“Volatility is one of those things that everyone feels but no one can touch.” – John Orford

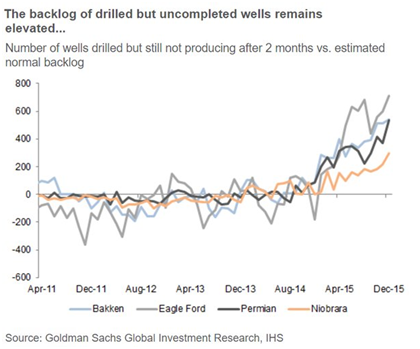

The quiet of May was short-lived as the market reacted to the US Federal Reserve switching its messaging from strong US GDP growth and improving economic conditions supporting a rate hike of an incremental +0.25% to backing off on lowered GDP expectations on disappointing job creation numbers and labor market sentiment. With Dr. Yellen’s focus on labor economics, this discouraging signal changed her public narrative to one of concern. The market leapt on the change of tone to sell the US Dollar and buy risk assets, namely stocks and commodities. With the formal June meeting coming soon, the investors have placed their bets on a dovish delay to the rate hike until after the election in November (or later). The Fed will likely follow their lead. Meanwhile, the ECB has begun buying corporate bonds, favoring large corporate issues and thus lowering their rates further. There may be some turmoil associated with the “Brexit” vote by the UK electorate on whether to stay in the EU or back out. With regards to “Brexit,” while there may be direct savings for the UK in terms of money sent to Brussels as well as lower obligations on any fiscal or banking crisis in Greece (or other country), re-negotiating agreements (e.g., trade and immigration) will be time-consuming, disruptive to business and banking and more uncertainty. We suspect that the UK will decide to stay in on the 23rd, but the polling is close. The June OPEC meeting came and went without a freeze or limit to production but geopolitical tensions (Nigeria primarily but also Venezuela and Libya) and natural disasters (Canadian wildfires) continued to disrupt production. Higher oil prices risk a turnaround in US production as drilled-but-unfinished wells, idle rigs and experienced workers are ready to be up and running in short order (a few weeks). North American grain planting is basically finished or ahead of schedule though South American harvests and transportation is being disrupted by weather. The short analysis says that there is sufficient supply to meet demand but speculation and “buying-the-dip” mentality may support risk-on rallies in the short term. The tug-of-war between supply and demand is underway and is trying to decide on a direction.

You Are in a Maze of Twisty Little Passages, All Alike: Once again the Federal Reserve led the market towards a rate hike of the mildest sort at the upcoming June meeting and then scurried back to dovishness on a single data point, albeit an important one. Non-farm payrolls rose only 38,000 in May, well below the 160,000 expected and even taking into account the 35,000 Verizon workers out on strike. The previous two months (March and April) employment growth numbers were revised downwards for a loss of -59,000 jobs, a large negative adjustment. The unemployment rate did fall notably by -0.3% to 4.7% but largely due to a decline in the total number workers (i.e., the participation rate). With Janet Yellen’s intense focus on the labor markets as a labor economist, this soft labor market would cause an increase in short-term rates to likely be off the table in June and even July. After then, further Fed action is unlikely due to the perception of politicking before the November elections (further QE or other expansionary monetary policy will be construed as benefiting incumbent party candidates). Barring an inflationary or similar emergency, it now seems that the Fed will not consider an increase until the end of the year.

