For investors new to managed futures, it can be confusing how everything works. First and foremost, it’s is crucial to understand what commodity trading advisors are, you can read a detailed explanation of what CTA’s are by clicking here. In short, investors give CTA’s the authority to trade an account on their behalf with a strict methodology that the CTA has developed, whether its systematic or discretionary. The aggregate performance of all the accounts that a CTA manages are reported on a monthly basis to CTA databases online (register for our CTA database for free by clicking here). Besides following the monthly and yearly ROR of a CTA strategy, there are a few other ways to track the performance of CTAs. One of the most common ways overall performance is displayed/reported to investors is through what’s called VAMI, value added monthly index.

Value added monthly index, more commonly referred to as VAMI, is a method of tracking the return on an investment over a given period of time and is calculated based on a hypothetical $1,000 investment (assuming reinvestment). For example, if you were to invest $1,000 into a CTA strategy that returned 10% in the first month, your $1,000 investment is now $1,100. Let’s take a closer look into how VAMI is calculated month over month and how it is visually displayed on many of the online CTA databases. VAMI is calculated as follows:

Initial Calculation = 1000 x (1 + Current Rate of Return)

Ongoing Calculation = Previous VAMI x (1 + Current Rate of Return)

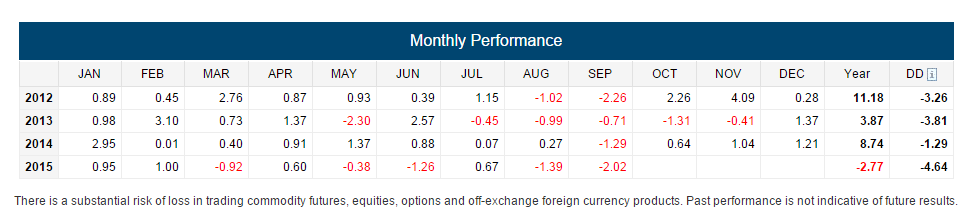

Let’s walk through a simple example that will help us calculate the VAMI for the following return stream:

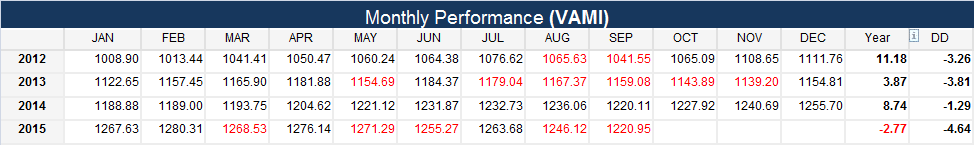

Using the formula above, we can calculate the VAMI for each month based on the monthly returns above and see how are initial investment of $1,000 grew month over month.

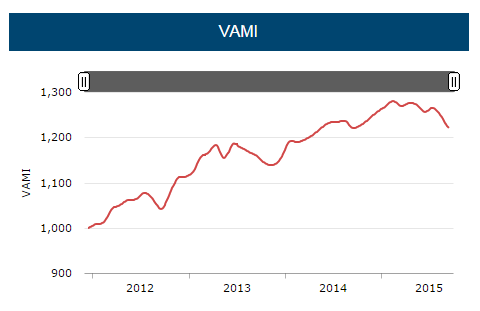

Now that we have the numerical VAMI numbers for each month, we can graph it on a line chart since inception (the beginning of the track record). The below graph is how you will most commonly see VAMI displayed throughout the managed futures industry or on performance tear sheets for CTA managers.

When analyzing returns on performance tear sheets or the online CTA databases, the majority of the time performance returns are reported NET of all fees (management, incentive, and brokerage fees). With that being said the VAMI calculation is also NET of all fees, which allows us to see how our investment has grown overtime net of all fees. The next time you analyze a CTA strategy, place close attention to its VAMI and how your hypothetical investment of $1,000 would have grown assuming you were invested from inception (the very beginning of the strategies track record).