Finally the US Presidential election is over and we can move on to more important things like the economy and foreign relations – of course both of those are highly politicized too. US Q3 GDP came in at +2.9%, beating expectations on surprisingly high soybean exports (who knew that silken tofu could be so important) and inventories. Of course the concern is that these are not particularly sustainable increases, but the Atlanta Fed is projecting a +3.1% increase for Q4 GDP so more good times to come. The Federal Reserve did not raise rates at their early November meeting as it was right before the election (perhaps they should move or remove that gathering in election years?) but continued to signal that a minimal hike is on the table for the December meeting. The Puerto Rico bankruptcy (or equivalent) will also not move forward until December or early 2017 – still far off in the future for these markets. The ECB is expected to expand its Q€ targets though a bond selloff in October expanded the purchase universe so Draghi may play it cool. The Italian referendum to restructure their government is the most important final political event for 2016 – a move to simplify their government could improve their stalled reform attempts – important for the third largest economy in continental Europe. The Spanish Socialist party finally allowed their opponent Mariano Rajoy to continue his reign as Prime Minister by abstaining in their parliamentary vote – now maybe they can move further along the road of recovery. China continues to pile on debt to fuel its mandated 6.5%+ growth rate – who knows when it ends, but it will end badly. Japan continues to stall out with declines in retail sales and industrial output. Finally, OPEC trumpeting of an output cutback deal ended October on a sour note as more countries sought exemptions from tapering production. Russia and the US are not cutting (the other top world producers) as they even look to expand output. The US even hit an oil export record (and not just to Canada!)! Perhaps a seasonal cut or freeze will be announced at the November OPEC meeting but one should expect low gasoline prices for another few months at least. Grains caught a bid in October as the US stepped in to fill the production gap left by Brazil and Argentina – hence that GDP boost in exports. However, planting is underway south of the Equator so global inventories will still be bountiful. US livestock supplies are also looking particularly plentiful and a weaker Yuan is holding back export demand. May the rest of this year be (more) peaceful!

Surprised? After all the twists and turns, the US election is over and done with – it was a season of unforced errors and a race to the bottom but someone figured out that the best way out of a hole is to stop digging before your opponent does. It will be interesting to see who the contenders are in four years as a one-term president seems fairly likely given the mood of the county. Of course, the citizenry may stick with the devil we know – and there may even be a pleasant surprise along the way. One can dream.

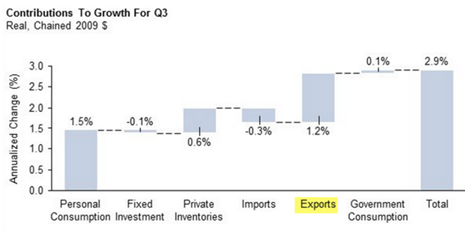

Meanwhile, the US Q3 GDP surprised to the upside with a +2.9% annualized print against +2.6% expected on surprisingly high soybean shipments to China contributing much of that +1.2% in exports. Miracles do happen though that print and the build in private inventories are generally one-off events so Q4 may have some work to do. The esteemed Atlanta branch of the Federal Reserve is projecting a solid +3.1% annualized rate for the final quarter so it could turn out alright. Janet Yellen and company is closer and closer to hiking rates by the minimal +0.25% figure in the final meeting of the year in December though she has repeatedly said that she prefers the US economy to “run hot” (i.e., inflationary) before raising rates. We do not think that a modest increase would do harm, if any. But optics are important so the guessing game continues.

Meanwhile, the US Q3 GDP surprised to the upside with a +2.9% annualized print against +2.6% expected on surprisingly high soybean shipments to China contributing much of that +1.2% in exports. Miracles do happen though that print and the build in private inventories are generally one-off events so Q4 may have some work to do. The esteemed Atlanta branch of the Federal Reserve is projecting a solid +3.1% annualized rate for the final quarter so it could turn out alright. Janet Yellen and company is closer and closer to hiking rates by the minimal +0.25% figure in the final meeting of the year in December though she has repeatedly said that she prefers the US economy to “run hot” (i.e., inflationary) before raising rates. We do not think that a modest increase would do harm, if any. But optics are important so the guessing game continues.

