Piketty may have pushed Putin off the front page for now, but one should never count an autocrat out. Putin’s strength in May is reversing with (1) the Ukrainian army now pushing successfully (though slowly) back on pro-Russian elements in the East and (2) the China-Russia deal not signed before the big state dinner on day one but at the 11th hour on day two. This deal will go through a number of iterations, especially as the first deliveries are not due until 2018 or 2019, so stay tuned. Putin also is keeping Crimea, so I would say that he is net-net ahead so far, just so we are all clear on that. The US got through another muddle-month with the economy moving sideways as the financial markets wait for the Federal Reserve and the ECB to do something to make them excited. Yes, the S&P 500 is up and bond yields down in many countries, but biding time with a bullish edge seems to be the market’s current modus operandi. Commodities though seem to be weighed down by fundamentals, at least in agriculture. Asia’s next move to either GDP growth or continued sluggishness will be key to a commodities price resurgence or downward drift. Draghi has already decided that Europe is on such a downward drift as on June 5th he announced new monetary stimulus. Given that the last one (€1 trillion in direct lending to banks in 2011 and 2012 called LTRO) is about to expire, he obviously feels that a new LTRO program is needed. However, since the first one did not jump-start the European economies (and many banks repaid the LTRO program early), I question whether this version will do any good as well. We will discuss the new program in next month’s commentary. In the meantime, keep your trades tight and your stops tighter.

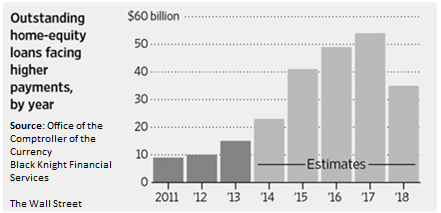

Ms. Muddle: The usual good news – bad economic news was pervasive in the US this month. Housing came in negative on sales volume, with purchases of existing homes falling 7.5% in March and new homes down 5.9%.  However, prices were up 12.9% versus the year previous (though the higher prices may have caused the lower sales too!). Looking ahead, there are a number of home loan resets that are coming into play during the next four years which shift the terms from an interest only credit line to a term loan with principal repayments. In short, monthly payments will be increasing soon (see right). Also, with the increase in home prices, there has been a pick-up in new home-equity lines of credit. New and increased lines jumped 8% in Q1 2014 year-on-year to $13 billion. A far cry from the cash-out refinancing peak of $113 billion in Q3 2006 but worth watching. Manufacturing data seems to be more on the good news side, with durable goods orders increasing in April but at a lower rate than in March (+0.8% versus +3.6%). Also the number was goosed by a one-time order for 10 new nuclear submarines. Without that item, the orders would have fallen -0.8%. ISM’s Purchasing Managers Index for April came in at a strong 55.4, the fourth straight month of improvement, although ISM had to correct their numbers twice after the first publishing. Not exactly reassuring. Finally, the federal government released its update to Q1 GDP, which was revised down from +0.1% to -1.0%. Inventory production was grossly overstated in the first estimate. It is very rare for economic output to contract outside a recession. Q2 appears to be on a positive GDP growth path but investment bank economists at the time of this writing recently revised downward their optimistic average estimates of +3% to +2.5%.

However, prices were up 12.9% versus the year previous (though the higher prices may have caused the lower sales too!). Looking ahead, there are a number of home loan resets that are coming into play during the next four years which shift the terms from an interest only credit line to a term loan with principal repayments. In short, monthly payments will be increasing soon (see right). Also, with the increase in home prices, there has been a pick-up in new home-equity lines of credit. New and increased lines jumped 8% in Q1 2014 year-on-year to $13 billion. A far cry from the cash-out refinancing peak of $113 billion in Q3 2006 but worth watching. Manufacturing data seems to be more on the good news side, with durable goods orders increasing in April but at a lower rate than in March (+0.8% versus +3.6%). Also the number was goosed by a one-time order for 10 new nuclear submarines. Without that item, the orders would have fallen -0.8%. ISM’s Purchasing Managers Index for April came in at a strong 55.4, the fourth straight month of improvement, although ISM had to correct their numbers twice after the first publishing. Not exactly reassuring. Finally, the federal government released its update to Q1 GDP, which was revised down from +0.1% to -1.0%. Inventory production was grossly overstated in the first estimate. It is very rare for economic output to contract outside a recession. Q2 appears to be on a positive GDP growth path but investment bank economists at the time of this writing recently revised downward their optimistic average estimates of +3% to +2.5%.

At the same time, the Federal Reserve is making noises about possible inflation, as their measure of “core” inflation (i.e., ex-food and energy) was up 1.4% year on year in April. Although still below the 2.0% worry mark, it is a pick-up from the sub-1.0% inflation of 2013. This core inflation is forecasted by the Fed to be below 2.0% through 2016 but it underscores the Fed’s decision to continue to remove excess monetary stimulus. We expect Dr. Yellen to announce another reduction in Quantitative Easing from $45 billion to $35 billion per month at the next FOMC meeting on June 17th and 18th. There is more and more evidence that the global monetary easing is driving investors into more risky products, increasing the chance for another wave of losses like what we saw during the mortgage crises. The Financial Times reported that US purchases of the lowest-rated CCC debt that matures in the ten-year timeframe have surged, with $13 billion done and another $1.3 billion priced in May. At 10.5% total yield, one can understand the temptation but with expected defaults at half the historical rate, investors feel the risk justifies the reward. Of course, who will they sell it when it all goes pear-shaped is a question for a later day. Paid-In-Kind (PIK) bonds which pay interest in either cash or more bonds also have been selling well, doubling issuance from 2013 to $4.2 billion so far this year. Again, the threat of loss seems far away. On the other, the market is not totally mad as a mortgage bond backed by defaulted home loans has been pulled from the market as S&P and Fitch could not agree on the value of the underlying collateral. S&P gave the usual AAA rating that was so prevalent in the years leading up to the mortgage crisis but Fitch accused S&P of inflating the value of the homes backing the loans. Their statements meant that the collateral would possibly not be sufficient to protect against expected losses and thus the MBS did not deserve the top rating.

GM also was in the news with their latest two separate recalls of 2.7 million and 2.4 million vehicles to total 15 million vehicles recalled in 2014, 50% more than the number of cars the company sold in 2013. The Q2 recall charges have totaled $400 million so far as well an additional $35 million in fines (the maximum allowed under the law) for the cover-up of faulty ignition switches that killed 12 people over 31 crashes. At least GM is no longer in the residential mortgage business (which was spun out to form Ally Bank) or who knows what would be lurking there.

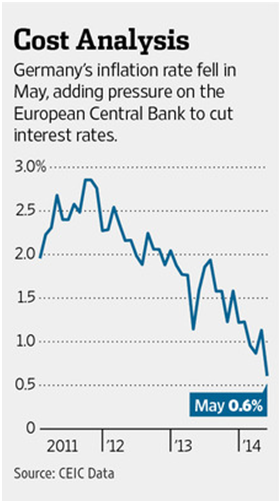

Stall Speed: At the risk of getting ahead of ourselves, Draghi announced a new round of Quantitative Easing and other measures to hurt savers and encourage risk-taking on June 5th. Since I am writing this section on that date, my first read of the announcements are that these are 1) policies to partially replenish QE initiated in 2011 and 2012 that is expiring later this and early next year and 2) more tinkering around the edges that at first glance will have minimal impact. Therefore, at this stage we will address his announcements in the next commentary when we have a better idea of their meaning. His announcements have been a month or so in coming and stems from declining inflation to about 0.5% annually (note the German inflation trend as a proxy for the Eurozone to the bottom right). The issues in Europe are similar to the ones here where the banks have no need of capital for growth (though many need capital to build buffers against losses associated with bad assets).

Economic growth remains sluggish and there are fewer and fewer places to purchase low-risk assets. Eurozone Q1 GDP growth was +0.2% for the quarter, half of the consensus view. Germany was the winner at +0.8% but Netherlands (-1.4%), France (0.0%) and Italy (-0.1%) dragged down the results on weaker household spending and corporate investment. Italy pushed forward with privatization plans, such as to float the state-owned shipbuilder by selling 49% for up to €700 million, though the firm will also raise an additional €600 million in capital. Spain announced a €6.3 billion stimulus package through lower corporate taxes and research and development spending. However, given the Prime Minister’s party’s poor showing in the recent EU elections, this move has been cynically written off as a publicity ploy. Spanish debt is slated to grow to over 100% of GDP by the end of this year and projected GDP growth is a token +1.0% for 2014. At least the costs of the debt are minimal as European sovereign debt costs remain at lows, with Ireland’s borrowing costs falling below the UK’s and Italy paid a record low on €7.5 billion issued at the end of May (average yield of 3.01% for its 10-year bonds).

European banks are also on the capital-raising path, with Italy’s Banco Popolare di Milano raising €500 million in equity and at least five other mid-sized Italian banks are slated to seek €10 billion in equity financing over the next few weeks. In fact, this year to date has hit a record €36 billion in equity issuance in front of the ECB’s asset quality review later this year. European banks’ bad loans rose 8.1% in 2013, reaching €1 trillion in impaired assets. There are questions about whether the €8 billion that Deutschebank raised in May will be enough to deal with its toxic debt and capital requirements. BNP Paribas is facing a €10 billion fine from US authorities for violating sanctions and money laundering associated with countries such as Iran, Sudan and Cuba. Besides the monetary penalty, the US government may suspend its ability to transact in US dollars, potentially crippling its US retail and wholesale operations. However, the matter is still under negotiation and given the importance of the bank to the French government, a political deal may be cut. In perhaps related news, the French government gave itself expanded powers to block the acquisition of French companies by foreign firms. No Alstom energy subsidiary for you, General Electric, unless BNP is left alone, n’est-ce pas? In the UK, Barclays Bank decided to cut the core of its fixed income/currency/commodities business by 7,000 people and put half of the unit’s assets (£90 billion) into a “bad bank” where these loans and investments will be allowed to expire. Another retreat into the “safer” world of traditional banking. Siemens outdid Barclays by announcing cuts of 11,600 jobs in addition to the 15,000 cut in a 2012 program. France’s Societe Generale took a €525 million asset hit from its Russian investments. In one of the bolder banking moves this year, it added to its exposure by buying the remaining outstanding shares in Rosbank, its Russian subsidiary, after the takeover of Crimea and the conflict in the Ukraine began. In Russian news, the country partially prepared for conflict with the US by selling $25 billion of its $125 billion US Treasury bond position. Someone understands hedging political risk. With some of the money, Russia bought 900,000 ounces of gold worth $1.2 billion in April. The news in Ukraine appears more focused on the recent gains that the Ukrainian government has made against the pro-Russian militias. And Putin has other demands for his attention as President of the Abkhazia region of Georgia that Russia took over in 2008 fled as demonstrators stormed and occupied the presidential administration and state television buildings. No tanks are rolling out, for now.

The Mask is Slipping: On the face of it, there appears to be much strength in Asia.  China is flexing its military muscles against Vietnam and economic muscles with the Sino-Russian $400 billion natural gas deal. On the other hand, Vietnamese rioted against Chinese factories, burning fifteen of them to the ground and damaging others, killing one Chinese employee. Also, the natural gas deal left a number of open issues, such as $75 billion in infrastructure build-out and that deliveries cannot start until 2018 or 2019. A lot can happen in the world between now and then. Chinese manufacturing is slightly expanding at 50.8 per the official purchasing managers’ index, though the HSBC alternative still has a contraction with their 49.7 reading. Property sales have fallen off at -7.8% for the first four months of 2014 versus the same period last year. With 23% of GDP related to construction, this is not a good sign. The shadow banking system also is very real estate development entwined so problems in construction metastasize into banking. Perhaps those Chinese Army hackers downloaded a real estate bubble virus by mistake.

