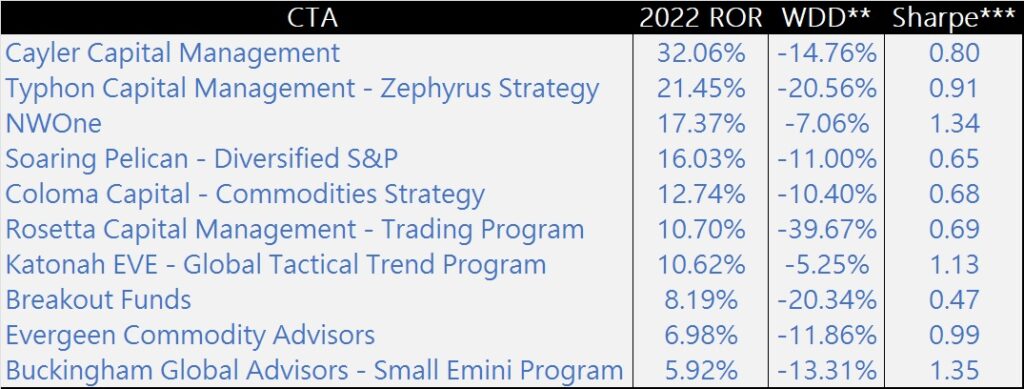

2022 was a good year for managed futures. CTA indices all reported positive results, with Barclay’s CTA index posting a ~+7% return for the year, and the SG CTA index posting a return of ~+20%. Trend following strategies, which had been looked over the last decade, came back into favor this year. Despite the volatility in various commodities, commodity specific managers performed well considering the circumstances. Lastly, short-term systematic space also performed well as day-to-day volatility has become a mainstay over the last year. Here are ten of the top performing CTAs in 2022 that are part of aiSource’s approved manager pool+:

Past performance is not indicative of future results. All RORs are through December 2022

**WDD: worst drawdown since the inception of the track record

***Sharpe: Sharpe Ratio since the inception of the track record

Three of the above managers are part of the short-term space: Soaring Pelican, Buckingham, and Breakout Funds. Commodity specific strategies from the above group are Cayler Capital, Coloma Capital, and NWOne. NWOne is on this list for consecutive years having also made it in 2021.

There are some new strategies that made the list this year: Typhon Capital’s Zephyrus Strategy and also Katonah EVE’s Global Tactical Trend Program. Manager’s that have made the list in previous years and have track records of 7 years or more include: Evergreen Commodity Advisors, Coloma Capital Futures, and Rosetta Capital Management.

+: Approved managers are CTAs with whom aiSource has active investments with or has had investments with previously.