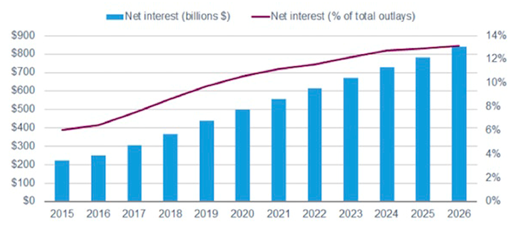

Increases in government rates of course will help fuel the deficit and national debt higher – the graph to the right shows the Congressional Budget Office’s projection on net interest expense and its increasing weight in overall spending. For this and other entitlement spending increases, US deficits are set to expand starting in the current fiscal year and beyond – a challenge for both our new President and Congress – how they square the circle of growth, taxes and deficits/unfunded liabilities will be as painful to watch as the election just past and could set the stage for another hotly contested election in 2020. Joy.

national debt higher – the graph to the right shows the Congressional Budget Office’s projection on net interest expense and its increasing weight in overall spending. For this and other entitlement spending increases, US deficits are set to expand starting in the current fiscal year and beyond – a challenge for both our new President and Congress – how they square the circle of growth, taxes and deficits/unfunded liabilities will be as painful to watch as the election just past and could set the stage for another hotly contested election in 2020. Joy.

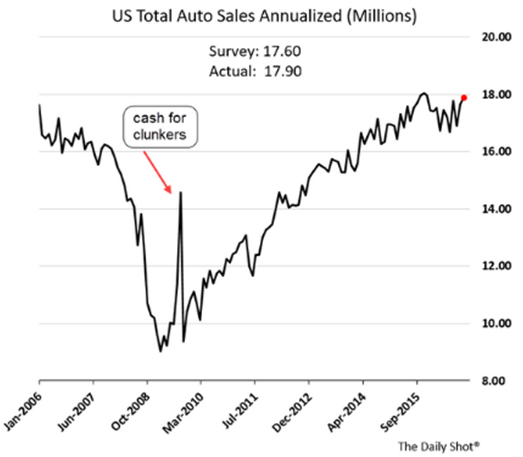

In the meantime the economic news is supportive enough. Employers added 161,000 jobs in October and gains in August and September were revised upwards a combined 44,000. The unemployment rate stayed at 4.9% though working-age participation in the labor markets of 62.8% stayed closed to the recently low of 62.4% – well below the highs of 66% back in 2004. However, hourly wages moved up nicely at +2.8% year-on-year, though inflation follow-though is still questionable. Orders to U.S. factories increased a modest +0.3% in September even though a key category that tracks business investment plans fell by the largest amount since February. Orders for durable goods, items expected to last at least three years, fell by -0.3% in September, slightly worse than the -0.1 percent decline estimated. The weakness in durable goods reflected in part a big drop in demand for military aircraft, a notoriously noisy number. Retail sales climbed in September by the most in three months, +0.6%, matching economist estimates. Finally, US auto sales maintained a high level, fueled by record light truck sales – guess those low gas prices are having an effect on consumers.

+2.8% year-on-year, though inflation follow-though is still questionable. Orders to U.S. factories increased a modest +0.3% in September even though a key category that tracks business investment plans fell by the largest amount since February. Orders for durable goods, items expected to last at least three years, fell by -0.3% in September, slightly worse than the -0.1 percent decline estimated. The weakness in durable goods reflected in part a big drop in demand for military aircraft, a notoriously noisy number. Retail sales climbed in September by the most in three months, +0.6%, matching economist estimates. Finally, US auto sales maintained a high level, fueled by record light truck sales – guess those low gas prices are having an effect on consumers.

Meanwhile Venezuela continues to spiral downward – the Maduro-controlled Supreme Court took the budgeting approval process away from the opposition-controlled National Assembly, effectively giving him license to spend on his cronies. The oil company PDVSA was successful in swapping $2.8 billion in soon-maturing debt for longer-dated bonds, lower than the targeted $3.55 billion. As the swapped bonds are backed by the government’s ownership in CITGO, the smaller amount means that the new bonds are highly if not overly collateralized, giving the swappers a high degree of security – something that Venezuelan investments typically lack these days!

