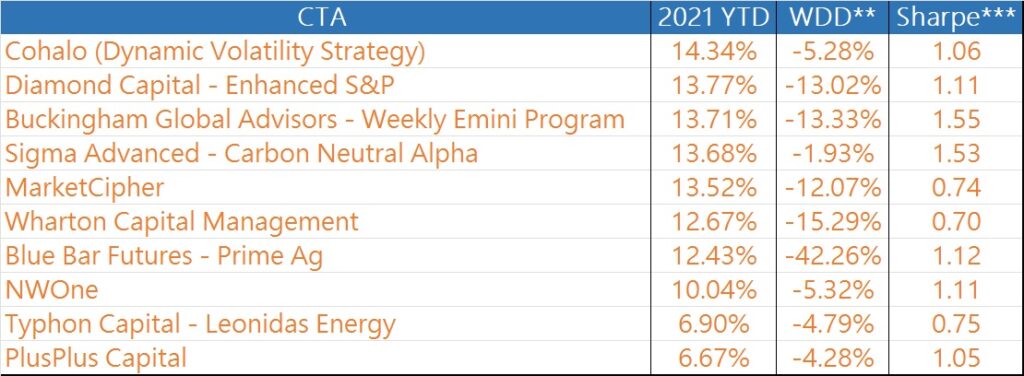

2021 was another strong year for managed futures and CTAs. While this post only displays the top 10 CTAs for the year, we could have easily made the list a top 20 list this year because we had enough positive performers. CTA indices are also performed well in 2021, with Barclay’s CTA index +5.29% and Soc Gen’s CTA index +6.8%. No one market sector or strategy type outshined the others in 2021: agriculture did well and so did quantitative strategies. Here are ten of the 10 performing CTAs of 2021 that are part of aiSource’s approved manager pool:

Past performance is not indicative of future results. All RORs are through December 2021. Above results are based on client track records, prop track records were not considered.

**WDD: worst drawdown since the inception of the track record

***Sharpe: Sharpe Ratio since the inception of the track record

As you can see from the above, we have a good mix of strategy types within the top 10 this year. Sectors, such as, livestock, volatility, indices, and diversified commodities are all represented throughout the top 10.

There are some new entrants to our approved CTA pool this year, which have broken into the top ten list: Typhon Capital Management Leonidas Strategy, Cohalo, and NWOne. Typhon’s Leonidas strategy is discretionary macro strategy focused on the energy sector. Cohalo trades volatility via VIX futures and VIX futures calendar spreads. Lastly, NWOne is a systematic relative value strategy that also trades calendar spreads across various commodities.

Please click here to visit our CTA database and view the full performance of the above CTAs: CTA Database.