Oil Production

Received a short-term shake-up as multiple events provoked oil and macro traders. First, Libyan fighting around the Ras Lanuf, Es Sider, al-Hariga and Zweitina oil terminals collapsed oil exports by 850,000 barrels per day (bpd) to 150,000 bpd or so. Also, the US announced their restart of sanctions against Iran effective November which would discourage buyers from continuing imports from that country, particularly affecting China, Japan, India, South Korea, and others. Iran is negotiating with the EU to figure out a workaround and companies have applied for waivers but the situation promises to be in flux for another four months. Iran also threatened to attack tankers that sail through the Strait of Hormuz if sanctions are not lifted – a frightening but unlikely prospect given the retaliation by the US and potentially other militaries on vulnerable refineries. Houthis in Yemen (supplied by Iran) fired missiles at the Saudi capital of Riyadh, though none of them hit. The continued Venezuelan economic crisis took off another estimated 500,000 bpd in production and the beleaguered country borrowed $5 billion more from China. We shall see if the money can avoid the chronic corruption to be invested in improving output. PDVSA (Venezuela’s oil company) is a month  behind with its existing crude loadings. Finally, a transformer blowout at an important Canadian oil sands project (the Syncrude Canada joint venture) removed 350,000 bpd from US supplies. Repairs are not expected to restore deliveries until late July for about half the lost barrels with most of the rest in early August.

behind with its existing crude loadings. Finally, a transformer blowout at an important Canadian oil sands project (the Syncrude Canada joint venture) removed 350,000 bpd from US supplies. Repairs are not expected to restore deliveries until late July for about half the lost barrels with most of the rest in early August.

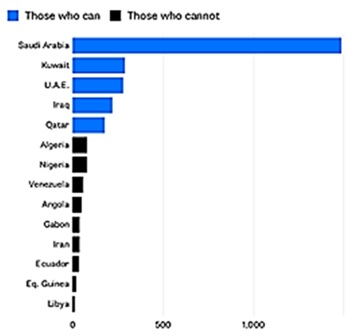

On the positive side, OPEC adopted at its June meeting language allowing its members to expand oil production. Russia and Saudi Arabia already began expanding oil exports with Russia up about 100,000 bpd in June (and a forecast of an additional 150,000 in July – see projections below from an oil consultant) while Saudi Arabia increased by about 460,000 bpd in June, with total production at almost a record. With Vladimir Putin and Mohammed bin Salman’s meeting at World Cup’s opening match, the world saw an image of cooperation. OPEC’s newest member, the Republic of Congo, may boost output as much as 65% this year to over 480,000 bpd as two large fields come on line. However, not everyone in OPEC can increase production as per the Bloomberg graphic above. In relation to ready supply, there are a number of full tankers sitting in the Straits of Malacca, about 6 million barrels worth. Reuters reported that floating storage of crude oil in Europe has risen to an 18 month high with more offshore Europe than Asia for the first time since early 2015. Libya in early July bounced that the four oil export terminals were almost back on-line, which would send its exports well back over 1 mbpd. In short, the world will gets its oil in the near term at least and for the rest of the year.

US output

Continued higher to a projected 10.9 mbpd despite a small decline in the oil-drilling rig count from 861 on June 1st to 858 rigs on June 29th. US crude oil exports continued their high pace, hitting 3 mbpd at the end of June. The real constraint that the US faces is not production but pipeline and export terminal capacity – can all the oil (and gasoline) actually leave the country to reach eager customers? Trucking and railroad alternatives are already running at high if not maximum rates. New pipelines are due to come on line in mid-2019 but with Canada also pushing oil output through the US network, there are bottlenecks. Refinery runs reached a new high (both absolutely and seasonally) as 18 mbpd was transformed into gasoline, diesel and other products. May’s US oil exports were primarily to China (about 1/3rd of the total), followed by Canada, the UK, Netherlands and India. To compare versus last year, China was the #2 destination with Canada in the lead.

