- OPEC+ Considered Raising Production in response to the spike in oil prices but decided not to – they have budget deficits to cover! Instead the cartel will stick to increasing production by 400,000 barrels per day, reaching 2 million barrels per day (mbpd) at the end of 2021. Then in May 2022, the baseline for cuts will reset higher, allowing for the UAE to produce about 500,000 bpd more (its reward for going along with the summer deal). The OPEC+ coalition next plans to meet November 4th to review production plans for December. Looking further ahead, OPEC’s latest long-term oil demand forecast saw continual growth until hitting a plateau shortly after 2035. Renewables, while expanding rapidly, were expected to take many years before reducing the demand for OPEC’s key product. Finally, as Iran demanded assets worth $10 billion to be released as a goodwill gesture before nuclear talks could continue, seeing their barrels legally on the market looked to be a slow process.

- US Oil Production fell versus last month to 11.1 mbpd while operating rigs continued higher from 410 as of August 27th to 428 as of October 1st. As reference, this is about half the rigs operating before the pandemic but efficiency has been much higher nowadays. US oil reserves moved lower to 418 million barrels (mb), down from 426 mb a month ago – a

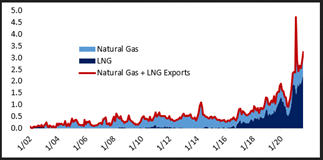

new low for the year and close to 2018 levels. Hurricane Ida which tore through the Gulf of Mexico and Louisiana at the end of the August took about 2.2 mbpd of refining capacity off-line. This capacity largely came back but still there was about 400,000 bpd that were not expected to fully return until next year. The story that dovetails with the shortages in Europe and Asia was the massive growth in liquefied natural gas (LNG) exports from the US, reaching over 3.5 billion cubic feet per day (including via pipeline – see graph right). In financial terms, the LNG portion was $2 billion a month. The Biden Administration played with the markets a little, raising the prospect of releasing oil from the strategic reserve and/or halting exports, but backed off that concept a few hours later. Recall last month that Biden called upon OPEC to increase production, to which Saudi Arabia expressed confusion as this plea was counter to his policies on fossil fuels. Nevertheless, the Financial Times opined that the US will increase output by about 800,000 barrels a day over the course of 2022, a sharp acceleration from this year.

new low for the year and close to 2018 levels. Hurricane Ida which tore through the Gulf of Mexico and Louisiana at the end of the August took about 2.2 mbpd of refining capacity off-line. This capacity largely came back but still there was about 400,000 bpd that were not expected to fully return until next year. The story that dovetails with the shortages in Europe and Asia was the massive growth in liquefied natural gas (LNG) exports from the US, reaching over 3.5 billion cubic feet per day (including via pipeline – see graph right). In financial terms, the LNG portion was $2 billion a month. The Biden Administration played with the markets a little, raising the prospect of releasing oil from the strategic reserve and/or halting exports, but backed off that concept a few hours later. Recall last month that Biden called upon OPEC to increase production, to which Saudi Arabia expressed confusion as this plea was counter to his policies on fossil fuels. Nevertheless, the Financial Times opined that the US will increase output by about 800,000 barrels a day over the course of 2022, a sharp acceleration from this year.

- China Was Compelled to Intervene in Energy Markets releasing crude from its strategic reserve for the first time last month with the explicit aim of lowering prices. Rumors were amounts of 20 ~ 30 million barrels over the summer, and any potential extra sale this year was unlikely to surpass the 10-to-15 million barrel range. To keep prices lower domestically, their exports of gasoline and diesel sank with gasoline averaging 154,000 barrels a day in August, down 23% from the previous month and the lowest since October 2015.

- India’s Supply Deficit also made headlines as oil imports hit a three-month peak in August rising by +15.8% versus July (+3.1% higher than a year-ago) at 4.1 mbpd. Like China, Indian utilities also scrambled to secure coal supplies as inventories hit critical lows after a surge in power demand from industries and sluggish imports due to record global prices push power plants to the brink. Over half of India’s 135 coal-fired power plants had fuel stocks of less than three days, government data showed, far short of federal guidelines recommending supplies of at least two weeks.

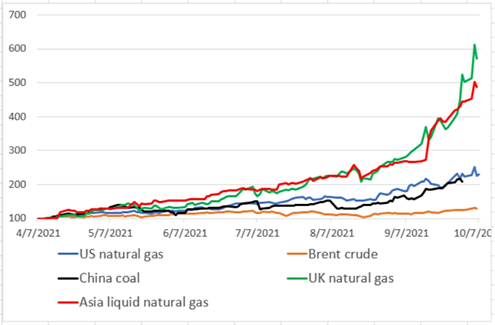

- Global Price Comparisons are easily seen looking at the graph (rebased to 100 in early April 2021), showing the rapid rise of natural gas, coal and oil… In fact, oil (the orange line at the bottom) looks a little behind despite all the headlines it receives and political sensitivity! Some forecasters are saying to just wait for winter in Europe!

- Not Just Energies Hitting Highs:

- Prices of silicon metal, used to make the material that comprises solar panels, have surged about 300% since the start of August after a top-producing Chinese province ordered production be slashed amid a power crunch. The price of solar-grade polysilicon jumped to $32.62 a kilogram at the end of September, the highest since 2011.

- US Cotton prices surged to a 10-year high in early October, reaching $1.16 per pound and touching levels not seen since July 7, 2011. Chinese demand was cited as the reason.

- Plant-based meats were hit by soaring pea prices – reaching over $450 per tonne in major supplier Canada from around $200 in late 2020. Beyond Meat and other brands already issued warnings that they could face “decreased availability or less favorable pricing.”

- The Green Markets North America Fertilizer Price Index hit $996.32 per short ton, soaring past its 2008 peak to set a new benchmark for the index that began in January 2002.

- Global food prices were up 33% in August from a year earlier with vegetable oil, grains and meat on the rise, data from the United Nations showed. And it’s not likely to get better as extreme weather, soaring freight and fertilizer costs (caused in part by soaring natural gas prices), shipping bottlenecks and labor shortages compounded the problem. Dwindling foreign currency reserves would hamper the ability of some nations to import food.

At least so far, many grain producing countries have put out good harvest / prospective harvest numbers. Australian grain growers are on course to harvest a second consecutive bumper crop with wheat production expected at 32.6 million tonnes for the season ending June 30, 2022, which would make it second only to last season’s record-breaking harvest of the country’s most valuable crop. Ukraine’s grain harvest may reach a record 80.3m tons this year, according to their Agriculture Ministry’s estimate as of Oct. 1 which would be higher up by +24% from previous year. Their wheat exports are up +5% already for the July-October period. Finally, Argentina’s corn crop will grow to a record 55 million tonnes in the 2021/22 season, the Buenos Aires grains exchange said.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource