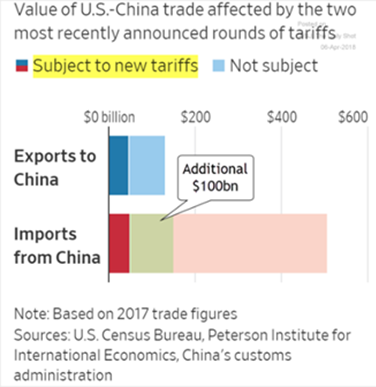

- Escalating Reciprocal Tariffs between the US and China caught the commodities world’s attention during March and into early April. The first round announced in early March of

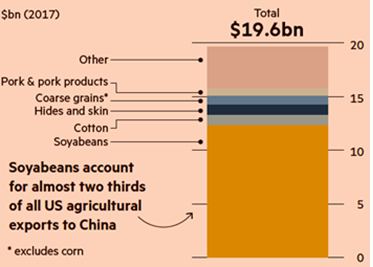

15% to 25% levies on $50 billion of trade by the US in industrial metals products with the $3 billion Chinese response focusing on primary steel products and pork (and other food products) and soybeans. About 7% of US pork and one-third of US pork variety meat exports head to China so it is meaningful in this commodity. The beef exports affected are minimal to the US (0.3% of total US beef exports) due to competition from other countries and other non-tariff barriers. More importantly, China imports about 40% of its soybeans from the US and soybeans are about 10% of t

15% to 25% levies on $50 billion of trade by the US in industrial metals products with the $3 billion Chinese response focusing on primary steel products and pork (and other food products) and soybeans. About 7% of US pork and one-third of US pork variety meat exports head to China so it is meaningful in this commodity. The beef exports affected are minimal to the US (0.3% of total US beef exports) due to competition from other countries and other non-tariff barriers. More importantly, China imports about 40% of its soybeans from the US and soybeans are about 10% of t otal US exports to China so this would be meaningful (see also the graphic below). After the first round, a second set of tit-for-tat tariffs kicked off at the end of March into early April with the US looking to impose costs on various industrial products,

otal US exports to China so this would be meaningful (see also the graphic below). After the first round, a second set of tit-for-tat tariffs kicked off at the end of March into early April with the US looking to impose costs on various industrial products,

including robots, electric vehicles and drugs, impacting another $100 billion of imports from China for a total of $150 billion out of roughly $500 billion of goods (see the graphic above right). China in turn is looking at expanding its list but as the graph above implies, adding a similar-sized $100 billion to their tariff list against the US would effectively place a tariff on all US exports to China (the light blue section) while the US still has room to add (the area to the right of the green section). With not all the tariffs in effect at the time of this writing and final lists of affected products not available, further negotiations could reverse or expand the situation quickly.

- NAFTA Risk also is on the agenda as Trump threatened to end the trade pact, though previous bilateral deals would still be in effect. Canada and Mexico are much more prominent then China in their commodities trade with the US as Mexico was the largest importer of US pork (and second largest of pork variety products) in 2017. US beef exports were big for both Mexico and Canada (each between 11 and 14%) in 2017. The US also imports significant numbers of feeder and live animals so the meat industry can be affected coming and going. Grains also are a major US trade item with Canada and Mexico. Mexico has already started to source corn, soy and related products from South America with the first Brazilian shipments already arriving. Energy products are the most significant where the US exports more to Mexico than it imports, with over twice the dollar value leaving the US as opposed to coming in ($20 billion versus $9 billion in 2016). Natural gas is also a critical import for Mexico from the US as insufficient local production means that Mexico relies on the US for 65% of its consumption. With the upcoming election in Mexico this year and the real possibility of an anti-US leader taking the helm (Andrés Manuel López Obrador), conflict odds are increasing in our view. So far, we think that the markets are discounting these regional risks and over-focusing on the China headlines – but it is all negative for the commodities markets as US supplies may not have a home.

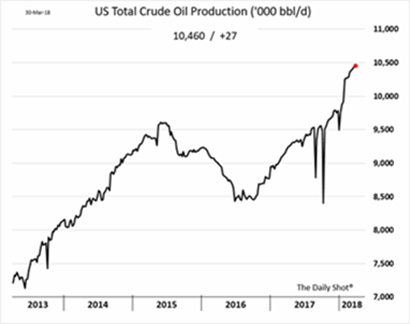

- Oil Production in the US powered higher to almost 10.5 million barrels per day (mbpd) (see right) despite a small fall in the oil-drilling rig count from 800 on March 2nd to 797 on March 30th. US crude production from major shale formations is expected to rise by 131,000 barrels per day in April from the previous month to a record high 6.95 mb

pd per the EIA. US crude oil exports hit a recent high of 2.1 mbpd (note that the US exports some types of crude and imports others to achieve optimal refinery blending and to take advantage of price discrepancies in the physical market). US monthly oil production is likely to have just surpassed Saudi Arabia’s due to their production cuts but the Saudis still lead by a healthy margin in exports. OPEC compliance actually improved as production dropped to the lowest in a year amid the woes in Venezuela’s oil industry. Output from the 14 members fell by 170,000 barrels to 32.04 million barrels a day in March, according to Bloomberg. That’s the lowest since last April’s 31.9 million barrels a day. Production in Venezuela declined by 100,000 barrels a day from February to 1.51 million barrels a day. Its production problems mean that it will not likely have the funds to pay over $9 billion in interest and principal payments due in 2018. With US futures prices in the low $60s, OPEC and Russia are still thinking about extending current cuts, but no decision has been made. US exploration companies which have the most price risk are generally profitable at current oil prices per RBN Energy, reversing the lean times over the last two years.