China is flexing its military muscles against Vietnam and economic muscles with the Sino-Russian $400 billion natural gas deal. On the other hand, Vietnamese rioted against Chinese factories, burning fifteen of them to the ground and damaging others, killing one Chinese employee. Also, the natural gas deal left a number of open issues, such as $75 billion in infrastructure build-out and that deliveries cannot start until 2018 or 2019. A lot can happen in the world between now and then. Chinese manufacturing is slightly expanding at 50.8 per the official purchasing managers’ index, though the HSBC alternative still has a contraction with their 49.7 reading. Property sales have fallen off at -7.8% for the first four months of 2014 versus the same period last year. With 23% of GDP related to construction, this is not a good sign. The shadow banking system also is very real estate development entwined so problems in construction metastasize into banking. Perhaps those Chinese Army hackers downloaded a real estate bubble virus by mistake.

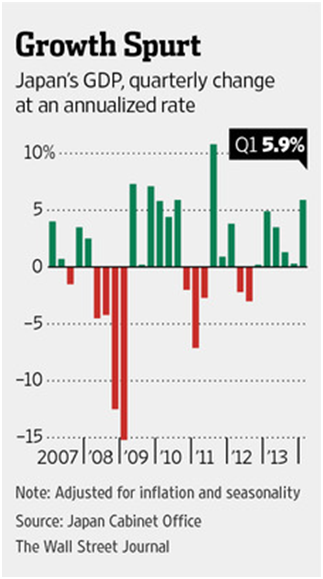

Japan’s Q1 GDP was a stupendous +5.9% annualized rate but retail sales collapsed a record 13.7% in April from the previous month, demonstrating the rush to purchase items before the sales tax increase. Q2 is projected to contract -3.3% to adjust for the timing of purchases and then GDP is supposed to return to growth with a consensus +2.0% estimate in Q3. Toyota, Japan’s largest auto maker said that profits should fall 2.4% in the coming fiscal year as the sales tax increase is expected to hurt sales going forward. On the plus side, Panasonic is considering whether it should bring some appliance production back to Japan on the weaker Yen. While a modest job creator, it would be hailed as a victory by Abe.

In other countries, the Thailand coup has called into question whether the economy can shake off its recent malaise caused by battling political factions that have regularly shut down streets and government buildings. Although the Thai central bank lowered its GDP growth forecast to 2.8%, it is still expected to be positive. Australia toughened its latest budget to reduce its deficit as the easy days of mining revenues appear to be over and the spending from those happy times needs to be throttled back. Most of the cuts came in social services and in raising the retirement age (from 67 to 70), while on the revenue side, there were increased taxes on the higher incomes and on gasoline. Some corporate taxes were cut and infrastructure and medical research spending was added so it was not a total austerity budget. Effectively, the budget is projected to be in balance by the 2017-18 fiscal year.

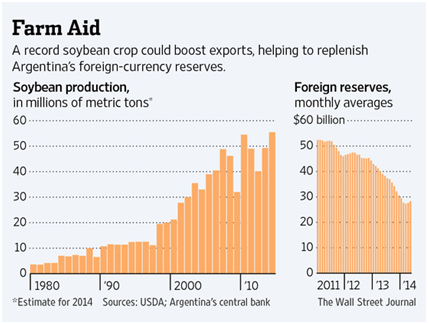

Predator or Prey in the Meat Market: May saw a buzz of merger activity related to various meat processors with Hillshire Brands (known for their pork and beef products) looking to buy Pinnacle Foods (prepared food maker of such as salad dressing and frozen vegetables) for $4.6 billion.  Pilgrim’s Pride (one of the US’ largest chicken processors majority-owned by meat monolith JBS) then jumped in to buy Hillshire Brands with a $5.5 billion offer. Tyson Foods (the current largest meat producer) then came in to try to take out Hillshire Brands with a $6.1 billion cash offer. Where will this feeding frenzy end? Hopefully with more food on the table, but we shall see. Also in farm notes, Argentina’s bumper soy crop is providing much needed foreign exchange reserves for Cristina Kirchner’s tottering regime. One can see on the right that the higher production is bending the curve as shipments have generated $8 billion in exports with an eventual $29 billion expected. The bounty should keep reserves at this $28 billion level. With next year’s soy prices falling from the current $15 per bushel level to $12 or less, this simply delays a foreign exchange crisis, not solve it. Tune in during mid-2015.

Pilgrim’s Pride (one of the US’ largest chicken processors majority-owned by meat monolith JBS) then jumped in to buy Hillshire Brands with a $5.5 billion offer. Tyson Foods (the current largest meat producer) then came in to try to take out Hillshire Brands with a $6.1 billion cash offer. Where will this feeding frenzy end? Hopefully with more food on the table, but we shall see. Also in farm notes, Argentina’s bumper soy crop is providing much needed foreign exchange reserves for Cristina Kirchner’s tottering regime. One can see on the right that the higher production is bending the curve as shipments have generated $8 billion in exports with an eventual $29 billion expected. The bounty should keep reserves at this $28 billion level. With next year’s soy prices falling from the current $15 per bushel level to $12 or less, this simply delays a foreign exchange crisis, not solve it. Tune in during mid-2015.

In energy news, Libya has basically stopped exporting as an ex-general is taking on some of the Islamist-aligned militias in the battle for controlling the country’s lucrative oil supply. The reason this is not a crisis like in 2011 with the uprising against Gaddafi is that there is so much oil available in Europe from other parts of the Middle East and refined products from the US that they do not need it. Hopefully this valuable supply of high-quality oil will be back on line in time. Meanwhile here in the US, scientific study is showing that shale oil has a higher percentage of more volatile gases, increasing the chances of devastation in pipeline and rail accidents. Given the aging rail tankers that many railroads use, we expect more rail safety regulation as well as renewed efforts at pipelines to try to address the risk. How successful these efforts will be is another item. In natural gas news, Egypt and Jordan are going to take deliveries of Israeli production as Egyptian production has fallen. Looks like there is some common ground in the Middle East after all. Italy’s Eni renegotiated its natural gas deal with Gazprom (yes firm supplying China as part of Putin’s deal), saving it about $1 per 1000 cubic foot which would add €506 million to Eni’s operating profit. Hopefully that relationship will be more stable than the one with the Ukraine.

Recalling Australia’s budget tightening from above, iron ore prices have approached the lows of 2012, breaking the $100 per tonne level, a 62% slide from the peak in in 2011. Australian production is expected to be 688 million tonnes in 2014, a 19.4% increase over 2013. As the largest exporter of iron ore by a factor of two over #2 Brazil, Australia is hitting smaller, more costly Chinese mills that are also struggling to get access to credit on their operating losses. Brazilian giant Vale projects that a potential $80 a tonne would shut down high-cost producers in China, Iran, Mexico and Vietnam or saddle those governments with significant losses. With an additional 108 million tonnes expected in 2015, supply looks to swamp even China’s demand. The opposite is occurring in nickel and potentially aluminum as mine production has disappointed and powerhouse Indonesia is banning raw ore exports in order to support a processing industry. While not a monopolist, Indonesia’s efforts have taken the nickel price from the $14 per tonne range to almost $19 per tonne in five months. Undoubtedly they feel emboldened as what choice do the stainless steel producers in China have? None. In precious metals news, Barclays Bank was fined £26 million for rigging the fixing price of gold. Daniel Plunkett was the trader who drew the fine as he drove the price lower one day in 2012 to avoid paying a client £2.3 million in option profits. Not a smart move. Finally, not to leave out platinum, South Africa’s economy contracted for the first time since the financial crisis as mining production fell the most in fifty years due to crippling strikes at the world’s top platinum producers. At -0.6% for Q1 2014, this economy was hit by a 25% decline in mining output as well as a 4.4% decline in manufacturing activity due to the labor action rippling through it. With President Zuma starting his second term imminently, it is up to him to correct his errors from the first term. With economist projecting a worse-than-2% fall in GDP for 2014, there is not a lot of optimism.

Invest wisely!

David Burkart, CFA

Coloma Capital Futures®, LLC

Special contributor to aiSource

June 9, 2014

Additional information sources: Bloomberg, Financial Times, South Bay Research, United ICAP, Wall Street Journal and Zerohedge.com.