Global Oil Production

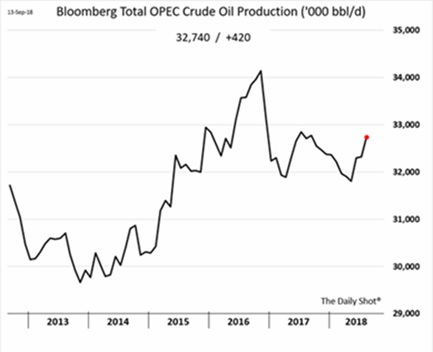

Had slight gains as major producers increased or maintained production while geopolitical tensions stayed relatively subdued outside of concerns over US sanctions on Iran. OPEC pumped 32.85 million barrels per day in September, a Reuter’s survey found, up 90,000 bpd from August’s revised level and the highest this year (see right). Nigeria claimed production rose 10% to 1.8 mbpd in August. Libya was a surprise contributor to the OPEC rise, increasing to 1.2 mbpd despite ongoing internal fighting and terror attacks against the national oil company. This would be close to 2013 levels but still below the historical highs under Qaddafi.  Iran has no plans to cut oil production, the head of the state-run National Iranian Oil Company (NIOC), Ali Kardor, said, though production fell by 100,000 bpd in September. Indian and Chinese imports from Iran have fallen with tankers utilized as floating storage for unsold oil (at least 2.4 million barrels per one report). The Chinese firm Sinopec publically announced it had cut its deliveries in half, for example. Russian oil output reached 11.4 million mbpd in September, a post-Soviet high and could raise oil production by another 200,000-300,000 bpd per President Vladimir Putin to tackle possible shortages. Iraq also pumped crude oil at record levels, unaffected by a number of local protests. The country’s crude exports reached a record 3.6 mbpd. Saudi Arabia sought to dispel fears of an oil supply squeeze by touting its significant spare production capacity. The kingdom says it holds the ability to pump 1.5 mbpd above its current output of 10.4 mbpd; crude that could be needed with US sanctions set to cripple Iranian supplies starting in November and Venezuela continuing its economic free fall. For example, the Khurais and Manifa fields are to be on-line in Q4 2018 with an output capacity of 550,000 bpd. Venezuela’s production continued to falter and the country was forced to effectively hand over economic interest in some fields to China in exchange for a $5 billion loan (which Venezuela cannot repay anyway). This deal sounds similar to the predatory investments that the Latin American far-left historically accused the US of carrying out. An ironic turn of events.

Iran has no plans to cut oil production, the head of the state-run National Iranian Oil Company (NIOC), Ali Kardor, said, though production fell by 100,000 bpd in September. Indian and Chinese imports from Iran have fallen with tankers utilized as floating storage for unsold oil (at least 2.4 million barrels per one report). The Chinese firm Sinopec publically announced it had cut its deliveries in half, for example. Russian oil output reached 11.4 million mbpd in September, a post-Soviet high and could raise oil production by another 200,000-300,000 bpd per President Vladimir Putin to tackle possible shortages. Iraq also pumped crude oil at record levels, unaffected by a number of local protests. The country’s crude exports reached a record 3.6 mbpd. Saudi Arabia sought to dispel fears of an oil supply squeeze by touting its significant spare production capacity. The kingdom says it holds the ability to pump 1.5 mbpd above its current output of 10.4 mbpd; crude that could be needed with US sanctions set to cripple Iranian supplies starting in November and Venezuela continuing its economic free fall. For example, the Khurais and Manifa fields are to be on-line in Q4 2018 with an output capacity of 550,000 bpd. Venezuela’s production continued to falter and the country was forced to effectively hand over economic interest in some fields to China in exchange for a $5 billion loan (which Venezuela cannot repay anyway). This deal sounds similar to the predatory investments that the Latin American far-left historically accused the US of carrying out. An ironic turn of events.

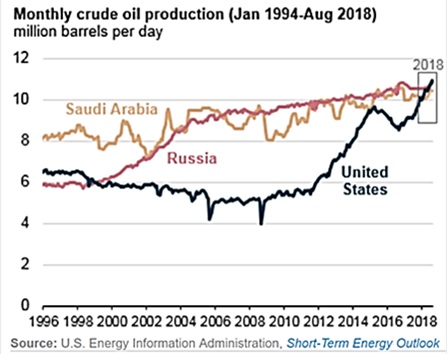

US crude oil production

Rose 269,000 bpd to a record 10.96 mbpd in July, led by record output from Texas and North Dakota, the U.S. Energy Information Administration said in its most recent monthly report. The agency also revised its June production figure slightly higher to 10.7 mbpd. While the graph to the right is partially official forecast for August, it cemented the US as a contender for the top spot. Hard to believe that production is over double what it was ten years ago! The 2019 forecast is up to  an average of 11.5 mbpd. Rig count moved up to 863 rigs for September from 862 in August. Oil production from the seven major shale basins is expected to rise 93,000 bpd in September to 7.5 million bpd, per the US Energy Information Administration (EIA). Oil output from the seven major shale formations in the United States is expected to rise by 79,000 barrels per day to 7.6 mbpd in October. OPEC released a report that said that total supply outside of the cartel will surge by 8.6 million barrels a day from 2017 to 2023, to 66.1 million barrels a day, mainly driven by increases in US shale oil. The US State Department issued an environmental assessment of a revised route for the Keystone XL crude pipeline that concluded it would not harm water or wildlife, clearing a hurdle for the project that has been pending for a decade. S. crude oil exports eased slightly to 2.1 million bpd in July (estimated) from a record 2.2 million bpd in June. Pemex is to raise their imports of US light crude oil in October by 100,000 bpd to use for domestic refining as their facilities have trouble processing all the heavy Mexican crude available to them.