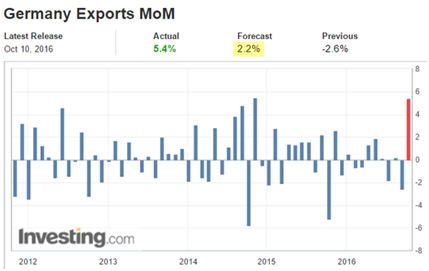

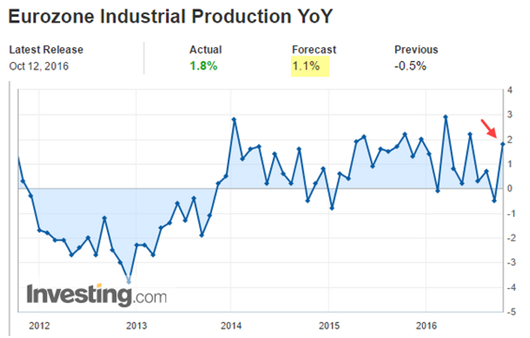

Big Money for Christmas? While the world’s bankers and investment managers try to figure out how big the ECB’s program is going to be early next year, the current one is at least allowing sovereigns to push out maturities, with Italy issuing €5 billion in 50-year bonds (yield of 2.8%) and Austria €2 billion in 70-year bonds (yield of 1.5%). That’s kicking the can way down the road! Eurozone inflation ticked up to a modest 0.5% rate with Q3 GDP growth was +0.3% (non-annualized) – same as Q2 and below the +0.5% rate in Q1. UK GDP growth for Q3 came in higher than expected at +0.5% versus +0.3% non-annualized – still waiting for that Brexit collapse everyone is  worried about. October’s Purchasing Manager Indices indicate a faster expansion of manufacturing activity than in September. As the graph to the left shows, the German export machine is still in full throttle and the overall Eurozone industrial production is holding up (as below it). In other good news, Spain’s unemployment rate fell below 20% for the first time in six years, and the government gained a level of stability as Rajoy was finally allowed to be elected as Prime Minister (the opposing Socialist party chose to abstain from blocking his bid after ten months of impasse). Of course the Socialists promised to continue to oppose the policies of his minority government so more potential infighting to come.

worried about. October’s Purchasing Manager Indices indicate a faster expansion of manufacturing activity than in September. As the graph to the left shows, the German export machine is still in full throttle and the overall Eurozone industrial production is holding up (as below it). In other good news, Spain’s unemployment rate fell below 20% for the first time in six years, and the government gained a level of stability as Rajoy was finally allowed to be elected as Prime Minister (the opposing Socialist party chose to abstain from blocking his bid after ten months of impasse). Of course the Socialists promised to continue to oppose the policies of his minority government so more potential infighting to come.

Overall Eurozone unemployment stayed steady at 10% with Greece’s falling to 23.5% (from a high of over 27% in 2013). No word on any potential bailout packages. On the corporate front, Ericsson is looking to cut 3,000 jobs in Sweden and an additional 900 outside the country and France bailed out Alstom with €600 million order for trains that it will not need for another four or five years. It keeps the historically sensitive plant at Belfort open, the location where the firm built France’s first steam locomotive in the 1880’s. It is a sop to the unions before Hollande heads to the polls in six months. Finally, Italy will be holding a reforms referendum in December to completely change the structure of their parliament, eliminating one house from all but the most important legislative procedures and shrinking the primary chamber by 2/3s to 100 representatives, speeding up the legislative process overall. PM Renzi has promised to resign if the measure fails – and it is struggling now – and thus potentially send the country into political crisis. December 4th is the date to watch.

Overall Eurozone unemployment stayed steady at 10% with Greece’s falling to 23.5% (from a high of over 27% in 2013). No word on any potential bailout packages. On the corporate front, Ericsson is looking to cut 3,000 jobs in Sweden and an additional 900 outside the country and France bailed out Alstom with €600 million order for trains that it will not need for another four or five years. It keeps the historically sensitive plant at Belfort open, the location where the firm built France’s first steam locomotive in the 1880’s. It is a sop to the unions before Hollande heads to the polls in six months. Finally, Italy will be holding a reforms referendum in December to completely change the structure of their parliament, eliminating one house from all but the most important legislative procedures and shrinking the primary chamber by 2/3s to 100 representatives, speeding up the legislative process overall. PM Renzi has promised to resign if the measure fails – and it is struggling now – and thus potentially send the country into political crisis. December 4th is the date to watch.

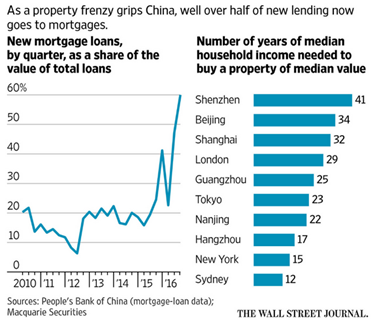

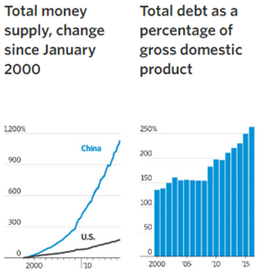

Nothing to See Here, Just Move Along: China delivered the promised +6.7% annualized GDP growth for Q3 despite many statistics that one could describe as soft as cha shu bao (AKA a delicious pork bun). Year-on-year industrial production was lower than expectations (+6.1% versus +6.4%), rail traffic was up +7.0% year-on-year but highway freight traffic which is over ten times larger was down -6.5% year-on-year and there was a recovery in electrical generation (+6.8%). Exports fell the most since February this year (-9.8%), demonstrating that the weaker Yuan is not spurring trade, though the PMI manufacturing indicator was expansive. How will factories make up lost revenues? Where GDP growth has been meeting expectations is consumption and investment – but on easy – very easy – credit. Housing prices are absorbing the speculative money that was directed to the stock market with total debt in the country expected to reach 260% of GDP in 2016, up from 154% in 2008. The below graphs from the Wall Street Journal show the increase in the money supply from true fiscal spending (no halfway spending plans there) as opposed to the US as well as the change in the debt-to-GDP. Xi also just replaced his veteran reform-focused finance minister Lou Jiwei so one must wonder about Xi’s direction for the country and the economy. The mass layoffs needed in smokestack industries have not yet happened so real reform that deals with overcapacity and reining in local governments has eluded him so far. The good news is that this debt is all in local currency so a foreign exchange crisis like what happened in

up lost revenues? Where GDP growth has been meeting expectations is consumption and investment – but on easy – very easy – credit. Housing prices are absorbing the speculative money that was directed to the stock market with total debt in the country expected to reach 260% of GDP in 2016, up from 154% in 2008. The below graphs from the Wall Street Journal show the increase in the money supply from true fiscal spending (no halfway spending plans there) as opposed to the US as well as the change in the debt-to-GDP. Xi also just replaced his veteran reform-focused finance minister Lou Jiwei so one must wonder about Xi’s direction for the country and the economy. The mass layoffs needed in smokestack industries have not yet happened so real reform that deals with overcapacity and reining in local governments has eluded him so far. The good news is that this debt is all in local currency so a foreign exchange crisis like what happened in  1997 is not going to be a trigger. On the other hand, with debt growth at roughly twice the rate of GDP growth, this trend cannot keep going forever. The ocean is calm on the surface but strong currents run just underneath.

1997 is not going to be a trigger. On the other hand, with debt growth at roughly twice the rate of GDP growth, this trend cannot keep going forever. The ocean is calm on the surface but strong currents run just underneath.

Japan and Korea have their own problems. Japan’s September industrial output and retail sales were flat month-on-month with August. Korean retail sales collapsed -4.5% offsetting gains for the previous twelve months. Hanjin Shipping’s bankruptcy is still roiling the container markets as creditors and other shipping companies take the boats for pennies on the dollar (if for anything) and thus keep excess capacity in the market. Christmas toys will stay cheap I suppose. Meanwhile Taiwan’s GDP has started to pick up on a small recovery in year-on-year exports and Singapore’s September industrial production grew by +3.3% instead of falling by -1.2% as expected. Too soon to expect a real recovery but better than nothing.

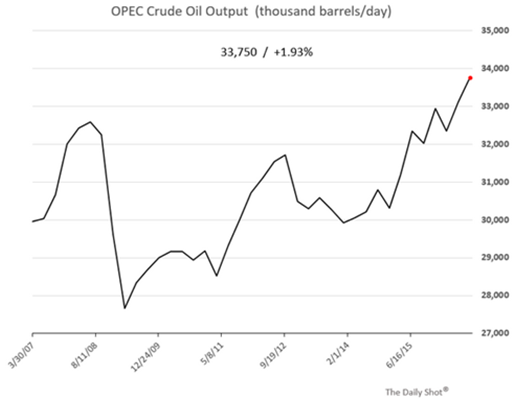

Deal or No Deal: Does OPEC have a deal to cut production? Looks less and less likely though there will be a talking frenzy going into their November 30th meeting. In addition to no cuts for Libya and Nigeria (after all, how much can they really cut from their already-low production amidst ongoing civil war?), Iran is still looking to expand and Iraq wants a pass as it had to pay for fighting ISIL. Venezuela also is producing lower than capacity so no cuts there. Russia is verbally supportive, but not a member of OPEC and Putin needs the revenue for his stumbling economy and warfighting capability in Syria and Ukraine. Saudi Arabia and the UAE will have to bear the cuts, which is possible but not likely. Saudi Arabia just issued a $17.5 billion bond so it has some money to tie itself over until the Aramco IPO in 2018 (indicated currently to sell 5% of the firm for $40 billion or a $2 trillion implied valuation). Leading up to the IPO, Saudi Arabia is motivated to increase the price of oil to support the valuation so one could see them cut production for that reason. However, I think that it is too early for that kind of maneuvering – wait until this time next year. Meanwhile OPEC production is at a high (see right) and Russia also just set a new record at 11.2 million barrels per day during October. US production has stabilized at about 8.5 million barrels per day and exported a record 692,000 barrels per day in September (primarily to Canada but also to Singapore and Europe). Production seems on pace in the US as the 70 oil and gas companies that have gone bankrupt in the last two years product the equivalent of one million barrels per day, about what they were producing before going under. Their creditors want them to generate cash flow at least! US oil rig count continued to expand, moving to 450 as of November 4th from 425 on September 30th. Libya’s production is increasing slightly and exports have increased sporadically. Even little Yemen torn apart by a proxy war between Saudi Arabia and Iran is increasing its meager production. Iraq is closing in on ISIL’s fortifications in Mosul though it will be a hard slog. In a worrying turn of events, environmentalists sabotaged five oil pipelines by breaking into valve stations – no lasting harm fortunately but if done wrongly, the resulting pressure buildup could cause a spill (hurting the environment). A pipe did burst twice – but it carried gasoline and it was an accident. It did cause a temporary panic but inventories generally are high and a local squeeze was addressed. Finally, the Orwell Award for Double-Speak goes to Russia on cutting oil production – review these comments made over a 24-hour period:

(indicated currently to sell 5% of the firm for $40 billion or a $2 trillion implied valuation). Leading up to the IPO, Saudi Arabia is motivated to increase the price of oil to support the valuation so one could see them cut production for that reason. However, I think that it is too early for that kind of maneuvering – wait until this time next year. Meanwhile OPEC production is at a high (see right) and Russia also just set a new record at 11.2 million barrels per day during October. US production has stabilized at about 8.5 million barrels per day and exported a record 692,000 barrels per day in September (primarily to Canada but also to Singapore and Europe). Production seems on pace in the US as the 70 oil and gas companies that have gone bankrupt in the last two years product the equivalent of one million barrels per day, about what they were producing before going under. Their creditors want them to generate cash flow at least! US oil rig count continued to expand, moving to 450 as of November 4th from 425 on September 30th. Libya’s production is increasing slightly and exports have increased sporadically. Even little Yemen torn apart by a proxy war between Saudi Arabia and Iran is increasing its meager production. Iraq is closing in on ISIL’s fortifications in Mosul though it will be a hard slog. In a worrying turn of events, environmentalists sabotaged five oil pipelines by breaking into valve stations – no lasting harm fortunately but if done wrongly, the resulting pressure buildup could cause a spill (hurting the environment). A pipe did burst twice – but it carried gasoline and it was an accident. It did cause a temporary panic but inventories generally are high and a local squeeze was addressed. Finally, the Orwell Award for Double-Speak goes to Russia on cutting oil production – review these comments made over a 24-hour period:

“Russia is ready to join the joint measures to cap production and is calling for other exporters to join.” – Russian President, Vladimir Putin on October 11

“Try to answer this question yourself: would Iran, Saudi Arabia or Venezuela cut their production?” – Igor Sechin, President of Rosneft on October 12 on why his company would not cap production

“Lukoil is ready to cap its oil output as part of the potential agreement with OPEC.” – Leonid Fedun, Lukoil’s Vice President on October 12

“We are considering the option of keeping the production at the current level; we’re not considering its reduction.” – Russian Energy Minister, Alexander Novak on October 12

In other energy news, the UK approved its second-ever shale gas fracking permit on a site in northwest England. Not sure where it is, but it must be pretty desolate. And US coal companies (also generally bankrupt), are increasing production as Chinese coal prices hit highs for the year. A warm summer in North America and falling inventories in Asia have led to a mini-revival into the end of the year.

Turning to agriculture, weather has turned positive for South America to support soy and corn production and wheat is well-supplied out of Europe and Australia. The US had strong crops in 2016 – largest amount of corn produced ever above 15 billion bushels – but a relatively poor showing in South America has supported prices after initial weakness. Supporting that move also is the growing livestock herd which has started to absorb additional feed with the USDA estimating the largest amount of corn going into feed and residual use since 2008. Now the action moves back below the Equator where Brazilian planting of corn and soy is running ahead of normal, though is still only about 60% complete for corn and 30% for soybeans.

Not just energy and grains, but we have plenty of inventories in many commodities. Total red meat production in the United States is at a record pace as pork poundage made up for a small drop in beef production. Weights are lower than average but the number of animals slaughtered has more than made up for it. More increases are expected in 2017 and 2018 as herd sizes continue to expand and exports should pick up the slack. Milk production has formed a glut too, with dumping in 2016 through August about 70% more than the average of the last fifteen years. Cheese in storage has likewise moved higher with this delightful graphic by Vox.com on the left underscoring the issue.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.