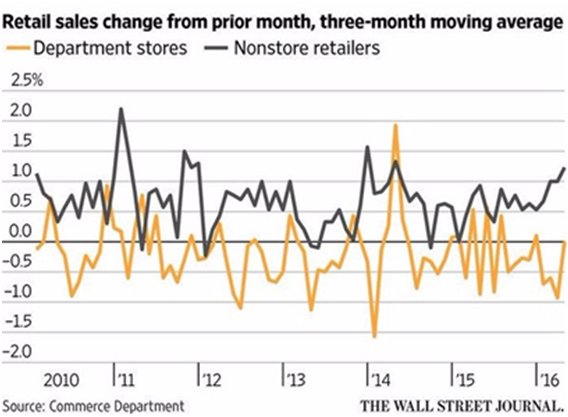

Before the labor data came out, the indications were supportive of a rate hike on an improving economy. Forecast Q2 GDP growth by the Federal Reserve is around +2.5% annualized, versus +0.8% for Q1. US retail sales expanded +1.3% in April, beating an expected +0.7% increase. As the graph to the right indicates, retail sales have been dominated by growth in non-store (i.e., internet) retailers, and after a number of years, this trend is having a greater impact on the headline numbers.  Personal consumption (a related but independent measure to retail sales) also rose more than forecast (+1.0% versus +0.7%). Industrial production expanded in April (+0.7%) and headline inflation as measured by CPI rose +0.4%, slightly above expectations. Pending sales of existing homes (about 90% of the home sales market) was up strongly at +5.1% versus +0.7% forecasted. US Q1 GDP was revised upwards from +0.5% to +0.8% as wages and salaries increased faster than first estimated. Durable goods orders ex-military and ex-aircraft fell in April -0.8%, showing slippage in core manufacturing. This economic review may be positive overall but we suspect the labor market news will dominate the Fed policy conversation and fallback position of caution (no change) will be followed.

Personal consumption (a related but independent measure to retail sales) also rose more than forecast (+1.0% versus +0.7%). Industrial production expanded in April (+0.7%) and headline inflation as measured by CPI rose +0.4%, slightly above expectations. Pending sales of existing homes (about 90% of the home sales market) was up strongly at +5.1% versus +0.7% forecasted. US Q1 GDP was revised upwards from +0.5% to +0.8% as wages and salaries increased faster than first estimated. Durable goods orders ex-military and ex-aircraft fell in April -0.8%, showing slippage in core manufacturing. This economic review may be positive overall but we suspect the labor market news will dominate the Fed policy conversation and fallback position of caution (no change) will be followed.

Puerto Rico is still in fiscal limbo as a bill to create a US government control board makes its way through Congress – it just passed the House of Representative on June 9th and is proceeding to the Senate. As the island owes $1.9 billion on July 1st (money that it does not have), such a board would have broad powers to determine the fate of the island’s bondholders and residents. However, what the board will actually do is uncertain, however, speculation would indicate that the July 1st payments would be delayed until after the board is formed and decisions made. Separately but related, some politicians are trying to void $4 billion of debt issued as the bonds were sold outside of Puerto Rico’s constitutional debt limits. In other words, the bonds should not have been sold but they were anyway and thus are invalid. If this proceeds, it will end up to the courts to decide and further impact the territory and its bondholders (past and future). Throw in a Zika virus outbreak and that society is under a lot of stress. Brazil is still fighting to stay afloat with President Dilma Rousseff under suspension while her impeachment trial is underway. Meanwhile Q1 2016 GDP fell -5.4% annualized, though better than the -6.0% forecasted. This is the fifth straight quarter of declines and with the Olympics coming up, any relief may be temporary. Venezuela also continues to struggle with its gold reserves (the only form of currency available) falling to the lowest level on record, leaving only $12 billion to finance imports and exports. PDVSA, the national oil company, owes $6 billion more this year in debt repayments, halving the reserves available assuming no refinancing. With China taking the surplus Venezuelan oil from previous debt deals, this obligation is looking harder and harder to live up to. Even now, four British Petroleum oil tankers are reportedly offshore awaiting payment before unloading their needed cargo. Grim indeed.

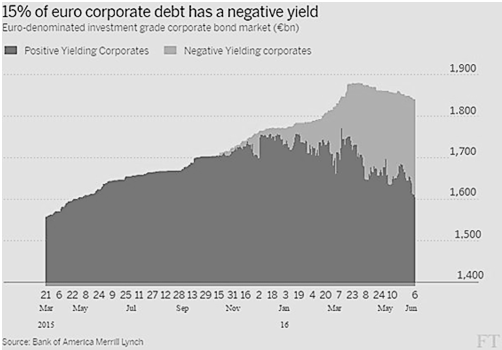

Time for Summer Vacation Already? Or should that be “time for strike season already?” Yes the weather must have turned for the better as the French refiners are on strike, running down gasoline reserves as Euro 2016 football (soccer to our American readers) kicked off on June 10th. Blockades by unions are disrupting transportation and fuel processing as they seek to overturn President Hollande’s labor reforms designed to give companies more flexibility on hiring and firing. In a world dominated by global competition, this seems like a losing battle. At least there is a new export market for American gasoline and diesel – we have plenty! Draghi began his corporate debt buying program under an expansion of his Q€ criterion. As the graph from the FT shows, his program has already had an effect with about 15% of all Euro investment grade debt now sporting negative yields and one should expect this trend to continue.  Like Switzerland, Japan and a few other countries, the ECB is effectively now a leveraged credit hedge fund. It borrows (prints) money at a low (government) rate and buys more risky bonds (no stocks yet like Switzerland or Japan) to earn a higher yielding rate from lower-rated countries or companies (including in junk-rated securities). Why not buy stocks, houses, commodities, people, etc.? Something will cause inflation (and possibly losses) eventually. Draghi’s Q€ hit €1.9 trillion in May, a new record.

Like Switzerland, Japan and a few other countries, the ECB is effectively now a leveraged credit hedge fund. It borrows (prints) money at a low (government) rate and buys more risky bonds (no stocks yet like Switzerland or Japan) to earn a higher yielding rate from lower-rated countries or companies (including in junk-rated securities). Why not buy stocks, houses, commodities, people, etc.? Something will cause inflation (and possibly losses) eventually. Draghi’s Q€ hit €1.9 trillion in May, a new record.

Greece finally struck a deal with the troika (IMF, EU and ECB) to release €10.3 billion under previous packages to receive debt relief assuming Athens adheres to stricter debt maintenance standards, with €7.5 billion available in a few days and the remainder in October assuming conditions are met. This will keep the government in balance for the rest of the year but not much longer. Italy received additional room to have a larger budget deficit than permitted under EU budget guidelines. Spanish voters, who go to the polls on June 26th, are already being promised budget-busting presents of lower taxes and higher spending. Other economic news is still marginal – Q1 GPD was revised upward from +0.5% to +0.6% on better-than-expected German industrial output, though industrial orders going forward fell by a larger-than-expected amount. The broader Euro-area unemployment rate remained unchanged at a stubbornly high 10.2% in April. Russia’s 2016 GDP forecast is expected to fall less than expected (-1.2% versus -2.1%), though European sanctions over Ukraine are to be renewed until the end of the year. Not a lot of news from eastern Ukraine as the battle seems to be in the courts over a $3 billion bond issued to Russia by the Ukraine’s former president (who conveniently is hiding out in Russia) and its validity given the invasion and annexation of Crimea and Eastern Ukraine.

