Most of our clients’ CTA investment portfolios are setup via a separately managed account structure where they setup one master/cash account that feeds into each of their CTA sub-accounts. The benefit of setting up a master and sub-account structure allows an investor to “cross margin” their cash account with each of their CTA sub-accounts. This structure works whether you have investments with two CTAs or a hundred different CTAs. Each CTA sub-account is able to “draw” money that it needs in margin to conduct trading on a day to day basis.

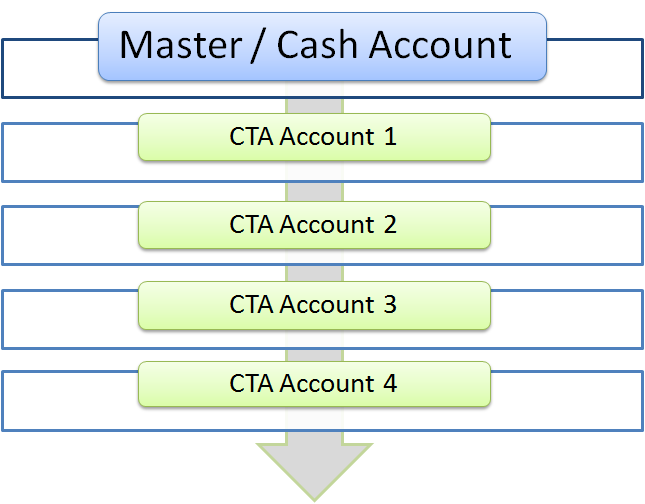

Here is an example of a simple CTA portfolio that invests in four different CTAs:

Setting up your CTA investment portfolio as highlighted above, allows you to monitor the performance of each CTA quite easily. Each “CTA Account” starts with a zero balance and the CTAs trading/performance updates from there. Furthermore, because all CTAs draw margin separately from the master account, the combined margin that all the CTAs use (i.e. portfolio margin) is the amount that needs to be monitored on a day-to-day basis.

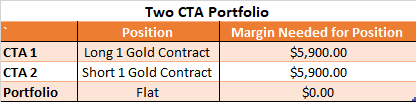

What many investors do not realize, is that the portfolio margin can many times be less than the sum of the margin dollars that each CTA is utilizing. Since this concept can be confusing to understand, let’s use a simple two CTA portfolio to explain it:

Let’s assume CTA 1 in your portfolio is long gold, and CTA 2 in your portfolio happens to be short gold. Because the margin needed to hold (and trade) one gold contract is $5,900, each CTA in this case is utilizing $5,900 in margin to hold that position. The $5,900 is being drawn from the master/cash account. However, when you cross margin all your accounts together, margin usage is calculated on a “portfolio” basis. When you view the positions in both CTA accounts from a portfolio level, technically both positions offset each other (the long gold offsets with the short gold), and the margin usage on a portfolio level is $0. The sum of each CTA’s margin usage was $11,800, but because the CTAs contained offsetting positions, the portfolio margin is $0. A break in margin as described in this example only applies to those days where the CTAs are holding offsetting positions. Using the same example above, if CTA 2 on day two switched their position from being short gold, to being short corn (corn margin is $1,500), then the portfolio would not contain any offsetting positions and the portfolio margin usage would be $7,400.

Most of our clients’ CTA investment accounts are “cross margined” together to produce one portfolio margin amount. When possible, CTA accounts may contain positions that are offsetting in nature, and this can benefit a CTA investment portfolio to draw less margin from the master/cash account and have more funds available to either cover drawdowns or invest in more CTAs.