OPEC Oil Production

- maintained its April level at about 30.2 million barrels per day (mbpd), reaching cuts of 1.2 mbpd or about 300,000 bpd lower than their target of 812,000 bpd. This is the lowest level since 2015. The next meeting is from June 25-26 to discuss continuing these cuts though it may be delayed to early July. Oil prices fell precipitously in May, raising the likelihood that OPEC+ will be forced to continue reductions for the rest of the year. Saudi production fell from April to 9.7 mbpd, which is more than 900,000 bpd below the cut baseline and three times as much as their target of 322,000 bpd. Russian oil output declined to about 11.1 mbpd, just below their target as Belarus discovered that Russia sent contaminated oil through their Druzhba pipeline, forcing a halt to normal oil supplies to Poland and Germany. It will take an estimated three months to negotiate the damages and cleanup of the corrosive liquids that can severely damage refinery equipment and pipelines. It was rumored that some of the polluted oil will be re-directed to Asia, particularly China. Venezuela continued to combat domestic unrest and US oil export sanctions kicked in, sending exports down -17% to about 0.9 mbpd. Finances are so bad that the country had to default on a $750 million loan backed by gold with Deutsche Bank as the country failed to make interest payments. A similar $1.1 billion loan with Citigroup backed by gold also failed in March. Estimated reserves stand at $7.9 billion, down from the 2009 high of $40 billion. Iranian exports dropped to 400,000 bpd in May as US sanctions limited willing purchasers. Iraq and China are the only countries left now that India is importing more from Saudi Arabia to satisfy its demand. Kazakhstan’s Kashagan field hit over 400,000 bpd from only 70,000 a month ago, reaching its expected output. This production technically will be more than their OPEC+ quota but only modestly. Libya continued to rebuild its production to over 1.2 mbpd despite the ongoing fighting between General Haftar and the central government around the capital of Tripoli.

US Crude Oil

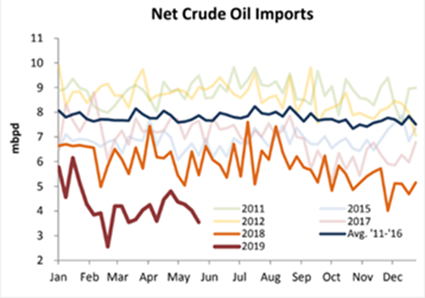

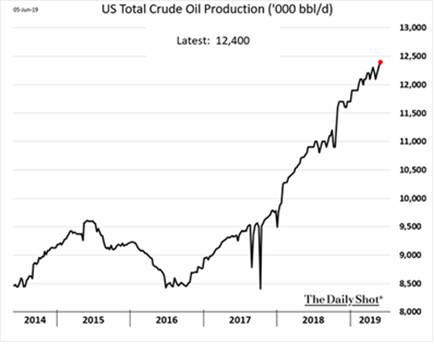

- weekly numbers indicated increased production to 12.4 mbpd of crude oil, defying the decline of drilling rigs in operation from 807 as of May 3rd to 800 of May 31st. Output

from seven major shale formations was projected to rise by about 83,000 bpd in June to a record 8.5 mbpd, the U.S. Energy Information Administration said in its latest monthly drilling productivity report. Again, the Permian Basin of Texas and New Mexico led forecasts, where output is expected to climb by 56,000 bpd to a fresh peak just shy of 4.2 mbpd. It may be easy to forget, but crude oil production offshore in the Gulf of Mexico (GOM) set a number of new, all-time records in the past couple of years. In addition, with a handful of key producers in the Gulf planning low-cost expansions to existing platforms (and still discovering more oil), offshore production will continue its upward trajectory into the early 2020s. And, unlike US shale wells, whose production peaks early then trails off, GOM wells typically maintain high levels of production for many years. Three times since August 2018, GOM production has topped 1.9 mbpd. US oil exportscontinued their trend higher, reaching over 3.3 mbpd (primarily to Asia), and product exports staying above 5.0 mbpd. US oil inventories have been increasing since March 2019, counter to the usual trend of lower inventories as refineries switch to summer grades of gasoline.