Obrador

Handily won Mexico’s election with his MORENA party taking the largest positions in both houses of the Mexican Congress. We should expect to see a more confrontational approach to the US as well as perhaps other countries on immigration, NAFTA/trade talks and oil policy. Obrador wants Mexico to be less dependent on the US for gasoline and natural gas but that will take billions in new investment as well as maintaining good relations with foreign oil exploration and production firms, which does not fit his nationalistic stance. As an example, Mexican refineries currently run at 48% average capacity, the lowest in their history and half the utilization for US refineries. Theft by organized crime is also a major issue. With his newly-won power, Obrador now needs to show the world that he can govern as well as speak.

China’s May Crude Oil Imports

Eased away from record highs hit the month prior, with state-run refineries entering planned maintenance and some independent plants told to curb pollution ahead of a summit. At 9.2 mbpd in May, according to data released by the General Administration of Customs, that compared to a decline from 9.6 million bpd in April but a year-on-year increase from 8.8 million bpd in May, 2017. China’s independent oil refiners are being hit by new tax rules, shrinking diesel demand and higher crude prices which threaten their profits. Industry executives and analysts said nearly 40 private refiners, often called “teapots” – which account for a fifth of China’s almost 10 mbpd in crude oil imports – are losing money and market share. Some are rumored to shut for good if the conditions continue or if the US-China trade war escalates.

US Tariffs

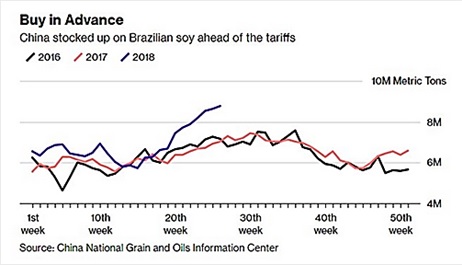

Were imposed on some $34 billion worth of Chinese imports effective July 6. China returned the move with 25% duties on products including soybeans, wheat, corn, sorghum, cotton and beef in response. Chinese purchases of US pork fell by a third in May as first shots were anticipated. A second list, which ranges from chemicals and plastics to motorcycles and technical equipment worth some $16 billion is expected to take effect by the end of July. Canada imposed tariffs on $12.5 billion of US goods, but the effects are so far modest, such as a 10% levy on cooked beef products which only had trade value of $170 million in 2017. Mexico has also applied limited tariffs, mostly notably on certain pork cuts. Finally in June, the EU applied 25% import duties on $3 billion of US products in retaliation for US steel tariffs. So far, just sparring but with $200 billion more in US imports from China under scrutiny by Trump, this tit-for-tat is not over.

Grain and Livestock News

Included the projection that Brazil, the world’s largest soybean exporter, may have to import the oilseed from the United States this year to satisfy demand. If China’s demand for Brazilian soy rises due to a trade war with the United States, local processors may import 500,000 to 1 million tonnes! US corn and soy are well ahead of the averages in terms of planting progress and crop condition, though there is the all-important July and August weather to contend with. The Buenos Aires Grain Exchange estimated soybean harvest at 97.1% complete, and left production unchanged at 36.0 million tons. However, Argentina’s Ag Ministry estimated soybean harvest at 37.2 million tons, up from 36.6 previously. In livestock news, the BBC announced that Scot scientists have successfully edited hog DNA to provide immunity to one of the animal’s most deadly diseases, Porcine Reproductive and Respiratory Syndrome. The edit is hereditary as well so the results are trumpeted as permanent. The losses associated with the disease equal to about $650 million annually for just the US. With regulations still far off, this scientific result is still a number of years from the marketplace (assuming it reaches there at all).

In Other Energy News

One must not put down incremental improvements in efficiency. The EIA estimated that in 2016, the world would have used 12% more energy had it not been for energy efficiency improvements since 2000 – the equivalent of the European Union! Solar power in US climbed 13% in Q1 2018 and overtook natural gas and wind as biggest source of new US power production that quarter. This result is despite rising costs from tariffs on imported solar panels from China. Natural gas supply and consumption still grew significantly from the first half of 2017 through the first half of 2018, with an 11% increase year-on-year. Low natural gas prices supported this trend. Finally, a Harvard professor says his company is looking to directly suck carbon dioxide out of the atmosphere at an industrial scale by 2021 (BBC and The Atlantic). The cost is expected to be the equivalent to $1 to $2.50 per gallon of gasoline, so not cheap but not crushing. A pilot plant is running in Squamish, British Columbia.

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource