Experience and extensive due diligence allows aiSource to avoid common pitfalls when selecting managed futures programs.

STEP ONE

Preliminary Due Diligence

aiSource continuously seeks new alternative investment opportunities—a process that requires filtering through numerous CTAs each year—in order to identify managed futures programs we feel merit a full due diligence.

STEP TWO

STEP TWO

Investment Strategy Analysis

Next, we perform a comprehensive vetting process in which we measure the commodity trading advisor’s performance on a risk-to-reward basis (and not an absolute basis), in order to compare that CTA to the entire CTA universe, and other CTAs in their respective niche or sector.

STEP THREE

STEP THREE

Operations Analysis

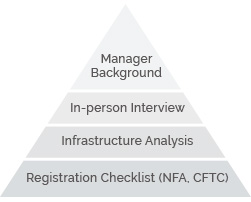

After a new program passes these fist two evaluations, an assessment is made on the program’s inner-workings. Analyzing a CTA’s operations requires due diligence to be completed on managerial, infrastructural and compliance levels. A CTA’s operational competency is oftentimes more important than the robustness of their investment strategy.