- The April OPEC+ Cuts Kicked In for a Phase 1 target of 9.7 million barrels per day (mbpd) for May and June 2020. Compliance was fairly good with one report at 74% of target reached. On June 6th, OPEC+ agreed to extend the cuts for another month (July) and worked out a deal for Iraq to reach its target in June. Nigeria and Kazakhstan also

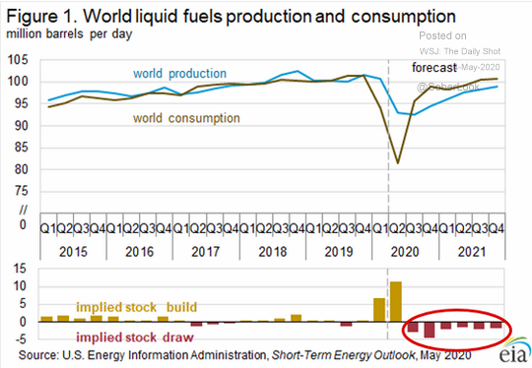

missed their targets. On the other hand, Iran’s oil exports have sunk to a record low as the coronavirus crisis compounded the impact of U.S. sanctions already limiting shipments. Russia, a reluctant cutter in the best of times, reached 9.4 mbpd, basically reaching its target. It is fair to say that the cuts in addition to the lower non-OPEC+ production has started to bring the market back into some balance though as the graph to the right indicates, the US government indicates that this may take into 2021 or beyond to absorb all the oil in storage. Furthermore, the US’ Energy Information Agency projected that OPEC will have about double the average excess production from the last ten year’s available – prices should stay low for the next three or more years with that projection. Some have said that floating storage (oil stockpiled on oil tankers) came off its high but with such inventories three to four times higher than normal still, those hopes seem premature.

missed their targets. On the other hand, Iran’s oil exports have sunk to a record low as the coronavirus crisis compounded the impact of U.S. sanctions already limiting shipments. Russia, a reluctant cutter in the best of times, reached 9.4 mbpd, basically reaching its target. It is fair to say that the cuts in addition to the lower non-OPEC+ production has started to bring the market back into some balance though as the graph to the right indicates, the US government indicates that this may take into 2021 or beyond to absorb all the oil in storage. Furthermore, the US’ Energy Information Agency projected that OPEC will have about double the average excess production from the last ten year’s available – prices should stay low for the next three or more years with that projection. Some have said that floating storage (oil stockpiled on oil tankers) came off its high but with such inventories three to four times higher than normal still, those hopes seem premature.

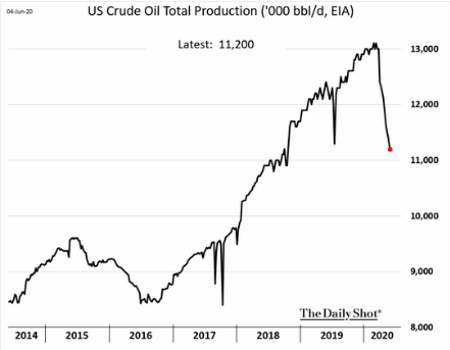

- US Oil Production Fell from 12.1 mbpd of crude oil to 11.2 mbpd by the end of May (see below), more-or-less reaching the forecast of 11 mbpd by the end of the year. The declines include 758,000 bpd of announced reductions by

producers including ConocoPhillips, Continental Resources Inc. and Chevron Corp. More than 500,000 bpd of production in the Bakken region of North Dakota and Montana has been shut in. It could easily go lower as operating drilling rigs continued to fall, from 325 on May 1st to 222 on May 29th. However with the recovery of US prices into the high $30s, shale firms such as EOG announced limited resumption of drilling programs. To demonstrate the limited range of profitability, S&P Global Platts Analytics estimated that in the Delaware portion of the Permian Basin, 33% of new wells would be profitable at $30 per barrel but in the Bakken, just 4% of new wells would be profitable. Therefore, it is too soon to say that the drilling rig count has stabilized but there seems to be light at the end of the tunnel. Hurricane season got a first taste from a tropical storm spinning up in the Gulf of Mexico with over 50 rigs evacuated or stripped to only essential personnel.

producers including ConocoPhillips, Continental Resources Inc. and Chevron Corp. More than 500,000 bpd of production in the Bakken region of North Dakota and Montana has been shut in. It could easily go lower as operating drilling rigs continued to fall, from 325 on May 1st to 222 on May 29th. However with the recovery of US prices into the high $30s, shale firms such as EOG announced limited resumption of drilling programs. To demonstrate the limited range of profitability, S&P Global Platts Analytics estimated that in the Delaware portion of the Permian Basin, 33% of new wells would be profitable at $30 per barrel but in the Bakken, just 4% of new wells would be profitable. Therefore, it is too soon to say that the drilling rig count has stabilized but there seems to be light at the end of the tunnel. Hurricane season got a first taste from a tropical storm spinning up in the Gulf of Mexico with over 50 rigs evacuated or stripped to only essential personnel.