from seven major shale formations was projected to rise by about 83,000 bpd in June to a record 8.5 mbpd, the U.S. Energy Information Administration said in its latest monthly drilling productivity report. Again, the Permian Basin of Texas and New Mexico led forecasts, where output is expected to climb by 56,000 bpd to a fresh peak just shy of 4.2 mbpd. It may be easy to forget, but crude oil production offshore in the Gulf of Mexico (GOM) set a number of new, all-time records in the past couple of years. In addition, with a handful of key producers in the Gulf planning low-cost expansions to existing platforms (and still discovering more oil), offshore production will continue its upward trajectory into the early 2020s. And, unlike US shale wells, whose production peaks early then trails off, GOM wells typically maintain high levels of production for many years. Three times since August 2018, GOM production has topped 1.9 mbpd. US oil exportscontinued their trend higher, reaching over 3.3 mbpd (primarily to Asia), and product exports staying above 5.0 mbpd. US oil inventories have been increasing since March 2019, counter to the usual trend of lower inventories as refineries switch to summer grades of gasoline.

Chinese Commodities Headlines

- included Chinese oil imports from the US at first collapsing then recovering even though crude is currently excluded from the tariffs Beijing imposed on US goods. Chinese refiners received only two cargoes totaling 3.9 million barrels in the first five months of 2019, but with 6 million US barrels en route and another 4 million planned for June, this is a marked turnaround. Meanwhile, the central government has increased export quotas of refined oil products (gasoline, gasoil and jet fuel) by 5.3% year-on-year as domestic automobile sales fell -16.6% year-on-year. The Chinese corn crop is still expected to grow (+2.2%) but an armyworm infestation cut the expected harvest modestly (by about 0.4%). Something to watch to see if it spreads. China expected its soybean output to hit the highest level in fourteen years this coming season, targeting 17.3 million tonnes of soybeans, up +7.9% from the year before, its agriculture ministry said. This is in the face of the collapse of their hog herd decimated by African Swine Fever. Brazilian exports of soybeans to China, their largest market, fell -13% in the first four months of 2019 versus a year ago, though new sales came into play in May. China put purchases of American soybean supplies on hold amid escalating trade tensions with the US, but reportedly had no plans to cancel previous soybean purchases. Overall, China’s soybean purchases dropped -24% in May from a year earlier to 7.4m tons. Canada has shipped the most wheat to China in fourteen years, contrasting with a sudden halt in canola exports amid a diplomatic dispute between the countries, as Chinese buyers shunned the United States. China bought 1.5 million tonnes of wheat from Canada from August 2018 through April 2019, nearly double the pace a year earlier and the most since 2004-05. Also, China did import 137,000 tonnes of pork in April from the US, up +24% from the same month a year earlier. Recall that China has pork import tariffs from the US of 65%. Have to keep the populace happy!

Grains Got a Lift

- as heavy rains delayed corn planting as only 58% of U.S. corn was planted by May 26, well behind the five-year average of 90%. Traders covered corn shorts though corn looks well-supplied in South America. Agroconsult raised its forecast by almost 2 million tonnes of Brazil’s harvest to 100.4 million tonnes and it was reported that ADM sold Brazilian corn to Smithfield Foods Inc in the United States to cover logistics issues caused by the mid-west rains (this happens periodically but pretty rare). Mississippi River flooding crested at the second-highest levels going back 150 years, though the waters were expected to recede in June on drier weather. The European Commission raised its estimate of its next wheat crop, excluding durum, to 143.8 million tonnes from 141.3 projected last month. Assuming a normal summer, it seems that the US and other grain producing countries will still produce massive supplies. Chinese African Swine Flu spread to Vietnam which has culled more than 1.7 million pigs (~5% of the herd) and threatens the other South-east Asian countries. The US on the other hand is forecasted by the USDA to raise record supplies of pork in 2019 and 2020 despite the tariff wars with China and Mexico. Beef production is expected to be solid but not record-setting. Ironically, meat substitute company Beyond Meat is trading at over five times its IPO price…

Russia Increased Gold Output

- to 297.3 tons last year, but a record 315 tons kept Australia in second place behind China, according to the World Gold Council. In the last ten years, the country quadrupled its bullion reserves as Putin strove to minimize US dollar holdings. In Mexico, Pemex’s bonds collapsed as Fitch (who?) downgraded the state oil company’s credit rating to BB+ (junk territory). If S&P or Moody’s follow suit, the bonds would be cut from the major investment grade indices and a forced sell-off would ensue. High debt with declining oil production has plagued the firm with its refineries at 35% capacity and needing to import energy from the US. Can President Obrador turn it around?

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource