For all those that had no luck participating in a Super Bowl pool, today is a good day to get your bearings straight and focus back on things you CAN control – like your investments.

As part of our on-going effort to help our investors enhance their research process, we try to provide as much insight into our analysis as possible. Perhaps the most unique thing about managed futures that differentiates it from other traditional assets, is the ability to leverage your investments. In Managed Futures, the ability to leverage a CTA is heavily dependent on that CTA’s margin usage percentage. Margin usage percentage is very important in a multi-CTA portfolio because it allows you to measure a CTA’s “return on margin” – a statistic not provided on most traditional performance capsules (aka tear sheets).

Before getting into return-on-margin, it’s important that everyone understand margin usage. Margin usage is the average percentage of an investment that a CTA uses on a day-to-day basis to conduct investment activity. For example, if a CTA with a minimum account size of $100,000, has an average margin usage of 25%, that means that on average they utilize $25,000 on a day-to-day basis in order to conduct their trading activity. Because most CTAs have margin usage in the 10% to 50% range, investors are generally allowed to notionally fund their accounts by only investing a fraction of the account size. In order to learn more about notional funding you can read more here.

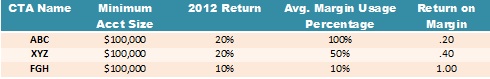

The reason aiSource compares return-on-margin of different CTAs is because it gives us a good idea of which CTAs give “the best bang for their buck.” Please see the table below to follow a simple example:

Looking at the “Return on Margin” column in the above table, it is simple to see that CTA ABC provides the smallest return on margin (providing a 20% return on the margin used), while CTA FGH provides the highest return on margin (providing a 100% return on the margin used). Based on this table, you can easily see why looking only at the rates of return for 2012 can be slightly deceiving – because they do not paint an accurate depiction of which CTAs use their margin most “efficiently. “

You might also be wondering why anyone would invest in a CTA that provides only a .20 return-on-margin? While return on margin is a very important metric to analyze, it doesn’t always mean that CTAs that have higher return on margin are the “best” ones. The reason is because you have to consider other factors such as, Sharpe Ratio, drawdowns, risk management…etc. For example, using the same numbers as above, if CTA FGH had a drawdown of 20% during 2012, and CTA ABC only had a 5% drawdown for the same year, then we wouldn’t be able to confidently claim that CTA FGH is “better” than CTA ABC. Hence it’s important to consider all statistics and ratios when analyzing different CTAs.

When the aiSource team builds a multi-CTA portfolio for our client(s), the CTAs in that portfolio have a varying mix of margin-usage, and hence there are varying degrees of return on margin. There are many reasons why each CTA is a critical part of the portfolio, and return on margin just happens to be one of the factors we consider during our design.

-Rishab Sharma

Disclaimer: Please use the above material strictly for educational purposes. Past performance is not indicative of future results. Futures trading involves substantial risk of loss. By no means is this newsletter offering any investment advice or suggesting to make any trade recommendations. Please consult an aiSource advisor prior to opening any managed futures accounts.