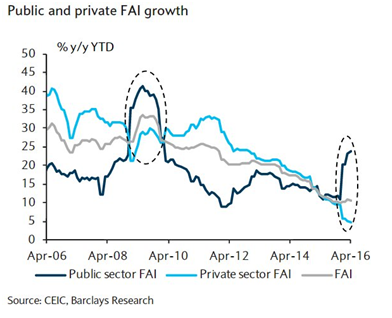

Same Headlines, Different Details: China is still projected to deliver official headline growth of +6.7% to GDP for 2016 though how it gets there is still subject to debate. Per Barclays, government fixed capital spending is taking up the slack as private spending slides downwards (see graph to right). Industrial production climbed +6.0 percent in April from a year earlier, down from +6.8 percent in March and missing economists’ estimates for +6.5 percent.  Retail sales also missed analyst forecasts, rising +10.1 percent, while fixed-asset investment increased +10.5 percent in the January-April period versus economists’ expectation for +11.0 percent. PMI data shows a flat or contracting environment still in manufacturing. Trade data was overall better than expected with exports falling by -4.1% but imports fell only -0.4% in US dollar terms. These results moderate April’s numbers but continue the declining trend. There were signs that the Chinese government is backing away from plans to cut overcapacity in steels as mills were allowed to restart production on a flare-up in prices in the futures market. Critical to local employment, steel producers can act cautiously defy the central government, at least on a temporary basis. China also accelerated its shift of bad debt off the balance sheets of banks in exchange for equity, with $100 billion done in the last two months alone and for a total of $220 billion through the end of April. Some estimates of bad debt reach to $1.4 trillion, which would require capital injections by the government. To that end, the Chinese government launched its first foreign bond offering in London – a $457 million dollar introductory deal to mature in 2019 with a coupon of 3.28% – better than the negative yields in Europe!

Retail sales also missed analyst forecasts, rising +10.1 percent, while fixed-asset investment increased +10.5 percent in the January-April period versus economists’ expectation for +11.0 percent. PMI data shows a flat or contracting environment still in manufacturing. Trade data was overall better than expected with exports falling by -4.1% but imports fell only -0.4% in US dollar terms. These results moderate April’s numbers but continue the declining trend. There were signs that the Chinese government is backing away from plans to cut overcapacity in steels as mills were allowed to restart production on a flare-up in prices in the futures market. Critical to local employment, steel producers can act cautiously defy the central government, at least on a temporary basis. China also accelerated its shift of bad debt off the balance sheets of banks in exchange for equity, with $100 billion done in the last two months alone and for a total of $220 billion through the end of April. Some estimates of bad debt reach to $1.4 trillion, which would require capital injections by the government. To that end, the Chinese government launched its first foreign bond offering in London – a $457 million dollar introductory deal to mature in 2019 with a coupon of 3.28% – better than the negative yields in Europe!

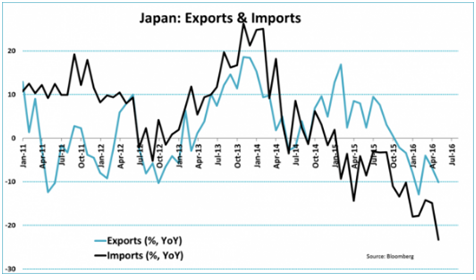

Japan enjoyed a positive GDP surprise in Q1, growing at a +1.7% annual rate as opposed to expectations of +0.3%. Revisions may adjust that surprise, however, as Prime Minister Abe delayed the planned April 2017 sales tax increase until October 2019 – a bet on a further uptick in growth before needing to reduce the budget deficit.  Q2 may be more of a challenge with factory activity falling as measured by PMI and falling imports and exports (see graph). India’s Q1 GDP growth accelerated to a +7.1% annualized rate, ahead of China. India’s economic activity is also confirmed by its increase in oil consumption, overtaking Japan at the number three spot (under China and the US). A domestic road-building campaign is partially responsible to make driving more attractive.

Q2 may be more of a challenge with factory activity falling as measured by PMI and falling imports and exports (see graph). India’s Q1 GDP growth accelerated to a +7.1% annualized rate, ahead of China. India’s economic activity is also confirmed by its increase in oil consumption, overtaking Japan at the number three spot (under China and the US). A domestic road-building campaign is partially responsible to make driving more attractive.

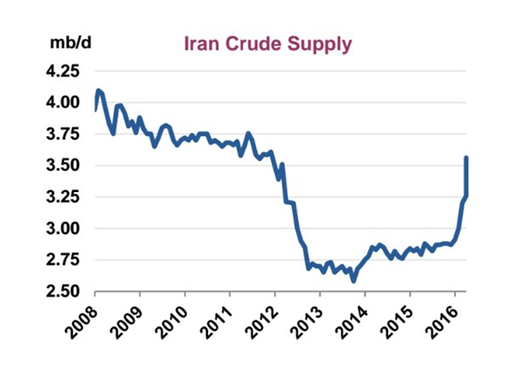

No Need to Act: OPEC met in early June and walked away without any limits on crude oil production as prices centered around $50 per barrel – an increase of almost twice the low set earlier this year. Shortfalls in Canada, Nigeria, Venezuela and Libya kept the bulls well fed on a diet of tight supply concepts, despite close-to-record oil in storage.  Saudi Arabia indicted that it will keep at maximum production as its planned IPO inches closer (early indications of a $2 trillion valuation). Perhaps ironically, Moody’s downgraded Saudi Arabia on its continuing budget woes from Aa3 to A1. The ratings for Oman and Bahrain were also cut. Oil prices are high enough to induce US production expansion, and at the end of May, there were tentative indications – oil rig counts declined from 332 as of April 29th to 316 on May 27th, but the following week saw an uptick to 325. The graph to the left shows the backlog of oil wells that can be turned on relatively quickly (“drilled but uncompleted” AKA “DUCs”) – US firms are ready to maintain or even add to production. US and Canadian banks have increased their loss reserves to counter sour loans made to oil production companies – there have been 27 energy-related bankruptcies so far in 2016 versus 41 in 2015 across the US and Canada. April saw 11 bankruptcies with debts totaling $14.9 billion, including the largest to-date (Pacific Exploration and Production with debts of $5.3 billion). Hong Kong-based Noble Group also continued its woes, with its CEO forced out, a $500 million rights issue announced and plans to sell off its US business as part of a plan to raise $1.5 billion to cover its debts. As the month moved to a close, Canadian authorities lifted the evacuation order around its affected oil sands projects and operations restarted. Iran announced continual supply increases (captured on the graph to the right), and Iraq claimed that total oil output has reached 4.7 million barrels per day (bpd) and exports are running at a record 3.9 million bpd. War-torn Libya made small progress in opening its eastern port of Hariga and production ticked upward as well. Finally, Iraqi forces have formally begun their assault on ISIL-held Fallujah, a strategic stronghold as it is only 50 miles from the capital Baghdad. With its capture, the army and supporting militias will turn their attention to Mosel, the biggest ISIL city in Iraq and a difficult target. The Kurds will also be key in a successful retaking of the city.

Saudi Arabia indicted that it will keep at maximum production as its planned IPO inches closer (early indications of a $2 trillion valuation). Perhaps ironically, Moody’s downgraded Saudi Arabia on its continuing budget woes from Aa3 to A1. The ratings for Oman and Bahrain were also cut. Oil prices are high enough to induce US production expansion, and at the end of May, there were tentative indications – oil rig counts declined from 332 as of April 29th to 316 on May 27th, but the following week saw an uptick to 325. The graph to the left shows the backlog of oil wells that can be turned on relatively quickly (“drilled but uncompleted” AKA “DUCs”) – US firms are ready to maintain or even add to production. US and Canadian banks have increased their loss reserves to counter sour loans made to oil production companies – there have been 27 energy-related bankruptcies so far in 2016 versus 41 in 2015 across the US and Canada. April saw 11 bankruptcies with debts totaling $14.9 billion, including the largest to-date (Pacific Exploration and Production with debts of $5.3 billion). Hong Kong-based Noble Group also continued its woes, with its CEO forced out, a $500 million rights issue announced and plans to sell off its US business as part of a plan to raise $1.5 billion to cover its debts. As the month moved to a close, Canadian authorities lifted the evacuation order around its affected oil sands projects and operations restarted. Iran announced continual supply increases (captured on the graph to the right), and Iraq claimed that total oil output has reached 4.7 million barrels per day (bpd) and exports are running at a record 3.9 million bpd. War-torn Libya made small progress in opening its eastern port of Hariga and production ticked upward as well. Finally, Iraqi forces have formally begun their assault on ISIL-held Fallujah, a strategic stronghold as it is only 50 miles from the capital Baghdad. With its capture, the army and supporting militias will turn their attention to Mosel, the biggest ISIL city in Iraq and a difficult target. The Kurds will also be key in a successful retaking of the city.

Chinese overcapacity has arrived to oil refiners with an estimated 100m tonnes of excess capacity of its 710m tonnes of capacity at the end of 2015. Some firms have cut runs (Sinopec and PetroChina, the country’s two largest) but excess amounts, particularly of diesel, are pushing their way onto the export market, squeezing tradition players in Singapore, South Korea and even Saudi Arabia.  With smaller “teapot” refiners still building capacity, this situation is turning into another one like steel and shipbuilding. The US is hitting new highs in gasoline consumption – in mid-May, a new record was set for the first time in nine years. Mexico’s consumption has turned around and is growing. India too is setting new consumption highs on demand growth, now the third largest consumer over Japan. With coal’s tumble and a slow restart in its nuclear plants, Japan actually is planning to expand its coal-fired electrical generation in order to rebuild its energy infrastructure. Despite heated criticism, Japan has sketched out 49 new plants capable of generating 28 gigawatts which would still leave a shortfall from its 2010 electrical output. Germany, in contrast, for a few hours under ideal conditions, was able to meet 99% of its needs from solar and wind sources – wind is highly variable, keep in mind. Last year Denmark had more than 100% of its needs from wind for a short while and has not reached that level since. Portugal ran solely on renewables (including hydro) for four consecutive days in mid-May and the UK also saw zero electricity generated from coal-run power plants several times over the course of the week of May 9th (albeit at night when demand was low, in summer when heat was not needed and when half the coal plants were down for scheduled maintenance).

With smaller “teapot” refiners still building capacity, this situation is turning into another one like steel and shipbuilding. The US is hitting new highs in gasoline consumption – in mid-May, a new record was set for the first time in nine years. Mexico’s consumption has turned around and is growing. India too is setting new consumption highs on demand growth, now the third largest consumer over Japan. With coal’s tumble and a slow restart in its nuclear plants, Japan actually is planning to expand its coal-fired electrical generation in order to rebuild its energy infrastructure. Despite heated criticism, Japan has sketched out 49 new plants capable of generating 28 gigawatts which would still leave a shortfall from its 2010 electrical output. Germany, in contrast, for a few hours under ideal conditions, was able to meet 99% of its needs from solar and wind sources – wind is highly variable, keep in mind. Last year Denmark had more than 100% of its needs from wind for a short while and has not reached that level since. Portugal ran solely on renewables (including hydro) for four consecutive days in mid-May and the UK also saw zero electricity generated from coal-run power plants several times over the course of the week of May 9th (albeit at night when demand was low, in summer when heat was not needed and when half the coal plants were down for scheduled maintenance).

US grain production is proceeding apace with planting done in Corn and almost finished in Soybeans. Now it is up to the weather. Last year’s US corn and soy crop was adjusted lower by the USDA and they increased US exports slightly to cover weaker than projected production in South America. China’s soy demand is quite strong, with May’s imports of 7.7 million metric tons in May up +8% from April and +25% from a year ago. Wheat on the other hand is looking well-supplied with Russia looking to harvest its largest crop since 2008 and Argentina expanding it planting acreage.

Sugar is seeing a deficit versus last year on China demand and falling supplies in key exporters, especially India. The USDA announced that it expects India’s production to fall 7.9% in the next crop season as well due to dry weather. Cocoa is being jostled not only by weather in West Africa, but also that hedging the UK cocoa contract is more difficult than usual with the US contract due to the volatility around the British Pound and Brexit. Cattle supplies as noted on the latest Cattle on Feed Report came in at over +8% the estimates and +7% versus last year’s number. Good pasture and the beginning of the seasonal increase in weight could prove too much for the market to lift. Finally, copper output and prices remain under pressure on a decline of Chinese demand – though any stimulus can change that picture quickly.

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.