Lately there has been much ado about “what’s going on” with the markets. Of course there were many concerns regarding the situation in Greece, the Chinese Stock Market, and the ongoing FOMC rate paradox. A media led barrage of news that seems to move the markets sharply in either direction, while the real battle is being waged beneath the surface between buyers and sellers. Uncertainty and fear leads to volatility in the markets, and that is where we find ourselves over the last couple weeks. By historical standards the volatility we have experienced of late is certainly less than severe, though it is worth noting.

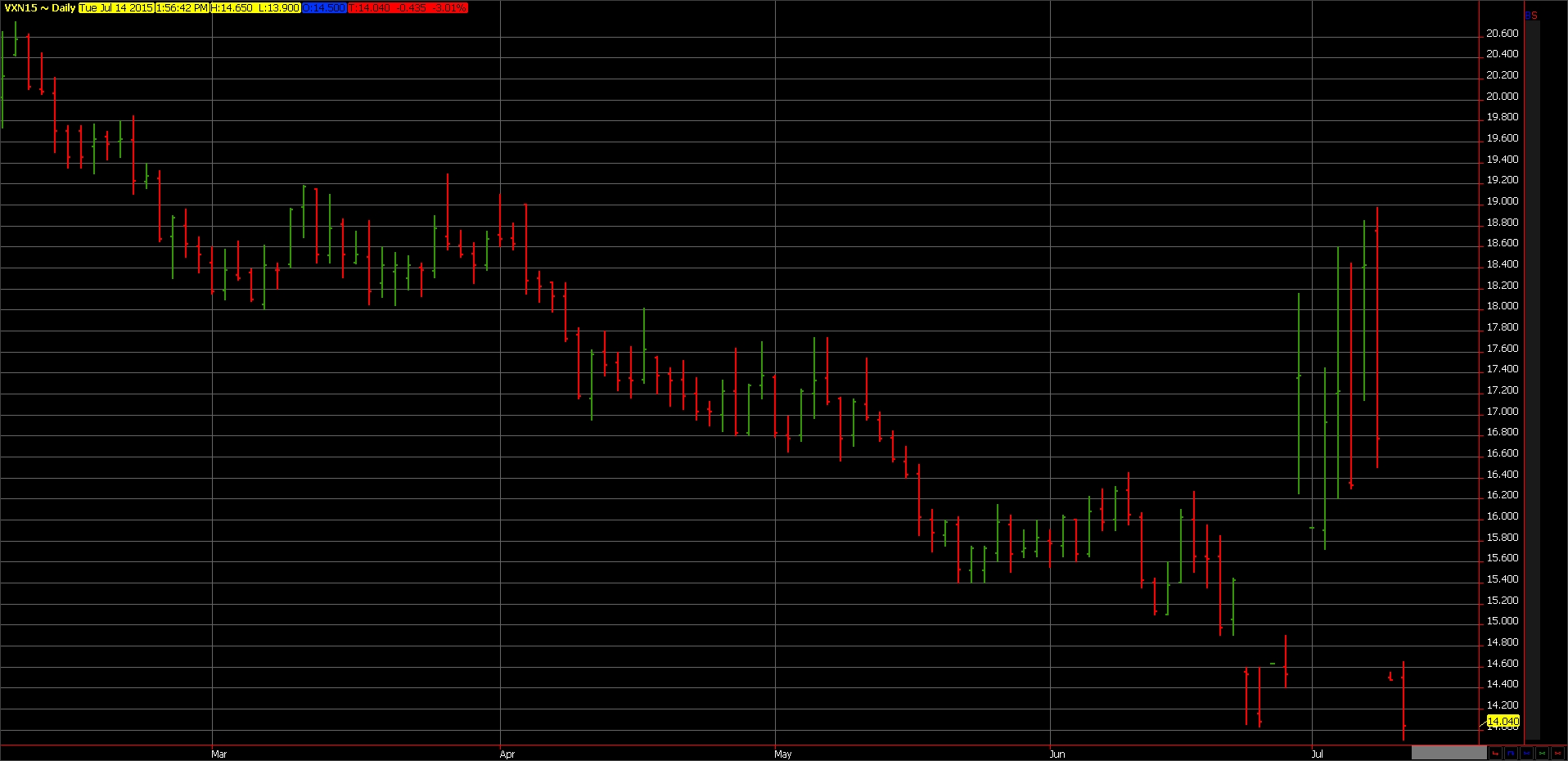

*Volatility has spiked since reaching lows in late June, and since then gapped lower after the Greek bailout announcement.

This battle is ever-present in the markets, the tides shift from one camp to the other on every time frame, though over the last several years the bulls have most certainly been in control outside of the occasional short-lived blip. This bull market has been in effect for roughly six years now, leading to a generation of traders that have been conditioned to buy every dip, and they have been rewarded for their efforts. You can make a case that the rally has been induced by the Fed, or large corporations borrowing low interest capital to buyback shares, but none of that really matters as the pattern for this generation of traders is engrained.

On the flipside we have the sellers, holding onto the hope that the long awaited 10% (at least) correction will finally arrive. These sellers have become more active over the last few weeks. Some of this can be attributed to longs lightening positions, or institutions moving to a ‘risk off’ stance, but in June we have seen an influx of equity short sellers sending bearish bets to their highest levels since the financial crisis. How will this all play out?

Only time will tell, the one thing that we can be certain of is that volatility brings opportunity for those willing to take risk. Anxiousness among investors has led to unusually large jumps in the Chicago Board Options Exchange Volatility Index, which measures hedging costs on the Standard & Poor’s 500 Index. When calm has been restored, the volatility gauge has dropped just as quickly It’s likely the recent volatility won’t last: Greece seems to have found a bail-out (again), and markets have since calmed. The question now is when will volatility spike again? And what will cause it? Big moves in U.S. stocks have been so rare lately that when they do happen, the rush to hedge is violent.