pd per the EIA. US crude oil exports hit a recent high of 2.1 mbpd (note that the US exports some types of crude and imports others to achieve optimal refinery blending and to take advantage of price discrepancies in the physical market). US monthly oil production is likely to have just surpassed Saudi Arabia’s due to their production cuts but the Saudis still lead by a healthy margin in exports. OPEC compliance actually improved as production dropped to the lowest in a year amid the woes in Venezuela’s oil industry. Output from the 14 members fell by 170,000 barrels to 32.04 million barrels a day in March, according to Bloomberg. That’s the lowest since last April’s 31.9 million barrels a day. Production in Venezuela declined by 100,000 barrels a day from February to 1.51 million barrels a day. Its production problems mean that it will not likely have the funds to pay over $9 billion in interest and principal payments due in 2018. With US futures prices in the low $60s, OPEC and Russia are still thinking about extending current cuts, but no decision has been made. US exploration companies which have the most price risk are generally profitable at current oil prices per RBN Energy, reversing the lean times over the last two years.

- Natural gas production increased year-to-year in January 2018 for the eighth consecutive month, and the average daily rate of dry natural gas production for January was the highest for the month since EIA began tracking monthly dry production in 1973. Exports though are increasing primarily from LNG shipments, and, for the first time since EIA began tracking natural gas net imports in 1973, total imports and total exports were equal in January, 2018.

- Saudi Arabia’s oil company Aramco informed the UK government that their IPO would likely be delayed until 2019. Part of the reason cited is apparent lack of interest by the US and the litigation and liability concerns in a NYSE listing. Our view is that the Saudis want too much money and it is more of a valuation question. To quote

an industry insider, “The Aramco IPO can be summed up this way: Aramco is owned by a bunch of rich people want a very good deal and if they don’t get a very good deal then they do not want to do the deal. But a very good deal for them requires someone else to get a very bad deal. And no one wants a very bad deal.”

an industry insider, “The Aramco IPO can be summed up this way: Aramco is owned by a bunch of rich people want a very good deal and if they don’t get a very good deal then they do not want to do the deal. But a very good deal for them requires someone else to get a very bad deal. And no one wants a very bad deal.”

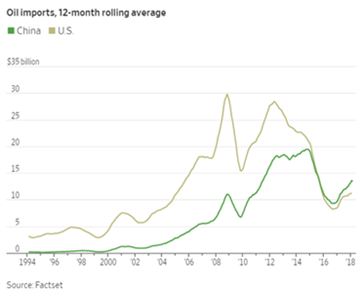

- China oil imports in January hit a record 9.6 mbpd, placing their rolling 12-month average higher than US oil imports (see graph to the right). The launch of their new oil futures contract on March 26th in Shanghai met expectations with good trading for a new contract ($2.8 billion in notional value) with open interest overnight building to about $600 million in value (the US contracts have about $150 billion in open interest in comparison). However, as global exports shift to China away from the US, there is more of a need to hedge against Chinese specifications so the Chinese numbers should increase. The US numbers may not fall assuming that there is more oil trade between the two countries (current verbal strife notwithstanding). While the Shanghai contract is denominated in yuan, Chinese currency controls limit the attractiveness of holding local currency as margin and to transfer significant capital there in the first place. There is a long way to go (five years in my opinion) for a “petro-yuan” market to fully form, assuming that currency regulation is eliminated.

- Tug-Of-War in Grains as plentiful supplies weighing on prices were challenged by weather issues affecting wheat and soy, particularly. Crop conditions in drought-saddled Argentina tumbled as forecasts remain stingy with rainfall into April. The Buenos Aires Grain Exchange revised the country’s soy forecast down to 44 million metric tonnes from 47 previously (the corn forecast was unchanged at 37 million metric tonnes). On the other hand, Brazilian farmers are expected to harvest a record 117.5 million tonnes of soybeans in the 2017/18 crop cycle, up from expectations last month of 114.1 million tonnes which would be above last year’s record-large harvest. Their soy harvest is well underway (77% done at time of writing). US farmers stated that they will plant the same amount of soybeans and corn this spring, potentially marking the first time since 1983 that corn has not been the nation’s top crop. Soybeans have gained favor on rising global demand, especially from China. However, the US corn and soybean harvests for 2018 are forecasted to come in below the levels reached in 2017 (though supplies should remain abundant). The US has been the world’s biggest corn producer and exporter, and the number two soybean exporter after Brazil. Many farmers in northern Illinois have their fields turned over and are ready to plant as soon as some warmth comes in during April.

- Ivory Coast’s Mid-crop Cocoa output is expected to drop 23 percent this season due to insufficient rain and poorly kept fields. The lack of rain from November to March in most production areas stunted pod development and reduced the survival rate of flowers during hot weather in early 2018 (Reuters).

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource