Micro E-mini futures contracts were launched by the CME group on May 6th, 2019 with the intent to offer speculators and hedgers the ability to better scale their positions. The micro e-mini contracts are a 1/10th of the size of the e-mini contract and are offered in all the financial indices: S&P 500, Russell 2000, Nasdaq 100, and Dow Jones Industrial Average. While the initial announcement of the launch of micro e-mini’s garnered mixed reviews, the wheel seems to finally be turning in everyone’s head on how to use them as a tool in trading.

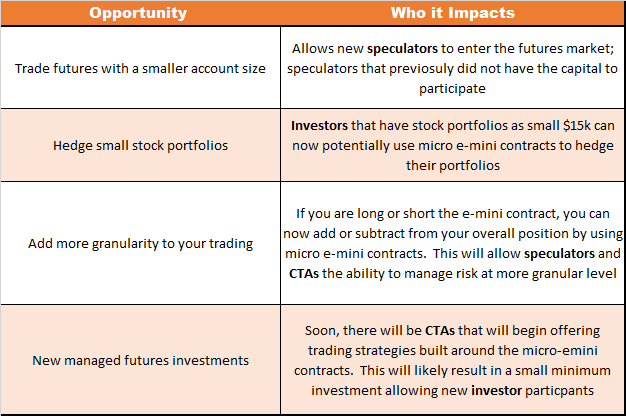

We came up with a list of ways that micro e-minis can be used as a tool to substitute or supplement e-mini contracts and which market participant would be most impacted by each opportunity:

The initial margin requirement on a micro e-mini contract is also 1/10th of the size of the e-mini contract, and this allows for many of the new opportunities to be possible. During our initial observation of the micro e-mini’s trading, we’re already seeing significant volume in both the micro e-mini S&P and the micro e-mini Nasdaq. The immediate impact of the micro e-mini contracts will be felt by new speculators that can immediately enter the market and participate. Micro e-mini’s will also immediately benefit existing speculators, who can better scale their portfolios in order to add risk or decrease accordingly. It’ll likely be at least a few months before we see any CTAs utilizing the micro contracts, as they analyze how to add them to their trading strategies. Soon after, new trading strategies centered around the micro e-mini contract will likely enter the market, as well.