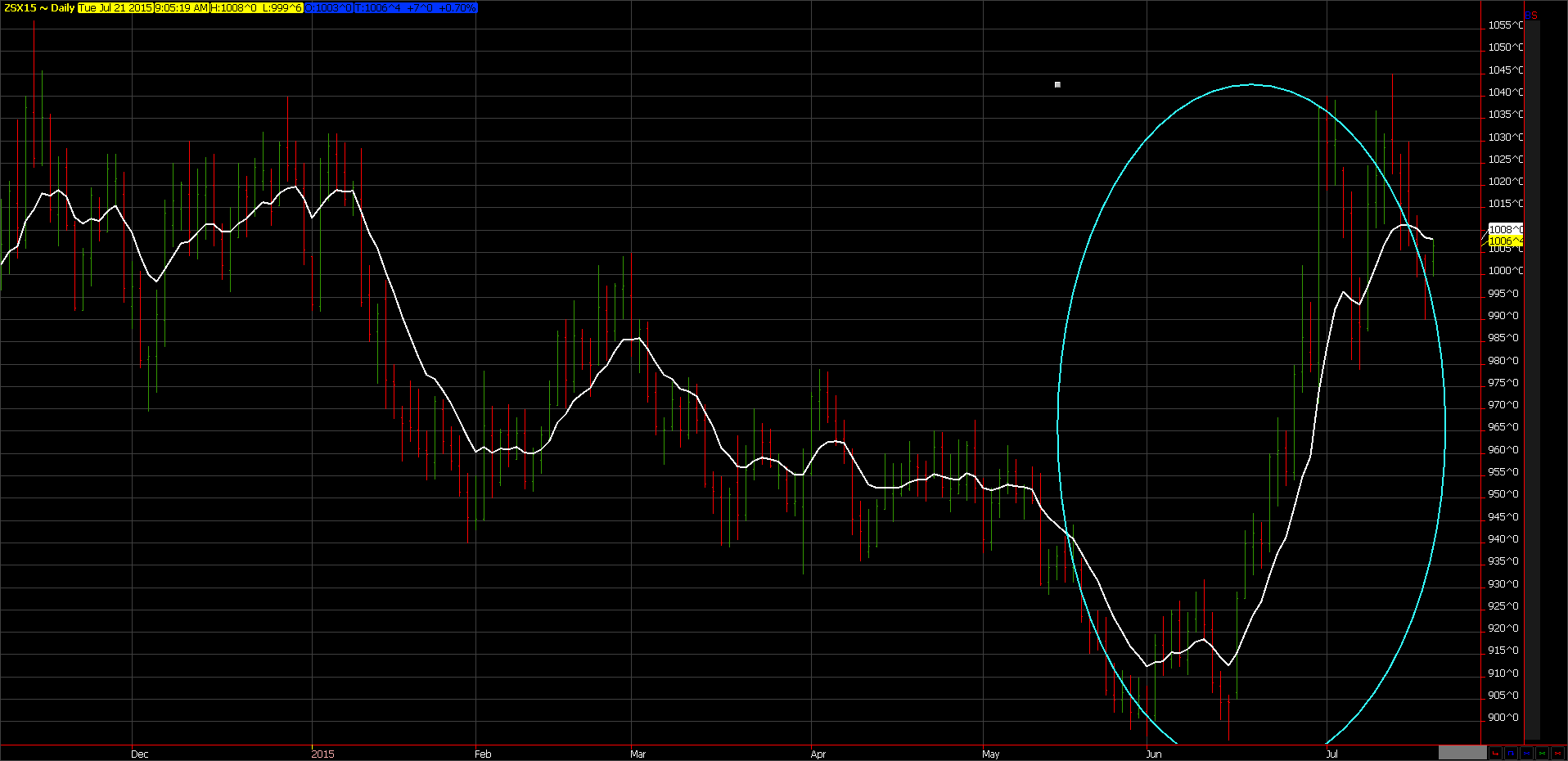

Here is a daily soybean chart:

The circled area shows the spike in June. Soybeans made low on June 15th of 895.75, but ended up closing the month at a price of 1037.25; almost a 16% increase in price.

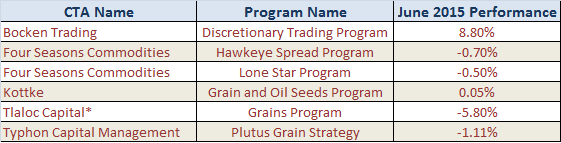

The rally in both markets came within a two week time frame, and had a significant impact (both positive and negative) on grain focused CTAs. Across all of our clients, aiSource allocates to five different grain CTAs. The following table shows the June performance for each CTA/program:

*Tlaloc Capital Return for June 2015 is an estimate, (past performance is not indicative of future results)

As you can see from the above performance, Bocken Trading was bullish grains and was able to parlay the rally into a strong month. On the other side, Tlaloc Capital was bearish soybeans and corn, and the rally led to a poor month for them. The other three CTAs’ performance was mildly negative or breakeven (past performance is not indicative of future results).

In our experience, grain sector CTAs tend to have the strongest correlation to one another. This is proven by June performance, when four out of the five CTAs were either negative or breakeven. Large intra-month moves in grains, whether they are rallies or sell-offs, can create volatility in CTA performance. Therefore, it’s important to make sure that your portfolio is not overly weighted with grain CTAs, or any CTA for that matter.