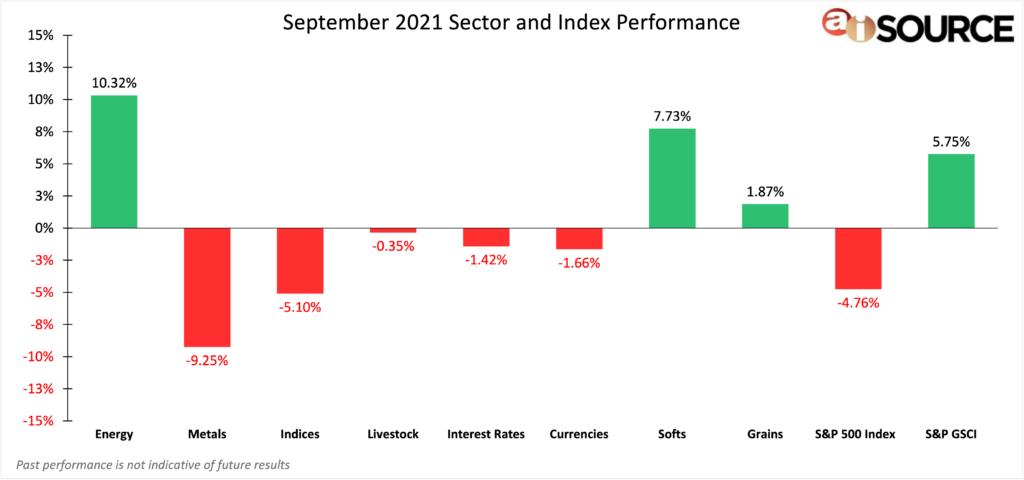

During the month of September, the top 3 performing sectors were: energies (+10.32%), softs (+7.73%), and grains (+1.87%). The bottom 3 sectors were: metals (-9.25%), financials (-5.10%) and currencies (-1.66%). The notoriously red September brought financials its first negative month in seven months. Since 1950, the Dow Jones Industrial Average (DJIA) has averaged a decline of -0.8%, while the S&P 500 has averaged a -0.5% decline during the month of September. (Investopedia)

Energies outperformed the rest of the market as supply tightened and demand increased with natural gas soaring over (+34%). And, compared to this time last year, WTI Crude (+9.53%) was trading around $43/barrel. Other top market performers include oats (+17.33%), lumber (+29.97%), and cotton (+14.13%).

For month-to-date and year-to-date CTA rankings, please remember to visit our CTA Database. If you do not have a login and wish to register for free, please click here.

Sector & Index Performance Consists of the following:

Grains: Corn, Soybean Meal, Oats, Soybeans, Soybean Oil, Wheat, Rough Rice. Livestock: Live Cattle, Feeder Cattle, Lean Hogs. Softs: Cocoa, Orange Juice, Sugar No. 11, Random Length Lumber, Coffee, Cotton No. 2. Currencies: Euro Currency, Japanese Yen, British Pound, Canadian Dollar, Swiss Franc, US Dollar, Brazilian Real, Mexican Peso, Australian dollar. Indices: S&P 500, Mini Dow, Mini Nasdaq. Interest Rates: 30-year t-bond, 10-year t-note, 5-year t-note, Eurodollars. Metals: Gold, Silver, Copper, Platinum, Palladium. Energy: Crude Oil, Reformulated Gas, Natural Gas, Heating Oil, Denatured Fuel Ethanol. S&P 500 Index – data collected from investing.com. S&P GSCI Index – data collected from us.spindices.com/indices/commodities/sp-gsci.