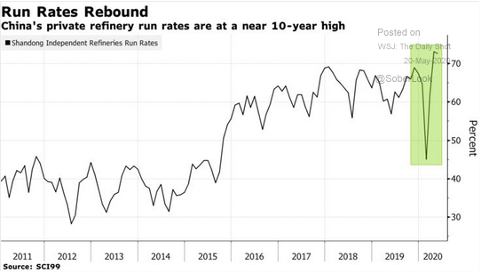

- On The Demand Side, China continued to make an official recovery with estimates of oil demand back to 90% of pre-virus crisis with strategic reserve buying and the announcement of building a new $20 billion petrochemical complex starting in the near future. South Korea refineries are also running above 90%. China received its first US oil shipment

since November with more loadings in June expected. As the graph on the right shows, this is due to the private Chinese firms taking advantage of low crude oil prices a few months ago. Moreover, China’s domestic product pricing mechanism effectively puts a floor on retail prices at $40 per barrel of crude, leading to strong refining margins. As the world reduces economic restrictions, we are seeing a pick-up in demand though prices are still low.

since November with more loadings in June expected. As the graph on the right shows, this is due to the private Chinese firms taking advantage of low crude oil prices a few months ago. Moreover, China’s domestic product pricing mechanism effectively puts a floor on retail prices at $40 per barrel of crude, leading to strong refining margins. As the world reduces economic restrictions, we are seeing a pick-up in demand though prices are still low.

- China’s Pork Imports reached a record 400,000 tonnes in April, up nearly 170% from a year earlier, customs data showed, as buyers took advantage of low prices to stock up on meat. China imported 1.35 million tonnes of pork in the first four months of this year, surging 170.4% from the same period a year ago. Despite the friction between the US and China, strong meat purchases should continue. The

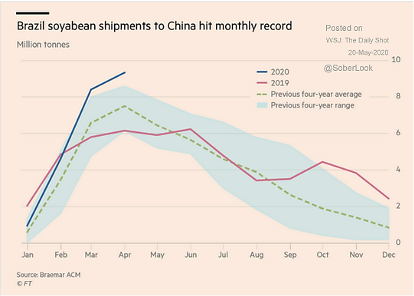

situation is different with grains as despite the COVID-19 disruptions to Brazilian ports, record amounts of grains are heading to China (see graph left). China’s soybean imports in April from top supplier Brazil rose 2.6% from a year earlier, customs data showed, as cargoes delayed by bad weather in the South American country began to arrive at ports. China, the world’s top soybean buyer, brought in 5.939 million tonnes of the oilseed from Brazil in April, up from 5.786 million tonnes last year. The Argentine corn harvest, which is expected to yield 2.8 billion bushels, is over halfway finished with 55.6% of acres completed for harvest. Argentina neared the end of its soybean harvest season in early June, with 98.6% of its crop harvested. Farmers immediately transitioned to wheat planting ahead of a rainy weekend forecast in the Pampas grain belt region. US corn planting are effectively finished with soybean sowing right behind it over the next week or two. Current crop conditions are good as well, indicating the potential for another strong US harvest. Finally, European grain powerhouse Ukraine exported a record 54.1 million tonnes so far in the season just ending, up +17.4% year-on-year. At least food shortages do not seem to be an issue in this strained world.

situation is different with grains as despite the COVID-19 disruptions to Brazilian ports, record amounts of grains are heading to China (see graph left). China’s soybean imports in April from top supplier Brazil rose 2.6% from a year earlier, customs data showed, as cargoes delayed by bad weather in the South American country began to arrive at ports. China, the world’s top soybean buyer, brought in 5.939 million tonnes of the oilseed from Brazil in April, up from 5.786 million tonnes last year. The Argentine corn harvest, which is expected to yield 2.8 billion bushels, is over halfway finished with 55.6% of acres completed for harvest. Argentina neared the end of its soybean harvest season in early June, with 98.6% of its crop harvested. Farmers immediately transitioned to wheat planting ahead of a rainy weekend forecast in the Pampas grain belt region. US corn planting are effectively finished with soybean sowing right behind it over the next week or two. Current crop conditions are good as well, indicating the potential for another strong US harvest. Finally, European grain powerhouse Ukraine exported a record 54.1 million tonnes so far in the season just ending, up +17.4% year-on-year. At least food shortages do not seem to be an issue in this strained world.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource