The paths of UK and Europe after the Brexit “Leave” vote are now wide open, though the direction is uncertain. There are a number of steps, the first being to sort out the UK’s leadership shuffles and struggles not only in the Conservative Party (Cameron resigning) but also the Labor Party (Corbyn lost a non-binding no-confidence vote) and UK Independence Party (UKIP) as its “Leave” leader Farage announced his (third) retirement. Only the Scottish National Party (the third largest party in UK’s House of Commons) seems united (in defiance). Then the House of Commons must vote to leave the EU (which they may never do) and then the actual negotiations can begin over the new treaty/treaties between the UK and the EU. Given the dysfunction in the EU over bailing out its current members and banks, dealing with migrants and Russia and other issues, this is going to be a drawn-out affair. The smartest approach for both sides is to have a small, quick compromise between the two parties and then move on to their more pressing problems. However, the divisiveness of the issue across the UK and Europe risks being bogged down in mire that sunk the Greece/PIIGS bailout and the migrant response, amongst others. The real question is whether the muddling through again becomes just a muddle.

In more fundamental news, the US Federal Reserve has almost completely backed off from any rate hikes in 2016 and the market has even started to price in a chance of a cut to reverse the December 2015 increase. More fumbling around, though at least the Atlantic Fed’s Q2 annualized GDP forecast is at +2.3%, a respectable level. Congress passed legislation to form a committee to manage Puerto Rico’s defaults and overall fiscal situation. The ECB’s balance sheet is now at the highest it has ever been – and little to show for it. But we digress. Greece passed laws to comply with receiving €10.3 billion from the troika, which will keep it from re-defaulting for the rest of 2016. However, Italian banks are teetering on the brink of collapse as bad loans from the financial crisis are catching up to them and legally the Italian government cannot directly bail them out. In Asia, China is spending to maintain its economy while Japan’s economic markers show a notable slowdown. Another stimulus package, Prime Minister Abe? Finally, commodities had a mixed month with Energy, Grains and Livestock all ending the month lower. Metals (both Precious and Industrial) and Softs, on the other hand moved up strongly. Inventories are the most relevant, with the losers fighting increasing and/or high supply levels while the winners benefited from either lower supply concerns (Softs), stimulus speculation (Industrial Metals) or monetary easing (Precious Metals). Politically, commodity news was generally positive with Iraq taking Fallujah back from ISIS (thus eliminating their so-called capital), the Ukrainian-Russian conflict has not widely re-ignited and Libya’s warring factions are reducing their fighting – allowing oil to be exported again. Little victories.

Those Pesky Jobs: Fed minutes revealed that fears over possible slowing employment growth and uncertainty over the Brexit vote kept Yellen and the committee from raising rates in the June meeting. A side note: while the Brexit “Leave” result did match their downside scenario, the US market quickly recovered and ended the month positive. Concerns alleviated. More interesting was the change

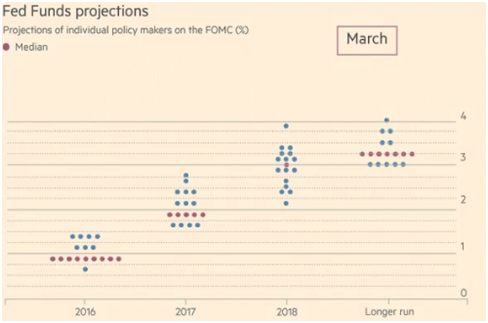

.png?sfvrsn=0&MaxWidth=400&MaxHeight=300&ScaleUp=false&Quality=High&Method=ResizeFitToAreaArguments&Signature=CCA783CF146E01746B936BA23180831F) in “dot plots” seen on the attached graphs from the Financial Times – the June meeting shows a substantial realignment of lower rates expected for 2016 and one member in particular (former hawk Bullard) forecasting no rate increases for two years after a modest +0.25% increase this year (which, as mentioned, the market is pricing to not happen either). With US GDP showing no strong acceleration of activity (Q1 annualized GDP revised up slightly to +1.1% and Q2 still estimated to +2.3%), Bullard’s bold forecast has as good chance of coming true. Also of note, Yellen put the Federal Reserve on record as having the legal basis to pursue a negative rates policy. The door is unlocked: will she step through?

in “dot plots” seen on the attached graphs from the Financial Times – the June meeting shows a substantial realignment of lower rates expected for 2016 and one member in particular (former hawk Bullard) forecasting no rate increases for two years after a modest +0.25% increase this year (which, as mentioned, the market is pricing to not happen either). With US GDP showing no strong acceleration of activity (Q1 annualized GDP revised up slightly to +1.1% and Q2 still estimated to +2.3%), Bullard’s bold forecast has as good chance of coming true. Also of note, Yellen put the Federal Reserve on record as having the legal basis to pursue a negative rates policy. The door is unlocked: will she step through?

In other economic news, US factory data was generally poor: durable goods orders fell -2.2% in May, worse than the expected -0.5%, and industrial production also missed forecasts (-0.4% for May, lower than the expected -0.2%). Lower automobile production led the way down, though mining production (which includes oil drilling) had a modest increase. Pending sales of existing homes (about 90% of all home sales) also fell more than forecast (-3.7% versus -1.1% expected) after some strong months. However, despite all this negative news, the expectations for Q2 GDP growth is expected to be notably better than Q1 on consumer spending having moved up strongly in the last three months. May retail sales were positive not just for automobiles and other core goods but also for gasoline, causing a beat of expectations, and implying that the underlying economics are moving forward, albeit slowly. Ironically, the latest payroll number for June jumped to +287,000, the most in eight months, though May’s number was revised down. Again, the Fed’s excuses for not raising rates may be just that – excuses.

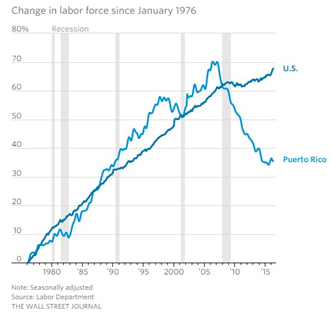

Meanwhile, Puerto Rico formally defaulted on its general obligation bonds on July 1st – about $1 billion worth (though about $358 million was insured). Note that per Puerto Rico’s constitution, that debt is “guaranteed.” Guess when you do not like the rules, you throw out the  rule book. However, right before the default, the US Congress passed legislation allowing a “control board” to manage the territories bankruptcy and ongoing budgets. The board has not yet been formed so what it will actually do is unclear. The core problem is a lack of opportunity and statist political system which has caused massive emigration as can be seen in the chart to the left – no population means that the tax base has eroded for decades. Without revenue, pensions cannot be paid, hospitals/schools/government offices are overstaffed and infrastructure cannot be maintained. Finally, while hedge funds may be the most visible holders of the debt, it is widely held in tax-exempt mutual funds and by the inhabitants of the island itself. Being paid 67 cents on the dollar (based on the June 30th price of the current 20-year bonds), will affect local people, further hobbling the economy. But what is the alternative? We wait and see.

rule book. However, right before the default, the US Congress passed legislation allowing a “control board” to manage the territories bankruptcy and ongoing budgets. The board has not yet been formed so what it will actually do is unclear. The core problem is a lack of opportunity and statist political system which has caused massive emigration as can be seen in the chart to the left – no population means that the tax base has eroded for decades. Without revenue, pensions cannot be paid, hospitals/schools/government offices are overstaffed and infrastructure cannot be maintained. Finally, while hedge funds may be the most visible holders of the debt, it is widely held in tax-exempt mutual funds and by the inhabitants of the island itself. Being paid 67 cents on the dollar (based on the June 30th price of the current 20-year bonds), will affect local people, further hobbling the economy. But what is the alternative? We wait and see.

EU is Dead, Long Live Europe: We have discussed Brexit already but that is probably the least of Europe’s problems. Headlines aside, Brexit is likely a slow burning fuse. More immediate is that the European Commission staff have found that Portugal and Spain have violated budgeting rules that keep the members in fiscal alignment. In other words, the two countries have repeatedly spent too much money despite pledges to the contrary. This finding was agreed to by the finance ministers of the EU states, so Brussels has 20 days to determine the appropriate fine. The money due to the EU is rumored to be nominal, which would encourage other members to start breaking the rules more flagrantly (looking at Belgium, France and Italy) but the amount may be meaningful, further pushing them to raise taxes and/or cut spending, precipitating further economic headwinds. This breakdown in reliability caused S&P to lower the EU credit rating from AA+ to AA at the end of June. Spain’s failure to again elect a majority coalition to their parliament means the leadership vacuum continues there – caretaker PM Rajoy won the most seats so he is trying to figure out a collation but the opposition parties are just too big and too antagonistic to make this an easy task (if possible).

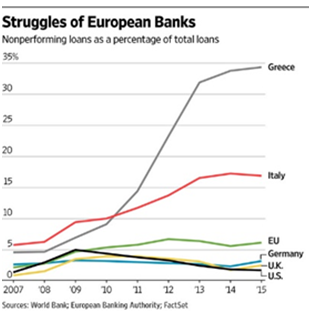

Meanwhile, Italy bailed out another small bank, Veneto Banca, which consumed €1 billion of its tiny €5 billion bailout fund – there are €85 billion in non-performing loans outstanding – and the Italian government is limited in additional borrowing it can do as their government debt-to-GDP ratio is already 132%. In addition, too-big-to-fail Monte dei Paschi shares collapsed as the ECB demanded that it write off €10 billion in bad loans to stay within ECB guidelines – money the bank does not have so another dilutive share offering? Fitch and Moody’s have already warned that Italy’s BBB+ rating is in jeopardy – three notches above junk. Finally, S&P downgraded the UK on Brexit from AAA to AA with more downgrades possible.

consumed €1 billion of its tiny €5 billion bailout fund – there are €85 billion in non-performing loans outstanding – and the Italian government is limited in additional borrowing it can do as their government debt-to-GDP ratio is already 132%. In addition, too-big-to-fail Monte dei Paschi shares collapsed as the ECB demanded that it write off €10 billion in bad loans to stay within ECB guidelines – money the bank does not have so another dilutive share offering? Fitch and Moody’s have already warned that Italy’s BBB+ rating is in jeopardy – three notches above junk. Finally, S&P downgraded the UK on Brexit from AAA to AA with more downgrades possible.

Economically, the news is highly mixed. Europe’s unemployment continued to improve in June, but is still above 10%. April’s industrial production beat forecasts but May’s looks shaky with German industrial production falling -1.3% instead of remaining flat and orders were unchanged instead of meeting the survey number of +1.0%. Relatedly, German exports fell -1.8%. Spanish industrial output also fell for the second month in a row. Ironically, UK industrial production surged by +1.9% through the end of May. We are still waiting for that ECB monetary stimulus to turn into economic results.

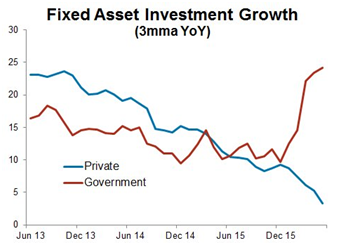

Maybe Fiscal Policy Will Work: While China has its own monetary stimulus programs, the attention there is on old-fashioned fiscal spending. Year-on-year, central government spending increased +17.6% from a year earlier – admittedly government revenue also increased, but only +7.3%. The results have been relatively unimpressive so far – industrial production held steady at 6.0% while retail sales fell to 10.0% from 10.1% the month prior. So where did the money go? Fixed asset

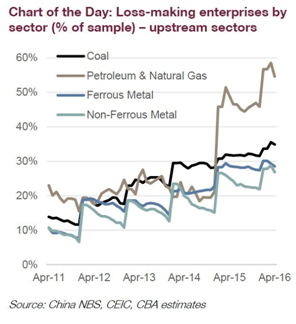

fiscal spending. Year-on-year, central government spending increased +17.6% from a year earlier – admittedly government revenue also increased, but only +7.3%. The results have been relatively unimpressive so far – industrial production held steady at 6.0% while retail sales fell to 10.0% from 10.1% the month prior. So where did the money go? Fixed asset  investment (spending on roads, factories, power plants and property took off as can be seen to the right, though one notes that many of the most capital-intensive industries are losing money (see graphic to the left). Caixin/Markit manufacturing PMI showed that China’s factory activity contracted by more than expected last month with a reading of 48.6 compared to May’s 49.2. On the consumer

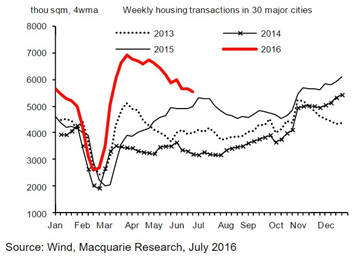

investment (spending on roads, factories, power plants and property took off as can be seen to the right, though one notes that many of the most capital-intensive industries are losing money (see graphic to the left). Caixin/Markit manufacturing PMI showed that China’s factory activity contracted by more than expected last month with a reading of 48.6 compared to May’s 49.2. On the consumer side, there are also signs of weakness. Chinese consumer goods sales to urban customers fell -0.9% year-on-year on volume terms with sales of instant noodles down -12.5% and beer down -3.6%. Perhaps most oddly or significantly, tobacco volumes fell for the first time in over twenty years as taxes and banning of indoor smoking hit consumers. Finally, housing transactions have been slowing down from the speculative spike earlier this year. Is this a symptom of more to come?

side, there are also signs of weakness. Chinese consumer goods sales to urban customers fell -0.9% year-on-year on volume terms with sales of instant noodles down -12.5% and beer down -3.6%. Perhaps most oddly or significantly, tobacco volumes fell for the first time in over twenty years as taxes and banning of indoor smoking hit consumers. Finally, housing transactions have been slowing down from the speculative spike earlier this year. Is this a symptom of more to come?

Meanwhile in Japan, retail sales came in at -1.9% year-on-year, below consensus of -1.6%. Industrial production also declined (-2.3%), much more than the forecasted -0.2%. With Q2 GDP expected to be negative, it looks like Japan will pass a stimulus package in order to try to spark top-line demand (a profound challenge in an aging society). South Korea is moving forward with their $17 billion stimulus as GDP growth expectations were reduced by its finance ministry from +3.1% to +2.8%, and after a -0.5% decline in Q1. Shipbuilding and shipping are facing restructuring and layoffs as exports and global trade stayed subdued. Australia just finished a close election where the incumbent PM Turnbull is likely to form a majority government – perhaps spurred on by S&P who lowered their credit rating outlook to “negative.” After six prime ministers in eight years, political credibility is suffering down under too.

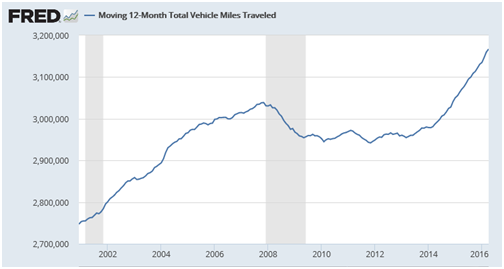

Help Yourself – There’s Crude Aplenty! Per Reuters, OPEC oil output hit a record high in June as Nigeria partially recovered from militant attacks and on overall production increases by Iran and Gulf states. 32.82 million barrels per day were supplied versus the 32.57 in May. Meanwhile, US production capacity may be turning around too as the rig count went from 316 on May 27th to 341 on July 1st – an almost 8% increase from the lowest count in five years. A private oil consultant (Rystad Energy) declared that US oil reserves (264 billion barrels) were larger than Saudi Arabia (212 billion) and Russia (256 billion) thanks to fracking technology. US oil inventories above ground are also at record levels for the season with gasoline supplies bursting. Demand has been running hot for gasoline – at all-time highs as driving season is in full swing in the US (see next page) coupled with strong truck sales. There are signs that refineries are throttling back production to cope with the glut, though that should push oil inventories higher in response (and just when Canadian exports to the US are recovering post-fire in Alberta). The US can react to this inventory situation by capping more wells but the backlog of fracked wells (AKA the “fracklog”) is high and can quickly be brought into full extraction. With a federal judge striking down the Obama administration’s proposed rules on fracking, producers and state regulators have less restraint on rebuilding production, if the price is high enough ($50 per barrel). US offshore oil production is also continuing to rise, with a record 1.91 million barrels per day expected in 2017 in the Gulf. Mexico also looking to expand its Gulf drilling so more to come there.

from militant attacks and on overall production increases by Iran and Gulf states. 32.82 million barrels per day were supplied versus the 32.57 in May. Meanwhile, US production capacity may be turning around too as the rig count went from 316 on May 27th to 341 on July 1st – an almost 8% increase from the lowest count in five years. A private oil consultant (Rystad Energy) declared that US oil reserves (264 billion barrels) were larger than Saudi Arabia (212 billion) and Russia (256 billion) thanks to fracking technology. US oil inventories above ground are also at record levels for the season with gasoline supplies bursting. Demand has been running hot for gasoline – at all-time highs as driving season is in full swing in the US (see next page) coupled with strong truck sales. There are signs that refineries are throttling back production to cope with the glut, though that should push oil inventories higher in response (and just when Canadian exports to the US are recovering post-fire in Alberta). The US can react to this inventory situation by capping more wells but the backlog of fracked wells (AKA the “fracklog”) is high and can quickly be brought into full extraction. With a federal judge striking down the Obama administration’s proposed rules on fracking, producers and state regulators have less restraint on rebuilding production, if the price is high enough ($50 per barrel). US offshore oil production is also continuing to rise, with a record 1.91 million barrels per day expected in 2017 in the Gulf. Mexico also looking to expand its Gulf drilling so more to come there.

Overseas, production is still set to grow, with Chevron green-lighting a $36.8 billion expansion project for its Tengiz field in Kazakhstan, which is expected to increase production there from 595,000 barrels per day to 855,000 bpd in 2022 and will still be profitable at $50 per barrel prices. China also is expanding its oil flows by a deal signed with Nigeria worth $80 billion to replace and expand oil infrastructure and gas pipelines. With the violence in the delta there recently, one wonders if a Chinese military presence will be in cards at some point. Another China oil supplier, Venezuela, is just a headache with falling oil production and a failing economy meaning that the South American country cannot pay its oil debt to its largest creditor – $65 billion since 2005. Not that China needs oil right now – JPMorgan said that Chinese crude oil demand may fall -15% as its strategic petroleum reserve demand eases back the second half of this year.

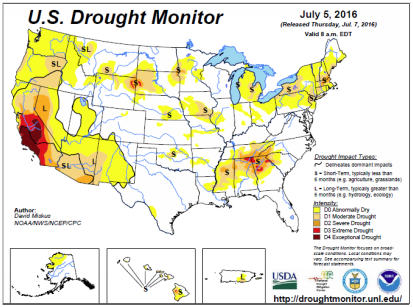

U.S. farmers seeded more corn and soybeans than initially planned during the spring, taking advantage of a rallying futures market and good weather to plant as much acreage as possible. Crop conditions are excellent so far as well and barring an extended period of heat, supplies should be healthy going into the end of the year. South America is less well than expected but the results are basically in and will be “good enough.” In livestock, the U.S. hog herd in the three months ending May rose 2 percent to a record high versus a year ago, according to the U.S. Department of Agriculture. Farmers added to their herds due to affordable feed and reasonable strong demand.

good weather to plant as much acreage as possible. Crop conditions are excellent so far as well and barring an extended period of heat, supplies should be healthy going into the end of the year. South America is less well than expected but the results are basically in and will be “good enough.” In livestock, the U.S. hog herd in the three months ending May rose 2 percent to a record high versus a year ago, according to the U.S. Department of Agriculture. Farmers added to their herds due to affordable feed and reasonable strong demand.

Coffee consumption caught the imagination of the market in June with U.S. coffee drinkers are consuming more of the brew than ever. World demand for coffee beans is poised to hit a record this year as people around the world are consuming more of the beverage. Global coffee consumption is expected to grow 1.2% over the next year starting in October, and American consumption is expected to be up 1.5% this year alone, reported Bloomberg. Coffee has also reached peak popularity in China, Japan, and India, which are expected to demand more java than ever.

Base metals caught fire as the news of Chinese deficit spending hit the markets, and in particular the government support of heavy industries as noted above. Gold and silver moved up in sympathy as well as on fears of central bank quantitative easing (particularly in Japan) and flight to safety concerns around Brexit.

And in case you wondered about the future of the EU, we learned that Brexit could be followed by Grexit, Departugal, Italeave, Chzechout, Oustria, Finish, Slovlong, Latervia and Byegium. See you later!

Best of investing!

David Burkart, CFA

Coloma Capital Futures®, LLC

www.colomacapllc.com

Special contributor to aiSource

Additional information sources: BAML, BBC, Bloomberg, Deutsche Bank, Financial Times, The Guardian, JP Morgan, PVM, Reuters, South Bay Research, Wall Street Journal and Zerohedge.