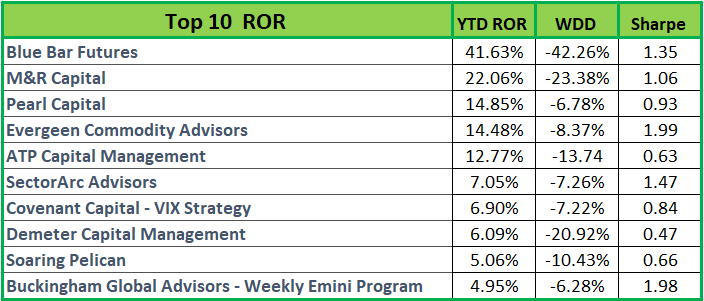

Outside of the February 2018 short volatility debacle, 2018 started promising for many CTAs. Most CTAs we were allocating to did well month after month until fall. Then, once volatility returned to the markets, the CTAs were not able to capitalize and ended up giving back much of their gains for the year. While many CTA indices reported negative performance in 2018, there are many CTAs in aiSource’s pool of approved managers that had positive performance for the year. Here are ten of the top performing CTAs in 2018 that are part of aiSource’s approved manager pool (not the top 10 performers in the entire CTA space):

WDD: Worst Drawdown since inception

Sharpe: Sharpe Ratio since inception

Most investors are judging this past year’s performance by looking directly at February 2018 and seeing how a CTA fared. Volatility traders’ performance was either feast or famine that month, and some notable names that thrived were: Pearl Capital, Buckingham Global Advisors, and Covenant Capital. All the mentioned names trade volatility either by trading VIX futures, S&P options or a combination of the two. In addition to volatility traders, Soaring Pelican, a S&P futures trader, was also able to take advantage of the S&P downtrend and go short S&P futures in February.

In addition to February 2018 being a focal point for this year, this year has also seen a comeback from livestock and grain traders. CTAs, such as, Blue Bar, M&R, Demeter Capital, and Sector Arc outperformed their peers. The grain sector remained challenging, therefore, having exposure to livestock was a good supplement and diversifier in a CTA portfolio. In addition to livestock traders, Evergreen, an energy trader, had another good year.

With 2018 out of the way, the focus now shifts to 2019. Many CTAs are bracing for volatility to come back after it dissipated in January 2019. These same CTAs feel they are better prepared to take advantage of the volatility if it returns as they were previously caught off guard in November 2018 and December 2018. aiSource is expecting good years from financial sector CTAs and discretionary strategies.