Notional funding is a concept unique to the Managed Futures industry, whereby an investor is able to leverage their cash investment by taking on additional risk for higher expected returns. When someone decides to “notionally fund” their managed futures investment, all that means is that they are only investing a portion of the minimum investment required by a CTA (commodity trading advisor). For example, let’s assume that a CTA’s minimum investment is $100,000 (also known as the nominal account size), but they allow the account to be notionally funded with only $25,000. In this instance, it is the investor’s decision on whether they would like to notionally fund the account with $25,000 cash, fully fund the account with $100,000, or fund somewhere in between $25,000 – $100,000.

The reason that notional funding is possible in Managed Futures investments is because at any given time, a CTA is only using a percentage of the nominal account size as margin to conduct investment activity. Therefore, as long as you fund enough cash to cover the margin, AND have enough buffer to sustain a realistic loss, then notional funding can be a great investment tool.

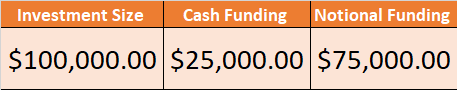

If an investor decides to fund the $100,000 investment with only $25,000, this is how each component would be labeled:

This means that the investor is using leverage of 4X – four times $25,000 equals the $100,000 minimum investment. The difference between the investment size (nominal size) and the cash funding is equal to the notional funds.

Investors are interested in using notional funding because notional funding capitalizes on the free cost of leverage. The leverage is free because the notionally funded amount (in this case, $75,000) is not borrowed or invested – the cash funding ($25,000) is a good faith deposit for the full value of the account. Therefore, if the investment is doing well, then the investor benefits on the performance of the $100,000 investment size, BUT if the investment is going through a losing period (or drawdown), then the investor will be responsible for those losses.

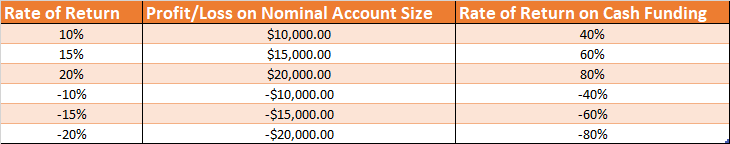

Using the same example above, let’s say a CTA returns 10% for the year, that would be a $10,000 return on the investment, however, if you have only funded the account with $25,000, that would be a 40% return on your cash funding. On the other hand, if a CTA loses 10% for the year, that would be a $10,000 loss on the investment, which would amount to a 40% loss on the cash invested. Assuming the same example as above, here is a table summarizing various rates of returns and the profits and losses associated with each:

As you can see from the table, notional funding has its pros and cons. The pros are obvious – you are able to take advantage of the free cost of leverage, and earn a higher percentage on your investment dollars. While the upside of notional funding looks very attractive, an investor should also consider the downside. In our example, a -20% drawdown would mean the loss of 80% of the cash funding. In this situation it is very likely that the investor would have to add more money in the account in order to keep it going.

From the example above, you can see why the cash funding percentage is very critical to an investor’s success. The above example is used just to illustrate the potential that notional funding has to offer, but in most cases, aiSource would not recommend to fund any account with 25% cash funding. We believe that the most efficient funding level for most managed futures accounts should be 50%, however this could vary from CTA to CTA. We think 50% provides the perfect balance between using the free cost of leverage, while also leaving a buffer for expected losses. Using the same investment example above, the below table illustrates what the rate of returns would be if the cash invested was $50,000 instead of $25,000.

By funding the account with 50% or $50,000, the rate of return on cash funding decreases, but so do the losses. If a CTA experienced a 20% drawdown, that would result in a 40% loss on the cash invested – a large loss, but not large enough to where in most cases an investor would not have to add additional funds.

You have to keep in mind that the notional funding percentage that an investor is comfortable with will vary from investor to investor and vary from CTA to CTA. An investor may be comfortable with 25% cash funding with one CTA, but only be comfortable with 50% with another CTA. When considering notional funding, it’s best to speak with your aiSource advisor to discuss the potential pros and cons of the funding level that you are considering.

-Rishab Sharma

Managing Partner, aiSource