an average of 11.5 mbpd. Rig count moved up to 863 rigs for September from 862 in August. Oil production from the seven major shale basins is expected to rise 93,000 bpd in September to 7.5 million bpd, per the US Energy Information Administration (EIA). Oil output from the seven major shale formations in the United States is expected to rise by 79,000 barrels per day to 7.6 mbpd in October. OPEC released a report that said that total supply outside of the cartel will surge by 8.6 million barrels a day from 2017 to 2023, to 66.1 million barrels a day, mainly driven by increases in US shale oil. The US State Department issued an environmental assessment of a revised route for the Keystone XL crude pipeline that concluded it would not harm water or wildlife, clearing a hurdle for the project that has been pending for a decade. S. crude oil exports eased slightly to 2.1 million bpd in July (estimated) from a record 2.2 million bpd in June. Pemex is to raise their imports of US light crude oil in October by 100,000 bpd to use for domestic refining as their facilities have trouble processing all the heavy Mexican crude available to them.

China

Has hiked its 2019 crude oil import quota for “non-state trade,” generally meaning independent refiners, by 42% as two private companies prepare to launch commercial production at major new plants. It is the second consecutive year that Beijing has increased the quota, which is equivalent to 4 mbpd. In terms of Iranian sanctions, we suspect that China will continue to import their oil, if nothing else as a bargaining chip in the trade negotiations. According to Reuters’, US officials that visited Beijing in August demanded steep reductions of oil imports from Iran – a position not to be appreciated by the Chinese. India is sending mixed messages with some reports saying they will not buy more Iranian crude, but other announcements said that Indian Oil Corp will buy six million barrels of Iranian oil and Mangalore Refinery and Petrochemicals will buy three million barrels. Given the increase in rhetoric against China by the US over spying and military confrontations, strategically granting waivers to India to buy Iranian crude oil appears to be in the US interest. We shall see.

The US-China Trade War

Saw China imposing tariffs ranging from five to ten percent on $60 billion of US goods while the US imposed tariffs on $200 billion of Chinese goods, but at the 10% level, lower than expectations. However, they are to move to 25% next year if no trade deal is reached, dodging the Christmastime import season. The US also approved a $330 million arms sale to Taiwan for fighter plane parts to turn up the pressure. Funny enough, Chinese soymeal prices have risen so much and US soybean prices have fallen so much that it makes sense for the Chinese to import US soybeans directly despite the tariffs! India’s soymeal exports in the current season could jump as much as 70% from a year ago (off a low base), buoyed by expected purchases from China to make up for the US. Fresh off the NAFTA 2.0 treaty, the US started to push Japan to enter into bilateral talks or face automobile tariffs. The question of steel tariffs with Canada and Mexico still pending too as the new treaty excluded them from the discussion. Automobile parts, Canadian dairy farmers and on-line sales were winning areas for the US, though the relative significance is debatable as Canada and Mexico benefit from some of these areas too.

Other Commodities Headlines

Focused on plentiful grains with the USDA issuing a surprise increase to its corn harvest forecast due to expectations of record yields in key production areas such as Illinois, Iowa, Nebraska and Indiana. Soybean yields were seen at an all-time high, with the production outlook raised above its already record-high  forecast. There are some indications that US beans are being transshipped to China via Argentina and Brazil. The Chinese have recently booked a record 12-14 million tonnes of Brazilian beans for October-November arrival. Last year Brazil shipped just a bit less than 9 million tonnes to China in the entire quarter, and that was the previous record. Brazil is expected to import around 1 million tonnes of soybeans in coming months from its largest global competitor, the United States. Ukraine grain exports were at 8.8 million tonnes so far, down from around 9.7 million tonnes at the same point last season as tough weather weighed on European crops. However, Russia through the first days of October has exported a record 12.9mmt of wheat, vs. 9.5mmt last year. Argentina’s 2018-19 wheat crop is expected to be a record-high 19.7 million tonnes, with heavy rains in the last week improving conditions.

forecast. There are some indications that US beans are being transshipped to China via Argentina and Brazil. The Chinese have recently booked a record 12-14 million tonnes of Brazilian beans for October-November arrival. Last year Brazil shipped just a bit less than 9 million tonnes to China in the entire quarter, and that was the previous record. Brazil is expected to import around 1 million tonnes of soybeans in coming months from its largest global competitor, the United States. Ukraine grain exports were at 8.8 million tonnes so far, down from around 9.7 million tonnes at the same point last season as tough weather weighed on European crops. However, Russia through the first days of October has exported a record 12.9mmt of wheat, vs. 9.5mmt last year. Argentina’s 2018-19 wheat crop is expected to be a record-high 19.7 million tonnes, with heavy rains in the last week improving conditions.

Gold giant Barrick agreed to buy rival Randgold for $6 billion, perhaps indicating a positive outlook for gold. S. gasoline consumption stalled as higher prices took their toll. The volume of traffic on U.S. highways stopped growing, and with it gasoline consumption, as rising prices curbed driving behavior. Traffic volumes in July were 0.3% lower than a year earlier, after seasonal adjustments, according to the US Federal Highway Administration.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource